|

市场调查报告书

商品编码

1836519

半拖车:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Semi-trailer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

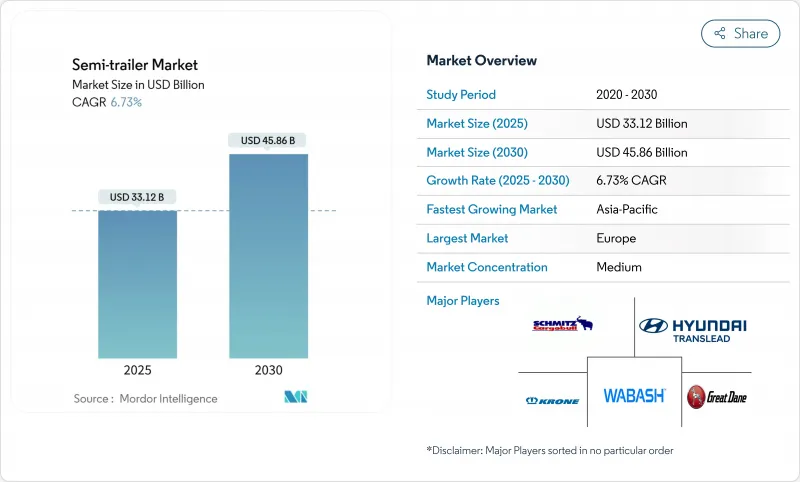

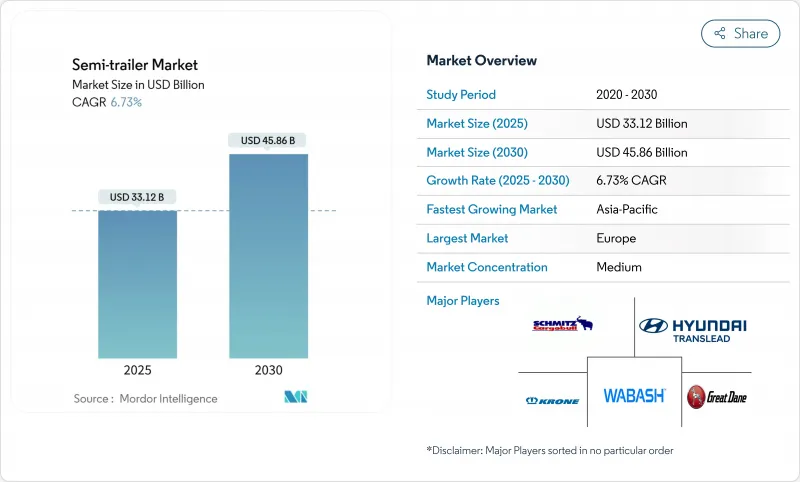

2025 年半拖车市场规模为 331.2 亿美元,预计到 2030 年将达到 458.6 亿美元,在此期间的复合年增长率为 6.73%。

电子商务对本地配送网路的持续影响、零排放货运的监管推动以及以拖车为中心的自动化投资的不断增加,共同推动了行业发展势头。干货厢型车保持了销售领先地位,但随着低温运输活动的扩展,冷冻设备的发展也正在加速。电动车轴、先进的远端资讯处理和空气动力学套件正日益成为购买标准,而新兴经济体的基础设施发展计画则正在推动基准车辆需求。

全球半挂车市场趋势与洞察

电子商务货运热潮

线上销售的成长正在改变路线密度和货物尺寸,推动了对多功能干货厢式货车的需求,这些设备既能服务于区域枢纽,又能在城市中心灵活移动。车队管理人员正在增加模组化车身,以便在旺季灵活调整运力;远端资讯处理技术使负责人能够避免城市拥堵,因为卡车在密集的交通干线上的延误率已经超过了疫情前的水平。宅配和小包裹托运人越来越多地指定使用高箱拖车,以最大限度地提高内部高度;供应商则鼓励采用复合材料面板,以在不牺牲刚性的情况下减轻自重。由于这些货物对时间敏感,托运人更倾向于配备预测性维护感测器的设备,这些感测器可以在故障发生前发出门密封条磨损或车轮端发热的讯号。这些变化使半拖车市场与消费者对隔日送达不断变化的期望紧密结合。

扩大全球低温运输物流

可支配收入的增加和药品分销的扩张正在推动全球对冷藏拖车的需求。欧洲的低温运输生态系统已支撑着8,000亿欧元的商业价值,并僱用了超过2,900万人。与传统系统相比,开利运输公司(Carrier Transicold)的新型Vector HE17冷冻机组可将燃料消费量降低30%,使托运人能够在不牺牲负载容量的情况下满足严格的排放法规。像Biocoop这样的零售商和合作杂货商已承诺到2030年将其近三分之一的冷藏设备电气化,利用静音运行的优势,充分利用隔夜送达的时段。

资金投入高、利息负担重

借贷成本上升导致续约週期放缓,正如Wabash National公司2025年第一季销售额下降26.1%所证实,原因是订单不足以满足车队维修需求。小型承运商缺乏可负担的信贷,这使得资金更充裕的买家得以收购陷入困境的竞争对手,并推动整合。主机厂的因应之策是提供包含维护的长期租赁,但残值风险的上升推高了总拥有成本,限制了半拖车市场的短期成长。

报告中分析的其他驱动因素和限制因素

- 新兴国家基础设施电气化奖励策略

- 再生轴拖车TCO降低

- 钢铁和铝价格波动

細項分析

干货厢型车平台凭藉其与日用百货、码垛设备和包装消费品的通用内部相容性,将在2024年保持半拖车市场55.21%的份额。干货厢式货车平台支援大型零售商和合约承运商的可预测更换週期,从而保持稳定的生产率。儘管如此,受快速发展的电子商务和疫苗物流的推动,预计到2030年,冷藏行业的复合年增长率将达到9.14%。像开利冷链全电动式Vector eCool这样的设备可将直接排放降至零,并允许营运商在低噪音的市中心区域运作。

在半拖车市场,平板车和低底盘车受基础设施资金筹措週期影响,而油罐车需求则与化学品和燃料吞吐量密切相关,法律规范使设计更加复杂。虽然北美地区优先考虑全封闭式车辆以防盗窃,但侧帘式车辆在欧盟仍然占据主导地位,因为它注重侧装效率。在装载完整性高于标价的情况下,提供具有远端资讯处理功能和预测性温度警报的冷冻车的原始设备製造商脱颖而出。因此,冷藏车类别正在引领整个拖车市场的规格创新。

25-50吨级拖车占销售额的38.26%,并维持了8.23%的成长率,这得益于其多功能性,无需特殊许可即可穿越区域车道。业者看重这些车辆与三轴牵引车和标准公路桥樑的兼容性,从而避免了重型钻机产生的通行额外费用。由于其均衡的装载效率吸引了托运人,预计到2030年,此类半拖车的市场规模将达到203亿美元。

重量在51吨至100吨之间的低底盘供应能源和建筑大型企划,但受週期性商品支出的影响。 100吨以上的模组虽然对风力发电机叶片和炼油容器至关重要,但仍属于利基市场。欧盟提案将零排放卡车重量限制提高至44吨,这可能会重塑需求曲线,但对基础设施成本的担忧可能会推迟全面协调。因此,在整个预测期内,半拖车市场可能仍将由中重型平台主导。

区域分析

到2024年,欧洲将占全球收益的35.22%,这得益于成熟的公路网络、密集的跨境贸易以及早期的排放法规刺激了轮调更新。欧盟二氧化碳排放标准要求在2025年将拖车的效率提高15%,到2040年提高90%,促使买家转向空气动力学裙边、低滚动阻力轮胎和电动轴。自2010年以来,半拖车市场成长了59%,并继续受益于同步的铁路公路联运,这降低了跨境停留时间。然而,电动联合收割机的重量增加提案引发了关于基础设施成本和潜在公路模式转换的讨论,为采购週期注入了谨慎的情绪。

受中国持续的高速公路建设和印度货运走廊的扩张推动,亚太地区以7.68%的复合年增长率脱颖而出。中集车辆累计,2024年上半年销售额达107亿元人民币,在其「星链」优化计画的带动下,半拖车销售额增长了24.67%。印度以卡车为重点的国家物流政策旨在将物流成本压缩至GDP的10%以下,这项变革预计将透过提高次大陆的周转率来扩大区域半拖车市场。在日本,日野和三菱扶桑之间的原始设备製造商整合加剧了竞争压力。

北美将保持强劲势头,这得益于预计2025年8级牵引车销量将达到25万至28万辆,以及政府制定的到2030年实现零排放商用车销量占比30%的蓝图。佩卡公司报告称,其售后零件销售额创下66.7亿美元的历史新高,显示老旧拖车市场的利用率很高。然而,计划对进口卡车征收25%的关税可能会导致挂车价格上涨9%,需求减少17%。南美洲严重依赖公路货运,巴西65%的货运量透过卡车运输。同时,随着开发银行向交通走廊注入资金,中东和非洲市场正在获得发展动力,塑造全球各地区半拖车市场的微妙前景。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电子商务货运热潮

- 扩大全球低温运输物流

- 北美采用 60 英尺干货车规则

- 利用电动再生轴拖车降低总拥有成本

- 采用拖车远端资讯处理及即时可视性

- 新兴国家基础设施奖励策略

- 市场限制

- 资金投入高、利息负担重

- 钢铁和铝价格波动

- 欧盟重量和长度法规

- 缺乏电动TRU和电动轴的充电基础设施

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模与成长预测:价值(美元)

- 按车辆类型

- 平板

- 干货车

- 冷藏(冷藏箱)

- 低底盘

- 油船

- 侧帘式

- 其他类型

- 按吨位

- 少于25吨

- 25吨-50吨

- 51吨至100吨

- 超过100吨

- 脚长

- 28至45英尺

- 超过 45 英尺

- 按最终用途行业

- 运输/物流

- 饮食

- 建筑和采矿

- 农业

- 製造业和工业产品

- 零售与电子商务

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 土耳其

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Wabash National Corporation

- Great Dane LLC

- Hyundai Translead

- Utility Trailer Manufacturing Company

- Schmitz Cargobull AG

- Krone GmbH & Co. KG

- China International Marine Containers Co., Ltd.

- Manac Inc.

- MAC Trailer Manufacturing Inc.

- East Manufacturing Corporation

- Stoughton Trailers LLC

- Vanguard National Trailer Corp.

- Kogel Trailer GmbH

- Wielton SA

- Fontaine Trailer Co.

- Pitts Trailers

- Premier Trailer Mfg. Inc.

- Kassbohrer Fahrzeugwerke

- Schwarzmuller Gruppe

第七章 市场机会与未来展望

The semi-trailer market size is valued at USD 33.12 billion in 2025 and is forecast to reach USD 45.86 billion by 2030, translating into a 6.73% CAGR over the period.

Industry momentum stems from e-commerce's relentless pull on regional distribution networks, regulatory pushes for zero-emission freight, and rising investments in trailer-centric automation. Dry van units uphold volume leadership, yet refrigerated equipment sets the pace as cold-chain activity broadens. Electrified axles, advanced telematics, and aerodynamic packages increasingly shape purchase criteria, while infrastructure programs across emerging economies lift baseline fleet demand.

Global Semi-trailer Market Trends and Insights

E-commerce freight boom

Online sales growth reshapes route density and shipment size, intensifying call-off rates for versatile dry-van equipment that can service regional hubs while maneuvering in urban cores. Fleet managers add modular bodies to flex capacity for peak seasons, and telematics enable crew schedulers to avoid city-center congestion as truck delays in dense corridors exceed pre-pandemic levels . Courier and parcel operators increasingly spec high-cube trailers that maximize internal height, prompting suppliers to adopt composite panels to trim tare weight without sacrificing stiffness. Because this freight is time-critical, carriers favor equipment with predictive-maintenance sensors that flag door seal wear and wheel-end heat before failures occur. Together, these changes keep the semi-trailer market in close alignment with shifting consumer expectations for next-day delivery.

Expansion of global cold-chain logistics

Rising disposable incomes and pharmaceutical distribution push refrigerated trailer demand worldwide. Europe's cold-chain ecosystem already supports EUR 800 billion in commerce and employs over 29 million people, underscoring the structural scale of temperature-controlled freight . New Vector HE 17 refrigeration units from Carrier Transicold cut fuel burn by 30% relative to legacy systems, letting shippers meet tightening emission ceilings without sacrificing payload. Retailers and cooperative grocers such as Biocoop have pledged to electrify nearly one-third of reefer equipment by 2030, leveraging whisper-quiet operations to access night-time delivery slots.

High capex & interest-rate burden

Elevated borrowing costs delay replacement cycles, evidenced by Wabash National's 26.1% revenue drop in Q1 2025 as orders fell below fleet sustainment needs. Smaller carriers lack inexpensive credit facilities, prompting consolidation as buyers with superior capital access scoop distressed competitors. OEMs respond with extended-term leases bundled with maintenance, though higher residual-value risk inflates the overall cost of ownership, tempering near-term semi-trailer market growth.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure stimulus in emerging economies

- Electrified regenerative-axle trailers cut TCO

- Volatile steel & aluminum prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dry van platforms kept a 55.21% share of the semi-trailer market in 2024 as their universal interior fits general merchandise, palletized machinery, and packaged consumer goods. They anchor predictable replacement cycles among big-box retailers and contract carriers, sustaining steady build rates. Nevertheless, the refrigerated segment is charting a 9.14% CAGR to 2030, catalyzed by rapid grocery e-commerce and vaccine logistics. Equipment such as Carrier Transicold's all-electric Vector eCool cuts direct emissions to zero, letting operators enter low-noise downtown zones.

The semi-trailer market also sees flatbeds and lowboys ride infrastructure funding cycles, whereas tanker demand tracks chemical and fuel throughput, with regulatory oversight adding design complexity. Curtain-sider adoption remains pronounced in the EU for side-loading efficiency, though North America prioritizes full-enclosure bodies for theft deterrence. OEMs that deliver telematics-ready reefers with predictive temperature alerts differentiate in a landscape where load integrity trumps sticker price. As a result, the refrigerated category steers overall specification innovation within the semi-trailer market.

Trailers rated 25-50 ton hold 38.26% of revenues and maintain an 8.23% expansion rate, underpinned by versatility across cross-regional lanes without special permits. Operators prize these units for matching three-axle tractors and standard highway bridges, cutting toll surcharges that heavier rigs attract. The semi-trailer market size for this class is set to reach USD 20.3 billion by 2030 as shippers gravitate toward balanced payload efficiency.

Heavier 51-100 ton lowboys serve energy and construction megaprojects but hinge on cyclic commodity spending. Above-100-tonne modules remain niche, albeit critical for wind-turbine blades and refinery vessels. EU proposals to lift zero-emission truck combos to 44 tonnes could reshape demand curves, yet infrastructure cost concerns may delay full harmonization. Consequently, mid-weight platforms will continue to anchor volume in the semi-trailer market through the forecast horizon.

The Semi-Trailer Market Report is Segmented by Vehicle Type (Flat Bed, Dry Van, and More), Tonnage (Below 25 Ton, 25 Ton - 50 Ton, and More), Foot Length (28-45 Ft and Above 45 Ft), End-Use Industry (Transportation and Logistics, Food and Beverage, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe anchored 35.22% of global revenue in 2024 as mature road networks, dense cross-border trade, and early emissions legislation stimulate rotational renewals. EU CO2 standards mandate trailer efficiency improvements of 15% by 2025 and up to 90% by 2040, channeling buyers toward aerodynamic skirts, low-rolling-resistance tires, and electrified axles. The semi-trailer market continues to benefit from synchronized rail-road combined transport, which has expanded 59% since 2010, keeping cross-border dwell times low. However, weight increases proposed for electric combinations trigger infrastructure cost debates and potential modal shifts back toward road, injecting cautious sentiment into procurement cycles.

Asia-Pacific stands out with a 7.68% CAGR, propelled by China's sustained highway build-out and India's freight-corridor rollouts. CIMC Vehicles booked 10.7 billion RMB revenue in H1 2024 and logged a 24.67% lift in semi-trailer sales under its Starlink optimization program, underscoring local production agility. India's truck-focused National Logistics Policy aims to compress logistics costs to under 10% of GDP-a change expected to swell the regional semi-trailer market by lifting asset turnover on the subcontinent. Japan's push for OEM consolidation between Hino and Mitsubishi Fuso adds competitive tension.

North America retains a solid base, buoyed by 250,000-280,000 projected Class 8 tractor sales in 2025 and a policy blueprint that targets 30% zero-emission commercial vehicle sales by 2030. PACCAR reports record USD 6.67 billion aftermarket parts turnover, signaling strong utilization of aging trailer pools. Yet prospective 25% tariffs on imported trucks could drive trailer price inflations of 9% and dent demand by 17%. South America relies heavily on road freight-Brazil moves 65% of goods by truck-while Middle East and Africa markets gain momentum as development banks funnel capital into transport corridors, altogether shaping a nuanced outlook for the semi-trailer market across global regions.

- Wabash National Corporation

- Great Dane LLC

- Hyundai Translead

- Utility Trailer Manufacturing Company

- Schmitz Cargobull AG

- Krone GmbH & Co. KG

- China International Marine Containers Co., Ltd.

- Manac Inc.

- MAC Trailer Manufacturing Inc.

- East Manufacturing Corporation

- Stoughton Trailers LLC

- Vanguard National Trailer Corp.

- Kogel Trailer GmbH

- Wielton S.A.

- Fontaine Trailer Co.

- Pitts Trailers

- Premier Trailer Mfg. Inc.

- Kassbohrer Fahrzeugwerke

- Schwarzmuller Gruppe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce freight boom

- 4.2.2 Expansion of global cold-chain logistics

- 4.2.3 Adoption of 60-ft dry-van rules in North America

- 4.2.4 Electrified regenerative-axle trailers cut TCO

- 4.2.5 Trailer telematics & real-time visibility adoption

- 4.2.6 Infrastructure stimulus in emerging economies

- 4.3 Market Restraints

- 4.3.1 High capex & interest-rate burden

- 4.3.2 Volatile steel & aluminium prices

- 4.3.3 EU weight/length regulatory limits

- 4.3.4 Sparse charging infra for electric TRUs & e-axles

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Flatbed

- 5.1.2 Dry Van

- 5.1.3 Refrigerated (Reefer)

- 5.1.4 Lowboy

- 5.1.5 Tanker

- 5.1.6 Curtain-Sider

- 5.1.7 Other Types

- 5.2 By Tonnage

- 5.2.1 Below 25 Ton

- 5.2.2 25 Ton - 50 Ton

- 5.2.3 51 Ton - 100 Ton

- 5.2.4 Above 100 Ton

- 5.3 By Foot Length

- 5.3.1 28 - 45 ft

- 5.3.2 Above 45 ft

- 5.4 By End-Use Industry

- 5.4.1 Transportation and Logistics

- 5.4.2 Food and Beverage

- 5.4.3 Construction nd Mining

- 5.4.4 Agriculture

- 5.4.5 Manufacturing and Industrial Goods

- 5.4.6 Retail and E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Wabash National Corporation

- 6.4.2 Great Dane LLC

- 6.4.3 Hyundai Translead

- 6.4.4 Utility Trailer Manufacturing Company

- 6.4.5 Schmitz Cargobull AG

- 6.4.6 Krone GmbH & Co. KG

- 6.4.7 China International Marine Containers Co., Ltd.

- 6.4.8 Manac Inc.

- 6.4.9 MAC Trailer Manufacturing Inc.

- 6.4.10 East Manufacturing Corporation

- 6.4.11 Stoughton Trailers LLC

- 6.4.12 Vanguard National Trailer Corp.

- 6.4.13 Kogel Trailer GmbH

- 6.4.14 Wielton S.A.

- 6.4.15 Fontaine Trailer Co.

- 6.4.16 Pitts Trailers

- 6.4.17 Premier Trailer Mfg. Inc.

- 6.4.18 Kassbohrer Fahrzeugwerke

- 6.4.19 Schwarzmuller Gruppe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment