|

市场调查报告书

商品编码

1844645

北美氰基丙烯酸酯黏合剂:市场份额分析、产业趋势、统计数据和成长预测(2025-2030 年)North America Cyanoacrylate Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

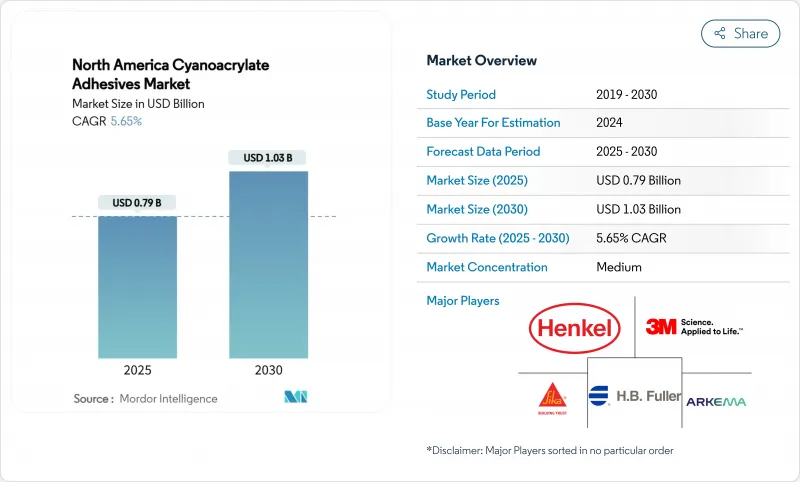

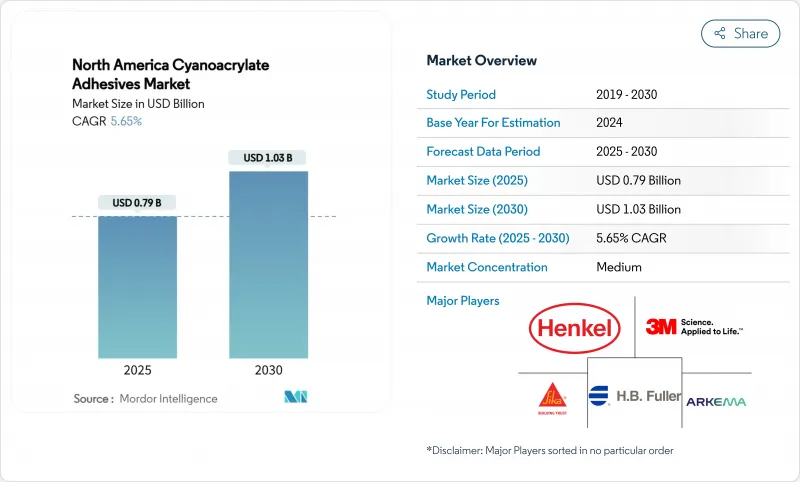

北美氰基丙烯酸酯黏合剂市场预计在 2025 年价值 7.9 亿美元,预计到 2030 年将达到 10.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.65%。

展望凸显了黏合剂产业蓬勃发展的能力,即便许多特种化学品正面临价格压力和日益严格的环境法规。强劲的电子产品小型化、医疗设备创新和轻量化运输项目将支撑需求。限制溶剂型化学品的监管趋势将推动买家转向速固化替代品,而供应链向终端市场的转移将有利于北美和墨西哥的生产基地。竞争的焦点在于配方速度、生物相容性和永续性,那些将全球规模与特定应用技术结合的公司将继续获得市场份额。

北美氰基丙烯酸酯胶黏剂市场趋势与洞察

小型化家电组件需求激增

设备的快速小型化促使製造商放弃使用螺丝和夹子,转而使用低粘度氰基丙烯酸酯胶,这种胶粘剂能够流入微米级缝隙并在数秒内固化。先进封装中的异质整合需要黏合剂来固定多个材料堆迭,同时防止导电路径。穿戴式装置、物联网感测器和车载资讯娱乐模组也面临同样的限制,从而扩大了驾驶者的全球影响力。原始设备製造商重视这种化学品能够以极低的表面处理速度黏合塑胶、金属和复合材料,从而提高亚洲大批量製造工厂的产量。因此,每一代新一代智慧型装置都一致采用优质氰基丙烯酸酯胶。

医疗设备黏合剂和伤口缝合领域的快速应用

医用级氰基丙烯酸酯黏合剂因其手术时间更短、疤痕更小、感染率更低等优点,正日益取代缝线。一项多中心研究表明,Dermabond Prineo 网片系统将术后併发症减少了两位数。长链丁基和辛基变异体具有较低的组织毒性,并在体液中保持抗拉强度,因此已核准用于体内和体外应用。 HB Fuller 收购 Medifil 以及 GEM 正在等待扩大欧洲供应的交易,显示供应商正在竞相剋服严格的 ISO 10993 和 FDA 障碍。随着全球手术量和人口老化加剧,医院纷纷转向使用一次性组织黏合剂,以简化培训并缩短恢復时间,从而推动医疗保健需求超过任何其他行业。

严格的VOC和职业健康法规

美国的气溶胶涂料法规、加拿大针对130个产品类型的挥发性有机化合物(VOC)上限以及澳洲的毒理学调查结果草案,迫使配方师去除溶剂或添加警告标籤,导緻小型生产商的合规成本高达销售额的12%。在已开发地区,强制要求改善通风、配备个人防护设备和职场监控,进一步增加了营运成本。虽然低气味产品很受欢迎,但它们通常需要昂贵的稳定剂,这会降低净利率。拥有专业监管团队的跨国公司可以承担这些负担,但规模较小的区域品牌面临退出或被收购的风险,从而推动该行业的整合。

細項分析

乙酯基氰基丙烯酸酯胶黏剂将维持市场主导地位,到2024年将占市场规模的47.18%。数十年的製程优化使其成本更低,基材相容性更强。面向电子组件和汽车线束的销售保持高产量,而诸如抗起霜添加剂等渐进式改进则使其保持竞争力。同时,预计到2030年,包含生物基或特种等级的「其他产品类型」的复合年增长率将达到6.69%,这反映了企业对气候变迁的承诺以及终端用户对差异化性能的需求。

虽然由于黏合速度超过极限强度,人们对甲酯等级产品的兴趣重新燃起,但随着工程师寻求更强的黏合力来黏合抗衝击塑料,销售量正在下降。烷氧基乙基酯在计划,以应对采购记分卡。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 小型化消费性电子元件需求激增

- 医疗设备黏合剂和伤口缝合领域的快速应用

- 努力减轻汽车和电动车的重量

- DIY 和消费者维修文化的成长

- 家具业需求不断成长

- 市场限制

- 严格的VOC和职业健康法规

- 与其他替代品相比,抗剪切和耐热性较差

- 股价波动

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依产品类型

- 烷氧基乙基

- 乙酯

- 甲酯

- 其他产品类型(例如生物基)

- 按最终用户产业

- 运输

- 鞋类和皮革

- 家具

- 消费品

- 卫生保健

- 电子产品

- 其他终端用户产业(纺织、船舶等)

- 按地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)排名分析

- 公司简介

- 3M

- Arkema

- Aron Alpha

- Chemence

- DELO

- Dymax

- HB Fuller Company

- Henkel AG and Co. KGaA

- Hernon Manufacturing

- ITW Performance Polymers

- Master Bond Inc.

- Permabond LLC

- Sika AG

第七章 市场机会与未来展望

The North America Cyanoacrylate Adhesives Market size is estimated at USD 0.79 billion in 2025, and is expected to reach USD 1.03 billion by 2030, at a CAGR of 5.65% during the forecast period (2025-2030).

This outlook underscores the adhesive sector's ability to grow even as many specialty chemicals struggle with price pressures and stricter environmental rules. Robust electronics miniaturization, medical device innovation and lightweighting programs in transportation underpin demand. Regulatory moves that restrict solvent-based chemistries are steering buyers toward instant-curing alternatives, while supply-chain shifts closer to end-markets favour production hubs in North America and Mexico. Competition centres on formulation speed, biocompatibility and sustainability, and firms that combine global scale with application-specific know-how continue to capture share.

North America Cyanoacrylate Adhesives Market Trends and Insights

Surging Demand from Miniaturised Consumer-Electronics Assembly

Rapid device shrinkage forces manufacturers to abandon screws and clips in favour of low-viscosity cyanoacrylates that flow into micron-scale gaps and cure within seconds, eliminating added heat cycles that can warp delicate substrates. Growth is amplified by heterogeneous integration in advanced chip packaging, where adhesives must secure multi-material stacks while preventing conductive pathways. Wearables, IoT sensors and automotive infotainment modules replicate these constraints, extending the driver's global reach. OEMs value the chemistry's ability to bond plastics, metals and composites with minimal surface preparation, streamlining throughput in high-volume Asian plants. The result is consistent pull-through of premium-grade cyanoacrylates into every new generation of smart devices.

Rapid Adoption in Medical Device Adhesives and Wound Closure

Medical-grade cyanoacrylates are gaining on sutures thanks to faster procedure times, smaller scars and reduced infection rates; the Dermabond Prineo mesh system cut post-operative complications by double-digit margins in multi-centre trials. Long-chain butyl and octyl variants show lower tissue toxicity and maintain tensile strength under bodily fluids, fostering approvals for internal and external applications. H.B. Fuller's acquisition of Medifill and pending GEM deal expands European supply, illustrating how suppliers race to clear strict ISO 10993 and FDA hurdles. As global surgical volumes rise alongside ageing populations, hospitals continue switching to single-use tissue adhesives that simplify training and shorten recovery, pushing healthcare demand above all other sectors.

Strict VOC and Occupational-Health Regulations

EPA aerosol-coating limits, Canada's VOC caps on 130 product categories and Australia's draft toxicology findings compel formulators to strip out solvents and add warning labels, raising compliance costs by up to 12% of sales for small producers . Upgraded ventilation, personal protective equipment and mandatory workplace monitoring further inflate operating expenses in developed regions. While low-odour lines gain traction, they often require costly stabilizers that squeeze margins. Multinationals with dedicated regulatory teams absorb these burdens, but smaller regional brands risk exit or acquisition, nudging sector consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Lightweighting Initiatives in Automotive and E-Mobility

- Expanding DIY and Consumer Repair Culture

- Limited Shear or Thermal Resistance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethyl Ester-based formulations retained a commanding 47.18% share of the cyanoacrylate adhesives market size in 2024, buoyed by decades of process optimization that deliver low cost and broad substrate compatibility. Sales into electronics sub-assemblies and automotive harnesses keep throughput high, and incremental tweaks-such as anti-bloom additives-preserve competitiveness. In parallel, "Other Product Types" that bundle bio-based or specialty grades are set to climb at a 6.69% CAGR through 2030, reflecting corporate climate pledges and end-user quests for differentiated performance.

Renewed interest in Methyl Ester grades persists where micro-bonding speed outranks final strength, yet volume dips as engineers chase tougher bonds for impact-laden plastics. Alkoxy Ethyl variants, while niche, win projects demanding cyclic thermal stability beyond 120 °C. University labs are publishing routes to ethoxyethyl a-cyanoacrylate with 24% higher peel strength, signalling potential disruptive entrants should scale economics line up. Over the forecast horizon, suppliers will likely hedge portfolios by balancing legacy Ethyl Ester tonnage with high-margin green or high-temperature offerings in response to procurement scorecards.

The North America Cyanoacrylate Adhesive Market Report Segments the Industry by Product Type (Alkoxy Ethyl-Based, Ethyl Ester-Based, Methyl Ester-Based, and Other Product Types), End-User Industry (Transportation, Footwear and Leather, Furniture, Consumer Goods, Healthcare, Electronics, and Other End-User Industries), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- Arkema

- Aron Alpha

- Chemence

- DELO

- Dymax

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Hernon Manufacturing

- ITW Performance Polymers

- Master Bond Inc.

- Permabond LLC

- Sika AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand from miniaturised consumer-electronics assembly

- 4.2.2 Rapid adoption in medical device adhesives and wound closure

- 4.2.3 Lightweighting initiatives in automotive and e-mobility

- 4.2.4 Expanding Do-It-Yourself (DIY) and consumer repair culture

- 4.2.5 Growing demand from furniture industry

- 4.3 Market Restraints

- 4.3.1 Strict Volatile Organic Compound (VOC) and occupational-health regulations

- 4.3.2 Limited shear or thermal resistance in comparison to alternatives

- 4.3.3 Peedstock price-volatility

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Alkoxy Ethyl-based

- 5.1.2 Ethyl Ester-based

- 5.1.3 Methyl Ester-based

- 5.1.4 Other Product Types (Bio-based, etc.)

- 5.2 By End-user Industry

- 5.2.1 Transportation

- 5.2.2 Footwear and Leather

- 5.2.3 Furniture

- 5.2.4 Consumer Goods

- 5.2.5 Healthcare

- 5.2.6 Electronics

- 5.2.7 Other End-user Industries (Textile, Marine, etc.)

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Aron Alpha

- 6.4.4 Chemence

- 6.4.5 DELO

- 6.4.6 Dymax

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG and Co. KGaA

- 6.4.9 Hernon Manufacturing

- 6.4.10 ITW Performance Polymers

- 6.4.11 Master Bond Inc.

- 6.4.12 Permabond LLC

- 6.4.13 Sika AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 The Development of Bio-based Adhesives