|

市场调查报告书

商品编码

1836661

柠檬酸钾:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Potassium Citrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

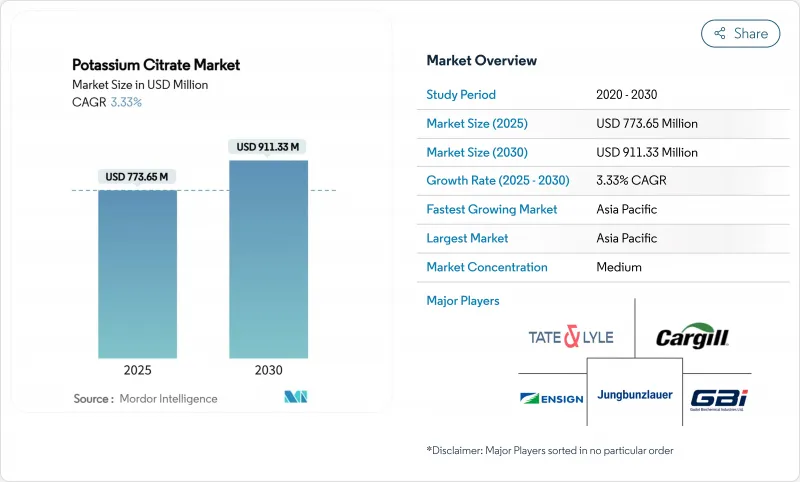

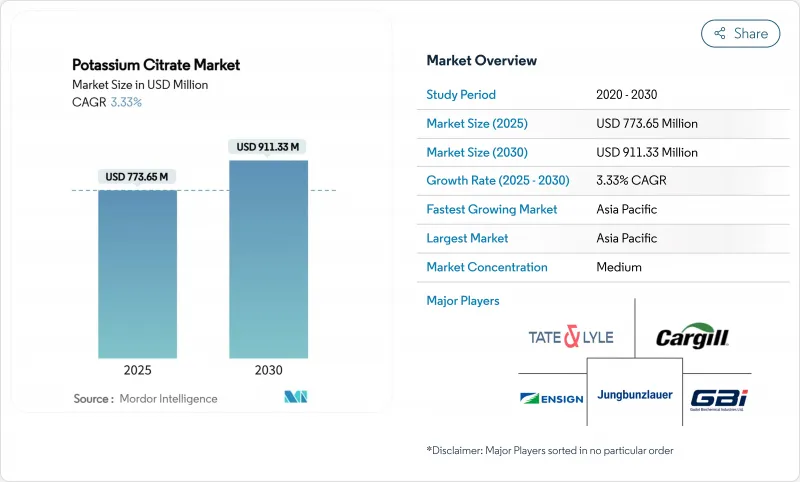

预计全球柠檬酸钾市场规模在 2025 年将达到 7.7365 亿美元,在 2030 年将达到 9.1133 亿美元,预测期内复合年增长率为 3.33%。

这种缓慢但持续的成长轨迹反映了该化合物在多种高价值应用领域的强势地位,从加工食品中的减钠措施到用于肾臟健康管理的特殊药物配方。柠檬酸钾市场的韧性归功于其独特的双重功能特性,即既可作为食品添加剂,又可作为活性药物原料药,这使其处于两个强劲终端使用领域的交汇点,而这两个领域始终优先考虑健康配方。监管势头强劲,尤其是美国食品药物管理局 (FDA) 于 2024 年 8 月发布的第二阶段减钠指南,该指南旨在将平均钠摄入量降至每天 2,750 毫克,这显着增强了市场动态。食品加工商越来越多地替代钾替代品取代钠基添加剂,以满足监管目标,同时保持产品功能性,这直接使柠檬酸钾製造商受益。同时,饮料行业越来越重视 pH 调节剂以保持产品稳定性和偏好,这正在创造新的需求载体,尤其是在机能饮料饮料和运动饮料类别中,电解质平衡至关重要。

全球柠檬酸钾市场趋势与见解

柠檬酸钾作为无钠食品添加剂的使用量迅速增加

全球致力于减少食品系统中的钠含量,这推动了柠檬酸钾市场的成长。随着监管机构提倡减少钠的消费量,柠檬酸钾成为可行的替代品。由于不含钠,柠檬酸钾可以取代传统的钠基添加剂,同时保持缓衝、乳化和矿物质强化等重要功能。这在加工食品中尤其重要,因为钠盐长期以来一直是加工食品的必需品。美国疾病管制与预防中心(2024 年 1 月)的数据突显了这个问题:美国人平均每天摄取 3,400 毫克钠,大大超过联邦政府对青少年和成年人 2,300 毫克的建议。这种过量摄取导致了严重的健康问题。 2021 年 8 月至 2023 年 8 月期间,美国成年人高血压发生率达 47.7%,男性为 50.8%,女性为 44.6%,并且随着年龄的增长而增加。监管格局正在不断演变,食品业明确推动减钠措施,力争在2026年前实现合规。这种迫切性推动了对柠檬酸钾作为可靠钠替代品的需求。柠檬酸钾可轻鬆融入现有食品配方中,无需製造商进行复杂的调整,确保产品品质、货架稳定性并符合健康标准。消费者健康意识的不断提升、钠与心血管风险之间密切的流行病学联繫以及日益严格的钠监管,正在推动柠檬酸钾在各种食品应用中的广泛应用。

洁净标示和日益增强的健康意识

在消费者对洁净标示和健康配方偏好不断变化推动下,食品饮料产业正经历重大变革时期,这对柠檬酸钾市场产生了显着影响。虽然柠檬酸钾是工业合成的,但由于与天然柠檬酸的结合,消费者对此评价较高。深入的消费者研究表明,消费者对天然营养成分的偏好日益增长。这一趋势在欧洲天然食品添加剂市场尤为明显,该市场的法律规范越来越倾向于天然衍生或天然加工的成分。製造商正在巧妙地重新定位柠檬酸钾,强调其与传统食品保鲜的关联以及其作为钾来源的作用,而钾对心血管健康和电解质平衡至关重要。国际食品资讯委员会2023年的一项调查突显了这一趋势,该调查发现,约26%的美国受访者认为「天然和低钠」是健康食品的主要指标,这证实了消费者对简单天然配方的需求日益增长。

遵守製药和食品行业的严格规定

柠檬酸钾在医药领域的应用面临日益复杂的监管要求,这延长了开发週期,并增加了製造商的合规成本。美国食品药物管理局 (FDA) 对药用级柠檬酸钾的药品主文件 (Drug Master File) 要求,必须对生产流程、杂质概况和稳定性数据进行全面的记录,这为寻求进入高价值医药市场的小型供应商设置了障碍。美国药典 (USP) 专论规定了严格的纯度标准,要求药品纯度达到 99.5% 以上,这需要复杂的生产流程和品管系统,从而增加了生产成本。虽然国际协调的努力从长远来看是有益的,但在短期内也会造成合规的复杂性,因为製造商必须应对各主要市场的不同要求。特别是,柠檬酸钾与其他活性成分相互作用的组合药物面临着日益严格的监管环境,需要广泛的稳定性和相容性测试。虽然这些合规要求有利于拥有现有监管基础设施的製药商,但它们也设置了市场准入壁垒,并限制了高端市场的竞争力。

报告中分析的其他驱动因素和限制因素

- 化妆品和个人护理配方中螯合剂的激增

- 纯素和植物性补充剂解决方案日益流行

- 食物口味的改变限制了更广泛的接受度

細項分析

2024年,纯度达到或超过99%的高纯度柠檬酸钾市场占了42.44%的市占率。这一趋势凸显了市场对超纯配方日益增长的需求,尤其是在高端製药和利基食品领域。严格的监管标准和对配方精度的极致重视是推动需求激增的关键因素。在製药等领域,即使是微量杂质也会影响安全性和疗效,因此纯度至关重要。柠檬酸钾兼具活性成分和缓衝剂的双重作用,尤其是在肾臟治疗和缓释性药物领域。该领域的主导地位凸显了业界对纯度和严格品质标准的坚定承诺。同时,98-99%纯度等级在食品加工和部分工业应用中占据利基地位,这些应用注重产品的功能性能,但对超高纯度并非必需。

同时,纯度低于 98% 的细分市场正经历最快的成长,复合年增长率高达 4.64%。这一成长轨迹是由大规模生产应用的吸引力所驱动的,这些应用优先考虑成本效益和一致的操作,而不是绝对纯度。关键驱动因素包括动物营养、散装食品生产和不同行业 pH 值调节用途的快速成长。为此,製造商正在转向提供低成本的柠檬酸钾配方,以满足基本功能需求,同时避免与超纯化配方相关的溢价。这种纯度偏好的差异显示市场格局日趋成熟。柠檬酸钾正在从一种商品演变为满足不同最终用户需求的客製化解决方案。这种演变不仅刺激了创新,也提高了供应链的适应性和竞争力,涵盖高端和低端市场。

区域分析

亚太地区不仅在 2024 年以 31.32% 的份额成为最大的区域市场,而且还表现出快速成长,预计到 2030 年的复合年增长率为 5.44%。这一增长主要得益于该地区不断扩大的食品加工基础设施和城镇居民日益增强的健康意识。正在进行的贸易调查和反倾销复审凸显了中国在柠檬酸盐生产方面的主导地位。印度快速发展的製药业正在推动对高纯度柠檬酸钾的需求,这对于学名药的生产至关重要。同时,印度不断扩大的加工食品产业为食品级应用提供了重要的生产机会。同时,日本和澳洲正透过专注于机能性食品和营养保健品等高端应用来推动该地区的成长。

北美市场日趋成熟,但也不断发展,这主要得益于重塑需求的监管措施。美国食品药物管理局(FDA)关于减钠的指导刺激了对柠檬酸钾作为钠替代品的持续需求。同时,北美先进的製药业确保了对用于特殊治疗用途的高纯度产品的稳定需求。值得注意的是,加拿大与中国共同参与贸易调查,使该地区的供应链相互关联,形成了影响价格和产品供应的竞争动态。此外,墨西哥的食品加工产业蓬勃发展,刺激了需求,尤其是来自註重健康的消费者的需求,他们寻求在传统食品中添加低钠产品。

欧洲处于洁净标示和天然成分潮流的前沿,柠檬酸钾正成为合成添加剂的热门天然替代品。欧盟对天然防腐剂的监管重视,正在提升柠檬酸钾的市场价值,尤其是在有机食品和高级食品领域。此外,欧洲成熟的化妆品行业越来越多地在个人保健产品中使用柠檬酸钾作为乙二胺四乙酸 (EDTA) 的替代品。永续性是关键关注点。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 柠檬酸钾作为无钠食品添加剂的使用量迅速增加

- 人们越来越偏好选择洁净标示、注重健康的成分

- 化妆品和个人护理配方中螯合剂的激增

- 纯素和植物来源补充剂解决方案日益流行

- 人们对食品安全中天然防腐剂的兴趣日益浓厚

- 饮料业对pH调节剂的需求不断增加

- 市场限制

- 严格遵守製药和食品业的法规

- 食物口味的改变限制了更广泛的接受度

- 长期使用过程中的储存与稳定性问题

- 消费者对听起来像化学的添加物持怀疑态度

- 供应链分析

- 监理展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(金额)

- 按纯度

- 低于98%

- 98-99%

- 超过99%

- 按用途

- 饮食

- 工业的

- 营养补充品

- 个人护理和化妆品

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 荷兰

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland(ADM)

- Jungbunzlauer Suisse AG

- Gadot Biochemical Industries

- Cofco Biochemical

- Huangshi Xinghua Biochemical

- Biofuran Materials

- American Tartaric Products

- Juxian Hongde Citric Acid

- Wang Pharmaceuticals & Chemicals

- Vishal Laboratories

- DPL-US

- Weifang Ensign Industry

- Spectrum Chemical Mfg Corp.

- Adani Pharmachem Private Limited

- Merck KGaA

- Dr. Paul Lohmann

- FBC Industries

- Ava Chemicals Private Limited,

第七章 市场机会与未来展望

The global potassium citrate market stands at USD 773.65 million in 2025 and is projected to reach USD 911.33 million by 2030, expanding at a CAGR of 3.33% during the forecast period.

This moderate yet consistent growth trajectory reflects the compound's entrenched position across multiple high-value applications, from sodium reduction initiatives in processed foods to specialized pharmaceutical formulations for renal health management. The market's resilience stems from potassium citrate's unique dual functionality as both a food additive and active pharmaceutical ingredient, positioning it at the intersection of two robust end-use sectors that continue to prioritize health-conscious formulations. Regulatory momentum significantly amplifies market dynamics, particularly through the FDA's Phase II sodium reduction guidance issued in August 2024, which targets average sodium intake reduction to 2,750 mg per day. This initiative directly benefits potassium citrate manufacturers, as food processors increasingly substitute sodium-based additives with potassium alternatives to meet regulatory targets while maintaining product functionality. Simultaneously, the beverage sector's growing emphasis on pH control agents for product stability and taste enhancement creates additional demand vectors, particularly in functional and sports drink categories where electrolyte balance remains paramount.

Global Potassium Citrate Market Trends and Insights

Surging Use of Potassium Citrate as a Sodium-Free Food Additive

Global efforts to reduce sodium in food systems are propelling the growth of the potassium citrate market. With regulatory bodies advocating for reduced sodium consumption, potassium citrate stands out as a viable substitute. Being sodium-free, it can replace conventional sodium-based additives, preserving crucial functions like buffering, emulsification, and mineral fortification. This is especially vital in processed foods, where sodium salts have long been essential. Data from the Centers for Disease Control and Prevention (January 2024) highlights the issue: Americans average 3,400 milligrams of sodium daily, well above the federal recommendation of 2,300 milligrams for teens and adults. This overconsumption is linked to serious health concerns. From August 2021 to August 2023, adult hypertension in the U.S. hit 47.7%, with men at 50.8% and women at 44.6%, and rates climbing with age . The regulatory landscape is shifting, with a clear push for sodium-reduction measures in the industry, aiming for compliance by 2026. This urgency boosts the demand for potassium citrate as a reliable sodium alternative. Potassium citrate can be easily incorporated into current food formulations, sparing manufacturers from intricate adjustments. This ensures product quality and shelf stability while adhering to health standards. Heightened consumer health awareness, solid epidemiological links between sodium and cardiovascular risks, and tightening regulatory sodium limits fuel the growing adoption of potassium citrate in various food applications.

Increasing Preference for Clean-Label and Health-Focused Ingredients

Driven by evolving consumer preferences for clean-label and health-centric formulations, the food and beverage industry is undergoing a significant transformation, with notable repercussions for the potassium citrate market. While potassium citrate is industrially synthesized, it enjoys a favorable consumer perception, largely due to its association with naturally occurring citric acid. In-depth consumer studies reveal a growing inclination towards ingredients perceived as natural or those that offer pronounced nutritional advantages. This trend is particularly evident in the European natural food additives market, where regulatory frameworks are increasingly endorsing ingredients sourced from natural origins or processes . Manufacturers have adeptly repositioned potassium citrate, emphasizing its ties to traditional food preservation and its role as a potassium source, vital for cardiovascular health and electrolyte balance. Highlighting this trend, the International Food Information Council's 2023 research found that about 26% of U.S. respondents view "natural and low-sodium" as the foremost indicator of healthy food . This underscores a rising consumer demand for straightforward, natural formulations.

Stringent Regulatory Compliance in Pharmaceutical and Food Sector

Pharmaceutical applications of potassium citrate face increasingly complex regulatory requirements that extend development timelines and increase compliance costs for manufacturers. The FDA's drug master file requirements for pharmaceutical-grade potassium citrate demand extensive documentation of manufacturing processes, impurity profiles, and stability data, creating barriers for smaller suppliers seeking to enter high-value pharmaceutical markets. USP monograph requirements specify stringent purity standards exceeding 99.5% for pharmaceutical applications, necessitating sophisticated manufacturing processes and quality control systems that increase production costs. International harmonization efforts, while beneficial long term, create short-term compliance complexity as manufacturers must navigate varying requirements across major markets. The regulatory landscape becomes particularly challenging for combination products where potassium citrate interacts with other active ingredients, requiring extensive stability and compatibility testing. These compliance requirements favor established pharmaceutical suppliers with existing regulatory infrastructure while creating market entry barriers that limit competitive intensity in premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Cosmetic and Personal Care Formulations Using Chelating Agents

- Rising Popularity of Vegan and Plant-Based Supplementation Solution

- Taste Alteration in Food Limiting Wider Acceptance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, the high-purity potassium citrate segment, boasting purity levels more than 99%, commanded a dominant 42.44% market share. This trend highlights a growing appetite for ultra-refined formulations, particularly in premium pharmaceuticals and niche food applications. Stringent regulatory standards and the paramount importance of formulation precision primarily drive the surge in demand. In sectors like pharmaceuticals, where even minute impurities can jeopardize safety or therapeutic outcomes, this emphasis on purity is critical. Potassium citrate, in these settings, plays dual roles: as an active ingredient and a buffering agent, notably in renal health treatments and extended-release drugs. The segment's dominance underscores the industry's unwavering commitment to purity and stringent quality benchmarks. Meanwhile, the 98-99% purity tier finds its niche in food processing and select industrial applications, where functional performance is key, but ultra-high purity isn't a prerequisite.

Meanwhile, the segment with purity levels below 98% is witnessing the most rapid expansion, boasting a notable CAGR of 4.64%. Its growth trajectory is fueled by its attractiveness in high-volume applications that prioritize cost-effectiveness and consistent operations over absolute purity. Key drivers include its burgeoning use in animal nutrition, bulk food production, and pH regulation across diverse sectors. In response, manufacturers are pivoting, rolling out more budget-friendly potassium citrate formulations that fulfill essential functional needs, sidestepping the premium of ultra-refinement. This divergence in purity preferences paints a picture of a maturing market landscape. Potassium citrate has evolved from a generic commodity to a tailored solution, catering to varied end-user demands. Such an evolution not only sparks innovation but also enhances supply chain adaptability and competitive edge, spanning both premium and budget-conscious market segments.

The Potassium Citrate Market is Segmented by Purity (Less Than 98%, 98 - 99%, and More Than 99%), by Application (Food and Beverage, Industrial, Dietary Supplement, Personal Care and Cosmetics, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific not only emerged as the largest regional market, holding a 31.32% share, but also showcased its rapid growth, boasting a 5.44% CAGR projected through 2030. This growth is largely attributed to the region's expanding food processing infrastructure and a heightened health consciousness among its urban populace. Ongoing trade investigations and antidumping reviews underscore China's leading role in citrate production. In India, the burgeoning pharmaceutical sector fuels the demand for high-purity potassium citrate, essential for generic drug manufacturing. Simultaneously, India's expanding processed food industry presents significant volume opportunities for food-grade applications. Meanwhile, Japan and Australia are driving regional growth by focusing on premium applications in functional foods and dietary supplements, with consumers willing to pay a premium for perceived health benefits.

North America, while mature, is undergoing an evolution, largely driven by regulatory initiatives reshaping demand. The FDA's guidance on sodium reduction has spurred a consistent demand for potassium citrate as a sodium substitute. Concurrently, North America's advanced pharmaceutical sector ensures a steady appetite for high-purity grades tailored for specialized therapeutic uses. Notably, Canada's involvement in trade investigations, alongside China, underscores the region's intertwined supply chains and the resultant competitive dynamics influencing pricing and product availability. Additionally, Mexico's burgeoning food processing sector amplifies the demand, especially for health-conscious consumers seeking reduced-sodium options in traditional foods.

Europe stands at the forefront of clean-label and natural ingredient trends, with potassium citrate gaining traction as a natural substitute for synthetic additives. The EU's regulatory stance, which leans towards natural preservatives, has elevated potassium citrate's market value, especially in organic and premium food sectors. Furthermore, Europe's sophisticated cosmetic industry is increasingly turning to potassium citrate as a preferred alternative to EDTA in personal care products. With a pronounced emphasis on sustainability,

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland (ADM)

- Jungbunzlauer Suisse AG

- Gadot Biochemical Industries

- Cofco Biochemical

- Huangshi Xinghua Biochemical

- Biofuran Materials

- American Tartaric Products

- Juxian Hongde Citric Acid

- Wang Pharmaceuticals & Chemicals

- Vishal Laboratories

- DPL-US

- Weifang Ensign Industry

- Spectrum Chemical Mfg Corp.

- Adani Pharmachem Private Limited

- Merck KGaA

- Dr. Paul Lohmann

- FBC Industries

- Ava Chemicals Private Limited,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Use of Potassium Citrate as a Sodium-Free Food Additive

- 4.2.2 Increasing Preference for Clean-Label and Health-Focused Ingredients

- 4.2.3 Surge in Cosmetic and Personal Care Formulations Using Chelating Agents

- 4.2.4 Rising Popularity of Vegan and Plant-Based Supplementation Solution

- 4.2.5 Growing Awarness of Natural Preservatives in Food Safety

- 4.2.6 Amplyfing Demand from the Beverage Sector for pH Control Agents

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Compliance in Pharmaceutical and Food Sector

- 4.3.2 Taste Alteration in Food Limiting Wider Acceptance

- 4.3.3 Storage and Stability Challenges During Long-Tem Use

- 4.3.4 Consumer Skepticism Towards Chemical-Sounding Additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Purity

- 5.1.1 Less than 98%

- 5.1.2 98 - 99%

- 5.1.3 More than 99%

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.2 Industrial

- 5.2.3 Dietary Supplement

- 5.2.4 Personal Care and Cosmetics

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Singapore

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Tate & Lyle PLC

- 6.4.3 Archer Daniels Midland (ADM)

- 6.4.4 Jungbunzlauer Suisse AG

- 6.4.5 Gadot Biochemical Industries

- 6.4.6 Cofco Biochemical

- 6.4.7 Huangshi Xinghua Biochemical

- 6.4.8 Biofuran Materials

- 6.4.9 American Tartaric Products

- 6.4.10 Juxian Hongde Citric Acid

- 6.4.11 Wang Pharmaceuticals & Chemicals

- 6.4.12 Vishal Laboratories

- 6.4.13 DPL-US

- 6.4.14 Weifang Ensign Industry

- 6.4.15 Spectrum Chemical Mfg Corp.

- 6.4.16 Adani Pharmachem Private Limited

- 6.4.17 Merck KGaA

- 6.4.18 Dr. Paul Lohmann

- 6.4.19 FBC Industries

- 6.4.20 Ava Chemicals Private Limited,