|

市场调查报告书

商品编码

1692452

美国光电:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)US Photonics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

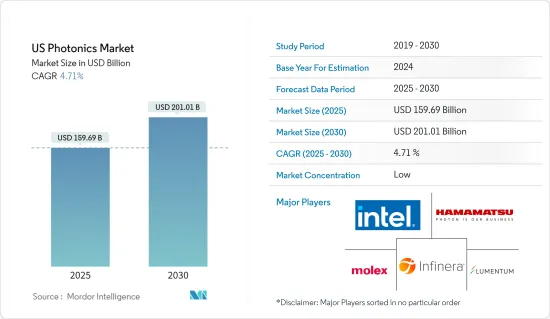

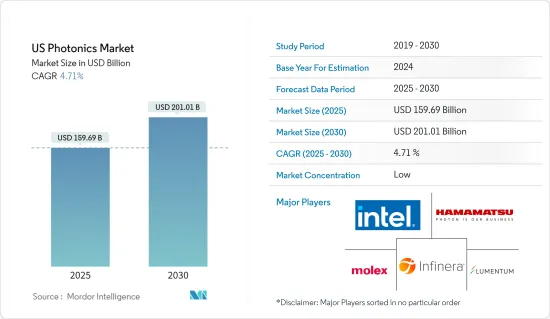

预计 2025 年美国光电市场规模为 1,596.9 亿美元,到 2030 年将达到 2,010.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.71%。

主要亮点

- 光电被认为是能够在医疗保健、汽车、通讯、製造和零售等各个行业创建节能智慧系统的关键技术。这些产业正在采用光电来提高效率并推动成长。

- 近期,各领域投资明显增加。光电正在被多个行业迅速采用为基础技术,并且市场正在扩展到新的垂直领域。

- 在光电,LiDAR 技术备受关注。它们最初用于研究大气中气体和污染物的分布,现在已成为自动驾驶的必需品。 LiDAR 测绘系统和相关技术的进步使其应用范围不断扩大,涵盖航太、国防、汽车、采矿以及石油和天然气等多个垂直领域。

- Google、微软、Facebook等产业参与者是美国市场的主要推动力,这要求每个资料中心优化其资料传输流程。该国也为技术进步和扩张提供了良好的环境。此外,美国硅光电元件行业的良好资金筹措状况正在鼓励组织和新兴企业投资不断扩大的光电市场。

- 2023 年 2 月,Excelitas TechnologiesO Corp. 收购了位于美国奥勒冈州希尔斯伯勒的 Phoseon Technology, Inc.,这是一家专注于提供创新、市场主导的光电解决方案的工业技术製造商。 Phoseon 是 LED工业固化和科学照明解决方案的主要企业设计者和製造商,为全球广大客户提供经过现场验证的可靠性和显着的效率提升。

- 然而,与传统产品相比,硅基光子产品和设备的初始成本较高,阻碍了该技术在许多领域的部署。儘管这项技术提供了更高的性能和效率,但由于预算有限,基于光电的设备对于各个行业的许多中小型终端用户来说仍然遥不可及。

美国光电市场趋势

硅基光电应用的出现推动市场

- 硅光电是光电的一个新兴领域,与半导体中的传统电导体相比具有明显的优势。这些半导体通常用于高速传输系统。预计该技术将得到 IBM、英特尔和 Kothura 等公司的突破,传输速度将达到 100Gbps。此外,这项技术正在彻底改变半导体产业,实现高速资料传输和处理。

- 此外,硅基光电为资料传输和处理提供了节能的解决方案,使其非常适合需要关注功耗的应用,例如资料中心和高功率计算。

- 网路流量的成长不仅推动了对支援更高连接埠密度和更快速度转换的下一代技术的需求,而且还伴随着更大的实体资料中心和资料之间更快的连接。随着传输高速资料所需的资料速率和距离的增加,传统铜缆和多模光纤解决方案的限制变得明显,推动产业转向采用单模光纤解决方案。

- 硅基光电有望在资料中心的发展中发挥关键作用,在短期内实现 100G,随后实现 400G 和 800G 电缆。它也是一种资料中心解耦的支援技术,并且可能成为未来的 CPO 方法。该技术越来越多地用于覆盖距离为 500 公尺的 DR 标准连接,但有时也在资料通讯通讯应用中与连贯技术一起使用。此外,对 400ZR 标准技术的需求也不断增加。

- 此外,硅光电在医疗应用的应用正在增加,许多新兴企业开始使用硅整合光学作为製造平台。根据美国人口普查局的数据,到2023年,美国医疗设备和耗材製造业销售额预计将达到435.1亿美元。同时,全国医疗保健支出从2022年的4.439兆美元预计到2031年将达到7.174兆美元(CMS公告)。

- 消费者健康领域的发展仍在继续,Lockley 宣布其 VitalSpexTM 生物感测平台将于 2022-23 年出货。预计这一趋势将鼓励苹果和华为等知名品牌将基于硅光电的生物感测器纳入其穿戴式装置中。

资料通讯通讯应用领域预计将占据主要市场占有率

- 通讯技术中光学解决方案的采用日益增多,尤其是光纤宽频,预计将推动该技术的市场需求。该部分占有主要市场占有率。

- 采用光纤网路作为基础设施的一部分,正在推动通讯公司投资升级传统网路。电话公司是率先以光纤线路取代老式铜线系统的公司。电话公司使用光纤作为其主干架构,为城域电话系统之间提供远距连接。

- 随着技术普及率的提高和线上影片内容消费量的增加,全球对宽频的需求正在上升。根据TeleGeography的海底电缆地图,海底电缆是网路的骨干。此外,根据美国研究所的数据,在400多条海底光缆中,美国透过大约88条与世界相连,其中17条计划于2022年至2024年间完工。

- 根据全球行动通讯系统协会 (GSMA) 的数据,预计到 2025 年,美国的 5G 普及率将超过 4G。此外,政府已拨出多项资金用于在该地区快速部署 5G 服务。 2023年4月,拜登—哈里斯政府推出公共无线供应链创新基金,将投资15亿美元建造开放、可互通的网路。这笔资金是为了确保 5G 和下一代无线技术的未来由美国及其在世界各地的盟友和合作伙伴共同建造。

美国光电产业概况

美国光电市场由多家全球性和地区性公司组成。 Finisar Corporation、Intel Corporation、NeoPhotonics Corporation、Infinera Corporation、Hamamatsu Photonics、IPG Photonics Corporation 和 Coherent Inc. 等现有企业已经建立了销售网络并对市场产生了重大影响。

拥有如此多的重要供应商而不损害市场占有率是永续的。全球领先供应商的品牌识别与本研究涵盖的各种产品相同。总体而言,所研究市场中的供应商之间的竞争非常激烈,预计在预测期内将保持不变。

- 2023年11月,Innolume推出了O波段量子点GaAs SOA,光输出功率达到1W。充分利用 LiDAR、PON 和 FSO。

- 2023年9月,ADLT Lighting Group宣布收购Cree Lighting 美国、E-conolight和Cree Lighting Canada,标誌着公司雄心勃勃的成长策略的一个重要里程碑。这些收购巩固了 ADLT 照明集团作为照明行业全球供应商的地位,并加强了其对创新和卓越的承诺。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估主要宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 硅基光电应用的兴起

- 日益关注高效能、环保的解决方案

- 市场挑战/限制

- 光电设备的初始成本高

第六章市场区隔

- 按应用

- 勘测与探测

- 生产技术

- 资料通讯

- 影像捕捉和显示

- 医疗技术

- 照明

- 其他用途

第七章竞争格局

- 公司简介

- Intel Corporation

- Neophotonics Corporation(lumentum Holdings)

- Infinera Corporation

- Molex Inc.

- Hamamatsu Photonics KK

- IPG Photonics

- Coherent, Inc.(Coherent Corp.)

- Vescent Photonics LLC

- Photonic Systems Inc.

- Thorlabs Inc.

- NEC Corporation

- ams OSRAM AG

- Trumpf Group

- Polatis Incorporated(huber+suhner)

- Alcatel-lucent SA(Nokia Corporation)

第八章光电产业从业人员场景

第九章 市场展望

The US Photonics Market size is estimated at USD 159.69 billion in 2025, and is expected to reach USD 201.01 billion by 2030, at a CAGR of 4.71% during the forecast period (2025-2030).

Key Highlights

- Photonics is considered a crucial technology that enables the creation of energy-efficient smart systems across various industries, including healthcare, automotive, communications, manufacturing, and retail. These sectors are adopting photonics to enhance efficiency and drive growth.

- In recent times, investments in various sectors have experienced substantial growth. Photonics, as a fundamental technology across multiple industries, is seeing rapid adoption, with the market expanding into new verticals.

- LiDAR technology has gained prominence in photonics. Originally used for studying atmospheric gas distribution and contaminants, it has now become crucial for autonomous driving. Advances in LiDAR mapping systems and related technologies have expanded its applications across various verticals, including aerospace, defense, automotive, mining, and oil and gas.

- The presence of industry players such as Google, Microsoft, and Facebook is the primary force driving the US market, necessitating optimization of the data transmission process for respective data centers. The country also provides a favorable environment for technological advancements and expansions. Furthermore, the significant funding landscape in the US silicon photonics devices industry has encouraged organizations and start-ups to invest in the expanding photonics market.

- In February 2023, Excelitas TechnologiesO Corp. which is a industrial technology manufacturer concentrated on delivering innovative, market-driven photonic solutions, acquired the Phoseon Technology, Inc, Hillsboro, OR, USA. Phoseon is a key player in the design and manufacturer of LED-based industrial curing and scientific illumination solutions offering the field-proven reliability and enabling significant efficiency gains for a wide range of global customers.

- However, compared to conventional products, the high initial cost of silicon-enabled photonic products and devices hinders technology deployment in many fields. While the technology provides higher performance and efficiency, photonics-based devices remain inaccessible to many small- and medium-sized end-users in various verticals due to limited budgets.

US Photonics Market Trends

Emergence of Silicon-based Photonics Applications to Drive the Market

- Silicon photonics, an emerging field within photonics, provides a distinct advantage over traditional electrical conductors found in semiconductors. These semiconductors are commonly used in high-speed transmission systems. This technology is expected to push the transmission speed up to 100 Gbps, with companies like IBM, Intel, and Kothura, achieving breakthroughs. Besides, this technology is revolutionizing the semiconductor industry, enabling high-speed data transfer and processing.

- Moreover, silicon-based photonics provides energy-efficient data transmission and processing solutions, making it suitable for applications where power consumption is a concern, such as data centers and high-power computing.

- The growth in internet traffic is not only accelerating the need for next-generation technology to support higher port density and faster speed transitions but is also accompanied by large physical data center sizes and faster connectivity between the data centers. As the data rates and distances to carry high-speed data are increasing, the limitations of traditional copper cable and multimode fiber-based solutions are becoming apparent, and the industry is shifting towards adopting single-mode fiber-optic solutions.

- Silicon-based photonics is expected to play a significant role in the evolution of data centers in the short term for 100G and then 400G and 800G pluggables. It will also be an enabling technology for disaggregating data centers and a possible future CPO approach. The technology is increasingly used for 500 m reach DR-standard connections but is also used with coherent technology in datacom applications. Moreover, the market is also witnessing increasing demand for 400ZR standard technology.

- Additionally, with the rising implementation of silicon photonics in medical applications, many start-ups have started using silicon-integrated optics as a manufacturing platform. According to US Census Bureau, the industry revenue of medical equipment and supplies manufacturing in the United States is expected to reach USD 43.51 billion by 2023. Whereas the national health expenditure in the country is expected to reach USD 7.174 trillion by 2031, which was USD 4.439 trillion in 2022, as stated by CMS.

- Consumer health development continues, with Rockley announcing the shipment of its VitalSpexTM biosensing platform in 2022-23. Such trends are expected to boost the integration of silicon photonics-based biosensors in wearables from prominent brands like Apple or Huawei.

Data Communication Application Segment is Expected to Hold Significant Market Share

- The increasing adoption of optical solutions in communication technologies, particularly optical broadband, is anticipated to boost demand for this technology in the market. This segment holds a significant market share.

- The increasing adoption of optical networks as part of infrastructure has led telecommunication companies to invest in upgrading their legacy networks. Telephone companies were pioneers in replacing their outdated copper wire systems with optical fiber lines. Telephone companies leverage optical fiber as the backbone architecture and a long-distance connection between the city phone systems.

- The global demand for broadband is on the rise due to the widespread adoption of technology and the increasing consumption of online video content. According to TeleGeography's submarine cable map, submarine cables act as the backbone of the Internet. Moreover, according to the US Naval Institute, of more than 400 fiber optics undersea cables, the United States is connected to the world through approximately 88, including 17 scheduled to be completed between 2022 and 2024.

- According to Global System for Mobile Communications (GSMA), the 5G penetration in the United States is expected to overtake 4G by 2025. In addition, the government is allocating several funds for the faster deployment of 5G services in the region. In April 2023, the Biden-Harris Administration introduced the Public Wireless Supply Chain Innovation Fund, which invested USD 1.5 billion to create open and interoperable networks. The initial round of funding will assist to ensure that the future of 5G and next-generation wireless technology is built by the United States and its global allies and partners.

US Photonics Industry Overview

The United States photonics market comprises several global and regional players vying for attention in a contested market space. Market incumbents, such as Finisar Corporation, Intel Corporation, NeoPhotonics Corporation, Infinera Corporation, Hamamatsu Photonics, IPG Photonics Corporation, and Coherent Inc., have a considerable influence on the overall market, with access to well-established distribution networks.

The existence of such a sheer number of significant vendors without compromising on their market shares is sustainable. Brand identity associated with major vendors became a synonym for various product offerings under the scope of the study worldwide. Overall, the intensity of competitive rivalry among the vendors in the market studied is expected to be high and remain the same during the forecast period.

- November 2023, Innolume launched O band Quantum Dot GaAs SOA that has reached 1W of optical power. It can be further leveraged in LiDARs, PONs and FSO.

- In September 2023, the ADLT Lighting Group announced the acquisition of Cree Lighting US, E-conolight, and Cree Lighting Canada, marking a significant milestone in the company's ambitious growth strategy. These acquisitions solidify ADLT Lighting Group's position as a global provider in the lighting industry and reinforce its commitment to innovation and excellence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyer/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Silicon-based Photonics Applications

- 5.1.2 Increasing Focus on High-performance and Eco-Friendly Solutions

- 5.2 Market Challenges/Restraints

- 5.2.1 High Initial Cost of Photonics - Enabled Devices

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Surveying And Detection

- 6.1.2 Production Technology

- 6.1.3 Data Communication

- 6.1.4 Image Capture and Display

- 6.1.5 Medical Technology

- 6.1.6 Lighting

- 6.1.7 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Neophotonics Corporation (lumentum Holdings)

- 7.1.3 Infinera Corporation

- 7.1.4 Molex Inc.

- 7.1.5 Hamamatsu Photonics KK

- 7.1.6 IPG Photonics

- 7.1.7 Coherent, Inc. (Coherent Corp.)

- 7.1.8 Vescent Photonics LLC

- 7.1.9 Photonic Systems Inc.

- 7.1.10 Thorlabs Inc.

- 7.1.11 NEC Corporation

- 7.1.12 ams OSRAM AG

- 7.1.13 Trumpf Group

- 7.1.14 Polatis Incorporated (huber+suhner)

- 7.1.15 Alcatel-lucent SA (Nokia Corporation)