|

市场调查报告书

商品编码

1693641

日本电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan Electric Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

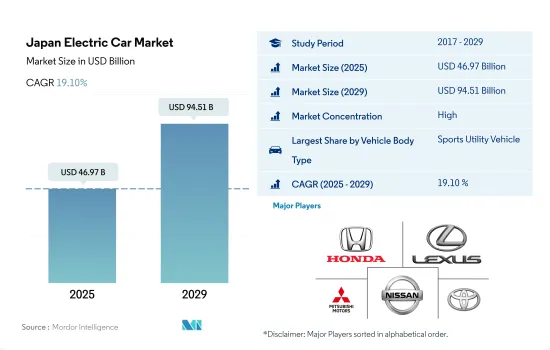

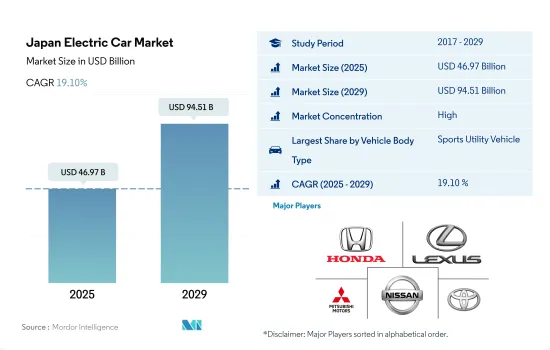

日本电动车市场规模预计在 2025 年为 469.7 亿美元,预计到 2029 年将达到 945.1 亿美元,预测期内(2025-2029 年)的复合年增长率为 19.10%。

日本越来越注重客製化电动车产品,以满足多样化的消费者生活方式和驾驶偏好。

- 日本致力于减少石油进口并最大程度降低对环境的影响,推动其电动车(EV)市场显着成长。日本政府有一个雄心勃勃的目标:到 2050 年,日本销售的所有新车都将是电动或混合动力汽车汽车。这符合全球向永续交通途径转变的趋势,并使日本成为亚太电动车市场的关键参与者。该市场扩张的势头显而易见,预计到 2024 年将达到 433.2 亿美元,预计到 2029 年将保持强劲增长率,凸显了日本向电动车转型的承诺。

- 掀背车和轿车由于其紧凑的尺寸和效率在城市环境中更为常见,因此它们占据了市场主导地位。同时,SUV 因其多功能性和舒适性而越来越受欢迎,吸引了许多追求性能和永续性的人士。市场结构反映了消费者多样化的偏好,消费者越来越倾向于选择兼具实用性和环保性的汽车。

- 然而,日本电动车市场的扩张面临挑战,特别是在充电基础设施和监管障碍方面。由于安装和运作成本高昂,以及高功率充电器的严格安全规定,充电站的数量正在减少。这种情况凸显了对基础设施进行大量投资以支持日益增长的电动车数量的必要性。儘管面临这些挑战,但仍存在大量机会,尤其是在日本,它正在推动汽车产业的数位转型和物联网连接。

日本电动车市场趋势

日本电动车市场在政府和产业伙伴关係的推动下逐渐成长

- 日本的电动车产业正在逐步发展,政府制定的规范和目标是到 2035 年实现所有新车销售电气化,推动日本转型为电动车。此外,补贴和回扣等政府措施正在推动日本电动车市场的发展。 2021年11月,日本政府宣布将对电动车提供补贴。不过,混合动力汽车并不在该补贴计画范围内。受这些因素影响,2022年电动车(乘用车)的成长率将比2021年增加11.11%。

- 各公司正在建立合作伙伴关係和合资企业,以增强全国各个领域的电动车发展。 2022 年 6 月,科技公司SONY和日本汽车製造商本田签署合资协议,共同致力于电动车领域。该合资公司的目标是到2025年在日本生产和销售电动车。此外,本田宣布将在2030年前推出30款电动车,每年生产200万辆。两家公司已向该合资企业投资约 3,752 万美元。预计这些因素将对电动车产生正面影响。

- 2022年4月,美国汽车製造商通用汽车宣布将扩大与本田的合作,生产电动车。作为扩大合作的一部分,两家公司将开发包括汽车在内的新型经济型电动车。该电动车预计将于 2027 年初开始生产。此外,这种国际扩张预计将开发出新的设计和增强型汽车,进一步增加 2024 年至 2030 年期间日本的电动车销量,同时也将加速日本对电池组的需求。

日本电动车产业概况

日本电动车市场格局较为统一,前五大厂商的市占率达113.79%。市场的主要企业是:本田汽车、Lexus、三菱汽车公司、日产汽车和丰田汽车公司(按字母顺序排列)

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 搭乘用车

- 掀背车

- 多用途车辆

- 轿车

- SUV

- 搭乘用车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- Bayerische Motoren Werke AG

- Daihatsu Motor Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Honda Motor Co. Ltd.

- Lexus

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Nissan Motor Co. Ltd.

- Subaru Corporation

- Tesla Inc.

- Toyota Motor Corporation

- Volvo Car AB

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93029

The Japan Electric Car Market size is estimated at 46.97 billion USD in 2025, and is expected to reach 94.51 billion USD by 2029, growing at a CAGR of 19.10% during the forecast period (2025-2029).

Japan is increasingly focusing on customizing electric car offerings to cater to diverse consumer lifestyles and driving preferences

- The electric vehicle (EV) market in Japan is experiencing significant growth, driven by the country's efforts to reduce oil imports and minimize environmental impact. Japan's government has set ambitious goals, aiming for all new cars sold in the country to be electric or hybrid by 2050. This aligns with a global shift toward sustainable transportation, placing Japan as a pivotal player in the Asia-Pacific EV market. The market's expansion is evident in its value, which is expected to reach USD 43.32 billion in 2024, with a robust growth rate projected through 2029, highlighting Japan's commitment to transitioning toward electric mobility.

- Hatchbacks and sedans, being more common in urban settings due to their compact size and efficiency, have a significant share. Meanwhile, SUVs are gaining popularity for their versatility and comfort, appealing to a broader audience seeking both performance and sustainability. The market's composition reflects a diverse consumer preference, leaning toward a mix of practicality and eco-friendliness in vehicle choice.

- However, the expansion of Japan's EV market faces challenges, notably in charging infrastructure and regulatory hurdles. The number of charging stations has seen a decline due to high installation and operational costs, exacerbated by stringent safety regulations for high-output chargers. This situation underscores the need for substantial investments in infrastructure to support the growing number of EVs. Despite these challenges, opportunities abound, especially with Japan's push toward digital transformation and IoT connectivity in the automotive sector.

Japan Electric Car Market Trends

Japan's electric vehicle market grows gradually due to government and industry partnerships

- The electric vehicle industry in Japan is growing gradually, and the government's norms and targets to electrify all new car sales by 2035 are shifting the country toward electric mobility. Moreover, government efforts in terms of subsidies and rebates are driving the country's electric vehicle market. In November 2021, the government of Japan announced that it would provide subsidies on electric vehicles, i.e., up to USD 7200 per vehicle. However, hybrid vehicles are not included in the subsidy program. Such factors contribute to the growth of electric vehicles (passenger cars) by 11.11% in 2022 over 2021.

- Various companies are signing partnerships and ventures to enhance electric mobility in various sectors across Japan. In June 2022, the technology company Sony and the Japanese automaker Honda signed a joint venture to work on electric mobility together. The objective of the venture is to produce and sell electric cars in Japan by 2025. Moreover, Honda has announced the launch of 30 electric vehicles and the production of 2 million vehicles annually by 2030. Each company has invested approximately USD 37.52 million in the venture. Such factors are expected to impact electric mobility positively.

- In April 2022, the US-based automaker General Motors announced an expand its partnership with Honda to produce electric vehicles. As part of the expansion, the companies will develop new affordable electric vehicles, including cars. The production of the vehicles is expected to start in early 2027. Moreover, such international expansions are expected to develop new designs and enhanced cars, which further is expected to raise the sales of electric cars During the 2024-2030 period in Japan, which will also accelerate the demand for battery packs across Japan.

Japan Electric Car Industry Overview

The Japan Electric Car Market is fairly consolidated, with the top five companies occupying 113.79%. The major players in this market are Honda Motor Co. Ltd., Lexus, Mitsubishi Motors Corporation, Nissan Motor Co. Ltd. and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bayerische Motoren Werke AG

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Honda Motor Co. Ltd.

- 6.4.5 Lexus

- 6.4.6 Mazda Motor Corporation

- 6.4.7 Mitsubishi Motors Corporation

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Subaru Corporation

- 6.4.10 Tesla Inc.

- 6.4.11 Toyota Motor Corporation

- 6.4.12 Volvo Car AB

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219