|

市场调查报告书

商品编码

1836726

虾青素:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Astaxanthin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

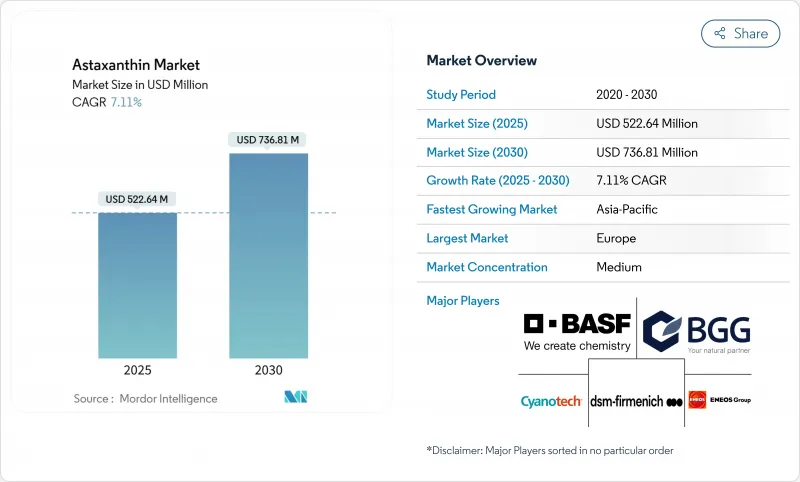

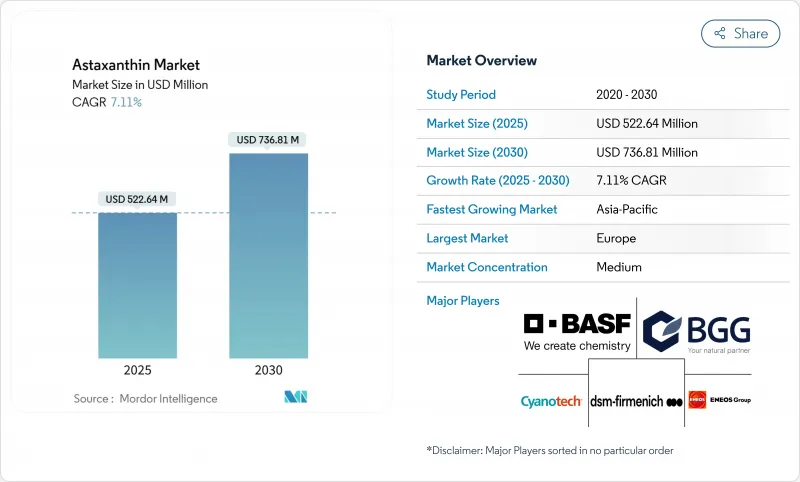

预计 2025 年虾青素市场规模为 5.2264 亿美元,到 2030 年将达到 7.3681 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.11%。

全球虾青素市场正处于强劲的成长轨迹,这得益于其抗氧化、抗发炎和认知支持特性越来越多的临床检验。随着美国、欧洲和亚洲的监管机构继续核准用于食品、补充剂和化妆品的新型虾青素,需求正在稳步扩大。天然虾青素主要来自微藻类,由于其卓越的生物利用度和清洁标籤的吸引力,正在推动新产品的推出,引起当今注重健康、精通成分的消费者的共鸣。虽然合成饲料仍然主导着对成本敏感的动物饲料领域,但技术创新正在稳步缩小成本差距。微藻类培养、人工智慧优化的光生物反应器系统和深共晶溶剂等绿色萃取技术的突破不仅降低了营运成本,也提高了永续性和扩充性。这些进步,加上消费者对天然和功能性成分的偏好变化,正在推动膳食补充剂、机能性食品和高端护肤的新收益来源。对于希望利用有前景的、有科学依据的健康成分的公司来说,虾青素提供了一个由技术创新、消费者信任和监管势头支持的引人注目的成长故事。

全球虾青素市场趋势与见解

预防保健和抗衰老趋势蓬勃发展

研究表明,经常摄取虾青素与降低氧化压力标记、改善内皮功能以及在精神疲劳评估中提高成年人的认知能力有关。市场显示消费者越来越偏好预防性保健解决方案,各公司纷纷将天然虾青素软胶囊作为综合保健产品进行行销。这一定位得益于虾青素比维生素 C 具有更出色的细胞膜穿透能力和中和单线态氧的能力。来自药局和线上零售商的销售数据表明,与传统抗氧化剂相比,消费者愿意为优质虾青素产品支付更高的价格。化妆品行业也将虾青素添加到旨在减轻光老化影响和促进胶原蛋白生成的局部产品中。不断扩大的应用基础将推动虾青素市场持续的研究投资、法规发展和消费者的广泛采用。

天然和植物来源补充剂日益流行

随着天然成分需求的不断增长,尤其是围绕α-硫辛酸补充剂日益增长的安全担忧,欧洲各地正在大力推动配方改良。虾青素萃取自雨生红球藻,是一种天然的非基因改造替代品,已在临床试验中展现出卓越的功效,与合成产品相比,其血浆浓度更高,保质期更长。据新兴国家进口促进中心 (CBI) 称,天然成分在各种健康应用中越来越受欢迎,主要用于食品补充剂、草药和替代医学治疗。这为虾红素等天然成分带来了机会。

生产成本限制了天然虾青素市场的成长

天然虾青素的生产成本仍然很高,下游加工占总生产成本的很大一部分,导致其价格高于合成替代品。从微藻类物质中提取和纯化虾青素需要复杂的製程、专用设备和受控环境。虽然技术进步正在降低生产成本,但价格差异仍然限制了天然虾青素在成本敏感应用中的应用,尤其是在动物饲料市场。儘管对天然成分的需求不断增长,合成虾红素仍保持着成本优势。市场动态对平衡生产经济效益与日益增长的消费者偏好提出了持续的挑战,尤其影响了製造商在各个终端用途领域拓展业务和保持竞争性定价策略的能力。

报告中分析的其他驱动因素和限制因素

- 藻类培养和萃取技术的进步提高了产品质量

- 消费者转向洁净标示、非基因改造成分

- 新兴市场消费者意识的局限性

細項分析

到2024年,合成虾虾青素市场将占据84.47%的市场份额,这得益于成熟的合成生产线,这些生产线能够为水产养殖加工商提供稳定的成本和着色力。几十年来,合成虾红素的生产过程基本上保持不变,为製造商提供了可靠的生产方法和标准化的产出品质。

天然萃取物领域,基于红球藻和法夫酵母的生产方法,预计到2030年将以8.74%的复合年增长率增长,这主要得益于健康和美容产品製造商寻求天然成分认证。研究表明,天然萃取物具有高抗氧化活性、增强的组织保留性和高稳定性,非常适合用于高端营养保健品和护肤品。

2024年,粉剂型虾青素市场营收占比75.55%,这得益于其与现有的胶囊、锭剂和预混合料生产线的兼容性。粉剂型的保质期为两年,即使在海运过程中的温度变化下也能保持稳定。预计到2030年,包括乳化和珠粒在内的液体型虾红素市场将以8.24%的复合年增长率增长,这得益于其冷水分散性的提高。目前,製造商生产的速溶小袋可在几秒钟内溶解在饮料中,使虾青素能够补充功能性美容饮品中的胶原蛋白和益生菌。

Soravia Algatec 开发了一种浓度为 2.5% 的冷水可分散虾青素粉末,兼具粉末稳定性和液体应用能力。该配方使饮料製造商能够将虾青素添加到其产品中,并充分利用其功能特性和临床益处。这项开发成果满足了饮料业对天然抗氧化剂日益增长的需求,并拓展了製造商的应用可能性。粉末分散性得到改善,降低了生产复杂性和添加虾青素的成本,并有望提升其在各个饮料领域的应用。

区域分析

欧洲拥有完善的法规结构,包括欧洲食品安全局(EFSA)的全面安全评估以及欧盟委员会对虾青素成分的新型食品的核准,因此,欧洲将在2024年保持市场主导,市场份额达32.94%。该地区成熟的补充剂市场和消费者对优质天然保健产品的接受度为虾青素的普及创造了有利条件,而严格的品质标准则推动了对高纯度製剂的需求。受监管发展和不断壮大的中产阶级寻求预防性医疗保健解决方案的推动,亚太地区预计将成为成长最快的地区,复合年增长率达5.55%。

亚太地区加速成长轨迹的原因是人口结构和监管趋势的融合有利于虾青素的应用。中国监管体系的现代化,包括批准微藻类油作为新型食品成分,正在消除其在机能性食品中的应用障碍,同时,中国不断壮大的中阶也对高端健康产品的需求。日本的功能性食品标籤制度简化了健康声明的佐证程序,使製造商能够更轻鬆地向消费者传达虾青素的益处,从而推动了市场的显着增长。该地区人口老化正在对认知健康和抗衰老应用产生巨大的需求,而成熟的水产养殖业为虾青素在多种应用领域的应用奠定了基础。

北美市场成熟,儘管美国食品药物管理局 (FDA)核准虾青素製剂为一般公认安全认证 (GRAS),使其得以进入市场,但现有抗氧化成分的竞争限制了其成长。该地区对临床检验的重视,有助于扩大虾青素的研究证据。儘管天然虾青素成本较高,但消费者对洁净标示和永续成分的偏好将推动其需求。南美、中东和非洲代表着新兴的市场潜力,随着人们虾青素健康益处的认识不断提高,其在补充剂和水产养殖领域的应用也逐渐增加。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 预防医学和抗衰老趋势蓬勃发展

- 天然和植物来源补充剂日益流行

- 藻类培养和萃取技术的进步提高了生产质量

- 消费者转向洁净标示和非基因改造成分

- 关注永续和环境友好的营养

- 扩大具有健康功效的功能性食品和饮料

- 市场限制

- 生产成本限制

- 新兴市场消费者意识有限

- 对食品污染的担忧日益加剧

- 严格的政府法规限制了市场成长

- 供应链分析

- 监理展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模及成长预测(金额)

- 按产地

- 自然的

- 合成

- 按形式

- 粉末

- 液体

- 按生产方式

- 微藻类培养

- 化学合成

- 发酵

- 按用途

- 饮食

- 营养补充品

- 动物饲料

- 个人护理和化妆品

- 製药

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- BASF SE

- dsm-firmenich

- Fuji Chemical Industry/AstaReal

- Cyanotech Corporation

- Beijing Gingko Group(BGG)

- Algatech Ltd.

- Algalif Iceland ehf.

- Divi's Laboratories Ltd.

- ENEOS Holdings Inc.

- Biogenic Co. Ltd.

- Otsuka Holdings Co. Ltd.

- INNOBIO Ltd.

- Yunnan Alphy Biotech Co.

- NOW Health Group Inc.

- Archer-Daniels-Midland Company

- Givaudan Active Beauty

- Kemin Industries

- Evonik Nutrition & Care

- Valensa International

- Atacama Bio(Northeastern Biotech)

第七章 市场机会与未来展望

The Astaxanthin Market size is estimated at USD 522.64 million in 2025, and is expected to reach USD 736.81 million by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

The global astaxanthin market is witnessing a powerful growth trajectory, driven by increasing clinical validation of its antioxidant, anti-inflammatory, and cognitive-support properties. As regulatory bodies across the U.S., Europe, and Asia continue approving new astaxanthin formats for use in food, supplements, and cosmetics, demand is steadily expanding. Natural astaxanthin, sourced primarily from microalgae, is gaining traction in new product launches, thanks to its superior bioavailability and clean-label appeal, which resonates well with today's health-conscious and ingredient-savvy consumers. While synthetic variants continue to dominate the cost-sensitive animal feed segment, technological innovations are steadily bridging the cost gap. Breakthroughs in microalgae cultivation, AI-optimised photobioreactor systems, and green extraction technologies like deep eutectic solvents are not only reducing operational costs but also enhancing sustainability and scalability. These advances, combined with shifting consumer preferences toward natural, functional ingredients, are opening new revenue streams across dietary supplements, functional foods, and premium skincare. For businesses looking to tap into a high-potential, science-backed wellness ingredient, astaxanthin offers a compelling growth story anchored in innovation, consumer trust, and regulatory momentum.

Global Astaxanthin Market Trends and Insights

Booming Preventive Healthcare and Anti-Aging Trends

Research demonstrates that regular astaxanthin consumption correlates with reduced oxidative-stress markers, improved endothelial function, and enhanced cognitive performance in adults during mental-fatigue assessments. The market shows increasing consumer preference for preventive health solutions, with companies marketing natural astaxanthin softgels as comprehensive wellness products. This positioning is supported by astaxanthin's superior ability to cross cell membranes and neutralize singlet oxygen compared to vitamin C. Sales data from pharmacies and online retailers indicates consumers willingly pay more for premium astaxanthin products compared to conventional antioxidants. The cosmetics industry has also incorporated astaxanthin in topical products designed to reduce photo-aging effects and enhance collagen production. This expanding application base drives continued research investment, regulatory development, and broader consumer adoption in the astaxanthin market.

Growing Popularity of Natural and Plant-Based Supplements

The growing demand for natural ingredients has driven significant reformulation efforts across Europe, particularly following heightened safety concerns surrounding alpha-lipoic acid supplements. Astaxanthin extracted from Haematococcus pluvialis offers a natural, non-GMO alternative that demonstrates superior performance, with clinical studies showing higher plasma concentration and longer retention periods compared to synthetic versions. According to the CBI (Centre for the Promotion of Imports from developing countries), natural ingredients have become increasingly prevalent in various health applications, primarily in food supplements, herbal medicinal products, and alternative medicine treatments . This translates into opportunities for natural ingredients like astaxanthin

Production Costs Limit Natural Astaxanthin Market Growth

Natural astaxanthin production costs remain high, with downstream processing representing a significant majority of total production expenses, resulting in higher prices compared to synthetic alternatives. The extraction and purification of astaxanthin from microalgae biomass requires complex processes, specialized equipment, and controlled environments. Although technological improvements are reducing production costs, the price difference continues to restrict natural astaxanthin adoption in cost-sensitive applications, especially in animal feed markets where synthetic versions maintain their cost advantage despite increasing demand for natural ingredients. The market dynamics indicate a persistent challenge in balancing production economics with growing consumer preferences, particularly affecting manufacturers' ability to scale operations and maintain competitive pricing strategies in various end-use segments.

Other drivers and restraints analyzed in the detailed report include:

- Advancement in Algae Farming and Extraction Boosting Output Quality

- Consumer Shift Towards Clean-Label, Non-GMO Ingredients

- Limited Consumer Awareness in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic astaxanthin segment held a 84.47% market share in 2024, supported by established chemical synthesis production lines that supply aquaculture processors with consistent costs and color potency. The manufacturing process has remained largely unchanged for decades, providing manufacturers with reliable production methods and standardized output quality.

The natural segment, based on Haematococcus and Phaffia production methods, is expected to grow at a CAGR of 8.74% through 2030, driven by wellness and beauty product manufacturers seeking natural ingredient certifications. Research shows that natural extracts offer higher antioxidant activity, enhanced tissue retention, and greater stability, making them suitable for premium dietary supplements and skincare products.

Powder formats accounted for 75.55% revenue share of the Astaxanthin market in 2024, driven by their compatibility with existing capsule, tablet, and premix production lines. The powder form offers a two-year shelf life and maintains stability during maritime shipping temperature variations. The liquid segment, including nano-emulsions and beadlets, is projected to grow at an 8.24% CAGR through 2030, following improvements in cold-water dispersibility. Manufacturers now produce quick-dissolving sachets that integrate into beverages within seconds, enabling astaxanthin to complement collagen and probiotics in functional beauty drinks.

Solabia-Algatech developed a 2.5% cold-water-dispersible astaxanthin powder that combines powder stability with liquid application capabilities. This formulation enables beverage manufacturers to incorporate astaxanthin into their products, leveraging its functional properties and clinical benefits. The development addresses the growing demand for natural antioxidants in the beverage industry and expands the application possibilities for manufacturers. The improved dispersibility characteristics of the powder reduce production complexities and costs associated with astaxanthin incorporation, potentially increasing its adoption across various beverage segments.

The Astaxanthin Market Report is Segmented by Nature (Natural and Synthetic), Form (Powder and Liquid), Production Method (Microalgae Cultivation, Chemical Synthesis, and Fermentation), Application (Food and Beverage, Dietary Supplement, Animal Feed, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintains market leadership with 32.94% share in 2024, supported by established regulatory frameworks including EFSA's comprehensive safety assessments and the European Commission's novel food approvals for astaxanthin-rich ingredients. The region's mature supplement market and consumer acceptance of premium natural health products create favorable conditions for astaxanthin adoption, while stringent quality standards drive demand for high-purity formulations. Asia-Pacific emerges as the fastest-growing region at 5.55% CAGR, propelled by regulatory developments and expanding middle-class populations seeking preventive healthcare solutions.

Asia-Pacific's accelerated growth trajectory stems from converging demographic and regulatory trends that favor astaxanthin adoption. China's regulatory modernization, including the approval of microalgae oil as a new food material, removes barriers to functional food applications while the country's expanding middle class seeks premium health products. Japan's Foods with Function Claims system has simplified health claim substantiation, driving significant market growth as manufacturers can more easily communicate astaxanthin's benefits to consumers. The region's aging population creates substantial demand for cognitive health and anti-aging applications, while established aquaculture industries provide a foundation for astaxanthin adoption across multiple applications.

North America represents a mature market where FDA GRAS approvals for astaxanthin formulations enable market access, though competition from established antioxidant ingredients limits growth. The region's focus on clinical validation supports astaxanthin's expanding research evidence. Consumer preferences for clean-label and sustainable ingredients drive demand for natural astaxanthin, despite higher costs. South America, Middle East, and Africa show emerging market potential, with increasing awareness of astaxanthin's health benefits driving gradual adoption in supplements and aquaculture applications.

- BASF SE

- dsm-firmenich

- Fuji Chemical Industry / AstaReal

- Cyanotech Corporation

- Beijing Gingko Group (BGG)

- Algatech Ltd.

- Algalif Iceland ehf.

- Divi's Laboratories Ltd.

- ENEOS Holdings Inc.

- Biogenic Co. Ltd.

- Otsuka Holdings Co. Ltd.

- INNOBIO Ltd.

- Yunnan Alphy Biotech Co.

- NOW Health Group Inc.

- Archer-Daniels-Midland Company

- Givaudan Active Beauty

- Kemin Industries

- Evonik Nutrition & Care

- Valensa International

- Atacama Bio (Northeastern Biotech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming in Preventive Heathcare and Ant-Aging Trends

- 4.2.2 Growing Popularity of Natural and Plant-Based Supplements

- 4.2.3 Advancement in Algae Farming and Extraction Boosting Output Quality

- 4.2.4 Consumer Shift Towards Clean-Label, Non-GMO Ingredients

- 4.2.5 Focus on Sustaniable and Eco-Friendly Nutritional Ingredients

- 4.2.6 Expansion of Functional Food and Beverage with Added Health Claims

- 4.3 Market Restraints

- 4.3.1 Production Costs Limit

- 4.3.2 Limited Consumer Awareness in Emerging Markets

- 4.3.3 Growing Concerns Over Food Adulteration

- 4.3.4 Stringent Government Regulation to Retrain the Market Growth

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Nature

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Production Method

- 5.3.1 Microalgae Cultivation

- 5.3.2 Chemical Synthesis

- 5.3.3 Fermentation

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.2 Dietary Supplement

- 5.4.3 Animal Feed

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Pharmaceuticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Spain

- 5.5.2.4 France

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 dsm-firmenich

- 6.4.3 Fuji Chemical Industry / AstaReal

- 6.4.4 Cyanotech Corporation

- 6.4.5 Beijing Gingko Group (BGG)

- 6.4.6 Algatech Ltd.

- 6.4.7 Algalif Iceland ehf.

- 6.4.8 Divi's Laboratories Ltd.

- 6.4.9 ENEOS Holdings Inc.

- 6.4.10 Biogenic Co. Ltd.

- 6.4.11 Otsuka Holdings Co. Ltd.

- 6.4.12 INNOBIO Ltd.

- 6.4.13 Yunnan Alphy Biotech Co.

- 6.4.14 NOW Health Group Inc.

- 6.4.15 Archer-Daniels-Midland Company

- 6.4.16 Givaudan Active Beauty

- 6.4.17 Kemin Industries

- 6.4.18 Evonik Nutrition & Care

- 6.4.19 Valensa International

- 6.4.20 Atacama Bio (Northeastern Biotech)