|

市场调查报告书

商品编码

1692152

智慧卡 MCU:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smartcard MCU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

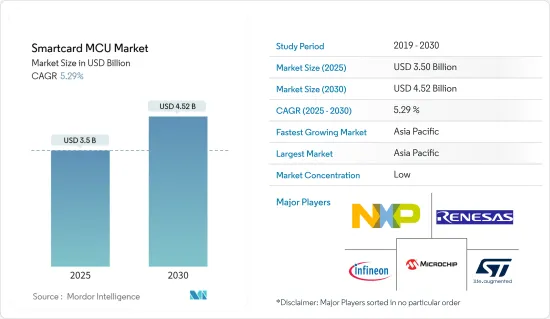

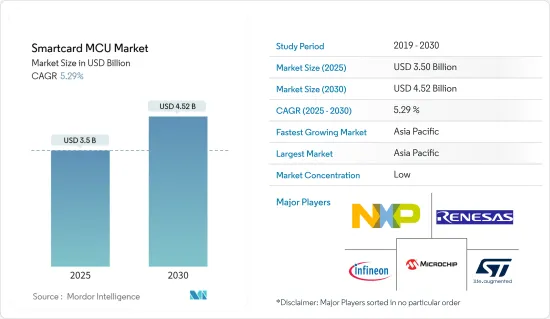

智慧卡 MCU 市场规模预计在 2025 年为 35 亿美元,预计到 2030 年将达到 45.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.29%。

就单位出货量而言,预计将从 2025 年的 93.2 亿台成长到 2030 年的 155.3 亿台,预测期间(2025-2030 年)的复合年增长率为 10.74%。

主要亮点

- 随着互联网的快速扩张,电子商务对于电脑使用者来说即使不是一种习惯也已经成为现实。然而,目前电子商务应用中使用的经营模式无法充分发挥电子媒介的潜力。

- 市场发展的驱动力是RFID技术和NFC在智慧卡领域的不断发展。接触型智慧卡利用无线射频辨识(RFID)技术的快速发展,变得越来越流行。这些卡片使用 RFID 技术来处理交易。随着主要供应商专注于接触型智慧卡的采用,不断增长的消费者需求正在推动市场的成长。

- 智慧卡技术在交通运输产业的广泛应用,以及政府对数位技术采用的投资不断增加,正在推动市场成长。电子智慧付款卡现在已成为交通运输业者可行的替代付款方式。近年来,许多商家和系统供应商推出了基于智慧卡的系统来补充甚至取代现有的付款方式。

- 此外,安全性和小型化是智慧卡技术发展最快的两个面向。随着世界逐渐转向更安全的 EMV 银行卡,最新一代智慧卡拥有完整的片上加密技术,大大增强了整个产业的卡片安全性。

- 此外,IC 卡正日益小型化,形成各种形状,如迷你标籤和智慧穿戴装置。随着智慧卡越来越多地被用作与电话和生物识别技术并列的第二因素凭证,这一趋势可能会持续下去。

- 智慧卡面临的主要挑战是其安全等级。为了充分发挥其潜力,智慧卡必须与各种介面进行互动。然而,公众认知中出现了安全问题。人们可能需要知道储存在卡上的个人资讯是否安全。然而,必须认识到,从智慧卡中提取的任何资讯都将在其他地方被收集和分析。

智慧卡 MCU 市场趋势

BFSI 有望成长

- 目前,银行和金融机构的智慧卡均采用专用积体电路卡,并具有强大的安全保障措施。这些卡包含一个记忆体晶片和一个微处理器,可以安全地储存和处理资料。这些卡片在金融活动中发挥多种功能,包括交易认证、安全存取网路银行服务、签帐金融卡卡和信用卡付款以及非接触式支付方式。

- 付款流程的数位化很大程度上得益于互联网的发展和电子商务的出现。这种转变催生了丰富的电子付款选项,包括付款卡(信用卡和金融卡)到数位钱包、电子现金和非接触式付款方式。日益普及的行动付款服务目前正经历转型期,为未来的技术进步做好准备。利用智慧卡技术的付款方式的进步预计将推动市场成长。

- 智慧卡包含 MCU(微控制器单元),与个人识别码(PIN)一起广泛使用。 MCU 有多种用途,包括增强组织的安全性、充当多因素身份验证 (MFA) 令牌以及对单一登入 (SSO) 使用者进行身份验证。由于疫情以及 Apple Pay、Klarna、Stripe 和 Amazon Pay 等替代付款方式的兴起,线上交易的激增已经超过了面对面交易。这些进步将大大扩展智慧卡技术的工业应用范围。

- EMV 卡技术采用整合在信用卡和签帐金融卡中的小型、坚固的晶片,并正在成为一种不断发展的付款解决方案。 EMV 是 Europay、Mastercard 和 Visa 的首字母缩写,象征着该行业标准背后的共同努力。这些先进的卡片对于透过减少信用卡诈欺造成的损失、促进更安全的付款环境和确保更安全的交易体验来增强业务和客户安全至关重要。

- 大多数新型 EMV 卡和基于晶片的读卡器都配备了近距离场通讯(NFC) 技术,可实现非接触式付款。顾客只需将卡片放在读卡机上轻触即可实现更快、更安全的交易。除了增强的安全性之外,EMV 智慧卡还透过卡片和终端之间的安全通讯提供更高的速度和便利性,使商家和持卡人均受益。

- EMV 卡包含一个晶片,该晶片采用加密演算法在每次使用时资料进行唯一加密,从而使交易更加安全。在刷卡交易期间,这些卡片采用双重身分验证流程,需要实体卡片和客户的密码。此身份验证方法可以验证持卡人,并允许验证和核准晶片产生的动态密码(OTP)。预期的技术进步将推动对智慧卡技术的广泛需求,从而推动短期市场成长。

预计亚太地区将占据主要市场占有率

- 亚太地区智慧卡技术的采用正朝向多应用智慧卡转变。这些卡片具有多种用途,包括付款、识别和门禁,为消费者带来便利和效率,为企业节省成本。此外,人们对改善智慧卡安全功能的需求也日益增长,尤其是随着网路交易的增加。

- 智慧卡技术在印度越来越受欢迎,部分原因是政府对数位化的重视。几乎每个印度公民都可能拥有某种形式的智慧卡。这些卡片广泛应用于银行、医疗保健、交通和政府识别等各个领域。例如,在印度,智慧卡用于驾驶执照/登记证 (DL/RC)、多用途国民身份证(MNIC)、国家身分证计画 (RSBY)、电子护照 (e-Passport) 等。该地区智慧卡技术的采用率不断提高,预计将推动市场发展。

- 预计在不久的将来,数位付款和智慧卡的需求将会激增。印度 BFSI 产业正在见证智慧卡技术的日益普及,预计将为 MCU 製造商带来巨大的前景。特别是在国家智慧卡计画(RSBY)下营运的保险公司和银行的业务代表已经生产了数百万张晶片卡,使印度成为智慧卡技术采用速度最快的国家之一。预计这些因素将刺激市场需求。

- 印度采用智慧卡技术也提高了普通公民的生活质量,使社会福利计划和交通系统受益。其中一个例子是 Shakti 智慧卡计划,该计划允许居住在卡纳塔克邦的女性自由乘坐非高级公车。 EMVCo 表示,印度智慧卡倡议缩短了交易时间、减少了损失并提高了受益人的满意度。智慧卡等创新技术的使用有可能增强未来的福利计划。

- 配备了能够建立短距离无线连接的MCU的智慧付款卡有可能用于非接触式付款系统。该地区非接触感应卡的使用持续增长,随着其普及率的提高,透过这种方式进行的付款量大幅增加,从而导致市场需求显着增加。

智慧卡 MCU 市场概况

智慧卡MCU市场呈现半整合态势,主要参与者之间的竞争日益激烈。这一格局的特点是,受一体化程度不断提高、技术进步和地缘政治情势演变的影响,情势不断波动。随着企业更加重视技术创新以获得永续的竞争优势以及终端用户产业新客户需求的激增,竞争将愈演愈烈。

在这种背景下,当考虑微控制器製造中最终用户的品质期望时,品牌标识至关重要。此市场渗透率较高,知名企业包括英飞凌科技股份公司、瑞萨电子株式会社、德州仪器公司、义法半导体公司等。

2023年9月,GlobalFoundries与Microchip Technology透过Microchip旗下子公司SST(Silicon Storage Technology)宣布推出SST ESF3第三代嵌入式SuperFlash技术NVM解决方案。此尖端解决方案目前已在 GF 28SLPe晶圆代工厂製程上投入生产,并受到 GF 客户的一致好评。它具有出色的性能、出色的可靠性、丰富的IP选择和成本效益,可以在先进的MCU、复杂的智慧卡以及消费性和工业物联网晶片中找到理想的应用。

2023 年 6 月,三星电子推出了一款具有一体化付款解决方案的生物识别卡 IC,有望带来革命性的付款体验。全新指纹安全晶片在2023年CES上获得高度认可,荣获网路安全与个人隐私类别最佳创新奖。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 新冠肺炎疫情与宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 数位科技快速发展

- 政府增加对交通系统的投资

- 市场挑战

- 行动和数位钱包日益普及

第六章 市场细分

- 按产品

- 8 位元

- 16 位元

- 32 位元

- 按功能

- 交易

- 通讯

- 安全存取控制

- 按最终用户产业

- BFSI

- 通讯业

- 政府和医疗保健

- 教育

- 零售

- 运输

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- NXP Semiconductors NV

- Renesas Electronics Corporation

- Infineon Technologies AG

- STMicroelectronics

- Microchip Technology Inc.

- Idemia Group

- Thales group

- Giesecke+Devrient

- Zilog, Inc.

- Samsung Electronics Co. Ltd

第八章 投资分析及市场展望

The Smartcard MCU Market size is estimated at USD 3.50 billion in 2025, and is expected to reach USD 4.52 billion by 2030, at a CAGR of 5.29% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 9.32 billion units in 2025 to 15.53 billion units by 2030, at a CAGR of 10.74% during the forecast period (2025-2030).

Key Highlights

- The Internet's rapid expansion has made electronic shopping a real possibility among computer users if not a habit; nevertheless, the present business model used in electronic commerce applications cannot fully exploit the potential of the electronic medium.

- The market growth is driven by the increasing development in RFID technology and NFC in smart cards. Contactless smart cards, leveraging the rapid evolution of radio frequency identification (RFID) technology, are gaining popularity. These cards use RFID technology to process transactions. Key vendors are concentrating on introducing contactless smart cards due to their growing consumer demand, which is expected to fuel market growth.

- The proliferation of smart card technology in the transportation industry, along with growing government investments in implementing digital technology, drives market growth. Electronic smart cards are now viable alternative payment methods for transport operators. In recent years, many operators and system providers have initiated smart card-based systems either to complement or replace existing payment methods.

- Furthermore, security and miniaturization represent the two fastest-evolving aspects of smart card technology. With global migration to higher security EMV banking cards, the newest generation of smart cards boasts full on-chip cryptography, significantly enhancing industry-wide card security.

- Moreover, smart cards are increasingly being miniaturized into diverse form factors like mini-tags and smart wearables. These trends will persist as smart cards are increasingly employed as a two-factor credential alongside phones or biometrics.

- The primary challenge facing smart cards is their security level. To realize their full potential, smart cards must interact with various interfaces. However, a security issue arises concerning public perception; people might need to be made aware of the personal details stored on their cards, assuming they are secure. Yet, there needs to be an awareness that information extracted from smart cards is collected and analyzed elsewhere.

Smartcard MCU Market Trends

BFSI to Witness the Growth

- Smart cards for banking and finance now incorporate specialized integrated circuit cards, ensuring robust security measures. These cards house embedded memory chips and microprocessors, enabling secure data storage and processing. They serve diverse functions in financial activities, including transaction authentication, secure access to online banking services, debit and credit card payments, and contactless payment methods.

- The digitization of payment processes owes much to the Internet's development and the emergence of e-commerce. This transition has led to a plethora of electronic payment options, ranging from payment cards (credit and debit) to digital wallets, electronic cash, and contactless payment methods. The surging popularity of mobile payment services is currently undergoing a transitional phase, poised for future technological advancements. These advancements in payment methods are expected to leverage smart card technology, driving market growth.

- Smart cards featuring MCUs (microcontroller units) are commonly used alongside personal identification numbers (PINs). They serve multiple purposes, enhancing organizational security, acting as multifactor authentication (MFA) tokens, and verifying single sign-on (SSO) users, ultimately facilitating passwordless authentication. The rapid increase in online transactions, partly due to the pandemic and the rise of alternative payment methods like Apple Pay, Klarna, Stripe, and Amazon Pay, has surpassed face-to-face transactions. These advancements significantly expand the potential applications of smart card technology in the industry.

- EMV card technology, employing compact yet robust chips integrated into credit and debit cards, is increasingly recognized as an evolving payment solution. EMV, an acronym for Europay, Mastercard, and Visa, denotes the collaborative efforts behind this industry standard. These advanced cards are indispensable in fortifying businesses and customer security by mitigating credit card fraud losses, fostering a more secure payment environment, and ensuring a safer transactional experience.

- Most new EMV cards and chip-based readers come equipped with near-field communication (NFC) technology, enabling contactless payments. Customers can wave their cards across the reader, facilitating quicker and more secure transactions. Besides heightened security, EMV smart cards offer enhanced speed and convenience by securely communicating between the card and the terminal, benefitting both merchants and cardholders.

- EMV cards, featuring chips employing cryptographic algorithms, heighten transaction security by uniquely encrypting data with each use. During card-present transactions, these cards employ a dual verification process, requiring the physical card and the customer's PIN. This authentication method validates the cardholder, enabling the confirmation and approval of the one-time password (OTP) generated by the chip. Anticipated technological advancements are poised to stimulate extensive demand for smart card technology, propelling market growth in the foreseeable future.

Asia-Pacific Expected to Hold Significant Market Share

- The adoption of smart card technology in the APAC is experiencing a change towards multi-application smart cards. These cards are being used for multiple purposes, such as payment, identification, and access control, resulting in greater convenience and efficiency for consumers and cost savings for businesses. Moreover, the need for enhanced security features in smart cards has been growing, particularly with the increase in online transactions.

- Smart card technology has gained widespread popularity in India, owing to the government's focus on digitalization. Almost every Indian citizen probably possesses some form of a smart card. These cards are extensively utilized in various sectors, such as banking, healthcare, transportation, and government identification. For example, smart cards are employed for Driving License/Vehicle Registration Certificate (DL/RC), Multi-purpose National Identity Card (MNIC), Rashtriya Swasthya Bima Yojana (RSBY), and Electronic Passport (e-Passport) in India. The increasing adoption of smart card technology in the region is expected to drive the market.

- The near future is expected to witness a surge in the demand for digital payments and smart cards. The Indian BFSI sector is progressively embracing smart card technology, which is anticipated to provide substantial prospects for MCU makers. Notably, insurance companies operating under the Rashtriya Swasthya Bima Yojana (RSBY) and business correspondents for banks are producing millions of chip cards, making India one of the swiftest adopters of smart card technology. Such factors are expected to drive the demand for the market.

- In addition, implementing smart card technology in India has benefited social welfare programs and transportation systems, as it has improved the quality of life for the general public. An example is the Shakti smart card scheme, which enables women residing in Karnataka to travel freely on non-premium buses. According to EMVCo, the Smart Card India initiative has reduced transaction time, minimized losses, and increased satisfaction among beneficiaries. The utilization of innovative technologies like smart cards has the potential to enhance future welfare programs.

- Smart cards equipped with MCUs that possess the ability to establish short-range wireless connections have the potential to be utilized in contactless payment systems. As the usage of contactless cards continues to rise and their adoption rates increase within the region, the volume of payments conducted through this method has experienced a substantial surge, consequently generating a notable market demand.

Smartcard MCU Market Overview

The smartcard MCU market demonstrates semi-consolidation, marked by intensifying competition among major players. This landscape is characterized by fluctuations influenced by growing consolidation, technological advancements, and evolving geopolitical scenarios. With a pronounced emphasis on innovation for sustainable competitive advantage, competition is poised to escalate, buoyed by the anticipated surge in demand from new customers within end-user industries.

In this context, brand identity assumes paramount importance, given the expectations of quality from end-users in microcontroller manufacturing. The market features prominent incumbents like Infineon Technologies AG, Renesas Electronics Corporation, Texas Instruments Incorporated, and STMicroelectronics NV, resulting in high market penetration levels.

September 2023 witnessed the unveiling of the SST ESF3 third-generation embedded SuperFlash technology NVM solution by GlobalFoundries and Microchip Technology, introduced through Microchip's subsidiary, Silicon Storage Technology (SST). Now available for production in the GF 28SLPe foundry process, this cutting-edge solution has garnered commendation from GF's clientele. It boasts remarkable performance, exceptional reliability, a diverse array of IP options, and cost efficiency, finding ideal applications in advanced MCUs, intricate smart cards, and IoT chips for consumer and industrial use.

In June 2023, Samsung Electronics introduced a biometric card IC featuring an all-in-one payment solution, promising an innovative payment experience. This new fingerprint security chip earned recognition as the winner of the CES 2023 Best of Innovation Awards in the Cybersecurity & Personal Privacy category.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Development of Digital Technologies

- 5.1.2 Increasing Investments by Governments in Transportation Systems

- 5.2 Market Challenges

- 5.2.1 Growing Popularity of Mobile or Digital Wallets

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 8-bit

- 6.1.2 16-bit

- 6.1.3 32-bit

- 6.2 By Functionality

- 6.2.1 Transaction

- 6.2.2 Communication

- 6.2.3 Security and Access Control

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Telecommunications

- 6.3.3 Government and Healthcare

- 6.3.4 Education

- 6.3.5 Retail

- 6.3.6 Transportation

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductors NV

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics

- 7.1.5 Microchip Technology Inc.

- 7.1.6 Idemia Group

- 7.1.7 Thales group

- 7.1.8 Giesecke+Devrient

- 7.1.9 Zilog, Inc.

- 7.1.10 Samsung Electronics Co. Ltd