|

市场调查报告书

商品编码

1693626

欧洲轻型商用车市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

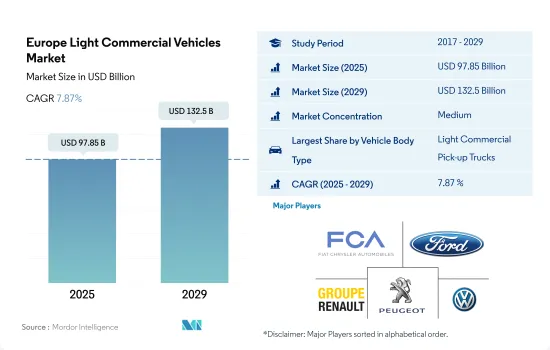

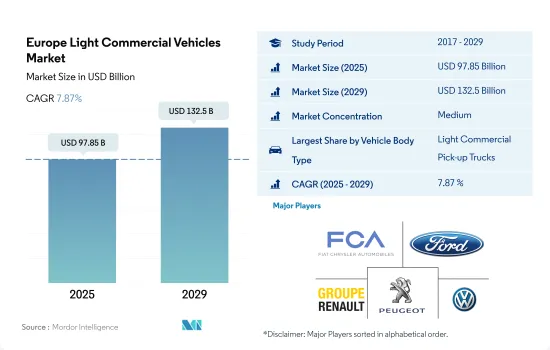

预计 2025 年欧洲轻型商用车市场规模将达到 978.5 亿美元,到 2029 年将达到 1,325 亿美元,预测期内(2025-2029 年)的复合年增长率为 7.87%。

欧洲轻型商用车市场因基础设施投资和电子商务的蓬勃发展而蓬勃发展,预计在都市化和绿色倡议的推动下将继续增长

- 2022年,欧洲轻型商用车(LCV)市场销售量强劲成长6.2%。预计这一积极势头将持续下去,2023 年增长率预计将达到 3.5%。这一增长主要得益于基础设施投资的活性化和电子商务的激增。欧盟对运输和能源计划的关注正在刺激对轻型商用车的需求,尤其是在建筑和公共领域。疫情期间,最后一哩配送网路的扩张趋势刺激了用于小包裹和食品配送的轻型商用货车的购买。

- 2017年至2023年间,欧洲轻型商用车市场将显着成长,销售量将激增38%。这种激增是由电子商务的繁荣所推动的,电子商务刺激了配送网路的扩张,并随之带动了货车销售的成长。此外,零售、建筑和服务等行业的更换需求也发挥了至关重要的作用。儘管2020年受疫情影响,市场有所萎缩,但随着数位化的加快,市场迅速復苏。整体而言,稳定的经济成长和强劲的基础设施投资是这段时期欧洲轻型商用车市场扩张的主要驱动力。

- 预计欧洲轻型商用车市场在 2024 年至 2030 年期间的复合年增长率将达到 3.1%。这一成长轨迹将受到持续的基础设施建设、最后一哩配送网路的持续扩张以及都市化趋势的推动。这些因素,加上饭店、食品配送和建筑业对轻型商用车的需求不断增长,描绘出一幅光明的前景。然而,市场可能面临阻力,因为不断变化的排放气体和都市区通行法规可能会推动替代燃料货车的采用。

欧洲轻型商用车市场各国的趋势凸显了该地区减少排放气体和提高效率的动力。

- 2022 年欧洲主要市场的轻型商用车销售数据各不相同,反映了各自的经济状况。在强劲经济的支撑下,德国经济强劲成长 6.3%。同时,英国面临经济不确定性,轻型商用车销售下降了2.1%。法国、义大利和西班牙的降幅在 3% 至 5% 之间,与更广泛的宏观经济挑战一致。然而,随着疫情后的情况好转,预计2023年将出现復苏,大多数国家的贸易量将成长4-6%。

- 2017 年至 2021 年间,欧洲主要的轻型商用车市场(德国、法国、义大利、西班牙和波兰)呈现健康扩张态势,疫情前的复合年增长率约为 3-5%。这一成长是由强劲的经济活动所推动的,特别是建筑、分销和服务等行业。 2020 年疫情引发的经济收缩相对短暂,但復苏并不均衡,这在很大程度上是由于财政奖励策略的差异以及零售和餐旅服务业等行业的脆弱性。

- 欧洲轻型商用车市场正处于更稳定的成长轨迹,预计2023年至2029年间年均成长率将达到3-4%。基础设施投资、最后一哩配送网路的兴起以及持续的经济復苏等因素预计将提振需求。然而,高通膨、能源成本和政治不确定性等因素也带来风险。此外,市场向电动传动系统的转变可能会进一步影响市场动态。预计欧洲轻型商用车市场长期内将缓慢扩张。

欧洲轻型商用车市场趋势

环境问题、政府支持和脱碳目标刺激了欧洲电动车的需求和销售

- 近年来,欧洲国家电动车的需求和销售量大幅成长。德国 2022 年电动车销量与 2021 年相比成长了 22%,其次是英国,2022 年电动车销量与 2021 年相比成长了 18.40%。日益增长的环境问题、严格的政府规范、电动车的优势(例如更好的燃油经济性、更低的服务成本、更少的碳排放)以及政府补贴是推动欧洲国家电动车成长的一些因素。

- 欧洲国家对电动商用车,特别是轻型卡车的需求逐渐增加。此外,世界各国政府也支持电动车的普及。 2021年11月,英国政府宣布承诺在2040年实现所有重型车辆零排放。这些因素将使2022年英国电动商用车销量较2021年成长23.17%,不同国家的类似做法将推动整个欧洲对电动商用车的需求。

- 预计未来几年欧洲国家的汽车电气化将呈指数级增长。预计政府在脱碳方面的努力将推动欧洲电动商用车市场的发展。例如,2022年1月,德国交通部长宣布了2030年道路上电动车保有量达到1,500万辆的目标。受这些因素影响,预计2024年至2030年间欧洲国家的电动车销量将会成长。

欧洲轻型商用车产业概况

欧洲轻型商用车市场适度整合,前五大企业占62.47%的市占率。市场的主要企业是:菲亚特克莱斯勒汽车公司、福特汽车公司、雷诺集团、标緻汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 轻型商用皮卡车

- 轻型商用厢型车

- 商用车

- 推进类型

- 混合动力汽车和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 天然气

- 柴油引擎

- 汽油

- LPG

- 混合动力汽车和电动车

- 国家

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- Groupe Renault

- Mercedes-Benz

- Peugeot SA

- Toyota Motor Corporation

- Volkswagen AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93014

The Europe Light Commercial Vehicles Market size is estimated at 97.85 billion USD in 2025, and is expected to reach 132.5 billion USD by 2029, growing at a CAGR of 7.87% during the forecast period (2025-2029).

The European LCV market thrives on infrastructure investments and e-commerce surge, with continued growth expected amid urbanization and green initiatives

- In 2022, the light commercial vehicle (LCV) market in Europe witnessed a robust 6.2% growth in sales volume. This positive momentum is expected to carry forward, with a projected growth of 3.5% in 2023. This growth is primarily fueled by heightened infrastructure investments and the surging tide of e-commerce. The EU's focus on transportation and energy projects has stimulated demand for LCVs, especially from the construction and utilities sectors. The expansion of last-mile delivery networks, a trend amplified during the pandemic, has spurred purchases of light commercial vans for parcel and food delivery.

- From 2017 to 2023, Europe's LCV market witnessed a remarkable upswing, with volumes surging by 38%. This surge was propelled by the e-commerce boom, which fueled the expansion of delivery networks and subsequently boosted van sales. Additionally, replacement demand from sectors like retail, construction, and services played a pivotal role. While the market contracted in 2020 due to pandemic disruptions, it swiftly rebounded, riding the wave of accelerated digital adoption. Overall, steady economic growth and robust infrastructure investments were key drivers of the European LCV market's expansion during this period.

- The LCV market in Europe is poised to register a CAGR of 3.1% from 2024 to 2030. This growth trajectory will be propelled by ongoing infrastructure development, the continued expansion of last-mile delivery networks, and the rising urbanization trend. These factors, coupled with the increasing demand for LCVs in services, food delivery, and construction sectors, paint a promising outlook. However, the market may face headwinds as evolving regulations on emissions and urban access could bolster the adoption of alternatively fueled vans.

Country-specific trends within the European light commercial vehicles market highlight the region's push toward reducing emissions and enhancing efficiency

- Major European markets witnessed varying LCV sales volumes in 2022, reflecting their distinct economic landscapes. Germany, buoyed by a resilient economy, saw a robust 6.3% growth. Conversely, the United Kingdom faced economic uncertainties, leading to a contraction of 2.1% in LCV sales. France, Italy, and Spain experienced declines of 3% to 5%, aligning with broader macroeconomic challenges. However, as the post-pandemic conditions improve, 2023 is projected to witness a rebound, with most countries eyeing a volume growth of 4-6%.

- From 2017 to 2021, the prominent European LCV markets - Germany, France, Italy, Spain, and Poland - showcased healthy expansion, registering a pre-pandemic CAGR of approximately 3-5%. This growth was propelled by robust economic activities, particularly in industries like construction, delivery, and services. While the pandemic-induced contractions in 2020 were relatively short-lived, the recovery has been uneven, primarily due to disparities in fiscal stimulus measures and vulnerabilities in industries such as retail and hospitality.

- The European LCV market is poised for a steadier growth trajectory, with an anticipated annual average of 3-4% from 2023 to 2029. Factors such as infrastructure investments, the rise of last-mile delivery networks, and ongoing economic recovery are expected to bolster demand. However, risks loom from factors like high inflation, energy costs, and political uncertainties. Additionally, the market's shift toward electric drivetrains will further shape its dynamics. The European LCV market is set for a gradual expansion in the long run.

Europe Light Commercial Vehicles Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Light Commercial Vehicles Industry Overview

The Europe Light Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 62.47%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Latvia

- 5.3.11 Lithuania

- 5.3.12 Norway

- 5.3.13 Poland

- 5.3.14 Russia

- 5.3.15 Spain

- 5.3.16 Sweden

- 5.3.17 UK

- 5.3.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 Mercedes-Benz

- 6.4.5 Peugeot S.A.

- 6.4.6 Toyota Motor Corporation

- 6.4.7 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219