|

市场调查报告书

商品编码

1693655

轻型商用车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

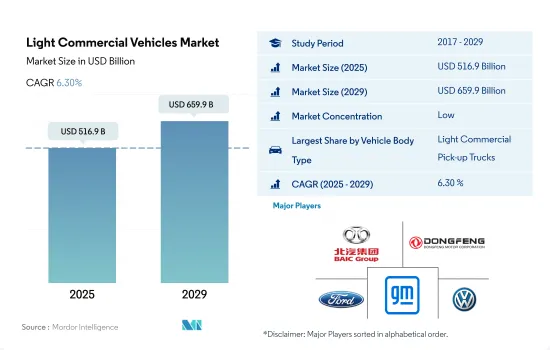

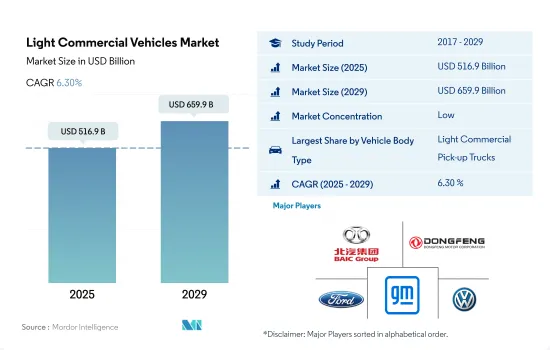

轻型商用车市场规模预计在 2025 年达到 5,169 亿美元,预计到 2029 年将达到 6,599 亿美元,预测期内(2025-2029 年)的复合年增长率为 6.30%。

快速成长的电子商务和物流行业刺激轻型商用车市场

- 轻型商用车市场受电子商务和物流行业推动。随着越来越多的人可以使用网路和智慧型手机,网路零售和电子商务正在兴起。轻型商用车的购买量预计将会增加,有助于更快地将货物交付给客户。

- 受新冠疫情线上销售的影响,全球电商市场收入和用户群大幅成长。然而,网路购物的日益普及可能会刺激成长。 2020年全球电子商务市场大幅扩张,2021年销售额达26.7兆美元。过去几年,全球网路购物的数量和比例稳步上升。 2020 年网上消费者人数的最大增幅是由于新冠疫情,迫使人们网路购物。

- 欧洲、美国和中国等主要经济体的电子商务和物流行业的快速扩张,刺激了对更现代化分销网络的需求。因此,轻型商用车的需求可能会增加。戴姆勒、日产、福特、雷诺等主要轻型商用车製造商的电子商务销售额大幅成长,并加强了其物流产业。皮卡车和货车传统上满足电子商务物流和消费者配送服务的运输需求,预计将对全球轻型商用车市场产生相当大的正面影响。

欧洲、美国和中国等主要经济体的电子商务和物流行业的快速成长推动了对更复杂的物流网路的需求。

- 电子商务和物流行业是轻型商用车市场的主要驱动力。随着网路和智慧型手机普及率的提高,网路零售和电子商务销售额正在飙升。预计这一趋势将推动对能够更快交付的轻型商用车的需求。 2016年全球轻型商用车产量为17,217,999辆,预计2021年将达18,593,850辆。

- 新冠疫情为全球电子商务产业带来了巨大的推动,无论是收益还是用户群。随着网路购物变得越来越流行,预计这种趋势将会持续下去。预计 2020 年全球电子商务市场将大幅成长,2021 年销售额将达到 26.7 兆美元。全球网路购物购者的数量和比例一直在稳步增长,而 2020 年的疫情则起到了催化剂的作用,推动更多人网路购物。

- 欧洲、美国和中国等主要经济体的电子商务和物流行业的快速成长推动了对更复杂的物流网路的需求。因此,轻型商用车的需求持续成长。尤其是戴姆勒、日产、福特、雷诺等知名轻型商用车製造商,其电子商务销售额大幅成长,并正在加强其物流部门。从历史上看,皮卡车和货车一直是电子商务运输的首选,既能满足物流需求,又能满足消费者的送货服务。预计这一趋势将对全球轻型商用车市场产生显着的正面影响。

全球轻型商用车市场趋势

全球需求成长和政府支持将推动电动车市场成长

- 电动车(EV)已成为汽车产业的重要组成部分,因为它具有提高能源效率、减少温室气体和污染排放的潜力。这种快速成长背后的主要因素是日益增长的环境问题和政府的支持。其中,电动车全球销售呈现强劲成长势头,2022年较2021年成长10.82%。据预测,2025年底,电动乘用车年销量将超过500万辆,约占汽车总销量的15%。

- 领先的製造商和组织(例如伦敦警察厅和消防队)正在积极推行电动车策略。例如,该公司设定了在 2025 年实现零排放汽车、在 2030 年实现 40% 货车电气化、到 2040 年实现全电动化的目标。预计全球也将出现类似的趋势,2024 年至 2030 年间电动车的需求和销售量将急剧成长。

- 在电池技术和汽车电气化进步的推动下,亚太地区和欧洲有望主导电动车生产。 2020年5月,起亚汽车欧洲公司公布“S计划”,宣布转向电动化策略。这项决定是在起亚电动车在欧洲创下销售纪录之际做出的。起亚雄心勃勃地计划在 2025 年之前在全球推出 11 款电动车,涵盖轿车、SUV 和 MPV 等各个领域。该公司的目标是到 2026 年实现全球电动车年销量达到 50 万辆。

轻型商用车产业概况

轻型商用车市场较为分散,前五大企业占24.80%的市占率。该市场的主要企业是:北京汽车股份有限公司、东风汽车公司、福特汽车公司、通用汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 消费者汽车购买支出(cvp)

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 通货膨胀率

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 新款 Xev 车型发布

- 物流绩效指数

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 燃油价格

- 製造商生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 轻型商用皮卡车

- 轻型商用厢型车

- 商用车

- 推进类型

- 混合动力汽车和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料类别

- 天然气

- 柴油引擎

- 汽油

- LPG

- 混合动力汽车和电动车

- 按地区

- 非洲

- 南非

- 非洲

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 亚太地区其他国家

- 欧洲

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Ashok Leyland Limited

- BAIC Motor Corporation Ltd.

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Dongfeng Motor Corporation

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Isuzu Motors Limited

- Mahindra & Mahindra Limited

- Nissan Motor Co. Ltd.

- Rivian Automotive Inc.

- Tata Motors Limited

- Volkswagen AG

- Volvo Group

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93048

The Light Commercial Vehicles Market size is estimated at 516.9 billion USD in 2025, and is expected to reach 659.9 billion USD by 2029, growing at a CAGR of 6.30% during the forecast period (2025-2029).

The rapidly growing e-commerce and logistics sectors fuel the light commercial vehicles market

- The e-commerce and logistics sectors fuel the light commercial vehicle market. Online retail sales and e-commerce have been rising due to more people having access to the internet and smartphones. Light commercial vehicle purchases are projected to rise, which will assist in the prompt delivery of goods to clients.

- As a result of COVID-19 online sales, the income and user base of the global e-commerce market greatly expanded. However, the increased popularity of internet shopping will encourage growth. The global e-commerce market experienced a remarkable expansion in 2020, and by 2021, it generated USD 26.7 trillion in sales. The number and percentage of online shoppers have constantly increased globally over the last few years. The highest increase in the number of online shoppers in 2020 was caused by the COVID-19 pandemic, which forced individuals to shop online.

- The rapid expansion of the e-commerce and logistics industries across major economies, including Europe, the United States, and China, is fueling the demand for a more contemporary distribution network. Thus, the demand for light commercial vehicles will increase. Significant light commercial vehicle manufacturers, like Daimler, Nissan, Ford, and Renault, experienced a dramatic increase in e-commerce sales, which bolstered the logistics industry. Pick-up trucks and vans have traditionally filled the requirement for e-commerce transportation for logistics and consumer delivery services, which is expected to have a substantial positive impact on the global light commercial vehicle market.

The rapid growth of the e-commerce and logistics sectors, spanning major economies like Europe, the United States, and China, is driving the need for more advanced distribution networks

- The e-commerce and logistics industries are the primary drivers of the light commercial vehicle market. With the rising internet and smartphone penetration, online retail and e-commerce sales have surged. This trend is expected to drive the demand for light commercial vehicles, enabling faster deliveries. In 2016, the global production of light commercial vehicles stood at 17,217,999 units and was projected to reach 18,593,850 units by 2021.

- The COVID-19 pandemic has significantly boosted the global e-commerce sector, both in terms of revenue and user base. This trend is expected to continue as online shopping gains further popularity. In 2020, the global e-commerce market witnessed substantial growth, culminating in sales worth USD 26.7 trillion by 2021. The number and proportion of online shoppers have been steadily rising worldwide, with the pandemic acting as a catalyst in 2020, pushing more individuals toward online shopping.

- The rapid growth of the e-commerce and logistics sectors, spanning major economies like Europe, the United States, and China, is driving the need for more advanced distribution networks. Consequently, the demand for light commercial vehicles is poised to rise. Notably, prominent light commercial vehicle manufacturers such as Daimler, Nissan, Ford, and Renault have witnessed a significant surge in e-commerce sales, bolstering the logistics sector. Historically, pick-up trucks and vans have been the go-to choices for e-commerce transportation, catering to both logistics and consumer delivery services. This trend is expected to have a pronounced positive impact on the global light commercial vehicle market.

Global Light Commercial Vehicles Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Light Commercial Vehicles Industry Overview

The Light Commercial Vehicles Market is fragmented, with the top five companies occupying 24.80%. The major players in this market are BAIC Motor Corporation Ltd., Dongfeng Motor Corporation, Ford Motor Company, General Motors Company and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 UAE

- 5.3.4.3 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.5.2 Mexico

- 5.3.5.3 US

- 5.3.5.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 Argentina

- 5.3.6.2 Brazil

- 5.3.6.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ashok Leyland Limited

- 6.4.2 BAIC Motor Corporation Ltd.

- 6.4.3 BYD Auto Co. Ltd.

- 6.4.4 Daimler AG (Mercedes-Benz AG)

- 6.4.5 Dongfeng Motor Corporation

- 6.4.6 Ford Motor Company

- 6.4.7 General Motors Company

- 6.4.8 Groupe Renault

- 6.4.9 Isuzu Motors Limited

- 6.4.10 Mahindra & Mahindra Limited

- 6.4.11 Nissan Motor Co. Ltd.

- 6.4.12 Rivian Automotive Inc.

- 6.4.13 Tata Motors Limited

- 6.4.14 Volkswagen AG

- 6.4.15 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219