|

市场调查报告书

商品编码

1693642

亚太地区电动商用车市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Electric Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

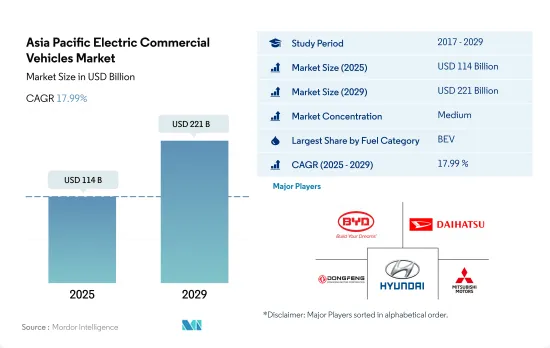

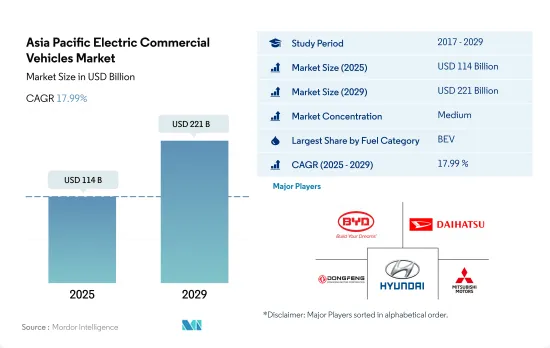

亚太地区电动商用车市场规模预计在 2025 年为 1,140 亿美元,预计到 2029 年将达到 2,210 亿美元,预测期内(2025-2029 年)的复合年增长率为 17.99%。

预计到 2030 年,亚太地区混合动力和电动商用车的普及率将增加两倍以上

- 2022-2023 年,亚太地区将转向更环保的交通解决方案,这在混合动力和电动商用车 (CV) 领域尤其明显。混合动力汽车和电动车的註册量将大幅成长,从 2021 年的 264,007 辆增加到 2022 年的 490,958 辆。这个数字不仅代表着从先前的疲软中復苏,也证实了在环保意识不断增强和政府政策不断演变的背景下,人们对这些清洁技术的强烈偏好。

- 历史数据提供了一些有趣的背景。 2017年至2019年期间,註册的混合动力汽车和电动车数量逐渐下降,从260,519辆下降到188,118辆。下降可能归因于基础设施准备、车辆价格分布和最初的犹豫等因素。然而,在随后的几年里,尤其是 2022 年,这一数字大幅反弹,凸显了该地区透过更清洁的 CV 解决方案快速适应对抗排放气体的能力。

- 展望未来,亚太地区的混合动力汽车和电动车正呈现令人惊讶的乐观上升轨迹。到 2025 年,这一数字预计将超过 926,761 台。到 2030 年,汽车总註册量预计将达到 1,677,598 辆。这项预测是由技术突破、成熟的充电基础设施、降低的总体拥有成本以及对电动商用车在实现永续性目标方面发挥的重要作用的认可所推动的。

在严格的排放法规和对更环保的公共和物流运输解决方案的大力推动下,亚太地区电动商用车市场预计将快速扩张。

- 亚太地区是电动商用车最具活力的市场之一,经济多元化,都市化迅速,并且越来越重视减少碳排放。各国的市场条件有很大差异,反映了经济发展、政府政策、基础设施发展和产业采用率的差异。中国是电动车技术的全球领导者,凭藉积极的政府倡议、对充电基础设施的大量投资以及众多国内製造商,在亚太电动汽车市场占据主导地位。

- 该地区的其他国家,如日本和韩国,也在电动商用车市场取得了长足的进步。日本拥有成熟的汽车工业,目前专注于氢燃料电池汽车,这是其与纯电动车共同推进的电动车 (ECV) 更广泛策略的一部分。日本致力于实现“氢能社会”,这与其在商用车电气化方面的努力相辅相成。同时,韩国正快速推进电池技术和基础建设。

- 相较之下,该地区的新兴国家,如印度、印尼和泰国,正处于采用 ECV 的早期阶段,面临基础设施有限和前期成本高等挑战。然而,由于都市化加快、人们对环境问题的认识不断提高以及政府致力于推广电动车使用的倡议,这些国家的电动车市场具有巨大的成长潜力。例如,印度已推出多项倡议来推动电动车的普及,重点是基础建设和购车补贴。

亚太地区电动商用车市场趋势

受政府措施和商用车电气化推动,亚太地区电动车需求和销售快速成长

- 近年来,亚太地区电动车(EV)的需求和销售量激增。主要市场中国2022年电动车销量较2021年成长2.90%,日本同期电动车销量成长11.11%。推动这一趋势的因素包括日益增长的环境问题、严格的法规以及电动车的优势,例如燃油效率、降低维护成本和零碳排放。政府补贴进一步推动了亚洲国家对电动车的采用。

- 使用传统燃料的商用车辆,尤其是卡车和公共汽车,正在导致亚太国家污染水平上升。为此,该地区许多国家正在大力投资,将内燃机 (ICE) 汽车转型为电动车,以减少二氧化碳排放。例如,2020 年 12 月,印尼市政公车业者 Transjakarta 宣布了雄心勃勃的计划,到 2030 年将其电动公车车队扩大到 10,000 辆。类似这样的全部区域努力正在推动商用车的电气化。

- 亚太地区各国政府机构正积极提案逐步淘汰石化燃料汽车的措施,此举可望提振电动商用车市场。值得注意的进展是,2022 年 5 月,塔塔汽车赢得了一份政府合同,根据 FAME 2 计划,向印度供应 5,450 辆电动公车,价值 500 亿印度卢比。该公司还宣布计划向六家大型电子商务公司交付20,000 辆小型电动卡车。预计电动车领域的这些进步将在 2024 年至 2030 年间进一步推动亚太地区对电动商用车的需求。

亚太地区电动商用车产业概览

亚太地区电动商用车市场适度整合,前五大公司占48.55%。该市场的主要企业有比亚迪汽车、大发汽车、东风汽车公司、现代汽车公司、三菱汽车公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 体型

- 公车

- 大型商用卡车

- 轻型商用皮卡车

- 轻型商用厢型车

- 中型商用卡车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 其他亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- BYD Auto Co. Ltd.

- Daihatsu Motor Co. Ltd.

- Dongfeng Motor Corporation

- Higer Bus Company Ltd.

- Hino Motors Ltd.

- Hyundai Motor Company

- Mahindra & Mahindra Limited

- Mitsubishi Motors Corporation

- Tata Motors Limited

- Zhengzhou Yutong Bus Co. Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93030

The Asia Pacific Electric Commercial Vehicles Market size is estimated at 114 billion USD in 2025, and is expected to reach 221 billion USD by 2029, growing at a CAGR of 17.99% during the forecast period (2025-2029).

The adoption of hybrid and electric commercial vehicles in Asia-Pacific is expected to be more than triple by 2030

- Asia-Pacific's transition toward greener transportation solutions has been pronouncedly evident in the hybrid and electric commercial vehicle (CV) sector between 2022 and 2023. The collective figures for hybrid and electric CV registrations rose significantly, reaching 490,958 units in 2022 from the previous 264,007 units in 2021. These numbers signify not only a rebound from the prior slump but also underline a strong preference for these cleaner technologies amid escalating environmental concerns and progressive governmental policies.

- Historical data provides an intriguing context. From 2017 to 2019, the combined registrations for hybrid and electric CVs experienced a gentle downward trend, from 260,519 units to 188,118 units. This dip might be attributed to factors like infrastructure readiness, vehicle price points, and initial hesitations. However, the next few years, especially 2022, saw a dramatic resurrection in the numbers, emphasizing the region's fast-adapting stance to combat emissions through cleaner CV solutions.

- Projecting into the future, the upward trajectory for hybrid and electric CVs in Asia-Pacific is remarkably optimistic. By 2025, it is estimated the numbers will cross the 926,761 units mark. By 2030, the total registrations are anticipated to reach an impressive 1,677,598 units. This forecasted upswing can be attributed to technological breakthroughs, a matured charging infrastructure, reduced total cost of ownership, and the realization of the critical role these vehicles play in achieving sustainability goals.

The Asia-Pacific electric commercial vehicles market is poised for rapid expansion, fueled by stringent emission regulations and a robust push for greener public and logistic transport solutions

- Asia-Pacific represents one of the most dynamic markets for electric commercial vehicles due to its diverse economies, rapidly growing urbanization, and increasing focus on reducing carbon emissions. The market landscape varies significantly by country, reflecting differences in economic development, government policies, infrastructure readiness, and industry adoption rates. China, as a global leader in electric vehicle technology, dominates the ECV market in Asia Pacific, benefiting from aggressive government policies, substantial investments in charging infrastructure, and a wide range of domestic manufacturers.

- Other countries in the region, such as Japan and South Korea, are also making significant strides in the electric commercial vehicle market. Japan, with its well-established automotive industry, is focusing on hydrogen fuel cell vehicles as part of its broader strategy for ECVs alongside BEVs. The country's commitment to creating a 'hydrogen society' complements its efforts in electrifying its commercial vehicle segment. South Korea, on the other hand, is rapidly advancing in battery technology and infrastructure development.

- In contrast, emerging economies in the region, such as India, Indonesia, and Thailand, are in the earlier stages of ECV adoption, facing challenges such as limited infrastructure and higher upfront costs. However, these countries hold significant potential for growth in the ECV market due to increasing urbanization, rising awareness of environmental issues, and government initiatives aimed at encouraging the use of electric vehicles. India, for example, has launched multiple initiatives to boost EV adoption, focusing on both improving infrastructure and offering subsidies to buyers.

Asia Pacific Electric Commercial Vehicles Market Trends

APAC's rapid electric vehicle demand and sales growth are driven by government initiatives and commercial vehicle electrification

- Electric vehicle (EV) demand and sales have surged in the APAC region in recent years. China, the dominant market, saw a 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. Factors driving this trend include mounting environmental concerns, stringent regulations, and the advantages of EVs, such as fuel efficiency, lower maintenance costs, and zero carbon emissions. Government subsidies further bolster the adoption of EVs in Asian nations.

- Conventional fuel-powered commercial vehicles, notably trucks and buses, are contributing to the escalating pollution levels in several Asia-Pacific countries. In response, many nations in the region are making substantial investments to transition their internal combustion engine (ICE) vehicles to electric ones, aiming to curb carbon emissions. For instance, in December 2020, TransJakarta, a city-owned bus operator in Indonesia, unveiled an ambitious plan to expand its electric bus (e-bus) fleet to 10,000 units by 2030. Such initiatives across the region are propelling the electrification of commercial vehicles.

- Government bodies in various APAC countries are actively proposing measures to phase out fossil fuel vehicles, a move that is poised to bolster the market for electric commercial vehicles. In a notable development, in May 2022, Tata Motors secured a government contract in India to supply 5,450 electric buses worth INR 5,000 crore under the FAME 2 scheme. Additionally, the company announced plans to deliver 20,000 light electric trucks to six major e-commerce players. These advancements in the EV space are anticipated to further fuel the demand for electric commercial vehicles in the APAC region from 2024 to 2030.

Asia Pacific Electric Commercial Vehicles Industry Overview

The Asia Pacific Electric Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 48.55%. The major players in this market are BYD Auto Co. Ltd., Daihatsu Motor Co. Ltd., Dongfeng Motor Corporation, Hyundai Motor Company and Mitsubishi Motors Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Body Type

- 5.1.1 Buses

- 5.1.2 Heavy-duty Commercial Trucks

- 5.1.3 Light Commercial Pick-up Trucks

- 5.1.4 Light Commercial Vans

- 5.1.5 Medium-duty Commercial Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Higer Bus Company Ltd.

- 6.4.5 Hino Motors Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 Mitsubishi Motors Corporation

- 6.4.9 Tata Motors Limited

- 6.4.10 Zhengzhou Yutong Bus Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219