|

市场调查报告书

商品编码

1693531

欧洲控制释放肥料:市场占有率分析、产业趋势与成长预测(2025-2030 年)Europe Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

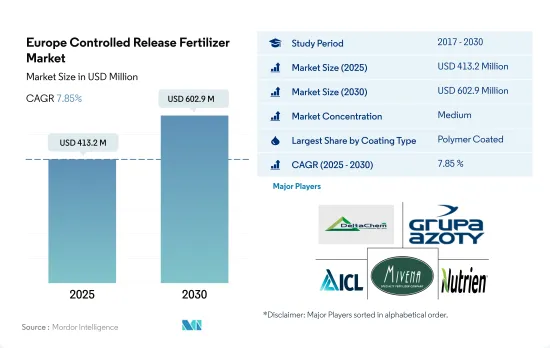

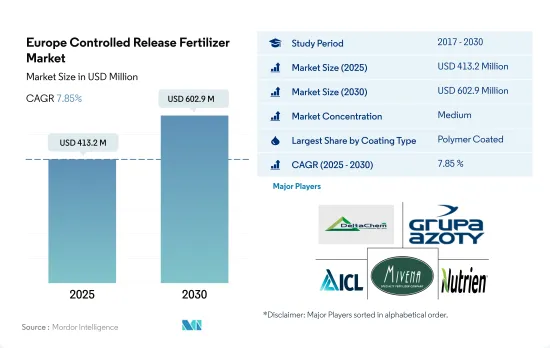

欧洲控制释放肥料市场规模预计在 2025 年为 4.132 亿美元,预计到 2030 年将达到 6.029 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.85%。

日益严重的环境污染和地下水污染导致该地区越来越多地采用CRF

- 2017 年至 2021 年间,欧洲控制释放肥料市场大幅成长了 142.4%。在其他包衣类型中,聚合物包衣控释肥料在 2022 年占据了 76.4% 的较大份额。

- 2017年至2021年间,聚合物包膜控制释放肥料的销售额显着成长了143.9%,但产量仅成长了24.3%。经欧洲化学管理局鑑定,这些肥料表面涂有该地区不同类型的聚合物,包括聚氨酯、聚乙烯醋酸乙烯酯、乙烯丙烯酸共聚物、甲醛磺酸盐磺酸缩合物钠盐以及植物油基醇酸树脂。市场规模的成长主要得益于产品价格的上涨,2022年与2017年相比大幅成长了96.3%。

- 欧盟 (EU) 对控制释放肥料(包括聚合物封装系统)有规则和法规,目前正处于未来监管阶段,直到 2026 年开发出生物分解性肥料。这些因素限制了该地区的市场成长。

- 人们对农业领域污染和水污染的日益担忧促使农民采用可持续的耕作方法和环保肥料。 CRF减少养分的淋失和挥发,并根据作物需求释放养分,使作物在需要时获得所需的养分,并降低养分流失的风险。

- 因此,控制释放肥料的其他包衣类型,尤其是生物分解性和聚合物基包衣类型,在 2023 年至 2030 年期间具有最高的市场潜力。

法国水果种植面积扩大,导致控释肥使用量增加

- 2022年欧洲控制释放肥市场中,法国将占最大的市场占有率,为22.4%,紧随其后的是英国。

- 对水果和蔬菜(尤其是葡萄和洋葱)的需求是西班牙生产活动的重要驱动力。因此,控制释放包膜肥料的需求预计会上升。这些肥料的使用对葡萄产量有显着的影响,使用控制释放肥料每公顷可达到 70 吨,而使用传统肥料每公顷仅能达到 30-40 吨。这导致聚合物包膜控制释放肥料的采用率增加,从而提高了西班牙的市场收益。

- 聚合物包膜性肥料占据市场主导地位,到 2022 年将占 76.4% 的份额。

- 英国整体市场大幅上涨74.4%。这种激增很可能在很大程度上是由于 2022 年初开始的俄罗斯和乌克兰之间的衝突,导致该国供不应求,随后价格上涨。

- 法国是世界主要农业生产国之一,2021年收穫了520万吨水果,成为继西班牙之后欧洲第四大水果生产国。由于法国高度重视作物品质和产量,并考虑到控制释放肥料具有减少淋失、减少蒸发和优化施用频率等优点,预计未来几年对这些肥料的需求将会增加。

欧洲控制释放肥料的市场趋势。

田间作物的种植面积一直在扩大,以满足国内消费和不断增长的出口需求。

- 在欧洲,油菜、小麦、黑麦和黑小麦等田间作物主要为冬季作物,而玉米、向日葵、水稻和大豆则在夏季种植。大麦是广泛种植的冬季作物和春季作物。受人口增长和粮食需求增加的推动,欧洲主粮作物种植面积正在稳步扩大。 2017年田间作物收穫面积将达78,500公顷,到2022年将增加至108,000公顷。

- 2021年,欧盟将收穫1.299亿吨普通小麦和斯佩耳特小麦,占谷物总产量的43.7%。这比2020年增加了1,100万吨,增幅达9.3%。产量增加的原因是收穫面积增加 5.6% 至 2,180 万公顷,且表观产量提高。

- 2021年,欧盟玉米和玉米穗混合谷物产量达7,300万吨,比2020年增加600万吨。整体成长主要得益于罗马尼亚(成长46.8%,增产470万吨)和法国(成长14.5%,增产190万吨)的强劲復苏。

- 2019年至2022年,该地区的采伐面积下降了34%。儘管如此,玉米和小麦的种植面积分别增加了11%和2%,而其他田间作物则有所下降。预计农民将在 2023 年至 2030 年间增加化肥使用量,以提高产量并抵消近年来收穫面积的下降。

该地区大部分土壤缺氮,因此氮是田间作物消耗的主要养分。

- 2022年,田间作物占据欧洲养分消耗的大部分,占总量的85%,利用量为4,700万吨。这种高需求是由于田间作物的大规模种植及其大量的营养需求所造成的。

- 欧洲主要的田间作物包括小麦、油菜籽、黑麦、大豆和玉米,这些作物都严重依赖化肥。 2022年,这些作物氮、磷、钾平均施用量为每公顷187.3公斤。

- 氮肥成为欧洲田间作物最需要的主要营养肥料,2022 年平均施用量为 130.64 公斤/公顷。氮缺乏是最大的产量限制因素,该地区大多数农业土壤缺乏这种营养,因此必须广泛施用。

- 钾是继氮之后第二消费量的肥料,2022 年的平均施用率为 103.75 公斤/公顷。瑞典、西班牙、波兰和拉脱维亚等土壤以沙质为主的国家,钾缺乏问题尤其明显。其次是磷肥,2022 年施用量为 56.93 公斤/公顷。

- 主要营养肥料对作物起着至关重要的作用,因为它们对于代谢过程以及细胞、细胞膜和叶绿素等重要植物组织的形成至关重要。磷在种植优质作物方面起着至关重要的作用,而钾则能激活植物生长发育所必需的酵素。

欧洲控制释放肥料产业概况

欧洲控制释放肥市场适度整合,前五大企业占51.97%。该市场的主要企业包括 Ekompany International BV (DeltaChem)、Grupa Azoty SA (Compo Expert)、ICL Group Ltd、Mivena BV、Nutrien Ltd. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 主要作物种植面积

- 田间作物

- 园艺作物

- 平均养分施用量

- 主要营养素

- 田间作物

- 园艺作物

- 主要营养素

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 涂层类型

- 聚合物涂层

- 聚合物硫涂层

- 其他的

- 作物类型

- 田间作物

- 园艺作物

- 草坪和观赏植物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Ekompany International BV(DeltaChem)

- Grupa Azoty SA(Compo Expert)

- Haifa Group

- ICL Group Ltd

- Mivena BV

- Nutrien Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The Europe Controlled Release Fertilizer Market size is estimated at 413.2 million USD in 2025, and is expected to reach 602.9 million USD by 2030, growing at a CAGR of 7.85% during the forecast period (2025-2030).

Increasing environmental and groundwater contamination lead to higher adoption of CRFs in the region

- The European controlled-release fertilizer market grew significantly by 142.4% from 2017 to 2021. Polymer-coated CRF, among all the other coating types, held the major share, 76.4%, in 2022.

- Between 2017 and 2021, there was a striking increase of 143.9% in the value of polymer-coated controlled-release fertilizers, while the volume increased by only 24.3%. These fertilizers are coated with various types of polymers in the region, including polyurethanes, polyethylene co vinyl acetate, ethylene acrylic acid copolymer, formaldehyde-naphthalene sulfonic acid condensate sodium salts, and alkyds based on vegetable oils, as identified by the ECHA. The rise in market value can be mainly attributed to the surge in product prices, which rose by a significant 96.3% in 2022, compared to 2017.

- The European Union has set rules and regulations for controlled-release fertilizers, including polymer encapsulation systems, which are currently under the scope of future restrictions until they are developed to be biodegradable by 2026. These factors restrict the market growth in the region.

- Growing concerns over agricultural sector pollution and water contamination have led farmers to adopt sustainable agricultural practices and environmentally friendly fertilizers. CRFs reduce nutrient leaching and volatilization and release nutrients based on crop requirements, which will provide necessary nutrients to the crops when required and reduce the risk of nutrient losses.

- Hence, the other coating types segment of controlled-release fertilizers, particularly biodegradable and polymer-based ones, has the highest market potential from 2023 to 2030.

Expansion of fruit cultivation in France increases the CRFs' use

- France held the largest market share of 22.4% in the European controlled release fertilizer market in 2022, with the United Kingdom following closely behind.

- The demand for fruits and vegetables, particularly grapes and onions, is a key driver of production activity in Spain. This, in turn, is expected to boost the demand for controlled release coated fertilizers. The use of these fertilizers has shown a significant impact on grape yields, with controlled release fertilizers delivering 70 metric tons per hectare compared to the 30-40 metric tons achieved with conventional fertilizers. Consequently, the increased adoption of polymer-coated controlled release fertilizers has bolstered the market revenue in Spain.

- Polymer-coated fertilizers dominated the market, accounting for a substantial 76.4% share in 2022.

- The United Kingdom witnessed a significant 74.4% surge in the overall market value. This surge can be largely attributed to the Russia-Ukraine conflict that commenced in early 2022, leading to a supply shortage and subsequent price hikes in the country.

- France, a prominent global agricultural producer, harvested 5.2 million metric tons of fruit in 2021, ranking it as the fourth-largest fruit producer in Europe, trailing behind Spain. Given France's emphasis on crop quality, production, and the advantages of controlled release fertilizers, such as minimizing leaching losses, reducing vaporization, and optimizing application frequency, the demand for these fertilizers is projected to rise in the coming years.

Europe Controlled Release Fertilizer Market Trends

The cultivation area for field crops is consistently expanding to cater to both domestic consumption and the growing export demand

- In Europe, field crops like rapeseed, wheat, rye, and triticale are predominantly winter crops, while maize, sunflowers, rice, and soybean are grown in the summer. Barley, in both winter and spring varieties, is widely cultivated. The area dedicated to major food crops in Europe has been steadily expanding, driven by population growth and rising food grain demand. In 2017, the harvested area for field crops stood at 78.5 thousand ha, which climbed to 108 thousand ha by 2022.

- In 2021, the European Union harvested 129.9 million tonnes of common wheat and spelled, accounting for 43.7% of all cereal grains. This marked an 11.0 million tonne increase from 2020, reflecting a 9.3% surge. The rise was propelled by a 5.6% expansion in the harvested area, reaching 21.8 million hectares, and improved apparent yields.

- In 2021, the European Union's production of grain maize and corn cob mix reached 73.0 million tonnes, up by 6.0 million tonnes from 2020. This overall increase was primarily driven by significant rebounds in Romania (a 46.8% increase, adding 4.7 million tonnes) and France (a 14.5% increase, adding 1.9 million tonnes).

- From 2019 to 2022, the region witnessed a notable 34% decline in harvested area. Despite this, corn/maize and wheat saw respective increases of 11% and 2% in their cultivation areas, while other field crops saw reductions. Farmers are expected to boost fertilizer usage during 2023-2030 to bolster yields and counterbalance the declining harvested areas of recent years.

Nitrogen is the primary nutrient consumed more in field crops as most of the soil in the region is deficient in nitrogen

- In 2022, field crops dominated nutrient consumption in Europe, accounting for 85% of the total and utilizing 47 million metric tons. This high demand can be attributed to both the extensive cultivation of field crops and their significant nutrient requirements.

- The primary field crops in Europe include wheat, rapeseed, rye, soybean, and corn, all of which have a substantial reliance on fertilizers. In 2022, the average application rate of nitrogen, phosphorous, and potassium in these crops stood at 187.3 kg per hectare.

- Nitrogen emerged as the most in-demand primary nutrient fertilizer for European field crops, with an average application rate of 130.64 kg/hectare in 2022. Nitrogen deficiency poses the most significant yield constraint, with a majority of agricultural soils in the region lacking this nutrient, necessitating its widespread application.

- Following nitrogen, potassium took the second spot in fertilizer consumption, with an average application rate of 103.75 kg/hectare in 2022. Notably, countries like Sweden, Spain, Poland, and Latvia face more pronounced potassium deficiencies, primarily due to the prevalence of sandy soils. Phosphatic fertilizers followed with an application rate of 56.93 kg/hectare in 2022.

- Primary nutrient fertilizers hold immense significance for crops, as they are integral to metabolic processes and the formation of crucial plant tissues such as cells, cell membranes, and chlorophyll. Phosphorous plays a vital role in cultivating high-quality crops, while potassium activates enzymes essential for plant growth and development.

Europe Controlled Release Fertilizer Industry Overview

The Europe Controlled Release Fertilizer Market is moderately consolidated, with the top five companies occupying 51.97%. The major players in this market are Ekompany International BV (DeltaChem), Grupa Azoty S.A. (Compo Expert), ICL Group Ltd, Mivena BV and Nutrien Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ekompany International BV (DeltaChem)

- 6.4.2 Grupa Azoty S.A. (Compo Expert)

- 6.4.3 Haifa Group

- 6.4.4 ICL Group Ltd

- 6.4.5 Mivena BV

- 6.4.6 Nutrien Ltd.

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms