|

市场调查报告书

商品编码

1844571

汽车空气滤清器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Air Filter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

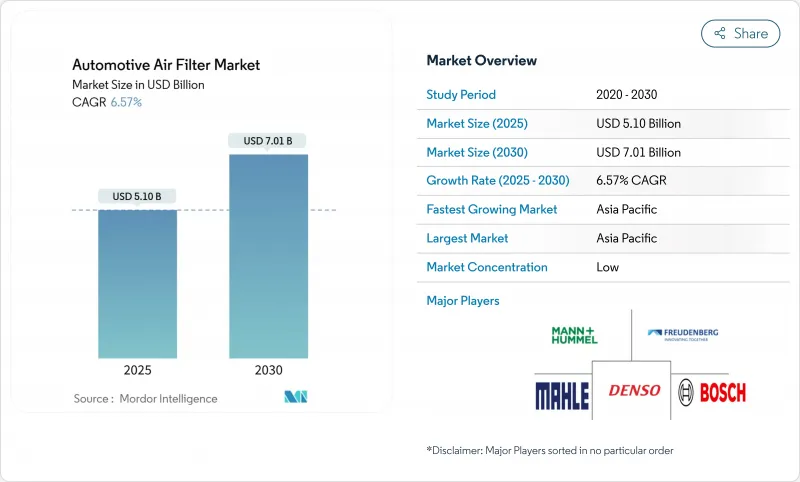

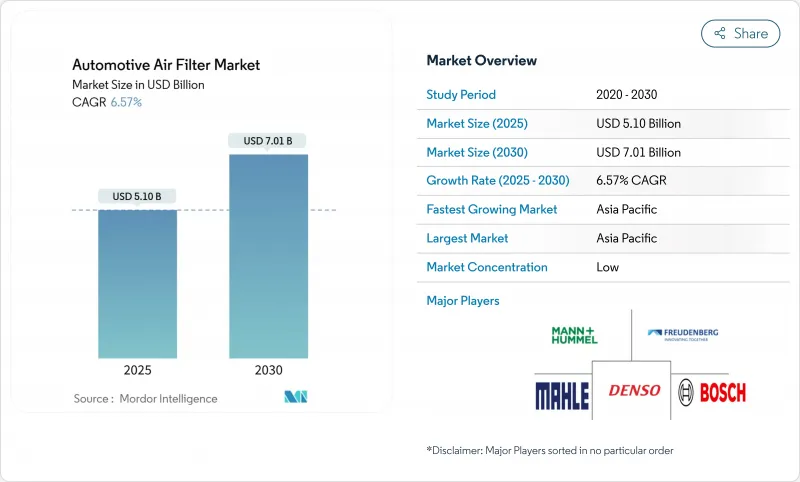

预计汽车空气滤清器市场规模到 2025 年将达到 51 亿美元,到 2030 年将达到 70.1 亿美元,复合年增长率为 6.57%。

欧洲、北美和亚洲主要经济体排放法规的日益严格,加上消费者对车内空气品质的担忧,推动了强劲的需求成长。为了符合欧盟7、EPA 2027-2032多污染物排放标准以及Bharat Stage VI排放标准,原始目标商标产品製造商 (OEM) 越来越多地指定使用高效微粒空气 (HEPA) 系统和静电奈米纤维滤材。电动车 (EV) 平台也带来了巨大的机会,因为电池散热系统和更安静的驾驶室会加剧过滤性能的差异。同时,售后市场经销商正在利用预测性维护数据来定位优质的替换滤材,以应对合成滤材提供的更长的维护间隔。

全球汽车空气滤清器市场趋势与洞察

严格的废气排放法规和车内空气品质法规

主要汽车市场法规趋同,对先进过滤技术的需求空前高涨,旨在保护引擎并改善车内空气品质。欧盟的欧7法规首次限制轮胎和煞车磨损排放的颗粒物排放,要求过滤系统能够捕捉废气中常见的颗粒物以外的其他颗粒物。这项扩展与美国环保署的Tier 4标准重迭,后者要求达到0.5 mg/mi PM排放的车辆配备汽油颗粒物过滤器,从根本上将过滤的价值提案从可选的舒适功能转变为合规的必需品。柬埔寨将于2030年采用欧盟6/VI标准,这标誌着监管协调将扩展到新兴市场以外的领域,为过滤供应商创造全球机会。紧迫的监管时间表迫使原始设备製造商加快过滤技术的整合,而合规期限人为地造成了需求激增,使供应商能够获得易于部署的解决方案。加州的「先进清洁车 II」计画要求到 2035 年销售 100% 零排放车,但这反而会增加对过滤设备的需求,因为电动车需要先进的车厢空气管理系统来维持电池热效率。

全球车辆数量和服务间隔里程数增加

全球汽车保有量(尤其是在新兴市场)的扩张,正在创造持续的售后市场需求,其成长速度超过了新车产量。合成润滑油的应用和引擎耐久性的提高延长了保养间隔,但这反而增加了滤清器系统的压力。这种动态有利于高阶滤清器製造商,他们可以透过符合OEM规格的长寿命产品来获得高额净利率。车队营运商越来越认识到高端滤清器对其总拥有成本的益处,而预测性维护演算法能够实现基于状态的更换计划,从而优化滤清器利用率,同时防止引擎过早磨损。随着商用车每年行驶里程超过个人乘用车,人们转向「出行即服务」模式,这推动了滤清器更换频率的提高,并为售后市场供应商创造了更可预测、更有利可图的更换週期。

长寿命合成介质延长更换间隔

先进的合成滤材技术将维护间隔延长至传统更换週期之外,反而限制了市场成长。奈米纤维涂层技术,例如 Hollingsworth & Vose 的 NANOWEB 系统,增强了深层过滤和脉衝清洁能力,使过滤器能够更长时间地保持高效,同时降低更换频率。这项技术进步带来了一个典型的创新者困境:卓越的产品性能会因为需要更少的更换次数而缩小潜在的市场规模。豪华汽车製造商越来越多地将长寿命过滤系统作为标准配置,以降低维护成本并提高客户满意度,这无意中缩小了其售后市场的收益潜力。豪华电动车中密封座舱滤清器模组的「使用寿命」趋势完全消除了售后市场的更换机会,迫使供应商在原厂组装中获取更高的利润,而不是依赖常规的售后市场销售。伊朗 Behran Filter Company 获得了其基于奈米技术的「Nano Namad」汽车空气过滤器的首个许可,这表明新兴市场正在向延长维护间隔的先进过滤技术迈进。过滤器製造商需要在技术进步与商业模式的永续性之间取得平衡,这可能需要转向基于订阅的维护服务和增值监控系统,以产生与物理过滤器更换频率无关的经常性收入流。

細項分析

到2024年,进气滤清器将占据55.21%的市场份额,这反映了其在所有车型中的普遍应用,以及出于引擎保护要求而强制更换的周期。然而,车厢空气滤清器将成为成长的驱动力,到2030年,其复合年增长率将达到9.21%。

博世推出的FILTER+pro车内空气滤清器,其抗菌层可有效对抗病毒、细菌和过敏原,展现了传统供应商如何透过创新在车内过滤领域获取溢价。空气品质法规的趋同和消费者健康意识的提升,正在持续推动车内滤清器升级的需求,促使汽车製造商在高端车型中统一采用HEPA级系统。受引擎保护需求的推动,进气滤清器的需求保持稳定,但由于技术成熟和更换週期的确定,其增长率落后于车内滤清器。静电滤清器和奈米纤维滤清器代表了该行业的技术前沿,供应商对性能超越传统滤清器的先进颗粒物捕获能力提出了更高的要求。

纤维素价格低廉,且为製造商所熟知,到 2024 年将保持 44.18% 的份额。奈米纤维和 HEPA 介质的汽车空气过滤市场规模预计将以 11.48% 的复合年增长率扩大,这清楚地表明优质、高效的介质正在引领技术创新的步伐。

奈米纤维层增加了深度负载和高容尘量,同时保持了低阻力,这是提升引擎性能和暖通空调能源效率的关键优势。供应商正在将其专有的奈米涂层整合到传统基材上,以打造差异化的产品,从而获得显着的价格溢价。活性碳製造商正在投资回收技术,以应对原材料价格波动,从而强化汽车製造商和监管机构所要求的性能与永续性的双重价值提案。

区域分析

受中国电动车热潮和印度巴拉特第六阶段排放标准的推动,亚太地区到2024年的市占率将达到38.75%。预计该地区在预测期内的复合年增长率将达到6.41%。本地供应商正在与全球品牌合作,以获得先进的媒体许可,而中国、泰国和越南的经济高效的製造工厂则支持全球需求。澳洲采用与欧6d相当的废气排放法规,将进一步扩大符合法规的市场。

在欧洲,欧盟7标准纳入了非废气颗粒物排放标准,扩大了轮胎磨损过滤器和煞车粉尘过滤器的市场空间。德国汽车製造商在高效能空气过滤器(HEPA)和感测器整合方面处于领先地位,通常与曼胡默尔等供应商进行联合设计。汉格斯特在罗马尼亚的工厂表明,东欧的成本基础正在吸引新的产能。消费者将先进的过滤与健康和环保责任联繫在一起,这支撑了其溢价。

在北美,美国环保署 (EPA) 2027-2032 年法规确保了对高效能引擎空气和座舱系统的持续需求。加州的零排放汽车强制要求将刺激对电动车专用温度控管过滤器的需求。 Hannon Systems 位于安大略的电动车压缩机工厂证明了供应商为满足该地区日益增长的电动车产量而进行的投资。售后市场物流的加强和 DIY 文化的兴起预计将推动性能升级的快速普及。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的废气排放法规和车内空气品质法规

- 全球汽车保有量和服务间隔里程的成长

- 重污染大城市消费者的健康意识

- 用于电动车和高端 OEM 平台的 HEPA 级过滤器

- 感测器启动的智慧型 HVAC过滤模组

- 预测性车队维护演算法可提高过滤器周转率

- 市场限制

- 长寿命合成介质延长更换间隔

- 不织布和活性碳价格不稳定

- 豪华电动车密封式「报废」车舱滤清器模组导致售后市场下滑

- 纯电动车中超高效能介质的能量/重量损失

- 价值/供应链分析

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

第五章市场规模及成长预测

- 依产品类型

- 进气过滤器

- 车厢空气滤清器

- 混合/静电奈米纤维过滤器

- 电增强型(ePM1)过滤器

- 按滤材

- 纤维素

- 合成/熔喷

- 活性碳复合材料

- 奈米纤维/HEPA等级

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按销售管道

- OEM配件

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会国家

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、合资、产能)

- 市占率分析

- 公司简介

- MANN+HUMMEL GmbH

- MAHLE GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Sogefi SpA

- Cummins Inc.

- DENSO Corporation

- Parker-Hannifin Corp.

- Ahlstrom-Munksjo

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Champion Laboratories Inc.

- Fram Group LLC

- Hollingsworth & Vose Co.

第七章 市场机会与未来展望

The automotive air filtration market size stands at USD 5.10 billion in 2025 and is forecast to reach USD 7.01 billion by 2030, advancing at a 6.57% CAGR.

Tightening emission norms in Europe, North America, and key Asian economies, together with consumer attention to in-cabin air quality, sustain a robust demand pipeline. Original equipment manufacturers (OEMs) increasingly specify high-efficiency particulate air (HEPA) systems and electrostatic nano-fiber media to comply with Euro 7, EPA 2027-2032 multi-pollutant standards, and Bharat Stage VI rules. Electric-vehicle (EV) platforms amplify the opportunity because battery thermal systems and silent cabins highlight filtration performance differences. At the same time, aftermarket distributors leverage predictive maintenance data to position premium replacement filters, countering the lengthening service intervals delivered by synthetic media.

Global Automotive Air Filter Market Trends and Insights

Strict Emission & In-Cabin Air-Quality Mandates

Regulatory convergence across major automotive markets creates unprecedented demand for advanced filtration technologies that address engine protection and cabin air quality. The EU's Euro 7 regulation introduces particulate emissions limits from tire and brake wear for the first time, requiring filtration systems to capture particles beyond traditional exhaust emissions. This regulatory expansion coincides with the EPA's Tier 4 standards mandating gasoline particulate filters for vehicles achieving 0.5 mg/mi PM emissions, fundamentally altering the filtration value proposition from an optional comfort feature to a regulatory compliance necessity. Cambodia's adoption of Euro 6/VI standards by 2030 demonstrates regulatory harmonization extending beyond developed markets, creating global scale opportunities for filtration suppliers. The regulatory timeline compression forces OEMs to accelerate filtration technology integration, with compliance deadlines creating artificial demand spikes that benefit suppliers with ready-to-deploy solutions. California's Advanced Clean Cars II program mandating 100% zero-emission vehicle sales by 2035 paradoxically increases filtration demand as EVs require sophisticated cabin air management systems to maintain battery thermal efficiency.

Growing Global Vehicle Parc & Service-Interval Mileage

The expanding global vehicle fleet, particularly in emerging markets, creates sustained aftermarket demand that outpaces new vehicle production growth rates. Extended service intervals, driven by synthetic lubricant adoption and improved engine durability, paradoxically increase filtration system stress as filters must perform longer between replacements while maintaining efficiency standards. This dynamic benefits premium filter manufacturers who can command higher margins for extended-life products that meet OEM specifications. Fleet operators increasingly recognize the benefits of premium filtration for total cost of ownership, with predictive maintenance algorithms enabling condition-based replacement schedules that optimize filter utilization while preventing premature engine wear. The shift toward mobility-as-a-service models intensifies filter replacement frequency as commercial vehicles accumulate higher annual mileage than private passenger cars, creating a more predictable and lucrative replacement cycle for aftermarket suppliers.

Long-Life Synthetic Media Extending Replacement Intervals

Advanced synthetic filter media technologies paradoxically constrain market growth by extending service intervals beyond traditional replacement cycles. Nano-fiber coating technologies, such as Hollingsworth & Vose's NANOWEB system, enhance depth filtration and pulse-cleaning capabilities, enabling filters to maintain efficiency longer while reducing replacement frequency. This technological advancement creates a classic innovator's dilemma where superior product performance reduces total addressable market size by decreasing replacement frequency. Premium vehicle manufacturers increasingly specify long-life filtration systems as standard equipment to reduce maintenance costs and improve customer satisfaction scores, inadvertently constraining aftermarket revenue potential. The trend toward "lifetime" sealed cabin filter modules in luxury EVs eliminates aftermarket replacement opportunities entirely, forcing suppliers to capture higher margins during OEM fitment rather than relying on recurring aftermarket sales. Iran's Behran Filter Company, receiving the first "Nano Namad" license for nanotechnology-based car air filters, demonstrates how emerging markets are leapfrogging to advanced filtration technologies that extend service intervals. Filter manufacturers must balance technological advancement with business model sustainability, potentially requiring shift toward subscription-based maintenance services or value-added monitoring systems that generate recurring revenue streams independent of physical filter replacement frequency.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Health Awareness in High-Pollution Megacities

- HEPA-Grade Filters Adopted by EV & Premium OEM Platforms

- Volatile Non-Woven & Activated-Carbon Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-intake filters command 55.21% market share in 2024, reflecting their universal application across all vehicle types and mandatory replacement cycles driven by engine protection requirements. However, cabin air filters emerge as the growth catalyst with 9.21% CAGR through 2030, propelled by consumer health awareness and regulatory mandates for in-cabin air quality improvement.

Bosch's introduction of FILTER+pro cabin air filters with antimicrobial layers effective against viruses, bacteria, and allergens demonstrates how traditional suppliers innovate to capture premium pricing in the cabin filtration segment. The convergence of air quality regulations and consumer health consciousness creates sustained demand for cabin filtration upgrades, with OEMs increasingly specifying HEPA-grade systems as standard equipment in premium vehicle segments. Air-intake filters maintain steady demand driven by engine protection requirements, though growth rates lag cabin filters due to mature technology and established replacement cycles. The electrostatic and nano-fiber segments represent the industry's technological frontier, where suppliers command premium pricing for advanced particle capture capabilities that exceed traditional media performance.

Cellulose retained a 44.18% share in 2024 because it is inexpensive and well-understood by manufacturers. The automotive air filtration market size for nano-fiber and HEPA media is projected to expand at 11.48% CAGR, a clear indicator that premium, high-efficiency media sets the innovation pace.

Nanofiber layers add depth loading and high dust-holding capacity while maintaining low restriction, a critical benefit for engine performance and HVAC energy efficiency. Suppliers integrate proprietary nano-coatings into traditional substrates to create differentiated SKUs with significant price premiums. Activated-carbon producers invest in recycling technology to combat feedstock price swings, reinforcing the dual performance and sustainability value proposition demanded by automakers and regulators.

The Automotive Air Filter Market Report is Segmented by Product Type (Air-Intake Filters, Cabin Air Filters, Hybrid Filters, and More), Filter Media (Cellulose, Synthetic, Activated-Carbon Composite, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM Fitment and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific's 38.75% share in 2024 is backed by China's EV surge and India's Bharat Stage VI norms. The region is anticipated to grow with a 6.41% CAGR during the forecast period. Local suppliers collaborate with global brands to secure advanced media licenses, while cost-efficient manufacturing plants in China, Thailand, and Vietnam feed worldwide demand. Australia's adoption of Euro 6d-equivalent tailpipe limits further widens the regulatory addressable market.

Euro 7's inclusion of non-exhaust particles in Europe opens niches for tire-wear capture devices and brake-dust filters. German OEMs spearhead HEPA and sensor integration, often co-engineering with suppliers such as MANN+HUMMEL. Hengst's Romanian plant shows that Eastern Europe's cost base attracts new capacity. Consumers associate advanced filtration with wellness and environmental responsibility, supporting premium pricing.

The EPA's 2027-2032 rules in North America guarantee sustained demand for high-efficiency engine-air and cabin systems. California's zero-emission vehicle mandate stimulates demand for EV-specific thermal-management filters. Hanon Systems' Ontario EV compressor plant signals supplier investment to serve growing regional EV output. Well-developed aftermarket logistics and strong do-it-yourself cultures ensure rapid uptake of performance upgrades.

- MANN+HUMMEL GmbH

- MAHLE GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Sogefi SpA

- Cummins Inc.

- DENSO Corporation

- Parker-Hannifin Corp.

- Ahlstrom-Munksjo

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Champion Laboratories Inc.

- Fram Group LLC

- Hollingsworth & Vose Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict emission & in-cabin air-quality mandates

- 4.2.2 Growing global vehicle parc & service-interval mileage

- 4.2.3 Consumer health awareness in high-pollution megacities

- 4.2.4 HEPA-grade filters adopted by EV & premium OEM platforms

- 4.2.5 Sensor-activated smart HVAC filtration modules

- 4.2.6 Predictive fleet-maintenance algorithms driving filter turnover

- 4.3 Market Restraints

- 4.3.1 Long-life synthetic media extending replacement intervals

- 4.3.2 Volatile non-woven & activated-carbon prices

- 4.3.3 Sealed "lifetime" cabin-filter modules in luxury EVs reduce aftermarket

- 4.3.4 Energy/weight penalty of ultra-high-efficiency media in BEVs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD and Volume in Units)

- 5.1 By Product Type

- 5.1.1 Air-Intake Filters

- 5.1.2 Cabin Air Filters

- 5.1.3 Hybrid / Electrostatic Nano-fiber Filters

- 5.1.4 Electrically-enhanced (ePM1) Filters

- 5.2 By Filter Media

- 5.2.1 Cellulose

- 5.2.2 Synthetic/Melt-blown

- 5.2.3 Activated-Carbon Composite

- 5.2.4 Nano-fiber/HEPA Grade

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM Fitment

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia & New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, and Capacity)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 MANN+HUMMEL GmbH

- 6.4.2 MAHLE GmbH

- 6.4.3 Donaldson Company Inc.

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Sogefi SpA

- 6.4.6 Cummins Inc.

- 6.4.7 DENSO Corporation

- 6.4.8 Parker-Hannifin Corp.

- 6.4.9 Ahlstrom-Munksjo

- 6.4.10 Freudenberg & Co. KG

- 6.4.11 Hengst SE

- 6.4.12 K&N Engineering Inc.

- 6.4.13 Champion Laboratories Inc.

- 6.4.14 Fram Group LLC

- 6.4.15 Hollingsworth & Vose Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment