|

市场调查报告书

商品编码

1692537

系统晶片(SoC) - 市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)System On Chip (SoC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

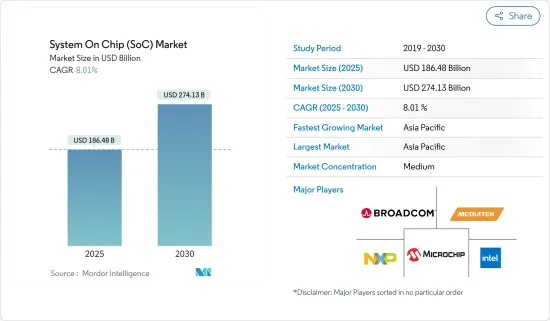

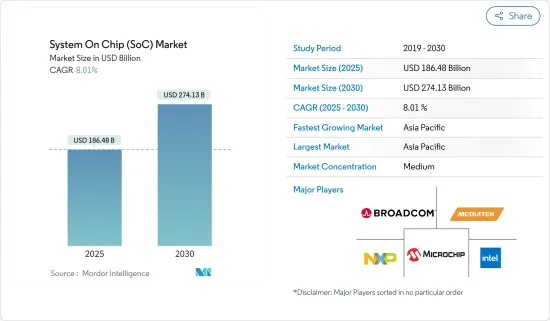

系统晶片市场规模预计在 2025 年为 1,864.8 亿美元,预计到 2030 年将达到 2,741.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.01%。

系统晶片(SoC) 技术已成为现代技术不可或缺的一部分,彻底改变了电子设备的设计和製造方式。本质上,系统晶片(SoC) 将电脑的所有元件(包括 CPU、记忆体、输入/输出埠和二级记忆体)整合到单一晶片上。

关键亮点

- 5G、6G、软体化汽车、非地面电波网路(NTN)、数位医疗等快速发展的技术、无限的想像力和跨产业的发明,为SoC快速进入消费市场铺平了道路。由于SoC结构紧凑、功耗低,它们早已嵌入平板电脑和行动电话等电子设备中。

- 如今,SoC 在物联网设备和其他设备中的应用越来越广泛。消费者对智慧和节能设备的需求不断增长,以及物联网在各行业的快速应用,预计将成为半导体市场参与企业的催化剂,推动 SoC 市场的成长。

- 电子产业的另一个重要趋势是物联网(IoT)的兴起。随着对智慧型设备的需求不断增加,物联网已成为我们日常生活中不可或缺的一部分。因此,企业主要使用这项技术来开发新产品和服务。 SoC 也将在软性电子产品的进步中发挥关键作用,为穿戴式和可植入装置提供新的形式。

- 随着技术的不断发展,许多行业正在采用自动化数位化,这为主要企业进入市场带来了新的机会,但与系统晶片(SoC)相关的初始研发成本很高。针对不同产品的SoC客製化程度不断提高,需要主要企业同时关注各种研发计划,增加了计划成本。预计这些因素将在预测期内阻碍市场成长。

- 虽然新冠疫情透过增加对家用电子电器的需求改变了消费者的支出模式,但汽车产业向电动车的转变也增加了对晶片的需求。例如,典型的汽油引擎汽车使用大约 50 到 150 个半导体晶片,而电动车则最多可使用 3,000 个半导体晶片。电动车生产比例的不断增长必将在未来大幅增加半导体晶片的消费量,使 SoC 在全球市场中发挥更大的作用。

系统晶片市场趋势

消费性电子领域占很大份额

- SoC 的效率提高、能耗降低以及尺寸紧凑,使其成为从智慧型手机到各种互联设备等许多家用电子电器应用中的必备元件。预计消费性电子产品对 SoC 的需求将根据应用而大幅成长。这主要是由于消费者可支配收入的增加导致智慧型手机的普及率不断提高。

- 高阶智慧型手机、智慧音箱、平板电脑、穿戴式装置等消费性电子产品正广泛采用边缘AI晶片。这些晶片专门用于提高网路边缘人工智慧演算法的运算能力和有效性,实现快速、即时的决策能力。预计人工智慧晶片技术需求的不断增长将推动整个预测期内的市场扩张。此外,人工智慧技术的日益普及以及物联网消费性设备的普及将进一步促进市场成长。

- 此外,互联网和智慧型手机用户的不断增长、云端运算和物联网平台的广泛使用以及智慧基础设施中无线感测器的广泛部署是推动市场成长的主要驱动力。随着市场对物联网和智慧型装置的持续成长,由于 SoC 晶片在这些装置中的应用多种多样,其需求预计也将以同样的速度成长。因此,该市场的多家供应商不断投资推出重要产品,以满足消费性电子产品日益增长的连结需求。

- 预计多个国家对消费性电子产业的投资将不断增加,从而创造不断扩大的市场机会。世界各国政府都在不断鼓励在本国进行新的投资,以建立电子製造设施并提高生产能力。行动性采用率的提高、互联网连接性的提高以及连网型设备的日益普及预计将推动家用电子电器产品的成长。这项在行动装置、个人电脑、平板电脑和音讯设备等多种消费性电子设备中受到青睐的关键功能预计将推动市场发展。

- 根据爱立信预测,全球智慧型手机行动网路用户数将在2022年接近64亿,到2028年将超过77亿人。值得注意的是,中国、印度和美国已成为智慧型手机行动网路用户数量最多的国家。爱立信报告强调,儘管预计智慧型手机销量将在 2022 年达到稳定水平,但由于智慧型手机平均售价上涨,预计未来几年市场将会增强。随着这些显着的发展,预计未来市场将变得更加光明。

亚太地区可望主导市场

- 亚太地区目前在全球半导体市场占据主导地位,并且由于政府措施的进一步支持,预计将继续占据市场主导地位。据 SIA 称,中国大陆、日本、台湾和韩国合计占全球半导体产量的 75% 左右,越南、泰国、马来西亚和新加坡等其他国家也对该地区的市场主导地位做出了重大贡献。

- 随着各行各业对技术先进设备的需求不断增加,预计该市场对 SoC 设备的需求将进一步增加。此外,随着汽车和智慧型手机市场中感测器应用范围的扩大,对感测器的需求预计将进一步增加。

- 此外,政府的「中国製造2025」计画也促进了电力电子市场的扩张。此外,该行业正在向该地区的电力电子领域注入新的资本。例如,领先的宽能带隙半导体製造商IIVI Incorporated已扩大其在中国的SiC晶圆精加工製造厂的规模。

- 透过此次推出,该公司旨在为 5G 建设提供下一代产品动力,包括下一代 5G 紧凑型宏、基频单元和大规模 MIMO 无线电。

系统晶片产业概况

由于国内外参与企业的存在,系统晶片(SoC)市场变得半固体。主要企业正在采用各种策略,例如产品推出、合约和收购,以扩大其在市场上的影响力。市场的主要企业是博通公司、英特尔公司、联发科公司、微晶片科技公司和恩智浦半导体公司。

- 2023年9月,格芯与美国微芯科技公司(Microchip Technology)透过微芯旗下子公司SST(Silicon Storage Technology)宣布推出SST ESF3第三代嵌入式SuperFlash技术NVM解决方案。此尖端解决方案目前可用于 GF 28SLPe晶圆代工厂製程的生产。 GF 客户对此解决方案提供的出色性能、无与伦比的可靠性、广泛的 IP 选项和成本效益表示满意。事实证明,该解决方案非常适合用于消费性和工业应用的高级 MCU、复杂智慧卡和物联网晶片。

- 2023年5月,STM宣布推出适用于STM32 MCU和BLE SoC的天线匹配单晶片IC。义法半导体推出了最新的单晶片天线匹配IC系列,以加快蓝牙LE晶片系统和两款STM32微控制器的创新步伐。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 物联网和人工智慧等新兴技术的采用日益增多

- 5G投资不断增加,5G智慧型手机需求不断成长

- 市场限制

- 研发初期成本高

第六章市场区隔

- 按类型

- 模拟

- 数位的

- 混合物

- 按最终用户产业

- 消费性电子产品

- 通讯

- 车

- 计算与资料存储

- 工业的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争格局

- 公司简介

- Broadcom Inc.

- Intel Corporation

- Mediatek Inc.

- Microchip Technology Inc.

- NXP Semiconductors NV

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd

- STMicroelectronics NV

- Toshiba Corporation

- Apple Inc.

- Taiwan Semiconductor Manufacturing Company Limited(TSMC)

- Texas Instruments Incorporated

第八章投资分析

第九章 市场机会与未来趋势

The System On Chip Market size is estimated at USD 186.48 billion in 2025, and is expected to reach USD 274.13 billion by 2030, at a CAGR of 8.01% during the forecast period (2025-2030).

System-on-chip (SoC) technology has become an integral part of modern technology, revolutionizing the way electronic devices are designed and manufactured. Basically, a system-on-a-chip, or SoC, integrates all the components of a computer onto a single chip, including CPU, memory, input and output ports, and secondary storage.

Key Highlights

- Rapidly evolving technologies, including 5G and 6G, software-packed vehicles, non-terrestrial networks (NTN), and digital healthcare, endless imagination, and invention across industries have been significantly paving the way for SoC to enter the consumer market rapidly. SoCs have long been incorporated into electronic devices such as tablets and mobile phones because they are compact and power-efficient.

- Today, SoCs are increasingly being used in the Internet of Things devices and other devices. The rising demand for smart and power-efficient devices by consumers and exponential adoptions of IoT by various industry verticals are expected to be driving factors for the players in the semiconductor market, thus boosting the growth of the SoC market.

- Another important trend in the electronics industry is the increase of the Internet of Things (IoT). With the rise in demand for smart devices, IoT has become an essential part of everyday life. Thus, businesses are primarily using this technology to develop new products and services. SoCs will also play a pivotal role in the advancement of flexible electronics, enabling new form factors for wearable and implantable devices.

- As technology continues to evolve, several industries are adopting automation and digitization, thereby bringing new opportunities to the key players for entering new markets but with high initial research and development costs associated with the system on a chip (SoC). Owing to the increasing customization of SoC for various products, the players need to focus on various R&D projects simultaneously, increasing their project costs. Such factors are expected to hamper the market growth over the forecast period.

- While COVID-19 changed consumer spending patterns by increasing the demand for consumer electronics, the automotive industry's move toward electric vehicles is also boosting the need for chips. For instance, a typical gasoline engine car uses about 50 to 150 semiconductor chips, but an electric vehicle can use up to 3,000 semiconductor chips. The growing emphasis on electric vehicle manufacturing is certain to consume vastly more semiconductor chips in the future, thus driving the role of SoC in the global market.

System On Chip Market Trends

Consumer Electronics Segment to Occupy a Significant Share

- The incorporation of SoCs facilitates improved efficiency, decreased energy usage, and compactness, rendering SoCs essential for numerous consumer electronics applications ranging from smartphones to various interconnected devices. Consumer electronics is projected to witness a significant demand for SoCs based on their application. This is primarily attributed to the increasing adoption of smartphones due to the growing disposable incomes of consumers.

- Consumer electronics such as premium smartphones, intelligent speakers, tablets, wearables, and other devices extensively employ edge AI chips. These chips are specifically crafted to augment the computational capabilities and effectiveness of AI algorithms at the network's edge, enabling quicker and real-time decision-making capabilities. The rising demand for AI chip technology is anticipated to propel market expansion throughout the projected timeframe. Furthermore, the escalating adoption of AI technology and the proliferation of IoT-connected consumer devices are poised to amplify the growth of the market.

- Moreover, the market growth is primarily driven by the expanding presence of the internet and smartphone users, the widespread utilization of cloud computing and IoT-enabled platforms, and the extensive deployment of wireless sensors in smart infrastructure. As the market continues to witness a rise in the number of IoT and smart devices, the demand for SoC chips is also anticipated to grow at a comparable rate due to their diverse applications in these devices. As a result, several vendors in the market are constantly investing in introducing significant products catering to the rising demand for connectivity in consumer electronics.

- The increasing investments in the consumer electronics industry across several countries are expected to enhance the market opportunities. Several governments across the world are constantly encouraging new investments into the country to set up electronics manufacturing facilities and aiming to enhance their production capabilities. The increasing mobile penetration, increasing internet connectivity, and the growing popularity of connected devices are expected to drive the growth of consumer electronics. Such significant capabilities preferred in several consumer electronics devices such as Mobile devices, PCs, Tablets, Audio Devices, and others are expected to drive the market.

- As stated by Ericsson, the worldwide tally of smartphone mobile network subscriptions came close to 6.4 billion in 2022 and is estimated to exceed 7.7 billion by 2028. It is worth mentioning that China, India, and the United States emerge as the countries with the most significant number of smartphone mobile network subscriptions. Ericsson's report emphasizes that although the sales reached a plateau in 2022, the increasing average selling price of smartphones is expected to strengthen the market in the coming years. These remarkable developments are set to enhance the market's prospects.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the market studied because it currently dominates the global semiconductor market, which is further supported by government policies. According to SIA, China, Japan, Taiwan, and South Korea account for about 75% of the world's semiconductor production collectively, and other countries like Vietnam, Thailand, Malaysia, and Singapore also make significant contributions to the region's market dominance.

- With the increasing demand for technologically advanced devices in every industry, the demand for SoC devices in the market is expected to increase further. Furthermore, the increasing applications of a wide range of sensors in the automotive and smartphone market are expected to increase the demand for sensors further.

- Furthermore, the government's Made in China 2025 initiative is helping to expand the power electronics market. Additionally, the industry is bringing in fresh funding for power electronics in the area. For instance, a significant manufacturer of wide-bandgap compound semiconductors, IIVI Incorporated, increased the size of its SiC wafer finishing manufacturing facility in China.

- In line with this launch, the company aims to power its next-generation products for 5G build-out, including the next-generation 5G Compact Macro, baseband units, and Massive MIMO radios.

System On Chip Industry Overview

The system-on-chip (SoC) market is semi-consolidated due to the presence of domestic and global players. Major players use various strategies, such as product launches, agreements, and acquisitions, to increase their footprints in the market. The key players in the market are Broadcom Inc., Intel Corporation, MediaTek Inc., Microchip Technology Inc., and NXP Semiconductors NV.

- In September 2023, GlobalFoundries and Microchip Technology, through Microchip's subsidiary Silicon Storage Technology (SST), have recently unveiled the SST ESF3 third-generation embedded SuperFlash technology NVM solution. This cutting-edge solution is now available for production in the GF 28SLPe foundry process. Customers of GF have expressed their satisfaction with the remarkable performance, exceptional reliability, wide range of IP options, and cost efficiency offered by this solution. It has proven to be the perfect fit for advanced MCUs, intricate smart cards, and IoT chips used in both consumer and industrial applications.

- In May 2023, STM launched single-chip ICs with antenna matching for STM32 MCUs and BLE SoCs. STMicroelectronics revealed its latest line of single-chip antenna-matching ICs that facilitate innovation speed for Bluetooth LE System of Chips and two STM32 microcontrollers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Emerging Technologies Like IoT and AI

- 5.1.2 Increasing Investments in 5G and Growing Demand for 5G Smartphones

- 5.2 Market Restraints

- 5.2.1 High Initial Costs of R&D

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Analog

- 6.1.2 Digital

- 6.1.3 Mixed

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Communications

- 6.2.3 Automotive

- 6.2.4 Computing and Data Storage

- 6.2.5 Industrial

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Mediatek Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Qualcomm Incorporated

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 STMicroelectronics NV

- 7.1.9 Toshiba Corporation

- 7.1.10 Apple Inc.

- 7.1.11 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 7.1.12 Texas Instruments Incorporated