|

市场调查报告书

商品编码

1842577

高阻隔包装膜:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)High-Barrier Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

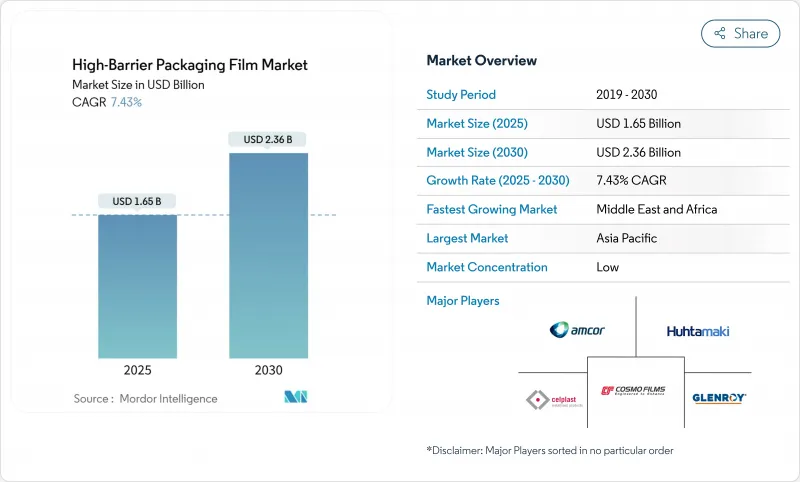

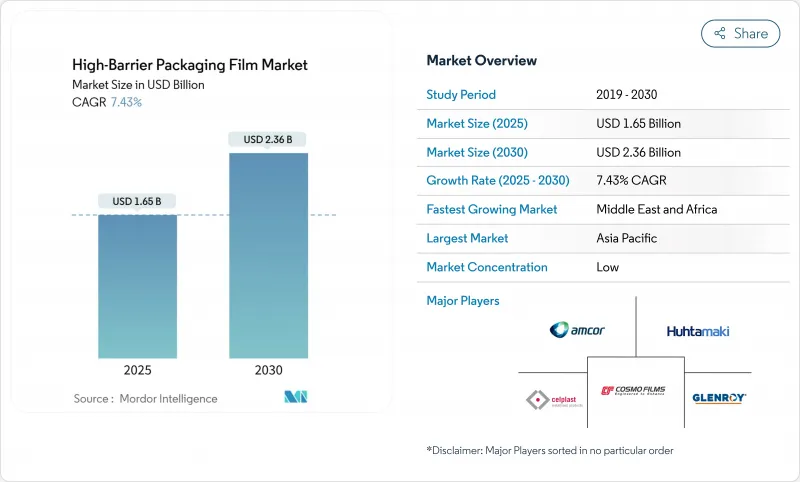

预计2025年高阻隔包装薄膜市场规模将达16.5亿美元,2030年将达23.6亿美元,复合年增长率为7.43%。

可回收单一材料薄膜的快速普及、生技药品低温运输解决方案需求的不断增长以及电子杂货的激增,都推动了这一扩张。该行业也在应对日益严格的「延伸生产者责任 (EPR)」法规,该法规将费用与可回收性挂钩,促使加工商转向机械拉伸聚乙烯 (MDO-PE) 和无溶剂有机涂料。树脂价格的波动、PVDC和EVOH等关键阻隔树脂的供应压力以及新拉伸生产线的资本密集度,正在形成一场成本转嫁竞争,使能够对冲原材料波动的综合製造商受益。

亚太地区是阻隔性包装薄膜市场的主导力量,预计到2024年将占市场总收入的42.67%。受药品灌装产能扩张和低温运输扩张的推动,中东和非洲地区正以9.78%的复合年增长率加速成长。袋装和小袋仍然是主要包装形式,占35.45%的市场。同时,由于高端生鲜食品零售商对更长保质期的需求,真空密着包装的复合年增长率达到9.84%。依材料划分,聚乙烯以32.54%的市占率领先市场,但生物聚合物儘管价格溢价40-60%,仍以10.48%的复合年增长率成长。金属化薄膜将维持41.72%的市场份额,而透明有机涂层结构则以8.66%的市占率新兴市场。

全球高阻隔包装薄膜市场趋势与洞察

生技药品和低温运输物流领域的药用泡壳热潮

全球生技药品疗法要求氧气透过率不超过 0.1 cc/m²/天,且温度稳定性在 -20 度C至 +25 度C之间,这促使加工商指定使用含有 EVOH 和新型涂层的多层薄膜,以满足这些严格的阈值。 DS Smith 的 TailorTemp Fiberpack 可保持 36 小时的冷藏状态,标誌着其向监管机构和医院可接受的可回收形式的转变。每剂价格超过 10,000 美元的肿瘤药物可以承受包装成本,使供应商能够获得利润来抵消高性能树脂的价格。美国和德国对区域冷藏仓库的投资也推动了对具有热稳定性和抗穿刺性且可与干冰运输相容的薄膜的需求。

电子杂货销售的快速成长推动了对包装袋和薄膜的需求

线上零售商在配送前会处理每份食品订购三到五次,因此抗穿刺和完美密封至关重要。为此,加工商正在加厚密封层,并添加高密度树脂,以便在更宽的温度范围内保持柔韧性。越南的包装产业的目标是到2026年达到35亿美元,这反映了电商经济如何直接朝向轻量化柔性包装模式迈进。酱料、调味品和婴儿食品采用大型立式袋包装,在最后一英里的运输过程中破损率比玻璃瓶包装低12%,这为跨国食品製造商在2025年宣布的品牌转型奠定了基础。

PE/PP树脂价格不稳定

2025年初,北美聚丙烯价格上涨了4至5美分/磅,因为炼油厂停产导致聚合级丙烯供应紧张,挤压了加工商的利润。亚洲薄膜製造商也面临来自中国2024年计划出口260万吨聚丙烯的竞争,这导致价格波动,并阻碍了长期供应协议的达成。规模较小的加工商成本转嫁速度较慢,导致一些企业缩减高阻隔包装薄膜的生产,直到对冲工具变得更经济实惠。

細項分析

到2024年,包装袋和小袋将占销售额的35.45%,到2030年,复合年增长率将达到9.84%。真空密着包装反映了高端肉类和水产品品牌在冷藏供应链中寻求13天或更短保质期的需求。高阻隔包装膜市场的这一部分也受益于产品良好的曝光度,从而提升了电商通路的购物车价值。立式袋将继续取代用于酱料和婴儿食品的玻璃瓶。食材自煮包供应商青睐带有可剥离选项的托盘盖膜,方便微波炉加热,这支撑了市场的温和增长。

真空密着包装需要更深的成型和更强的抗穿刺性,这促使薄膜製造商添加线型低密度聚乙烯密封网或 EVOH 黏结层。这些包装通常可以在第 8 天的气调包装中保留 97% 的氧气,从而延长保质期并减少食物浪费。主要基于 PET 或 PP 的热成型薄膜仍然是药品泡壳包装必不可少的材料,但随着单一材料 PE 替代品通过监管审核,其增长速度已经放缓。小袋和流动包装在东南亚面临消费者的强烈抵制,尤其是在印尼,该国到 2029 年将小袋浪费减少 30% 的目标迫使加工商改用可回收替代品。儘管面临监管阻力,泡壳基底膜在高价值药片市场仍占有一席之地,因为这类药片需要接近零的水分渗入。

聚乙烯凭藉其广泛的加工相容性,保持了32.54%的市场份额,但价格波动导緻密封层共混物每季进行调整,以保护利润率。聚乳酸(PLA)和聚羟基酸(PHA)等生物聚合物的市占率仅为个位数,但受零售商大力推广可堆肥包装的推动,其复合年增长率达10.48%。生物聚合物高阻隔包装薄膜的市场规模仍有限,但随着各大糖果甜点品牌在欧洲各地推出包装生产线,年需求量增加至12,000吨,其市场规模已变得举足轻重。

聚丙烯紧随其后,主要用于热填充应用和透明度,但双向拉伸聚酯 (BOPET) 因其尺寸稳定性仍然很重要。 EVOH 的氧气阻隔性低于 0.1 cc/m²/天,即使在原料短缺时期也能确保其高价格分布。 PVDC 虽然受到严格审查,但仍是咖啡和调味品包装袋的主要材料。由于永续性宣传,铝箔在柔性层压板中的使用正在减少,但它在已调理食品的杀菌袋仍然占主导地位,因为在 121°C 的灭菌循环中,铝箔的性能至关重要。基于微纤化纤维素和几丁聚醣的有机涂层正日益受到关注,因为它们可以减轻整体重量,同时增加不到 1µm 的沉积物,并且可以轻鬆整合到现有的凹版涂布生产线中。

区域分析

2024年,亚太地区将占据全球塑胶包装销售额的42.67%,这得益于中阶消费的不断增长,以及从硬罐到软包装袋的转变,从而降低了物流成本。中国政府计划在2024年出口260万吨聚丙烯,这降低了树脂价格,使该地区的加工商能够在出口竞标中积极竞标,但也使其面临价格波动的风险。日本将于2025年6月生效的食品接触材料正面表列要求薄膜供应商对21种聚合物类别和827种添加剂进行认证,这将延长新结构的上市时间。东南亚的包装袋困境正引发填充用袋的创新,以配合印尼到2029年减少30%的废弃物目标。

中东和非洲地区预计将以9.78%的复合年增长率扩张,这得益于对医药泡壳产能扩张的投资,以及连接海湾国家与北非和东非的冷藏运输走廊的建设。各国政府正在利用医疗保健预算推出疫苗工厂,生产多层低温运输袋,从而推动了对富含EVOH结构的需求。沙乌地阿拉伯的能源补贴正在降低乙烯成本,为该地区的综合製造商提供了足够的利润空间,以支持下游阻隔膜的投资。

北美市场日趋成熟,但受益于依赖多层包装袋的填充生技药品和高端宠物食品形式的扩张。加州和奥勒冈州的《生产者责任延伸法》根据可回收性指数征收费用,引导零售商转向单一材料解决方案。加拿大对一次性塑胶的禁令正在加速从热成型泡壳式包装袋转向可重复密封聚乙烯包装袋的转变。墨西哥正利用《美墨加协定》(USMCA)吸引共挤投资,并将自己定位为近岸外包中心。

欧洲在循环经济指令方面仍处于领先地位。高达每公斤0.80欧元的EPR税率正在推动单一材料双向拉伸聚乙烯(BOPE)和阻隔涂层纸的采用。安姆科(Amcor)的AmFiber纸因其高阻隔性可回收性而获得欧盟专利,推动了铝箔的替代方案。东欧较低的营运成本正在鼓励西方品牌商进行批量生产,而寒冷的冬季考验着薄膜的韧性,推动了高抗冲树脂的采用。

受加工食品和农产品出口的推动,南美洲经济稳定成长。阿根廷和巴西由于汇率波动,在进口树脂的平价定价方面面临挑战,并经常用更便宜的混合物取代隔离层。该地区的回收商缺乏处理金属化废弃物的能力,但巴西一家新的化学回收工厂预计将在2027年前实现这一目标。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 生技药品和低温运输物流领域的药用泡壳热潮

- 电子杂货销售的快速成长推动了对包装袋和薄膜的需求

- 亚太地区从硬质袋转向轻质立式袋

- 高蛋白宠物食品形式依赖阻隔袋

- 采用 MDO-PE/BOPE 实现可回收(新)

- 利用近红外线可检测奈米涂层降低 EPR 成本(新)

- 市场限制

- PE/PP树脂价格不稳定

- 多层薄膜塑胶废弃物法规

- SiOx/AlOx BOPE 回收限制(新)

- 2027年起PVDC和EVOH供不应求(新)

- 供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按包装产品

- 袋子和小袋

- 自立袋

- 托盘盖膜

- 热成型薄膜

- 拉伸收缩包装

- 泡壳基膜

- 流动包装和包装袋

- 真空密着包装

- 按材质

- 聚乙烯(LDPE、HDPE、MDO-PE)

- 聚丙烯(BOPP、CPP)

- 双轴取向聚对苯二甲酸乙二醇酯(BOPET)

- 乙烯 - 乙烯醇共聚物(EVOH)

- 聚酰胺

- 铝箔

- 聚偏二氯乙烯(PVDC)

- 生物聚合物(PLA、PHA)

- 其他材料

- 按最终用户产业

- 食品和宠物食品

- 肉类和海鲜

- 乳製品和乳酪

- 零食和糖果甜点

- 饮料

- 药品和医疗用品

- 个人护理和化妆品

- 电子产品

- 农业和化学

- 食品和宠物食品

- 按屏障类型

- 金属化薄膜

- 透明高阻隔薄膜

- 有机涂膜

- 无机氧化物薄膜

- 依技术

- 多层共挤(7层以上)

- 高层(少于7层)共挤

- 单层阻隔膜

- 其他技术

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- ASEAN

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 肯亚

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Amcor plc

- Mondi Group plc

- Sealed Air Corp.

- Huhtamaki Oyj

- Taghleef Industries

- Toppan Printing Co. Ltd.

- Cosmo Films Ltd.

- Polyplex Corp. Ltd.

- Uflex Ltd.

- Glenroy Inc.

- Winpak Ltd.

- Jindal Films

- Bemis(now Amcor)

- Toray Advanced Film

- Mitsubishi Chemical Group

- Dow Inc.

- SABIC

- BASF SE

- Kuraray Co. Ltd.

- ExxonMobil Chemical

第七章 市场机会与未来展望

The high barrier packaging films market size was valued at USD 1.65 billion in 2025 and is forecast to reach USD 2.36 billion by 2030, reflecting a 7.43% CAGR.

Rapid adoption of recyclable mono-material films, stronger demand for biologics cold-chain solutions, and surging e-grocery volumes underpin this expansion. The industry is also reacting to tougher Extended Producer Responsibility (EPR) rules that tie fees to recyclability, prompting converters to pivot toward machine-direction-oriented polyethylene (MDO-PE) and solvent-free organic coatings. Resin price volatility, supply pressure for key barrier resins such as PVDC and EVOH, and the capital intensity of new orientation lines are creating a cost pass-through race that rewards integrated players able to hedge raw-material swings.

Asia-Pacific anchors the high barrier packaging films market with 42.67% of 2024 revenue, propelled by regional migration from rigid containers to stand-up pouches. The Middle East and Africa is on a faster trajectory at 9.78% CAGR on the back of new pharmaceutical filling capacity and a widening cold-chain footprint. Bags and pouches remain the workhorse format, taking 35.45% share, while vacuum skin packs enjoy 9.84% CAGR because retailers of premium fresh foods demand longer shelf life. Polyethylene leads the material mix at 32.54%, yet biopolymers, despite a 40-60% price premium, are expanding at 10.48% as brand owners try to pre-empt stricter plastic-waste laws. Metallized films keep a 41.72% hold, although transparent organic-coated structures are gaining ground at 8.66% as pack designers look to decouple barrier performance from aluminum usage.

Global High-Barrier Packaging Film Market Trends and Insights

Pharma blister Boom in Biologics and Cold-chain Logistics

Global biologics therapies require oxygen transmission rates below 0.1 cc/m2/day and temperature stability from -20 °C to +25 °C, pushing converters to specify multilayer films containing EVOH and novel coatings that meet these strict thresholds. DS Smith's TailorTemp fiber pack keeps chilled conditions for 36 hours, illustrating a switch to recyclable formats acceptable to regulators and hospitals. Oncology drugs valued at more than USD 10,000 per dose tolerate packaging cost premiums, allowing suppliers to command margins that offset higher-performance resin prices. Investment in regional cold warehouses in the United States and Germany is also lifting demand for heat-stable, puncture-resistant films compatible with dry-ice shipping.

E-grocery Surge Driving Pouch and Film Demand

Online retailers handle each grocery order three to five times before delivery, making puncture resistance and flawless seals mandatory. Converters respond by thickening sealing layers and adding higher-density tie resins that retain flexibility over a wider temperature range. Vietnam's packaging sector, racing toward USD 3.5 billion by 2026, exemplifies how e-commerce economies jump directly to lightweight flexible formats. Sauces, condiments, and baby food moving into large stand-up pouches show 12% fewer breakages than glass jars during last-mile transit, underpinning brand conversions announced by multinational food manufacturers in 2025.

Volatile PE/PP Resin Prices

North American polypropylene rose 4-5 cents per pound in early 2025 after refinery shutdowns tightened polymer-grade propylene supply, squeezing converters' margins. Asian film makers also face competition from China's planned 2.6 million-tonne PP export push in 2024, creating a price whipsaw and deterring long-term supply contracts. Smaller converters pass through costs more slowly, prompting some to scale back high barrier packaging films production until hedging tools become affordable.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Rigid to Lightweight Stand-up Pouches in Asia-Pacific

- Mono-material MDO-PE/BOPE Adoption for Recyclability

- PVDC and EVOH Supply Crunch Post-2027

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment led by bags and pouches banked 35.45% of 2024 revenue, while vacuum skin packs are projected to record a 9.84% CAGR through 2030, reflecting premium fresh meat and seafood brands' need for up to 13-day shelf life in chilled supply chains. This portion of the high barrier packaging films market also benefits from attractive product visibility that drives higher cart values in e-grocery channels. Stand-up pouches continue to replace glass jars in sauces and infant food, aided by shipping-cost savings that run to USD 100 per pallet. Meal kit suppliers favor tray lidding films with peelable options compatible with microwave reheating, supporting moderate growth.

Vacuum skin packs require deeper forming and stronger puncture resistance, prompting film formulators to add linear low-density polyethylene seal webs and EVOH tie layers. Such packs often preserve 97% of modified-atmosphere oxygen at day eight, extending the sell-by date and shrinking food waste. Thermoforming films, mostly PET or PP-based, remain essential for blister packs in pharma, but growth lags as mono-material PE replacements pass regulatory audits. Sachets and flow wraps face consumer backlash in Southeast Asia, notably Indonesia's 30% reduction target for sachet waste by 2029, pushing converters toward recyclable alternatives. Blister base films, despite regulatory headwinds, preserve share for high-value tablets that demand near-zero moisture ingress; converters hedge risk by offering bio-based PET versions.

Polyethylene retains the lion's share at 32.54%, anchored by broad processing compatibility, although price volatility triggers quarterly reforms in sealing-layer blends to protect margin. Biopolymers such as PLA and PHA, while accounting for a single-digit slice, are clocking a brisk 10.48% CAGR, buoyed by retailer commitments to compost-ready packaging. The high barrier packaging films market size for biopolymers is still limited, but becomes meaningful when a large confectionery brand rolls out pouch lines across Europe, scaling annual demand to 12,000 tons.

Polypropylene follows as the solution for hot-fill applications and transparency, whereas BOPET retains importance for dimensional stability. EVOH's sub-0.1 cc/m2/day oxygen barrier secures its premium price point even during raw-material shortfalls because no drop-in substitute matches performance at similar thickness. PVDC, though under scrutiny, remains the workhorse in coffee and seasoning sachets. Aluminum foil use recedes in flexible laminates due to sustainability claims, yet still prevails in retort pouches for ready-to-eat meals where 121 °C sterilization cycles demand metal performance. Organic coatings based on micro-fibrillated cellulose or chitosan draw interest because they add less than 1 µm of deposit yet cut overall weight, integrating well within existing gravure-coated production lines.

The High Barrier Packaging Films Market Report is Segmented by Packaging Product (Bags and Pouches, Stand-Up Pouches, and More), Material (Polyethylene, Polypropylene, and More), End-User Industry (Food and Pet Food, Beverages, and More), Barrier Type (Metallized Films, and More), Technology (Multilayer Co-Extrusion Layers), High-Layer Co-Extrusion, and More) and Geography (North America, Asia-Pacific, and More).

Geography Analysis

Asia-Pacific retained 42.67% of 2024 revenue, sustained by rising middle-class consumption and a shift from rigid jars to flexible pouches that pare logistics costs. The Chinese government's push to export 2.6 million tons of polypropylene in 2024 dampened resin prices, allowing regional converters to quote aggressive bids in export tenders yet exposing them to price whiplash. Japan's positive list for food contact materials, effective June 2025, obliges film suppliers to qualify 21 polymer classes and 827 additives, lengthening time-to-market for new structures. Southeast Asia's sachet dilemma sparks innovation in refillable pouches, aligning with Indonesia's 30% waste-cut target by 2029.

Middle East and Africa expands at 9.78% CAGR, fueled by investment in pharmaceutical blister capacity and improved refrigerated transport corridors linking the Gulf to North and East Africa. Governments funnel health budgets into local vaccine plant start-ups that specify multilayer cold-chain pouches, propelling demand for EVOH-rich structures. Energy subsidies in Saudi Arabia reduce ethylene costs, giving regional integrated producers margin to support downstream barrier film investments.

North America, though mature, gains from biologics fill-finish expansions and premium pet food formats that rely on multi-layer pouches. EPR laws in California and Oregon levy fees by recyclability index, steering retailers toward mono-material solutions. Canada's single-use plastics ban accelerates moves from thermoform clamshells to resealable PE pouches. Mexico leverages USMCA to attract co-extrusion investments, positioning itself as a near-shoring hub.

Europe remains a bellwether for circular economy mandates. EPR charges of up to EUR 0.80 per kilogram drive adoption of mono-material BOPE and barrier-coated papers. Amcor's AmFiber paper received an EU patent for high barrier recyclable performance, validating movement away from foil amcor.com. Eastern Europe's lower operating costs entice western brand owners to shift volume, yet cold winters test film toughness, spurring higher-impact resins.

South America records stable growth, hinged on processed foods and agricultural exports. Argentina and Brazil see currency swings that challenge import resin parity pricing, causing periodic substitution of barrier layers with cheaper blends. Regional recyclers lack capacity for metallized scrap, but new chemical recycling plants in Brazil promise to close loops by 2027.

- Amcor plc

- Mondi Group plc

- Sealed Air Corp.

- Huhtamaki Oyj

- Taghleef Industries

- Toppan Printing Co. Ltd.

- Cosmo Films Ltd.

- Polyplex Corp. Ltd.

- Uflex Ltd.

- Glenroy Inc.

- Winpak Ltd.

- Jindal Films

- Bemis (now Amcor)

- Toray Advanced Film

- Mitsubishi Chemical Group

- Dow Inc.

- SABIC

- BASF SE

- Kuraray Co. Ltd.

- ExxonMobil Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pharma blister boom in biologics and cold-chain logistics

- 4.2.2 E-grocery surge driving pouch and film demand

- 4.2.3 Shift from rigid to lightweight stand-up pouches in APAC

- 4.2.4 High-protein pet-food formats relying on barrier pouches

- 4.2.5 Mono-material MDO-PE/BOPE adoption for recyclability (new)

- 4.2.6 NIR-detectable nano-coatings reducing EPR fees (new)

- 4.3 Market Restraints

- 4.3.1 Volatile PE/PP resin prices

- 4.3.2 Plastic-waste regulations vs multilayer films

- 4.3.3 Limited recycling for SiOx/AlOx BOPE (new)

- 4.3.4 PVDC and EVOH supply crunch post-2027 (new)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Product

- 5.1.1 Bags and Pouches

- 5.1.2 Stand-up Pouches

- 5.1.3 Tray-Lidding Films

- 5.1.4 Thermoforming Films

- 5.1.5 Stretch and Shrink Wrap

- 5.1.6 Blister Base Film

- 5.1.7 Flow-wrap and Sachets

- 5.1.8 Vacuum Skin Packs

- 5.2 By Material

- 5.2.1 Polyethylene (LDPE, HDPE, MDO-PE)

- 5.2.2 Polypropylene (BOPP, CPP)

- 5.2.3 Biaxially Oriented Polyethylene Terephthalate (BOPET)

- 5.2.4 Ethylene Vinyl Alcohol Copolymer (EVOH)

- 5.2.5 Polyamide

- 5.2.6 Aluminium Foil

- 5.2.7 Polyvinylidene Chloride (PVDC)

- 5.2.8 Biopolymers (PLA, PHA)

- 5.2.9 Other Material

- 5.3 By End-user Industry

- 5.3.1 Food and Pet Food

- 5.3.1.1 Meat and Seafood

- 5.3.1.2 Dairy and Cheese

- 5.3.1.3 Snacks and Confectionery

- 5.3.2 Beverages

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Electronics

- 5.3.6 Agriculture and Chemicals

- 5.3.1 Food and Pet Food

- 5.4 By Barrier Type

- 5.4.1 Metallized Films

- 5.4.2 Clear High-Barrier Films

- 5.4.3 Organic-coated Films

- 5.4.4 Inorganic Oxide Films

- 5.5 By Technology

- 5.5.1 Multilayer Co-extrusion (?7 layers)

- 5.5.2 High-layer (>7) Co-extrusion

- 5.5.3 Mono-material Barrier Films

- 5.5.4 Other Technology

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 ASEAN

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Kenya

- 5.6.4.2.3 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi Group plc

- 6.4.3 Sealed Air Corp.

- 6.4.4 Huhtamaki Oyj

- 6.4.5 Taghleef Industries

- 6.4.6 Toppan Printing Co. Ltd.

- 6.4.7 Cosmo Films Ltd.

- 6.4.8 Polyplex Corp. Ltd.

- 6.4.9 Uflex Ltd.

- 6.4.10 Glenroy Inc.

- 6.4.11 Winpak Ltd.

- 6.4.12 Jindal Films

- 6.4.13 Bemis (now Amcor)

- 6.4.14 Toray Advanced Film

- 6.4.15 Mitsubishi Chemical Group

- 6.4.16 Dow Inc.

- 6.4.17 SABIC

- 6.4.18 BASF SE

- 6.4.19 Kuraray Co. Ltd.

- 6.4.20 ExxonMobil Chemical

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment