|

市场调查报告书

商品编码

1693637

法国轻型商用车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)France Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

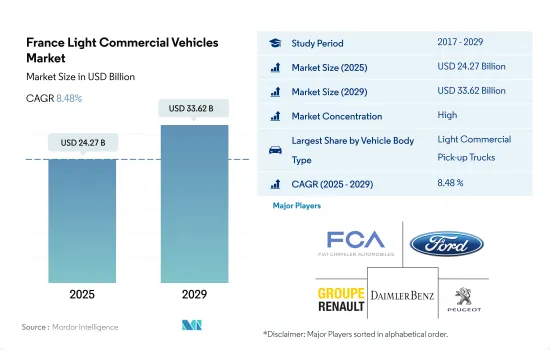

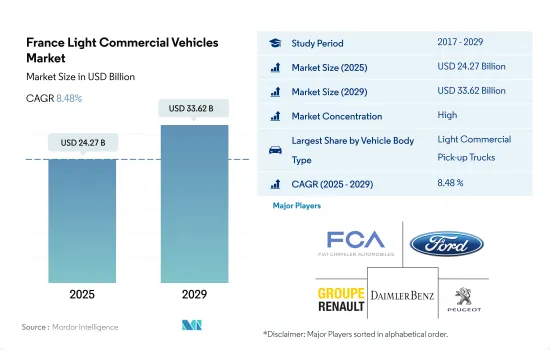

预计 2025 年法国轻型商用车市场规模将达到 242.7 亿美元,到 2029 年将达到 336.2 亿美元,预测期内(2025-2029 年)的复合年增长率为 8.48%。

法国正致力于实现轻型商用车系列多样化,以满足国内外特定的市场和物流需求。

- 法国轻型商用车 (LCV) 市场以其多样化的车辆和应用而闻名,其特点是高度重视效率、环保意识和技术创新。这个市场包括各种各样的车辆,包括厢型车、皮卡车和小型卡车,每种车辆都满足不同的经济需求。这些细分市场涵盖小型企业和商家以及大型企业和送货服务。每种车辆类型的需求都受到负载容量、燃油经济性、可靠性以及最近的环境考虑等因素的影响。

- 厢型车因其在城市环境中的适应性、负载容量和机动性而备受推崇,在法国轻型商用车市场占据主导地位。这些货车是送货和服务业的中坚力量,利用了网路购物和宅配业务的激增。值得注意的是,在法国政府环保政策的推动下,厢型车市场正明显转向电气化。这些政策包括鼓励购买电动车和在都市区建立低排放气体区。

- 皮卡和轻型卡车是法国轻型商用车市场的重要参与者,服务于建筑、园艺和公共工程等特定领域。这些行业在采用电动车和混合动力技术方面进展缓慢,但人们对永续替代品的兴趣日益浓厚。这种转变是由社会对永续性的广泛推动和日益严格的排放法规所推动的。这些因素迫使製造商不断创新并提供更环保的选择。

法国轻型商用车市场趋势

法国透过政府支持和奖励促进电动车销量

- 加拿大的 GDP 从 2017 年的 45,191.99 美元成长到 2018 年的 46,625.86 美元。然而,这种趋势并不是直线性的,受到全球动盪的严重影响,2020 年跌至 43,383.71 美元。不过,随着 2021 年的数据回升至 52,387.81 美元,加拿大的经济实力得到了充分体现,2022 年的数据进一步凸显。领先的产业观察家将此归因于加拿大经济的多样化、策略性财政措施以及在服务和技术领域的强势地位。

- 在法国,政府正在进行大量投资,以期提高消费者对绿色汽车的接受度。例如,2021 年 1 月,法国政府投资 2 亿欧元,支持准备实现车辆(公车队)电气化的地区和城市交通管理部门。此外,2021年2月,法国政府将GreenMott的Green-eBus计划选定为未来投资计划之一。欧洲投资银行为该计划提供资金,旨在使欧盟到2050年成为第一个实现温室气体中和的经济体,此类计划有望加速法国电动车的发展。

- 政府推出的各种计划和策略刺激了该国对电动车的需求和销售。 2021年10月,法国总统马克宏宣布了一项名为「法国2030」的新计画。根据该计划,政府将投资300亿美元,到2030年在国内生产200万辆全电动和混合动力汽车汽车。在法国,电动车的销售和需求预计将在2024年至2030年间增加。

法国轻型商用车产业概况

法国轻型商用车市场格局较为巩固,前五大厂商的市占率为66.91%。市场的主要企业是:菲亚特克莱斯勒汽车公司、福特汽车公司、雷诺集团、梅赛德斯-奔驰和标緻汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 轻型商用皮卡车

- 轻型商用厢型车

- 商用车

- 推进类型

- 混合动力汽车和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料类别

- 天然气

- 柴油引擎

- 汽油

- LPG

- 混合动力汽车和电动车

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- Groupe Renault

- IVECO SpA

- Mercedes-Benz

- Peugeot SA

- Toyota Motor Corporation

- Volkswagen AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93025

The France Light Commercial Vehicles Market size is estimated at 24.27 billion USD in 2025, and is expected to reach 33.62 billion USD by 2029, growing at a CAGR of 8.48% during the forecast period (2025-2029).

France is focusing on diversifying light commercial vehicle offerings to meet specific market and logistic demands within and beyond its borders

- The French light commercial vehicles (LCV) market, known for its diverse range of vehicle types and applications, is witnessing a notable emphasis on efficiency, environmental consciousness, and innovation. This market encompasses a wide array of vehicles, including panel vans, pickup trucks, and small trucks, each catering to distinct segments of the economy. These segments span from small businesses and tradesmen to large corporations and delivery services. The demand for each vehicle type is influenced by factors like payload capacity, fuel efficiency, reliability, and increasingly, environmental considerations.

- Panel vans, highly prized for their adaptability, payload capacity, and maneuverability in urban settings, dominate the French LCV market. These vans serve as the backbone of the delivery and services sectors, capitalizing on the surge in online shopping and home delivery. Notably, the panel van market is experiencing a notable shift toward electrification, propelled by the French government's environmental policies. These policies include incentives for electric vehicle purchases and the establishment of low-emission zones in urban areas.

- Pick-up trucks and small trucks, crucial players in the French LCV market, cater to specific sectors like construction, landscaping, and utility services. While these segments have been slower in adopting electric and hybrid technologies, there is a rising interest in sustainable alternatives. This shift is driven by both a broader societal push for sustainability and stricter emission regulations. These factors are compelling manufacturers to innovate and offer more eco-friendly options.

France Light Commercial Vehicles Market Trends

France drives electric vehicle sales with government support and incentives

- Canada's GDP stood at USD 45,191.99 in 2017 and a surge to USD 46,625.86 was observed in 2018. This trend, however, was not linear, with 2020 revealing a dip to USD 43,383.71, largely influenced by global disruptions. However, Canada's economic forte shone bright as 2021 numbers rebounded to USD 52,387.81, further accentuated by the 2022 figure. Key industry observers attribute this to Canada's diversified economy, strategic fiscal measures, and strong foundation in the service and technological sectors.

- The government is investing heavily and making efforts to increase the adoption of green vehicles among consumers in France. For instance, in January 2021, the French government invested EUR 200 million to support the local and urban mobility authorities who are ready to electrify their vehicles (bus fleet). Moreover, in February 2021, the French government selected Greenmot's Green-eBus project as one of the future projects to invest in. European Investment Bank funds the project intending to make the European Union the first greenhouse gas-neutral economy by 2050, and such projects are expected to accelerate electric mobility in France.

- Various plans and strategies introduced by the government are adding to the demand and sales of electric vehicles in the country. In October 2021, French President Emmanuel Macron announced a new plan named France 2030. Under the plan, the government will invest USD 30 billion to produce 2 million fully electric and hybrid vehicles domestically by 2030. Production growth is expected to increase the sales and the growing demand for EVs during 2024-2030 in France.

France Light Commercial Vehicles Industry Overview

The France Light Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 66.91%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Mercedes-Benz and Peugeot S.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 IVECO S.p.A

- 6.4.5 Mercedes-Benz

- 6.4.6 Peugeot S.A.

- 6.4.7 Toyota Motor Corporation

- 6.4.8 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219