|

市场调查报告书

商品编码

1693654

乘用车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Passenger Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

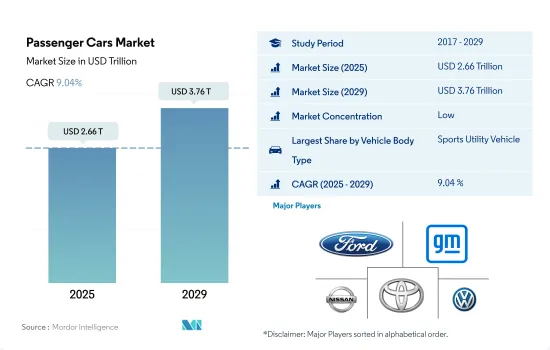

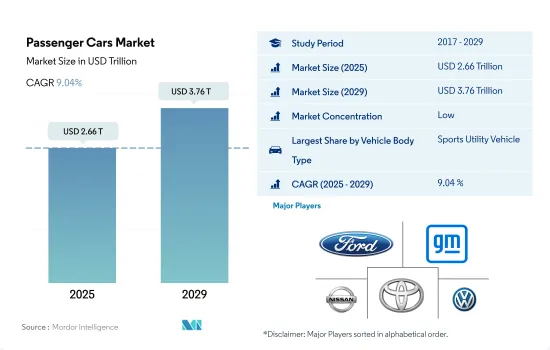

预计 2025 年乘用车市场规模将达到 2.66 兆美元,到 2029 年预计将达到 3.76 兆美元,预测期内(2025-2029 年)的复合年增长率为 9.04%。

人口成长、消费能力增强以及电动和混合动力技术的采用预计将促进 2024 年至 2030 年期间乘用车市场的成长

- 乘用车市场正在经历显着成长,主要原因是中等收入家庭的需求不断增加以及新兴经济体生活水准的提高。此外,乘用车实惠的价格也吸引着消费者。将所有电动车充电站与物联网 (IoT) 和即时资讯解决方案相结合等技术进步进一步推动了市场扩张。

- 世界各国政府正在采取积极措施鼓励人们使用电动车(EV)。特别是,中国、印度、法国和英国等国家已设定目标,2040年才逐步淘汰汽油和柴油汽车。产业领导者正在提高产能,以遵守严格的排放法规(例如印度的Bharat Stage 6),中国、印度、日本和韩国等国家已宣布计划在2040年禁止销售新的内燃机(ICE)汽车。这些发展正在推动电动车领域乘用车的销售。

- 福特汽车马达、现代汽车马达、日产汽车公司、丰田汽车公司和大众汽车公司等该领域的主要企业正在透过合资、合併、新产品发布和研发等策略倡议扩大其市场占有率。这些汽车製造商将在未来五到十年内投资高达 5,150 亿美元用于电池汽车的开发和製造,这标誌着汽车行业从传统内燃机转向电动车的趋势。

由于向电动车的转变、技术创新和消费行为的变化,全球乘用车市场正在发生动态变化。

- 由于技术进步、消费者偏好的变化以及严格的环境法规,全球乘用车市场正在经历重大变革时期期。近年来,由于全球努力减少二氧化碳排放以及消费者永续性意识的不断增强,电动车出现了明显的转变。世界各国政府都在透过激励措施鼓励购买电动车和投资充电基础设施来支持这一转变,这对于克服潜在买家的里程焦虑至关重要。然而,在许多地区,由于燃油效率提高和排放气体减少,内燃机汽车仍然占据市场主导地位。

- 经济因素在塑造乘用车市场方面发挥着至关重要的作用。新冠疫情引发的全球经济放缓和供应链中断,以及地缘政治紧张局势的加剧,导致汽车销售出现波动。这些中断导致半导体等关键部件短缺,影响了生产力并提高了汽车价格。

- 未来几年,乘用车市场预计将持续发展,自动驾驶技术、联网汽车功能和先进安全系统等创新将变得更加普遍。这些功能不仅增强了驾驶体验,而且还有望提高道路安全性并缓解交通拥堵。此外,出行即服务(MaaS)的兴起正在改变人们对汽车拥有量的看法,并可能导致个人汽车拥有量下降。

全球乘用车市场趋势

全球需求成长和政府支持将推动电动车市场成长

- 电动车(EV)已成为汽车产业的重要组成部分,因为它具有提高能源效率、减少温室气体和污染排放的潜力。这种快速成长背后的主要因素是日益增长的环境问题和政府的支持。其中,电动车全球销售呈现强劲成长势头,2022年较2021年成长10.82%。据预测,2025年底,电动乘用车年销量将超过500万辆,约占汽车总销量的15%。

- 领先的製造商和组织(例如伦敦警察厅和消防队)正在积极推行电动车策略。例如,该公司设定了在 2025 年实现零排放汽车、在 2030 年实现 40% 货车电气化、到 2040 年实现全电动化的目标。预计全球也将出现类似的趋势,2024 年至 2030 年间电动车的需求和销售量将急剧成长。

- 在电池技术和汽车电气化进步的推动下,亚太地区和欧洲有望主导电动车生产。 2020年5月,起亚汽车欧洲公司公布“S计划”,宣布转向电动化策略。这项决定是在起亚电动车在欧洲创下销售纪录之际做出的。起亚雄心勃勃地计划在 2025 年之前在全球推出 11 款电动车,涵盖轿车、SUV 和 MPV 等各个领域。该公司的目标是到 2026 年实现全球电动车年销量达到 50 万辆。

乘用车产业概况

乘用车市场分散,前五大企业占35.10%的市占率。市场的主要企业是:福特汽车公司、通用汽车公司、日产汽车公司、丰田汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 消费者汽车购买支出(cvp)

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 通货膨胀率

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 搭乘用车

- 推进类型

- 混合动力汽车和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料类别

- 天然气

- 柴油引擎

- 汽油

- LPG

- 混合动力汽车和电动车

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 欧洲

- 比利时

- 捷克共和国

- 法国

- 德国

- 义大利

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 英国

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 阿根廷

- 巴西

- 亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Bayerische Motoren Werke AG

- Daimler AG(Mercedes-Benz AG)

- Ford Motor Company

- General Motors Company

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- Kia Corporation

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

- Volkswagen AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93047

The Passenger Cars Market size is estimated at 2.66 trillion USD in 2025, and is expected to reach 3.76 trillion USD by 2029, growing at a CAGR of 9.04% during the forecast period (2025-2029).

Rising population, increasing spending power, and adoption of electric vehicles and hybrid technology are all expected to contribute to the growth of the passenger car market between 2024 and 2030

- The market for passenger cars is witnessing significant growth, primarily driven by the increasing demand from middle-income households and improving living standards in emerging economies. Additionally, the affordability of these vehicles is attracting consumers. Technological advancements, like the integration of all-EV charging stations with the Internet of Things (IoT) and real-time information solutions, have further fueled market expansion.

- Global governments have taken proactive measures to promote the adoption of electric vehicles (EVs). Notably, countries like China, India, France, and the United Kingdom have set targets to phase out petrol and diesel vehicles by 2040. Major industry players are ramping up production capacities, adhering to stringent emission norms (e.g., India's Bharat Stage 6), and countries like China, India, Japan, and South Korea have announced plans to ban the sales of new internal combustion engine (ICE) vehicles by 2040. These developments are driving the sales of passenger cars in the electromobility sector.

- Leading companies in the sector, including Ford Motor Company, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Corporation, and Volkswagen AG, are bolstering their market presence through strategic moves like joint ventures, mergers, new product launches, and R&D. These automakers have committed a staggering USD 515 billion over the next five to ten years to develop and manufacture battery-powered vehicles, signaling a shift away from traditional combustion engines.

The global passenger car market is dynamically evolving, driven by shifts toward electric vehicles, technological innovations, and changing consumer behaviors

- The global passenger car market is undergoing significant transformations, which are driven by technological advancements, changing consumer preferences, and stringent environmental regulations. In recent years, there has been a marked shift toward electric vehicles, prompted by global efforts to reduce carbon emissions and the growing consumer awareness about sustainability. Governments worldwide are supporting this shift with incentives for EV purchases and investments in charging infrastructure, which are crucial for overcoming range anxiety among potential buyers. However, internal combustion engine vehicles still dominate the market in many regions, supported by improvements in fuel efficiency and emissions reductions.

- Economic factors play a pivotal role in shaping the passenger car market. The global economic slowdown and supply chain disruptions, initially sparked by the COVID-19 pandemic and exacerbated by geopolitical tensions, led to fluctuations in car sales. These disruptions have caused shortages in critical components such as semiconductors, impacting production rates and increasing vehicle prices.

- In the coming years, the passenger car market is expected to continue evolving, with innovations such as autonomous driving technologies, connected car features, and advanced safety systems becoming more prevalent. These features not only enhance the driving experience but also promise to improve road safety and reduce traffic congestion. Additionally, the rise of mobility-as-a-service (MaaS) is changing how people perceive vehicle ownership, potentially leading to decreased private car ownership in favor of shared transportation solutions.

Global Passenger Cars Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Passenger Cars Industry Overview

The Passenger Cars Market is fragmented, with the top five companies occupying 35.10%. The major players in this market are Ford Motor Company, General Motors Company, Nissan Motor Co. Ltd., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.9.1 Africa

- 4.9.2 Asia-Pacific

- 4.9.3 Europe

- 4.9.4 Middle East

- 4.9.5 North America

- 4.9.6 South America

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Sedan

- 5.1.1.3 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.2 Europe

- 5.3.2.1 Belgium

- 5.3.2.2 Czech Republic

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Italy

- 5.3.2.6 Norway

- 5.3.2.7 Poland

- 5.3.2.8 Russia

- 5.3.2.9 Spain

- 5.3.2.10 UK

- 5.3.3 North America

- 5.3.3.1 Canada

- 5.3.3.2 Mexico

- 5.3.3.3 US

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bayerische Motoren Werke AG

- 6.4.2 Daimler AG (Mercedes-Benz AG)

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 Honda Motor Co. Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Kia Corporation

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Toyota Motor Corporation

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219