|

市场调查报告书

商品编码

1844448

北美能源管理系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

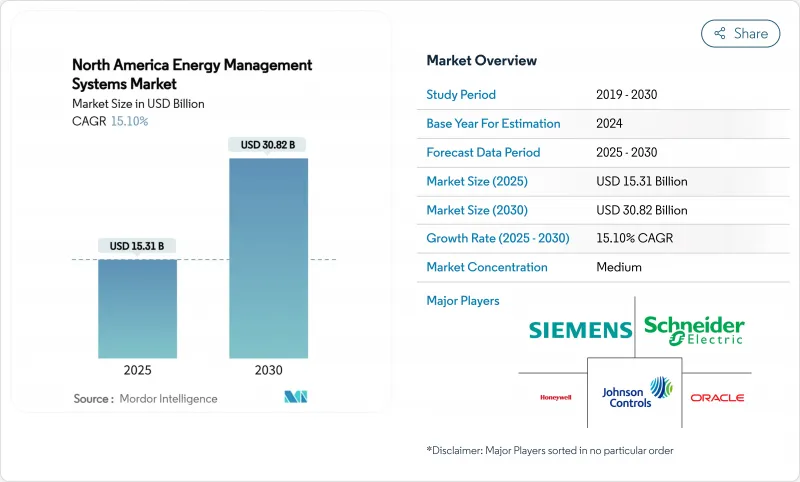

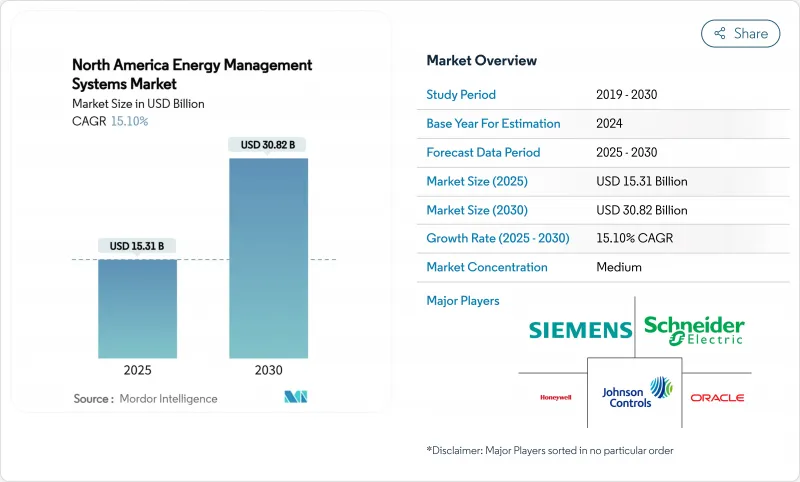

预计到 2025 年北美能源管理系统市场规模将达到 153.1 亿美元,到 2030 年将达到 308.2 亿美元,复合年增长率高达 15.10%。

短短五年内,市场规模翻了一番,凸显了该地区正快速转向智慧化、软体定义基础设施,以减少排放并优化电力使用。联邦奖励、企业净零排放要求以及人工智慧优化工具的快速发展是推动这一成长的关键因素。美国的主导地位、云端运算转型以及无线连接都透过缩短投资回收期来加速能源的采用。同时,中型企业和公共机构正在透过基于绩效的合约将风险转移给服务提供者,从而实现新的成本节约。不断增长的资料中心负载、更严格的建筑规范以及动态的公用事业费率正在进一步拓宽北美能源管理系统市场。

北美能源管理系统市场趋势与洞察

美国《通货膨胀削减法案》下的维修奖励

根据3,700亿美元的《通膨削减法案》,慷慨的税额扣抵和退税将缩短维修的投资回收期,并刺激网路控制和分析平台的即时采购。商业建筑现在可以为符合条件的升级项目每平方英尺抵扣高达5美元,加州等州已拨出2.91亿美元,为全屋建筑提供退税,目标是节省20%至35%的开支。国内生产抵免额度鼓励本地EMS硬体生产,并简化供应链。例如,江森自控报告称,透过利用联邦和州奖励措施的绩效合同,已为客户节省了84亿美元。

智慧电网部署和AMI的传播

公共产业美国能源局,到2030年,VPP的装置容量将达到80至160吉瓦。边缘分析可将反应时间缩短高达92%,在保持居住者舒适度的同时实现灵活性的收益。墨西哥230亿美元的电网规划正在推动对相容解决方案的跨境需求。

初期投资及维运成本高

承包系统(不含维护费)成本可能超过5万美元,生命週期成本通常是初始投资的五倍。当地方奖励有限时,购屋者会感到更大的压力。能源即服务合约可以降低风险:科布县710万美元的合约保证在20年内节省200万美元的公用事业成本。儘管如此,半导体短缺和对清洁晶片製造的资本需求将在短期内推高硬体价格。

細項分析

2024年,建筑能源管理系统将占据北美能源管理系统市场62%的主导地位。然而,受智慧音箱普及、公用事业补贴以及互通性标准日趋成熟的推动,家庭能源管理系统正在迅速扩张。到2030年,该细分市场的复合年增长率将达到17.23%,成为北美能源管理系统市场中最具颠覆性的市场。

根据参考资料,当机器学习演算法协调暖通空调 (HVAC) 和家电调度时,HEMS 部署可将住宅消费量降低 20% 以上。 Matter通讯协定的采用简化了设备配对,并使其成为主流。工业 EMS 占据了两者之间的利基市场,为重工业客户提供特定流程的分析和合规性仪表板。这些动态使北美能源管理系统市场保持多元化和韧性。

到2024年,服务将占据43%的市场份额,到2030年将以17.02%的最高复合年增长率增长,这标誌着从一次性硬体合约到持续优化合约的决定性转变。经常性收益来源包括监控、分析和成本节省保证合同,这些合约将效能风险转移给提供者。虽然硬体必不可少,但正日益商品化,但云端软体层透过预测控制创造价值。

服务主导合约通常包含融资、性能再检验和营运商培训,从而建立了一条通往能源即服务的整合路径。透过数据主导的评估,Limback Holdings 在每个站点发现了数百条可操作的洞察,证明了分析技能胜过单纯的设备专业知识。此类发展正在帮助北美能源管理系统市场在资本预算紧缩的情况下保持成长动能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电费上涨和永续性的承诺

- 严格的能源效率法规和建筑规范

- 智慧电网部署和AMI的传播

- 美国《通货膨胀削减法案》下的维修奖励

- 企业虚拟电厂 (VPP) 与净零筹资策略

- 动态即时电价

- 市场限制

- 前期成本和维运成本高

- 资料安全和隐私问题

- 缺乏整合商技能

- 碎片化的遗留通讯协定和互通性差距

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章市场规模及成长预测

- 按 EMS 类型

- 建筑能源管理系统(BEMS)

- 家庭能源管理系统(HEMS)

- 工业能源管理系统(IEMS)

- 按组件

- 硬体

- 软体

- 按服务

- 依部署类型

- 本地部署

- 云端基础

- 边缘/混合

- 按最终用户部门

- 商业

- 工业和製造业

- 住房

- 医疗机构

- 教育设施

- 公共产业和能源供应商

- 透过通讯技术

- 有线(BACnet、Modbus 等)

- 无线(Zigbee、Wi-Fi、蓝牙、Z-Wave)

- 按国家

- 美国

- 加拿大

- 墨西哥

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Johnson Controls International plc

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Oracle Corporation

- Panasonic Holdings Corporation

- Uplight Inc.

- Enel X North America

- ABB Ltd.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- Cisco Systems Inc.

- Honeywell Building Technologies

- Schneider EcoStruxure

- Itron Inc.

- GridPoint Inc.

- Trane Technologies plc

- Schneider EcoStruxure(division)

第七章 市场机会与未来展望

The North America energy management systems market size stood at USD 15.31 billion in 2025 and is projected to reach USD 30.82 billion by 2030, registering a firm 15.10% CAGR.

The doubling of value in just five years underlines the region's swift shift toward intelligent, software-defined infrastructure that cuts emissions and optimizes power use. Federal incentives, corporate net-zero mandates, and rapid advances in AI-enabled optimization tools are the primary forces behind this rise. US dominance, the cloud pivot, and wireless connectivity all accelerate adoption by shrinking payback periods. At the same time, mid-sized enterprises and public institutions unlock fresh savings through performance-based contracts that transfer risk to service providers. Rising data-center loads, strengthened building codes, and dynamic utility tariffs further widen the addressable pool for the North America energy management systems market.

North America Energy Management Systems Market Trends and Insights

US Inflation Reduction Act Retrofit Incentives

Generous tax credits and rebates under the USD 370 billion Inflation Reduction Act cut retrofit payback periods and spur immediate procurement of networked controls and analytics platforms. Commercial buildings can now deduct up to USD 5.00 per square foot of qualifying upgrades, while states such as California have secured USD 291 million to deliver whole-home rebates that target 20-35% savings. Domestic production credits encourage local EMS hardware output and cushion supply chains. As evidence, Johnson Controls reports USD 8.4 billion in customer savings created by performance contracts that ride on federal and state incentive stacks.

Smart-Grid Roll-outs and AMI Penetration

Utilities invested USD 320 billion in grid upgrades during 2023, including USD 50.9 billion for distribution assets that host advanced metering infrastructure. AMI data feeds granular load curves into AI engines embedded in modern platforms and enables virtual power plant (VPP) participation. The US Department of Energy projects 80-160 GW of VPP capacity by 2030. Edge analytics shrinks response times by up to 92%, letting buildings monetize flexibility while preserving occupant comfort. Mexico's USD 23 billion grid program adds cross-border demand for compatible solutions.

High Upfront and O&M Costs

Turnkey systems for mid-sized offices can surpass USD 50,000 before maintenance fees, and life-cycle costs often climb to five times the initial outlay. Residential buyers feel the pinch even more sharply when local incentives are limited. Energy-as-a-service contracts mitigate risk: Cobb County's USD 7.1 million deal guarantees USD 2 million utility savings over 20 years. Still, semiconductor shortages and the capital demands of cleaner chip fabrication inflate hardware prices in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Corporate VPP and Net-Zero Procurement Strategies

- Dynamic Real-Time Utility Tariffs

- Data-Security and Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Energy Management Systems retained a commanding 62% share of the North America energy management systems market in 2024, anchored by large commercial portfolios that prize operational transparency and tenant comfort. Yet Home Energy Management Systems are scaling swiftly on the back of smart-speaker ubiquity, utility rebates, and maturing interoperability standards. The segment's 17.23% CAGR through 2030 makes it the most disruptive pocket of the North America energy management systems market.

Annual data show HEMS installations reducing household consumption by more than 20% once machine-learning algorithms adjust HVAC and appliance schedules. Matter protocol adoption simplifies device pairing and propels mainstream appeal. Industrial EMS offerings occupy a middle niche, providing process-specific analytics and compliance dashboards for heavy manufacturing clients. Collectively, these dynamics keep the North America energy management systems market diversified and resilient.

Services captured 43% share in 2024 and delivered the highest 17.02% CAGR to 2030, underscoring a decisive tilt away from one-off hardware deals toward continuous optimization agreements. Recurring revenue streams cover monitoring, analytics, and guaranteed-savings contracts that shift performance risk to providers. Hardware is indispensable but increasingly commoditized, while cloud software layers create value through predictive controls.

Service-led engagements often bundle financing, retro-commissioning, and operator training, forming an integrated pathway to energy-as-a-service delivery. Limbach Holdings uses data-driven reviews to uncover hundreds of actionable insights per site, illustrating how analytics skills eclipse pure equipment know-how. These developments sustain the North America energy management systems market momentum even when capital budgets tighten.

The North America Energy Management Systems Market Report is Segmented by EMS Type (Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and More), Component (Hardware, Software, and Services), Deployment Mode (On-Premise, Cloud-Based, and More), End-User Sector (Commercial, Residential, and More), Communication Technology (Wired and Wireless), and Geography.

List of Companies Covered in this Report:

- Johnson Controls International plc

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Oracle Corporation

- Panasonic Holdings Corporation

- Uplight Inc.

- Enel X North America

- ABB Ltd.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- Cisco Systems Inc.

- Honeywell Building Technologies

- Schneider EcoStruxure

- Itron Inc.

- GridPoint Inc.

- Trane Technologies plc

- Schneider EcoStruxure (division)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing electricity prices and sustainability commitments

- 4.2.2 Stringent energy-efficiency regulations and building codes

- 4.2.3 Smart-grid roll-outs and AMI penetration

- 4.2.4 US Inflation Reduction Act retrofit incentives

- 4.2.5 Corporate VPP and net-zero procurement strategies

- 4.2.6 Dynamic real-time utility tariffs

- 4.3 Market Restraints

- 4.3.1 High upfront and OandM costs

- 4.3.2 Data-security and privacy concerns

- 4.3.3 Integrator skill-set shortage

- 4.3.4 Fragmented legacy protocols and interoperability gaps

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By EMS Type

- 5.1.1 Building Energy Management Systems (BEMS)

- 5.1.2 Home Energy Management Systems (HEMS)

- 5.1.3 Industrial Energy Management Systems (IEMS)

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud-based

- 5.3.3 Edge / Hybrid

- 5.4 By End-User Sector

- 5.4.1 Commercial

- 5.4.2 Industrial and Manufacturing

- 5.4.3 Residential

- 5.4.4 Healthcare Facilities

- 5.4.5 Education Campuses

- 5.4.6 Utilities and Energy Providers

- 5.5 By Communication Technology

- 5.5.1 Wired (BACnet, Modbus, etc.)

- 5.5.2 Wireless (Zigbee, Wi-Fi, Bluetooth, Z-Wave)

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Johnson Controls International plc

- 6.4.2 Honeywell International Inc.

- 6.4.3 Siemens AG

- 6.4.4 Schneider Electric SE

- 6.4.5 General Electric Company

- 6.4.6 Oracle Corporation

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Uplight Inc.

- 6.4.9 Enel X North America

- 6.4.10 ABB Ltd.

- 6.4.11 IBM Corporation

- 6.4.12 Eaton Corporation plc

- 6.4.13 Rockwell Automation Inc.

- 6.4.14 Cisco Systems Inc.

- 6.4.15 Honeywell Building Technologies

- 6.4.16 Schneider EcoStruxure

- 6.4.17 Itron Inc.

- 6.4.18 GridPoint Inc.

- 6.4.19 Trane Technologies plc

- 6.4.20 Schneider EcoStruxure (division)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment