|

市场调查报告书

商品编码

1844485

日本太阳能:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Japan Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

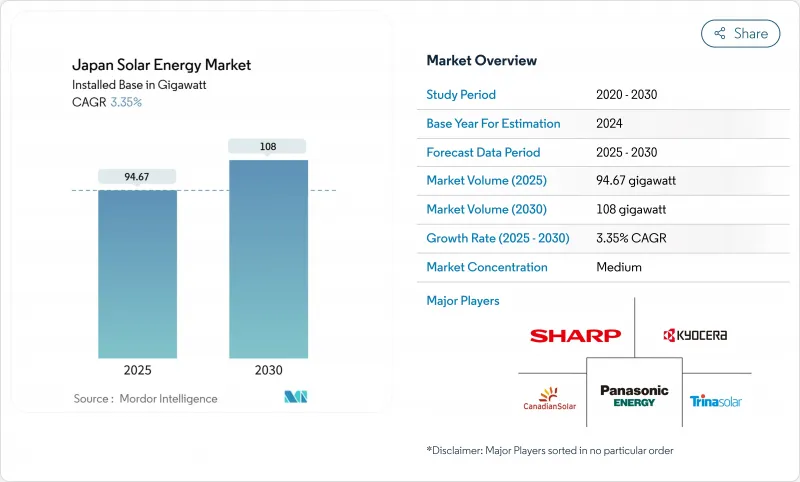

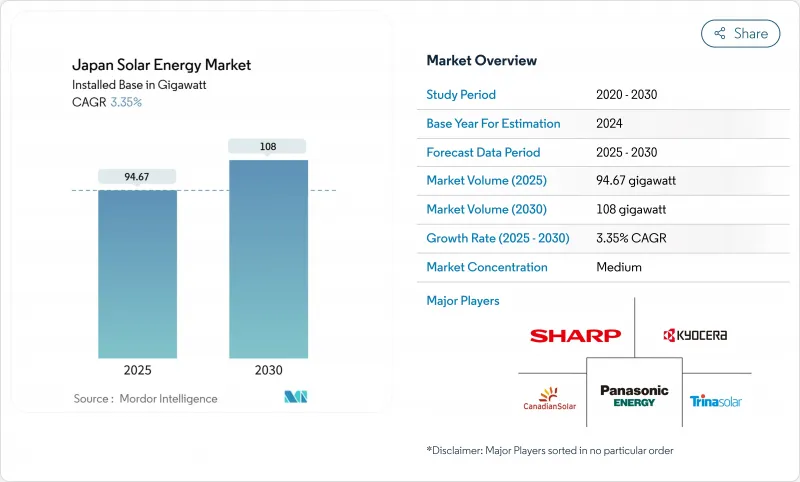

日本太阳能市场的安装基数预计将从 2025 年的 94.67 吉瓦成长到 2030 年的 108 吉瓦,预测期间(2025-2030 年)的复合年增长率为 3.35%。

从上网电价制度过渡到溢价上网制度后,发展仍在继续。溢价上网制度鼓励开发商遵循批发价格讯号,整合电池储能係统,并降低消费者课税。屋顶光电阵列许可的加速授权、东京强制实施的自发电规定以及组件和电池价格的下降,正在扩大分散式系统的潜在市场。来自海外製造商的竞争压力正在压低硬体成本,而国内企业正在加速钙钛矿研究、共置储能和能源管理软体的开发,以保值。资料中心电力需求的不断增长以及企业脱碳目标的实现,正在透过长期购电协议深化企划案融资管道。

日本太阳能市场趋势与洞察

2050年净零排放蓝图和FIT→FIP奖励

从保证电价到高于批发价的溢价的转变使日本太阳能市场与标准电力市场经济重新接轨。截至 2024 年 2 月,FIP 计画已认证了 1,036 个计划,其中包括 518 兆瓦的太阳能发电,促进了模组电池组合的发展,以捕捉峰值价差。政府的 2025 财政年度公告确认了早期太阳能投资的新预算拨款,显示了持续的政策承诺。随着开发商投资发电和输电能力以对冲价格波动,计划结构现在整合了预测软体、虚拟发电厂能力和配套服务收益。这些调整支持了日本太阳能市场的长期竞争力,并减轻了公共补贴的影响。

《建筑基准法》规定屋顶必须安装光电系统(东京、神奈川)

东京颁布了一项法令,要求自2025年4月起,所有超过2000平方公尺的新建筑都必须安装太阳能板,此举将改变城市建设的基本原则。现在,合规责任落在了建筑商而非最终业主的肩上,这简化了物流,并规定了年度最低安装限额。同时,每千瓦最高8万日圆的补贴也支持高效系统,进一步提高了收益。早期的现场考察数据表明,建筑商现在正在将太阳能采购纳入其设计工作流程,并规范首都的现场发电。多个县正在起草类似的法令,这表明日本有可能在全国范围内推行连锁监管,以支持日本太阳能市场的可持续需求。

九州和北海道电网拥塞、断电

区域间连接受限,基本负载核子反应炉弹性,导致日间太阳能高峰利用空间有限,因此九州地区2023财年的弃电率达6.7%,发电量跃升至176太瓦时。公用事业公司正在试行基于人工智慧的电压调节器,将稳定器启动率降低高达70%。政策制定者也正在起草负电价规则以及经济发电和输电方案,但具体时间表仍不确定。在基础设施到位之前,日本太阳能市场参与者必须增设电池储能係统、迁移发电厂,否则在供应过剩时期将面临收益蚕食的风险。

細項分析

到2024年,屋顶安装将占日本太阳能市场的49.4%,这反映了土地稀缺以及零成本安装方案的成熟,这些方案能够引起城市居民的共鸣。该行业的优势,包括靠近需求点、避免电网连接成本以及简化的授权,正在巩固其在日本太阳能市场的主导地位。东京的强制性屋顶安装规定和全国范围内的「零日元」合约趋势消除了前期成本,并为住宅和商业租户带来了可预测的节省。这些结构性奖励将分散式发电与更广泛的净零路线蓝图紧密联繫在一起。

浮体式太阳能光电是成长最快的部署类型,到2030年,其复合年增长率将达到4.1%。安装在灌溉水库和东京湾的试点电站已证明其在颱风条件下的技术可行性,并显示出减少水分蒸发等额外效益。由于过去曾发生边坡崩塌事故,地面安装系统的分区面积已趋于严格,促使开发商转向屋顶、车棚和水面等地点。借助可黏贴在建筑幕墙和隔音屏障上的更轻的钙钛矿层压板,建筑一体化太阳能光电正在兴起,为日本太阳能市场提供了另一个成长管道。

日本太阳能市场报告按部署类型(屋顶光伏、地面光伏、浮体式、建筑一体化光伏)、应用类型(住宅光伏、商业/工业光伏、公用事业规模光伏、农业光伏)和组件类型(光伏组件/逆变器、支架/追踪系统、系统平衡、共置电池)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 2050年净零排放蓝图及FIT及FIP奖励

- 《建筑基准法》规定屋顶必须安装光电系统(东京、神奈川)

- 组件和电池价格下降提高计划内部报酬率

- 资料中心电力激增刺激企业电力购买协议 (PPA)

- 轻质钙钛矿太阳能电池装饰建筑幕墙和汽车外壳

- 「零日圆太阳能」统一费率模式让一般家庭也能享受太阳能

- 市场限制

- 九州、北海道电网拥塞及抑制

- 土地稀缺和地面计划严格分区

- 太阳能废弃物管理责任与不断上升的回收成本

- 高压太阳能加储能设施缺乏技术纯熟劳工

- 供应链分析

- 监管状况

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- PESTLE分析

第五章市场规模及成长预测

- 按部署

- 屋顶

- 地面安装

- 浮体式太阳能

- 建筑一体化光伏(BIPV)

- 按用途

- 住房

- 商业和工业

- 公共产业规模

- 农业太阳能发电

- 按组件

- 光电模组

- 逆变器(串式、中央式、微型逆变器)

- 安装和追踪系统

- 系统平衡(电缆、组合器等)

- 附蓄电池

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- Sharp Corporation

- Kyocera Corporation

- Panasonic Energy Co.

- Canadian Solar Inc.

- Trina Solar Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Technology Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Hanwha Q CELLS

- First Solar Inc.

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Omron Corporation

- Nihon Techno Co. Ltd.

- SoftBank Energy(SB Power)

- Eurus Energy Holdings

- RENOVA Inc.

- Shizen Energy Inc.

- West Holdings Corporation

- Sekisui Chemical(Perovskite R&D)

第七章 市场机会与未来展望

The Japan Solar Energy Market size in terms of installed base is expected to grow from 94.67 gigawatt in 2025 to 108 gigawatt by 2030, at a CAGR of 3.35% during the forecast period (2025-2030).

Growth continues even after the shift from the Feed-in Tariff to the Feed-in Premium scheme, which encourages developers to follow wholesale price signals, integrated battery storage, and lower consumer levies . Faster permitting for rooftop arrays, mandatory on-site generation rules in Tokyo, and falling module plus battery prices have enlarged the addressable base for distributed systems. Competitive pressure from overseas manufacturers decreases hardware costs, while domestic firms accelerate perovskite research, co-located storage, and energy-management software to retain value. Rising power demand from data centers and corporate decarbonization targets deepens the project finance pool through long-term power-purchase agreements.

Japan Solar Energy Market Trends and Insights

Net-zero 2050 roadmap & FIT -> FIP incentives

The move from a guaranteed tariff to a premium above the wholesale price has realigned the Japanese solar energy market with standard power-market economics. By February 2024, the FIP program had accredited 1,036 projects, including 518 MW of solar, driving developers to pair modules with batteries to capture peak-price spreads . Government notices released for fiscal 2025 confirm fresh budget lines for early-stage solar investments, signaling ongoing policy commitment. As developers invest in dispatchable capacity to hedge price risk, project structures now integrate forecasting software, virtual power-plant functions, and ancillary service revenues. These adaptations anchor the long-term competitiveness of the Japanese solar energy market while easing public-subsidy exposure.

Mandatory rooftop-PV building codes (Tokyo, Kanagawa)

Tokyo's regulation that all new buildings above 2,000 m2 must include solar panels from April 2025 has changed the baseline for urban construction. Compliance obligations rest with the builder, not the end-owner, simplifying logistics and placing a floor under annual installation volumes. The city's parallel subsidy of up to JPY 80,000 per kW supports high-efficiency systems, further lifting return profiles. Early site inspection data indicates that builders now embed solar procurement into design workflows, normalizing on-site generation in the capital. Several prefectures are drafting similar ordinances, pointing toward a potential nationwide regulatory cascade that would underpin sustained demand in the Japanese solar energy market.

Grid congestion & curtailment in Kyushu/Hokkaido

Curtailment jumped to 1.76 TWh in fiscal 2023, with Kyushu hitting a 6.7% rate because limited inter-regional links and inflexible baseload reactors leave little room for midday solar peaks. Utilities are piloting AI-based voltage control that has cut stabilizer activations by up to 70%, showing a technical path forward. Policymakers also draft negative-pricing rules and economic dispatch, but timelines remain unsettled. Until infrastructure aligns, Japanese solar energy market developers must add batteries, reposition plants, or accept revenue cannibalization during oversupply events.

Other drivers and restraints analyzed in the detailed report include:

- Falling module and battery prices improve project IRRs

- Data-center electricity surge spurring corporate PPAs

- Skilled-labour gap for HV solar-plus-storage installs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rooftop arrays accounted for 49.4% of the Japanese solar energy market in 2024, reflecting scarce land and maturing zero-cost installation schemes that resonate with city dwellers. The segment benefits from proximity to demand, avoiding grid-upgrade fees, and straightforward permitting, reinforcing its primacy in the Japanese solar energy market. Tokyo's compulsory rooftop rules and the nationwide "zero-yen" subscription trend remove upfront costs and establish predictable savings for households and commercial tenants. These structural incentives tie distributed generation closely to the broader net-zero roadmap.

Floating solar is the fastest-growing deployment class, expanding at 4.1% CAGR through 2030. Pilot plants in irrigation reservoirs and Tokyo Bay demonstrate technical viability under typhoon conditions and show ancillary benefits such as reduced water evaporation. After past slope-failure incidents, ground-mount sites face stricter zoning, steering developers toward rooftops, carports, and water surfaces. Building-integrated photovoltaics are emerging, aided by lighter perovskite laminates that can attach to facades and acoustic barriers, offering another outlet for growth in the Japanese solar energy market.

The Japan Solar Energy Market Report is Segmented by Deployment (Rooftop, Ground-Mounted, Floating Solar, and Building-Integrated PV), Application (Residential, Commercial and Industrial, Utility-Scale, and Agrivoltaics), and Component (PV Modules Inverters, Mounting and Tracking Systems, Balance-Of-System, and Co-Located Battery Storage). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Sharp Corporation

- Kyocera Corporation

- Panasonic Energy Co.

- Canadian Solar Inc.

- Trina Solar Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Technology Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Hanwha Q CELLS

- First Solar Inc.

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Omron Corporation

- Nihon Techno Co. Ltd.

- SoftBank Energy (SB Power)

- Eurus Energy Holdings

- RENOVA Inc.

- Shizen Energy Inc.

- West Holdings Corporation

- Sekisui Chemical (Perovskite R&D)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Net-zero 2050 roadmap and FIT and FIP incentives

- 4.2.2 Mandatory rooftop-PV building codes (Tokyo, Kanagawa)

- 4.2.3 Falling module + battery prices improve project IRRs

- 4.2.4 Data-center electricity surge spurring corporate PPAs

- 4.2.5 Lightweight perovskite PV opens facade &and vehicle skins

- 4.2.6 "Zero-Yen Solar" subscription model unlocks households

- 4.3 Market Restraints

- 4.3.1 Grid congestion and curtailment in Kyushu/Hokkaido

- 4.3.2 Scarce land/strict zoning for ground-mount projects

- 4.3.3 PV waste-management liability and recycling cost spike

- 4.3.4 Skilled-labour gap for HV solar-plus-storage installs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Deployment

- 5.1.1 Rooftop

- 5.1.2 Ground-mounted

- 5.1.3 Floating Solar

- 5.1.4 Building-Integrated PV (BIPV)

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.2.4 Agrivoltaics

- 5.3 By Component

- 5.3.1 PV Modules

- 5.3.2 Inverters (String, Central and Micro-inverter)

- 5.3.3 Mounting and Tracking Systems

- 5.3.4 Balance-of-System (Cables, Combiner, etc.)

- 5.3.5 Co-located Battery Storage

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Sharp Corporation

- 6.4.2 Kyocera Corporation

- 6.4.3 Panasonic Energy Co.

- 6.4.4 Canadian Solar Inc.

- 6.4.5 Trina Solar Co. Ltd.

- 6.4.6 JinkoSolar Holding Co. Ltd.

- 6.4.7 JA Solar Technology Co. Ltd.

- 6.4.8 LONGi Green Energy Technology Co. Ltd.

- 6.4.9 Hanwha Q CELLS

- 6.4.10 First Solar Inc.

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 Toshiba Energy Systems & Solutions

- 6.4.13 Omron Corporation

- 6.4.14 Nihon Techno Co. Ltd.

- 6.4.15 SoftBank Energy (SB Power)

- 6.4.16 Eurus Energy Holdings

- 6.4.17 RENOVA Inc.

- 6.4.18 Shizen Energy Inc.

- 6.4.19 West Holdings Corporation

- 6.4.20 Sekisui Chemical (Perovskite R&D)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment