|

市场调查报告书

商品编码

1849960

欧洲能源管理系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

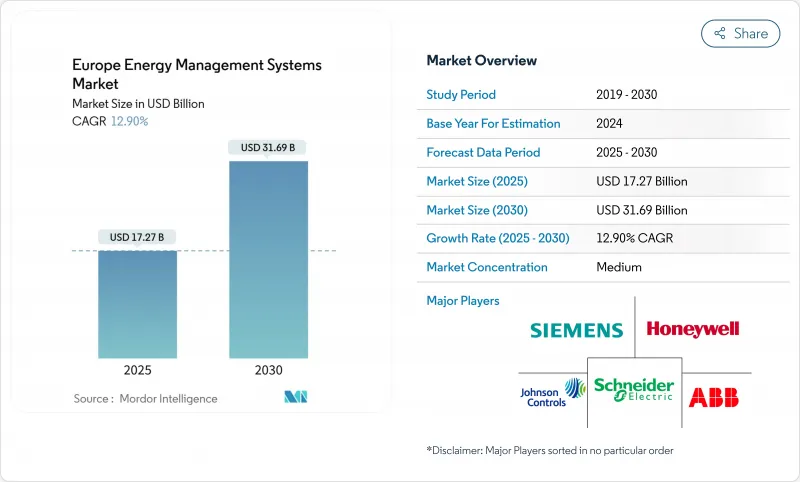

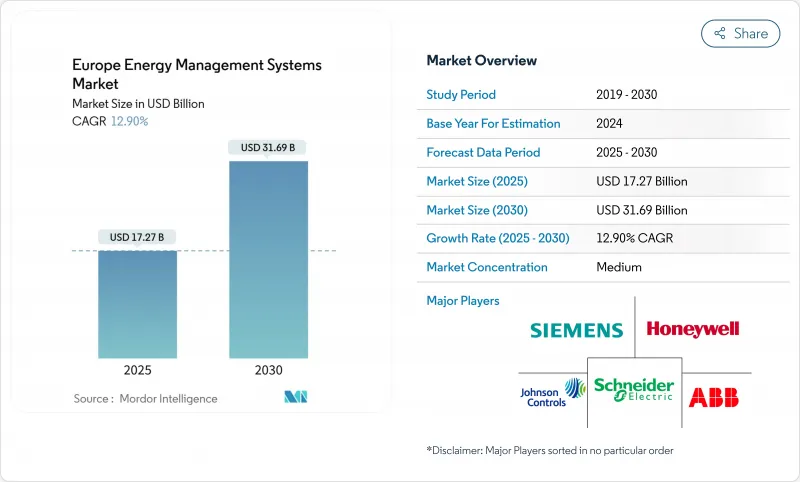

预计欧洲能源管理系统市场规模到 2025 年将达到 172.7 亿美元,到 2030 年将达到 316.9 亿美元。

数位优先电网升级、「55% 上网电价」(Feed-for-55)强制规定以及企业净零目标的加速推进,共同推动了这一扩张,使这项技术从一项可自由支配的支出转变为一项基础设施必需品。智慧电网的快速现代化,加上计划投资 5,840 亿欧元的电力,正在推动对以软体为中心的优化平台的广泛需求。楼宇级人工智慧工具正在将能源强度降低 30%,将设施转变为活跃的电网节点。德国在其 80%可再生能源目标的推动下,正在推动早期应用,而西班牙的智慧家庭热潮则为住宅规模的扩大奠定了基础。随着供应商竞相整合预测分析和网路安全,竞争也越来越严重。

欧洲能源管理系统市场趋势与洞察

扩大智慧电网基础设施的采用

欧盟公用事业公司计划在2030年在电网方面投资5,840亿欧元,其中1,700亿欧元将用于数位化依赖强大的EMS平台。分散式可再生、Vehicle-to-Grid的流动以及虚拟变电站都需要即时编配,这使得EMS从一项成本节约资产提升为电网关键资产。Schneider Electric在Enlit 2024展会上部署的虚拟变电站展示了其在双向电力架构方面的定位。如今,楼宇提供灵活性服务,在HEMS和配电网营运商之间建立了互惠数据环路。 GridX预测,随着互通性标准的成熟,到2030年,欧洲住宅EMS将成长11倍。 via-tt.com

欧盟「Fit-for-55」能源效率指令

修订后的《建筑能效指令》要求在2030年实现零排放建筑,并逐步升级性能最差的建筑,因此,功能齐全的能源管理系统 (EMS) 是合规的先决条件。强制性的全生命週期碳评估将推动暖通空调、照明和现场可再生能源的全面监控。西班牙透过其国家综合能源与气候计划,建筑自动化软体的年增长率已达17.21%,而该法规的紧迫性也反映在销售管道上。整合资料登录、分析和彙报的解决方案可缩短审核週期并降低认证风险。

国家建筑标准碎片化

儘管欧盟层级存在指令,但各国法规各不相同,迫使供应商客製化认证和接口,延长了计划生命週期。德国标准与西班牙和义大利的标准差异很大,迫使多个国家的供应商并行合作。能源智慧家电的自愿行为准则试图协调通讯协定,但缺乏执行力。缺乏监管专业知识的小型企业可能难以竞争,从而推动整合。

細項分析

到 2024 年,建筑能源管理系统 (BEMS) 将占据欧洲能源管理系统市场份额的 45.3%。随着办公大楼和零售连锁店维修暖通空调、照明和电网服务现场存储,与 BEMS 相关的欧洲能源管理系统市场规模预计将稳定成长。供应商将需量反应模组与监控系统捆绑在一起,将建筑定位为灵活性资产。受西班牙在 2025 年实现 380 万户家庭智慧化的计画推动,家庭能源管理系统 (HEMS) 将实现 13.1% 的最快复合年增长率。支援人工智慧的仪表板和行动应用程式将推动消费者采用,而公用事业回扣将进一步提高投资回报。 GridX 预测,到 2030 年,HEMS 将扩大 11 倍,与欧盟的消费者奖励相吻合,这凸显了其颠覆家庭市场的潜力。

工业能源管理服务 (EMS) 市场规模较小,主要针对追求范围一减排的能源密集型产业。资料中心能源管理服务和智慧城市平台则属于「其他」类别,其中对延迟敏感的最佳化正在推动成长。建筑能耗管理系统 (BEMS) 供应商正在整合微电网控制器,而家庭能源管理 (HEMS) 应用正在推出电动车到户 (EV-to-home) 和虚拟发电厂 (VPP) 参与功能。

到2024年,硬体将占总收入的42.7%,这凸显了在分析技术蓬勃发展之前,对仪表、网关和控制器的需求。然而,软体将以14.3%的复合年增长率引领成长,这反映了欧洲能源管理系统市场向云端和人工智慧价值层的转变。快速发展的SaaS软体包支援预测性维护、碳计量、自适应费率调度等功能。随着订阅模式取代永久许可证以及资金限制的缓解,伴随软体的欧洲能源管理系统市场规模预计将扩大。

服务实施、分包和託管优化填补了前面提到的人才缺口。随着硬体商品化,供应商交叉销售咨询服务以维持净利率。江森自控专注于分析的 Metasys 14.0 体现了从静态仪表板到持续改进引擎的转变,模糊了软体和服务之间的界限。

欧洲能源管理系统市场按解决方案类型(建筑能源管理系统 (BEMS)、家庭能源管理系统 (HEMS)、其他)、组件(硬体、软体、服务)、部署类型(本地部署、云端基础)、最终用户(商业/零售、住宅、其他)和国家细分。市场预测以美元计算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 扩大智慧电网基础设施的采用

- 欧盟「Fit-for-55」能源效率法规

- 企业净零目标加速EMS的采用

- 建筑级 HVAC 负载的 AI/ML 优化

- 灵活性市场和需量反应收入的兴起

- 边缘到云端网路安全套件可降低计划风险

- 市场限制

- 国家建筑规范的碎片化

- 缺乏高级分析所需的技能

- 传统BMS通讯协定之间的互通性差距

- 中小企业领域因通货膨胀而延后资本支出

- 供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 宏观经济趋势的市场评估

第五章市场规模及成长预测

- 按解决方案类型

- 建筑能源管理系统(BEMS)

- 家庭能源管理系统(HEMS)

- 工业/製造业 EMS (IEMS)

- 其他的

- 按组件

- 硬体

- 软体

- 服务

- 依部署方式

- 本地部署

- 云端基础

- 按最终用户

- 商业和零售

- 住宅

- 工业设施

- 卫生保健

- 其他的

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟

- 北欧国家

- 其他欧洲地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Johnson Controls International plc

- Panasonic Holdings Corp.

- Enel X Srl

- Uplight Inc.

- SAP SE

- British Gas Services(Centrica plc)

- Green Energy Options Ltd

- Efergy Technologies SL

- Cisco Systems Inc.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- ENGIE Digital

- Landis+Gyr AG

- Delta Electronics Inc.

- Trane Technologies plc

第七章 市场机会与未来展望

The Europe energy management systems market reached USD 17.27 billion in 2025 and is projected to attain USD 31.69 billion by 2030, reflecting a 12.9% CAGR.

Digital-first grid upgrades, Fit-for-55 mandates, and accelerating corporate net-zero targets collectively underpin this expansion, moving the technology from discretionary spend to infrastructure necessity. Rapid smart-grid modernization, worth EUR 584 billion in planned electricity investments, is triggering widespread demand for software-centric optimization platforms. Building-level artificial-intelligence tools are unlocking 30% energy-intensity cuts, turning facilities into active grid nodes. Germany anchors early adoption on the back of 80% renewable-power goals, while Spain's smart-home boom sets the pace for residential scale-up. Competitive intensity is rising as vendors race to integrate predictive analytics and cybersecurity by design.

Europe Energy Management Systems Market Trends and Insights

Growing deployment of smart-grid infrastructure

EU utilities plan EUR 584 billion of grid spending by 2030, with EUR 170 billion earmarked for digitalization that depends on robust EMS platforms. Distributed renewables, vehicle-to-grid flows, and virtual substations require real-time orchestration, elevating EMS from cost-saver to grid-critical asset. Schneider Electric's Virtual Substation rollout at Enlit 2024 illustrates vendor positioning for two-way power architectures. Buildings now supply flexibility services, creating reciprocal data loops between HEMS and distribution system operators. GridX forecasts an 11-fold expansion of European residential EMS by 2030 as interoperability standards mature via-tt.com.

EU "Fit-for-55" energy-efficiency mandates

The revised Energy Performance of Buildings Directive enforces zero-emission construction by 2030 and stepwise upgrades for worst-performing stock, making EMS functionality a compliance prerequisite. Mandatory whole-life-carbon assessments drive integrated monitoring across HVAC, lighting, and on-site renewables. Spain's transposition through its National Integrated Energy and Climate Plan is already lifting building-automation software 17.21% annually, translating regulatory urgency directly into sales pipelines. Solutions that bundle data logging, analytics, and reporting shorten audit cycles and de-risk certification.

Fragmented country-level building codes

Despite an EU-level directive, divergent national rules compel suppliers to customise certifications and interfaces, inflating project lifecycles. Germany's standards depart materially from those in Spain and Italy, compelling multi-country vendors to run parallel development tracks. The voluntary Code of Conduct for Energy Smart Appliances seeks to align protocols yet lacks enforcement teeth. Smaller firms without regulatory specialists can struggle to compete, nudging consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero targets accelerating EMS adoption

- Building-level AI/ML optimization of HVAC loads

- Skill-set shortage for advanced analytics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Energy Management Systems (BEMS) captured 45.3% of the Europe energy management systems market share in 2024, reflecting mandated zero-emission targets for commercial real estate. The Europe energy management systems market size tied to BEMS is expected to climb steadily as office and retail chains retrofit HVAC, lighting, and on-site storage for grid services. Vendors bundle demand-response modules with supervisory controls, positioning buildings as flexibility assets. Home Energy Management Systems (HEMS) post the swiftest 13.1% CAGR, propelled by Spain's plan to make 3.8 million homes smart by 2025. AI-ready dashboards and mobile apps drive consumer uptake, and utility rebates further sweeten paybacks. GridX's projection of 11-fold HEMS expansion by 2030 dovetails with EU prosumer incentives, underlining residential disruption potential.

The industrial EMS niche grows off a smaller base, serving energy-intensive sectors chasing scope 1 abatements. Data-center EMS and smart-city platforms populate the "others" bucket, where latency-sensitive optimisation gains traction. Cross-segment convergence is visible; BEMS suppliers integrate microgrid controllers while HEMS apps expose EV-to-home and VPP participation features.

Hardware claimed 42.7% of 2024 revenue, underlining the need for meters, gateways, and controllers before analytics can flourish. Yet software leads growth at 14.3% CAGR, mirroring the Europe energy management systems market's pivot to cloud and AI value layers. Fast-evolving SaaS packages unlock predictive maintenance, carbon accounting, and tariff-adaptive scheduling. The Europe energy management systems market size attached to software is forecast to broaden as subscription models replace perpetual licences, easing capital constraints.

Services installation, retro-commissioning, and managed optimisation fill the talent void discussed earlier. Vendors cross-sell advisory offerings to sustain margins as hardware commoditises. Johnson Controls' analytics-heavy Metasys 14.0 exemplifies the move from static dashboards to continuous-improvement engines, blurring the line between software and service.

Europe Energy Management Systems Market is Segmented by Solution Type (Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and More), Component (Hardware, Software, and Services), Deployment Mode (On-Premises and Cloud-Based), End-User (Commercial and Retail, Residential, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Johnson Controls International plc

- Panasonic Holdings Corp.

- Enel X S.r.l.

- Uplight Inc.

- SAP SE

- British Gas Services (Centrica plc)

- Green Energy Options Ltd

- Efergy Technologies SL

- Cisco Systems Inc.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- ENGIE Digital

- Landis+Gyr AG

- Delta Electronics Inc.

- Trane Technologies plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing deployment of smart-grid infrastructure

- 4.2.2 EU Fit-for-55" energy-efficiency mandates"

- 4.2.3 Corporate net-zero targets accelerating EMS adoption

- 4.2.4 Building-level AI/ML optimisation of HVAC loads

- 4.2.5 Rise of flexibility markets and demand-response revenues

- 4.2.6 Edge-to-cloud cybersecurity toolkits reducing project risk

- 4.3 Market Restraints

- 4.3.1 Fragmented country-level building codes

- 4.3.2 Skill-set shortage for advanced analytics

- 4.3.3 Inter-operability gaps across legacy BMS protocols

- 4.3.4 Inflation-driven capex deferrals in SMB segment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Building Energy Management Systems (BEMS)

- 5.1.2 Home Energy Management Systems (HEMS)

- 5.1.3 Industrial/Manufacturing EMS (IEMS)

- 5.1.4 Others

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.4 By End-User

- 5.4.1 Commercial and Retail

- 5.4.2 Residential

- 5.4.3 Industrial Facilities

- 5.4.4 Healthcare

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Benelux

- 5.5.7 Nordics

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd

- 6.4.5 Johnson Controls International plc

- 6.4.6 Panasonic Holdings Corp.

- 6.4.7 Enel X S.r.l.

- 6.4.8 Uplight Inc.

- 6.4.9 SAP SE

- 6.4.10 British Gas Services (Centrica plc)

- 6.4.11 Green Energy Options Ltd

- 6.4.12 Efergy Technologies SL

- 6.4.13 Cisco Systems Inc.

- 6.4.14 IBM Corporation

- 6.4.15 Eaton Corporation plc

- 6.4.16 Rockwell Automation Inc.

- 6.4.17 ENGIE Digital

- 6.4.18 Landis+Gyr AG

- 6.4.19 Delta Electronics Inc.

- 6.4.20 Trane Technologies plc