|

市场调查报告书

商品编码

1851414

能源管理系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

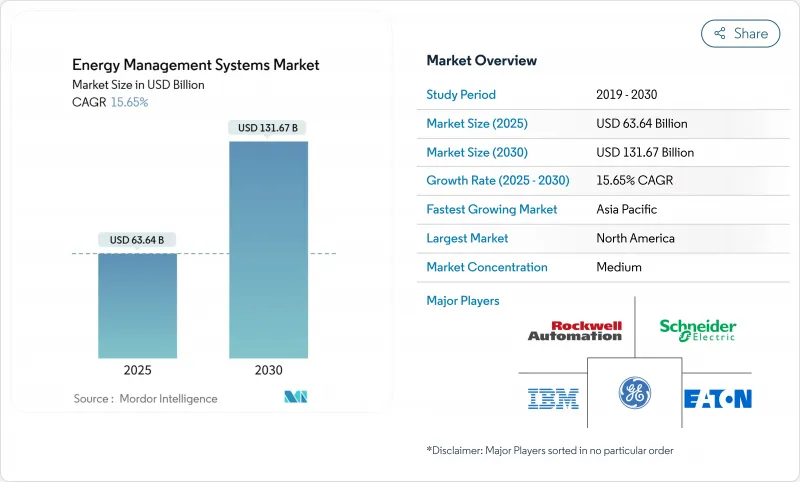

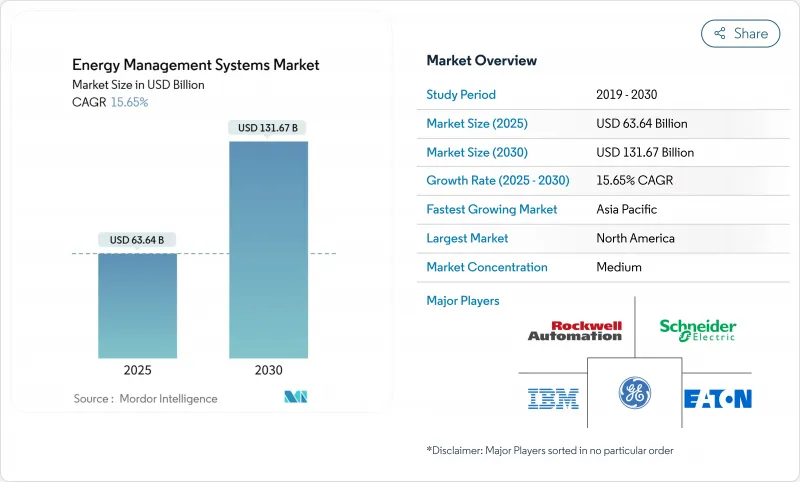

预计到 2025 年,能源管理系统市场规模将达到 636.4 亿美元,到 2030 年将达到 1,316.7 亿美元,复合年增长率为 15.65%。

这种快速成长反映了更严格的脱碳法规、智慧电网的快速部署以及企业日益增长的净零排放目标,这些因素使得即时能源优化成为必需而非可选项。公共产业正在大规模部署高级计量基础设施 (AMI),为营运商提供实现电网自愈能力和人工智慧主导分析所需的精细数据,从而降低营运成本。商业房地产所有者将面临从 2026 年开始实施的强制性净零建筑规范,这将推动对互联的暖通空调、照明和控制平台的需求激增。同时,签订大规模可再生能源购电协议的公司需要能够进行小时追踪、证书管理和碳计量的整合系统。气候政策、大宗商品价格波动以及不断上涨的碳成本,都凸显了能源管理系统市场的经济价值,因为企业都在寻求两位数的节能效果和应对供应面衝击的能力。

全球能源管理系统市场趋势与洞察

快速普及先进计量基础设施将变革电网智能

成熟经济体的公共产业正在加速推进其高级计量基础设施(AMI)项目,目标是在2024年之前完成,届时将安装数百万个智慧电錶,并将间隔数据传输到云端分析引擎。 Eversource公司在麻萨诸塞州和康乃狄克州完成了一个涵盖130万个电錶的计划,而National Grid公司则在东北地区连接了340万个终端。这些资料馈送自动需量反应、故障自癒和预测性负载预测等功能提供支援——这些都是现代能源管理系统市场平台的核心模组。人工智慧演算法能够在几秒钟内重新分配电力,从而缩短恢復时间并减少配电损耗。随着配电公司实现电网服务的商业化并整合可再生能源,AMI正在成为连接现场资产和云端基础优化系统的关键环节。

强制性净零排放建筑规范加速商业环境管理系统的采用

纽约市、华盛顿州和加州等地区已颁布相关法规,旨在推动大型建筑最快于2026年开始实现净零排放营运。第97号地方法律要求面积超过25,000平方英尺的设施到2030年将排放减少40%,并对不合规者处以严厉处罚。加州第24号法规的更新强制要求采用先进的控制和计量技术,使能源管理系统市场从自愿升级转变为合规要求。类似的强制规定正在加拿大和欧盟蔓延,推动了对整合式暖通空调、照明和可再生能源平台的需求。

系统整合的高昂初始成本阻碍了中小企业的市场渗透。

全面部署的成本仍然在 5 万至 50 万美元之间,这对资金紧张的企业来说是一道障碍。硬体、整合和培训的投资回收期长达 18 至 36 个月,减缓了中小企业采用该技术的步伐。 Iris Ohyama 于 2025 年发布的 ENEverse 云端套件就是一个很好的例子,它将感测器、分析和远端控制功能整合到一个无需硬体的模型中。

细分市场分析

到2024年,楼宇能源管理系统将占据能源管理系统市场最大的份额,达到46.0%。在监管要求日益严格、租户永续性报告要求不断提高以及对健康室内环境日益重视的推动下,商业房地产持续投资于先进的控制系统,以降低25%至40%的公用事业成本。家庭解决方案将以17.2%的复合年增长率快速增长,能源价格上涨、智慧家电普及以及公用事业需求响应奖励促使家庭用户转向语音控制恆温器和电动车自动充电调度系统。整合平台正在融合居住感应器、光伏逆变器和电池调度功能,以建构自平衡微电网。儘管供应商提供边缘中心或云端优先架构,但两者都会将资料路由至人工智慧引擎进行即时优化,从而扩大了能源管理系统市场的潜在用户群。

近期进展表明,自动化方式正从基于规则的自动化转向预测性编配。 C3.ai 模型将基于物理的设备库与机器学习相结合,预测负载峰值并主动调节暖通空调系统,从而最大限度地降低能耗。开利 BluEdge 控制中心将冷水机组层级的资料传输给远端工程师,工程师只需几分钟即可微调设定值,无需现场人员即可实现冷却器的节能效果。由此产生的回馈循环使得已确认的节能成果可用于资助进一步的维修,并建立长期服务协议,从而保障供应商的收入。

至2024年,製造业将占据能源管理系统31.4%的市场。水泥、钢铁和化学等产业正利用高速感测器和数位孪生技术来控制熔炉、压缩机和生产线,力求最大限度地提高每一千瓦时的生产力。同时,医疗保健产业正以16.25%的复合年增长率快速成长。医院全天候运作,对湿度和温度有严格的控制要求,因此是利用人工智慧控制空调和锅炉的理想场所。阿波罗医院在实施了一套整合医疗设备调度和热电汽电共生控制的云端能源管理系统后,公用事业成本降低了30%。

电力公司作为第二大终端用户,正在利用能源管理系统(EMS)模组进行需求预测和可再生能源併网。 IT和电讯也在资料中心应用类似的逻辑,因为资料中心的冷却负荷接近总消费量的40%。随着人工智慧工作负载的激增,伺服器密度也随之飙升,先进的气流建模和液冷优化正成为设施蓝图中的主流方案。住宅和商业综合体的需求也在不断增长,这主要得益于净计量政策和屋顶太阳能货币化的推动。

能源管理系统市场报告按 EMS 类型(BEMS、IEMS、HEMS)、最终用户(製造业、电力能源、IT 和通讯、医疗保健、住宅和商业)、应用(能源产出、能源传输、能源监控)、组件(硬体、软体、服务)和地区进行细分。

区域分析

北美将继续保持领先地位,预计到2024年将占能源管理系统市场收入的35.6% 。 《税额扣抵计量、电动车充电和建筑维修计划。像Eversource和National Grid这样的公共产业将在2024年新增数百万个智慧终端,从而建立支援进阶分析的资料基础。Schneider Electric积极响应,投资7亿美元扩建美国的工厂,用于本地生产开关设备、微电网控制器以及进行软体研发,体现了其对政策稳定性和客户需求的信心。

在「欧洲绿色新政」和「Fit-for-55」一揽子计画的推动下,欧洲正积极效仿。 「Fit-for-55」计画的目标是到2030年将排放量比1990年水准降低55%。成员国正在将数位化建筑要求纳入当地立法,从而推动了对整合建筑分析的强劲需求。德国P2P交易沙盒的推出以及荷兰大力推行的热泵奖励,都反映了监管的广泛性。 TPG斥资67亿欧元收购Techem,也显示了其投资意愿。公共产业正在加速电网边缘数位化,以应对可再生能源的波动,这进一步扩大了能源管理系统市场。

亚太地区是经济成长引擎,预计将以16.05%的复合年增长率成长。中国正在投资建造超高压输电和人工智慧增强型发电配电中心,以平衡计画在2030年新增的120万千瓦风能和太阳能发电装置容量。日本计划在2025年向住宅和建筑能源管理系统(EMS)提供40亿日圆的补贴,将增强供应商储备。印度的智慧城市计画已将EMS要求纳入公共设施和路灯网路的竞标中,东南亚国家正在寻求电网稳定解决方案,以支援屋顶太阳能的快速部署。跨国公司在建立区域製造地之初就指定采用EMS,加速了待开发区的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速部署先进测量基础设施(AMI)

- 从2026年起,主要国家将强制执行净零能耗建筑标准。

- 人工智慧驱动的预测性维护可降低电力公司的营运成本

- 越来越多的企业购电协议(PPA)需要精细的能源数据。

- 基于区块链的P2P(P2P)能源交易试点项目

- 市场限制

- 系统整合初期成本较高

- 棕地专案中遗留的OT/IT互通性差距

- 在不断发展的关键基础设施法律下的网路安全责任

- 经合组织地区以外熟练的急救医疗服务技术人员短缺

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按EMS类型

- 建筑能源管理系统(BEMS)

- 工业电子管理系统(IEMS)

- 家庭急救服务 (HEMS)

- 最终用户

- 製造业

- 电力和能源

- 资讯科技/通讯

- 卫生保健

- 住宅及商业地产

- 透过使用

- 能源产出

- 能源运输

- 能源监控与优化

- 按组件

- 硬体

- 软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达等)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- General Electric

- Eaton Corporation

- Rockwell Automation Inc.

- Johnson Controls

- IBM Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems

- Enel X

- Autogrid Systems

- Itron Inc.

- Honeywell Smart Energy

- Mitsubishi Electric

- Yokogawa Electric

- Tendril(Uplight)

- WAGO Kontakttechnik

第七章 市场机会与未来展望

The Energy Management Systems market size reaches USD 63.64 billion in 2025 and is forecast to climb to USD 131.67 billion by 2030, advancing at a 15.65% CAGR.

The surge reflects stricter decarbonization rules, rapid smart-grid deployment, and mounting corporate net-zero targets that elevate real-time energy optimization from optional to indispensable. Utilities are rolling out advanced metering infrastructure (AMI) at scale, giving operators the granular data they need to pair with AI-driven analytics for self-healing grid functions and lower operating costs. Commercial real-estate owners face mandatory net-zero building codes starting in 2026, driving a jump in demand for connected HVAC, lighting, and controls platforms. Meanwhile, firms signing large renewable power-purchase agreements require integrated systems capable of hourly tracking, certificate management, and carbon accounting. Beyond climate policy, volatile commodity prices and growing carbon costs sharpen the economic case for the Energy Management Systems market, as enterprises chase double-digit savings and resilience against supply-side shocks.

Global Energy Management Systems Market Trends and Insights

Rapid Roll-out of Advanced Metering Infrastructure Transforms Grid Intelligence

Utilities across mature economies accelerated AMI programs in 2024, installing millions of smart meters that stream interval data to cloud analytics engines. Eversource finished a 1.3 million-meter project spanning Massachusetts and Connecticut, while National Grid connected 3.4 million endpoints in the Northeast. The data feed underpins automated demand response, outage self-healing, and predictive load forecasting, all core modules in modern Energy Management Systems market platforms. AI algorithms re-route power within seconds, cutting restoration times and trimming distribution losses. As distribution operators monetize grid services and accommodate renewables, AMI forms the essential layer linking field assets with cloud-based optimization.

Mandatory Net-Zero Building Codes Accelerate Commercial EMS Adoption

Jurisdictions such as New York City, Washington State, and California enacted rules that push large buildings toward net-zero operations, starting as early as 2026. Local Law 97 requires facilities over 25,000 ft2 to cut emissions 40% by 2030, with steep fines for non-compliance. California's Title 24 updates stipulate advanced controls and measurement, turning Energy Management Systems market deployments from voluntary upgrades into compliance necessities. Similar mandates ripple across Canada and the EU, expanding addressable demand for integrated HVAC, lighting, and renewable-ready platforms.

High Up-Front System Integration Costs Constrain SME Market Penetration

Comprehensive deployments still command USD 50,000-500,000, a hurdle for cash-constrained facilities. Hardware, integration, and training extend payback to 18-36 months, delaying adoption in small enterprises. Energy-as-a-Service subscriptions now re-cast capex as opex, lowering entry barriers; Iris Ohyama's 2025 launch of the ENEverse cloud suite typifies that pivot, bundling sensors, analytics, and remote operations into a no-hardware model.

Other drivers and restraints analyzed in the detailed report include:

- AI-Powered Predictive Maintenance Revolutionizes Utility Operations

- Corporate Power Purchase Agreements Drive Granular Energy Data Requirements

- Legacy OT/IT Interoperability Gaps Complicate Brownfield Deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Energy Management Systems capture the largest slice of the Energy Management Systems market at 46.0% in 2024. Tighter codes, tenant sustainability reporting, and the premium on healthy indoor environments keep commercial campuses investing in advanced controls that trim 25-40% of utility spend. Home solutions post the fastest trajectory, rising at a 17.2% CAGR as rising electricity tariffs, smart-appliance penetration, and utility demand-response incentives nudge households toward voice-controlled thermostats and automated EV-charger scheduling. Integrated platforms now fuse occupancy sensors, PV inverters, and battery dispatch to create self-balancing nanogrids. Suppliers differ on architecture-edge hubs versus cloud-first-but all route data into AI engines for real-time optimization, broadening the Energy Management Systems market addressable base.

Recent advancements illustrate the shift from rule-based automation to predictive orchestration. C3.ai models combine physics-based equipment libraries with machine learning to anticipate load peaks and pre-condition HVAC for minimal energy intensity. Carrier's BluEdge Command Center streams chiller-level data to remote engineers who tweak set points in minutes, achieving double-digit savings without on-site staff. The result is a feedback loop: verified savings fund further retrofits, cementing long-term service contracts that anchor vendor revenue.

Manufacturing facilities accounted for 31.4% of Energy Management Systems market share in 2024 owing to energy bills that routinely reach 20% of operating costs. Sectors such as cement, steel, and chemicals leverage high-speed sensors and digital twins to orchestrate furnaces, compressors, and process lines, seeking every kilowatt of productivity. Nevertheless, the healthcare vertical is expanding at a 16.25% CAGR. Hospitals run 24/7, with stringent humidity and temperature thresholds, making them ideal candidates for AI-guided HVAC and boiler sequencing. Apollo Hospitals reports 30% utility savings after deploying a cloud EMS that integrates medical equipment scheduling and cogeneration controls.

Power utilities, the second-largest end-user, rely on EMS modules for demand forecasting and renewables integration. IT and telecom operators apply similar logic inside data centers where cooling loads approach 40% of total consumption. As server densities jump with AI workloads, advanced airflow modeling and liquid-cooling optimization enter mainstream facility roadmaps. Residential and commercial mixed-use complexes round out demand, driven by net-metering policies and the urge to monetize rooftop solar.

The Energy Management System Market Report is Segmented by Type of EMS (BEMS, IEMS, and HEMS), End-User (Manufacturing, Power and Energy, IT and Telecommunication, Healthcare, and Residential and Commercial), Application (Energy Generation, Energy Transmission, and Energy Monitoring), Component (Hardware, Software, and Services), and Geography.

Geography Analysis

North America retains its pole position with 35.6% of Energy Management Systems market revenue in 2024. Federal funding through the Inflation Reduction Act and state tax credits catalyze metering, EV-charging, and building-retrofit projects. Utilities such as Eversource and National Grid added millions of smart endpoints in 2024, laying the data fabric that underpins advanced analytics. Schneider Electric responded with a USD 700 million expansion across U.S. plants to localize production of switchgear, microgrid controllers, and software R&D, signalling confidence in policy stability and customer demand.

Europe follows closely, propelled by the European Green Deal and Fit-for-55 package that stipulate 55% emission cuts versus 1990 by 2030. Member states embed digital-building requirements in local codes, fostering robust demand for integrated building analytics. Germany's roll-out of P2P trading sandboxes and the Netherlands' aggressive heat-pump incentives showcase regulatory breadth. Investment appetite surfaced when TPG paid EUR 6.7 billion for Techem, attracted by recurring revenues from sub-metering and efficiency services. Utilities accelerate grid-edge digitization to handle variable renewable flows, further enlarging the Energy Management Systems market.

Asia-Pacific is the growth engine with a projected 16.05% CAGR. China invests in ultra-high-voltage transmission and AI-enhanced dispatch centers to balance its 1,200 GW of wind-solar capacity planned by 2030. Japan's subsidies for Home EMS and Building EMS, backed by JPY 4 billion earmarked in 2025, bolster vendor pipelines. India's Smart Cities Mission embeds EMS requirements in tenders for public buildings and street-lighting networks, while Southeast Asian economies seek grid-stability solutions to cope with rapid rooftop-solar adoption. Multinationals setting up regional manufacturing hubs specify EMS from day one, accelerating greenfield demand.

- Schneider Electric

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- General Electric

- Eaton Corporation

- Rockwell Automation Inc.

- Johnson Controls

- IBM Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems

- Enel X

- Autogrid Systems

- Itron Inc.

- Honeywell Smart Energy

- Mitsubishi Electric

- Yokogawa Electric

- Tendril (Uplight)

- WAGO Kontakttechnik

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid roll-out of advanced metering infrastructure (AMI)

- 4.2.2 Mandatory net-zero building codes in major economies from 2026

- 4.2.3 AI-powered predictive maintenance lowering OPEX for utilities

- 4.2.4 Growing corporate PPAs demanding granular energy data

- 4.2.5 Blockchain-enabled peer-to-peer (P2P) energy trading pilots

- 4.3 Market Restraints

- 4.3.1 High up-front system integration costs

- 4.3.2 Legacy OT/IT interoperability gaps in brownfield sites

- 4.3.3 Cyber-security liability under evolving critical-infrastructure laws

- 4.3.4 Shortage of EMS-skilled technicians outside OECD

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of EMS

- 5.1.1 Building EMS (BEMS)

- 5.1.2 Industrial EMS (IEMS)

- 5.1.3 Home EMS (HEMS)

- 5.2 By End-User

- 5.2.1 Manufacturing

- 5.2.2 Power and Energy

- 5.2.3 IT and Telecommunication

- 5.2.4 Healthcare

- 5.2.5 Residential and Commercial

- 5.3 By Application

- 5.3.1 Energy Generation

- 5.3.2 Energy Transmission

- 5.3.3 Energy Monitoring and Optimization

- 5.4 By Component

- 5.4.1 Hardware

- 5.4.2 Software

- 5.4.3 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Russia

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar, etc.)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd.

- 6.4.5 General Electric

- 6.4.6 Eaton Corporation

- 6.4.7 Rockwell Automation Inc.

- 6.4.8 Johnson Controls

- 6.4.9 IBM Corporation

- 6.4.10 Oracle Corporation

- 6.4.11 SAP SE

- 6.4.12 Cisco Systems

- 6.4.13 Enel X

- 6.4.14 Autogrid Systems

- 6.4.15 Itron Inc.

- 6.4.16 Honeywell Smart Energy

- 6.4.17 Mitsubishi Electric

- 6.4.18 Yokogawa Electric

- 6.4.19 Tendril (Uplight)

- 6.4.20 WAGO Kontakttechnik

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment