|

市场调查报告书

商品编码

1693671

印度垃圾焚化发电-市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Waste-to-Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

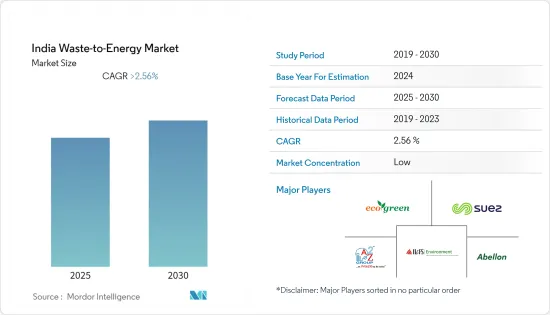

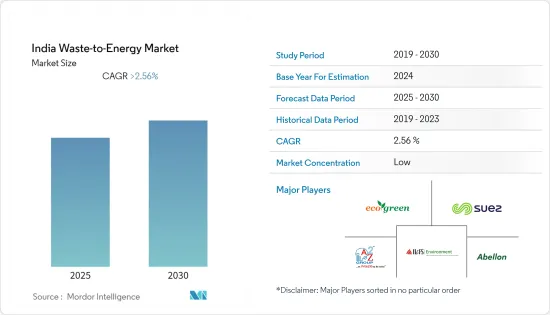

预计预测期内印度垃圾焚化发电市场复合年增长率将超过 2.56%。

2020年,市场受到新冠疫情的不利影响。目前市场已恢復至疫情前的水准。

从长远来看,废弃物产生的增加和缓解废弃物管理危机的努力,加上政府的有利政策,预计将推动研究市场的发展。

另一方面,能源焚化厂废弃物对环境的影响预计会抑制所研究的市场。

采用发酵和厌氧消化等先进且环境可持续的废弃物能源技术预计将为印度废弃物转化能源市场创造充足的机会。

印度垃圾焚化发电市场趋势

市场主导的热技术

预计热垃圾焚化发电技术将在预测期内主导印度垃圾焚化发电市场,这主要是因为其製程相对简单且成本较低。

热技术进一步细分为焚烧、热解和气化。在各个环节中,焚烧占了很大的份额。

都市固态废弃物焚烧(MSWI)是在为此目的而建造的特定设施中以受控製程焚烧废弃物。 MSWI 的主要目标是减少 MSW 的体积和质量,并使其在不需要额外燃料(自热燃烧)的燃烧过程中呈现化学惰性。另一个好处是,还可以从废弃物流中回收能源、矿物和金属。

这是一项成熟的技术。在印度,许多计划已成功在商业层面部署,用于处理固态废弃物(包括城市和工业废弃物)并发电。

考虑到上述情况,预计热技术部门将在预测期内占据市场研究的主要份额。

预计废弃物产生量的增加和缓解废弃物管理危机的努力将推动市场

印度是世界上城市人口成长最快的国家之一。由于城市人口的快速增长,该地区城市人口产生的废弃物量激增。这些废弃物大部分是有机物(约 50% 或更多)。印度采用堆肥、焚烧、固态废弃物处理和其他回收及废弃物能源等技术。根据世界银行统计,在印度各种废弃物管理方式中,固态废弃物处理约占总量的77%。

印度快速的都市化导致人口稠密的特大城市和大都会圈的扩张,造成安全和道德的废弃物处理空间短缺。此外,也缺乏适当的废弃物管理解决方案(减重、再利用、回收),大部分废弃物掩埋垃圾掩埋场。这导致大城市中出现了大型、密集的垃圾掩埋场,而这些垃圾掩埋场的空间正在迅速耗尽,并引发了迫在眉睫的废弃物管理危机。

在印度,回收是在正式和非正式的市场机制下进行的,从而产生了诸如电子废弃物回收和铅酸电池使用造成的空气和水污染、使用废纸的造纸厂造成的水污染以及回收公司不当倾倒废弃物等问题。

国内处理的废弃物份额预计将从 2016 财年的 17.97% 大幅增长至 2022 财年的 73%,其中垃圾焚化发电的份额将稳步增加。

WtE 工厂可以有效处理废弃物并显着减少其体积,同时产生能源以满足印度日益增长的能源需求。这使得印度将 WtE 工厂定位为废弃物管理最可行的解决方案。

根据住宅和城市事务部的数据,截至 2022 年 3 月,印度共有约 249 个垃圾焚化发电(垃圾焚化发电/沼气/生物甲烷化)工厂投入运营,每日输入能力为 0.074 吨。印度最古老的垃圾焚化发电是 Narela垃圾焚化发电。它每天处理 2,000 吨废弃物并产生 24MW 的能源。

据住宅和城乡建设部称,截至 2021 年 12 月,约有 44 个垃圾焚化发电正在建设中,处理废弃物的能力为 0.12 万吨/天。例如,2022年3月,德里市政公司开始在Tehkhand建造一座新的垃圾焚化发电发电厂。该工厂每天将消耗 2,000 吨废弃物并产生约 25MW 的能源。 Tehand 工厂占地 15 英亩,耗资约 375 亿印度卢比,预计将于 2023 年 3 月开始商业运作。

因此,预计上述因素将在预测期内推动显着成长。

印度垃圾焚化发电产业概况

印度的垃圾焚化发电市场高度分散。市场上的主要企业包括 A2z Group、Ecogreen Energy Pvt。 Ltd、Il&fs 环境基础设施和服务有限公司、Abellon 清洁能源有限公司和苏伊士集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测(百万美元)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 科技

- 火力

- 焚化

- 热解

- 气化

- 生物化学品

- 其他的

- 火力

- 处置方法

- 掩埋

- 废弃物处理

- 回收利用

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- A2z Group

- Ecogreen Energy Pvt. Ltd

- Jitf Urban Infrastructure Limited

- Il& fs Environnemental Infrastructure And Services Limited

- Abellon Clean Energy Ltd

- Suez Group

- Hitachi Zosen Inova

- Rollz India Waste Management

- Gj Eco Power Pvt. Ltd

- Veolia Environnement SA

- Hydroair Techtonics(pcd)Limited

- Ramky Enviro Engineers Ltd

- Mailhem Environment Pvt. Ltd

第七章 市场机会与未来趋势

The India Waste-to-Energy Market is expected to register a CAGR of greater than 2.56% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Over the long term, increasing waste generation and efforts to mitigate the waste management crisis combined with favorable government policies are expected to drive the market studied.

On the other hand, the environmental impact of waste from energy incineration plants is expected to restrain the market studied.

Nevertheless, the adoption of advanced and environmentally sustainable waste-to-energy techniques such as fermentation and anaerobic digestion is expected to create ample opportunities for the Indian waste-to-energy market.

India Waste-to-Energy Market Trends

Thermal Technology to Dominate the Market

Thermal technology of waste-to-energy is expected to dominate the Indian waste-to-energy market during the forecast period, mainly due to the relatively easier process and low costs.

Thermal technology is further subdivided into incineration, pyrolysis, and gasification. Incineration holds the major share among the subdivisions.

Municipal solid waste incineration (MSWI) is the burning of waste in a controlled process within a specific facility that has been built for this purpose. The primary goal of MSWI is to reduce MSW volume and mass and make it chemically inert in a combustion process without the need for additional fuel (autothermic combustion). As a side effect, it also enables the recovery of energy, minerals, and metals from the waste stream.

This technology is a well-established technology. It has been deployed in many projects successfully at the commercial level to treat solid wastes, such as municipal solid waste and industrial solid waste, and generate electricity in India.

Hence, owing to the above points, the thermal technology segment is expected to maintain its major share of the market studied during the forecast period.

Increasing Waste Generation and Efforts to Mitigate Waste Management Crisis is Expected to Drive the Market

India has one of the fastest-growing urban populations worldwide. The rapid increase in the urban population has led to explosive growth in the amount of waste generated by the urban population across the region. Most of this waste is organic in nature (about or more than 50%). India practices compost, incineration, solid waste disposal, and other techniques, including recycling, waste-to-energy, and other waste disposal methods. According to the World Bank, in India, out of the various waste disposal methods, solid waste disposal accounts for approximately 77% of the total.

The rapid urbanization in India has led to the growth of massive megacities and metropolitan areas with high population densities, due to which there is a lack of space for safe and ethical waste disposal. There is also a lack of proper waste management (reduction, reuse, and recycling) solutions, with most of the waste entering landfills. This has led to the creation of large and dense landfills in megacities, which are running out of space quickly, leading to an impending waste management crisis.

In India, recycling is carried out under both formal and informal market mechanisms, which leads to problems such as air and water pollution from the recycling of e-waste and use of lead-acid batteries, water pollution from paper mills using wastepaper, and the improper dumping of waste by recycling companies.

The country's share of waste processed has witnessed significant growth from 17.97% in FY2016 to 73% in FY2022, of which the waste-to-energy is also witnessing a steady rise in its share.

WtE plants can handle waste effectively and reduce its volume significantly while generating energy to supplement the growing energy demand in India. Due to this, India has identified WtE plants as the most practical solution for waste management.

According to the Ministry of Housing and Urban Affairs, as of March 2022, there are approximately 249 waste-to-energy (waste-to-electricity / biogas / bio-methanation) plants that are functional in India, with an input capacity of 0.074 lakh tonnes per day. The oldest waste-to-energy plant in India is the Narela Waste-to-Energy Plant. It processes 2,000 metric tonnes of waste every day to generate 24 MW of energy.

According to the Ministry of Housing and Urban Affairs, as of December 2021, there are approximately 44 waste-to-energy plants under construction, with the capacity to process 0.12 lakh TPD of waste. For instance, in March 2022, the Delhi Municipal Corporation started the construction of a new Waste-to-Energy Plant at Tehkhand. The plant is likely to consume 2,000 tonnes of waste daily and generate approximately 25 MW of energy. The Tehkhand plant is being developed for approximately INR 3.75 billion on 15 acres of land, and the project is expected to begin commercial operations by March 2023.

Hence, due to the aforementioned factors, the market studied is expected to witness significant growth during the forecast period.

India Waste-to-Energy Industry Overview

The Indian waste-to-energy market is highly fragmented. Some major players in the market include A2z Group, Ecogreen Energy Pvt. Ltd, Il&fs Environmental Infrastructure and Services Limited, Abellon Clean Energy Ltd, and Suez Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Thermal

- 5.1.1.1 Incineration

- 5.1.1.2 Pyrolysis

- 5.1.1.3 Gasification

- 5.1.2 Bio-Chemical

- 5.1.3 Other Technologies

- 5.1.1 Thermal

- 5.2 Disposal Method

- 5.2.1 Landfill

- 5.2.2 Waste Processing

- 5.2.3 Recycling

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 A2z Group

- 6.3.2 Ecogreen Energy Pvt. Ltd

- 6.3.3 Jitf Urban Infrastructure Limited

- 6.3.4 Il&fs Environnemental Infrastructure And Services Limited

- 6.3.5 Abellon Clean Energy Ltd

- 6.3.6 Suez Group

- 6.3.7 Hitachi Zosen Inova

- 6.3.8 Rollz India Waste Management

- 6.3.9 Gj Eco Power Pvt. Ltd

- 6.3.10 Veolia Environnement SA

- 6.3.11 Hydroair Techtonics (pcd) Limited

- 6.3.12 Ramky Enviro Engineers Ltd

- 6.3.13 Mailhem Environment Pvt. Ltd