|

市场调查报告书

商品编码

1844714

碳纤维增强热塑性(CFRTP)复合材料:市场份额分析、产业趋势、统计数据和成长预测(2025-2030)Carbon Fiber Reinforced Thermoplastic (CFRTP) Composite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

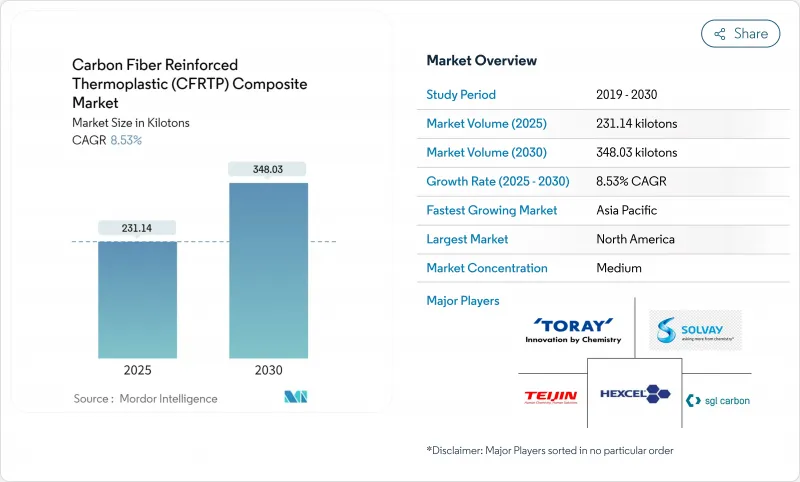

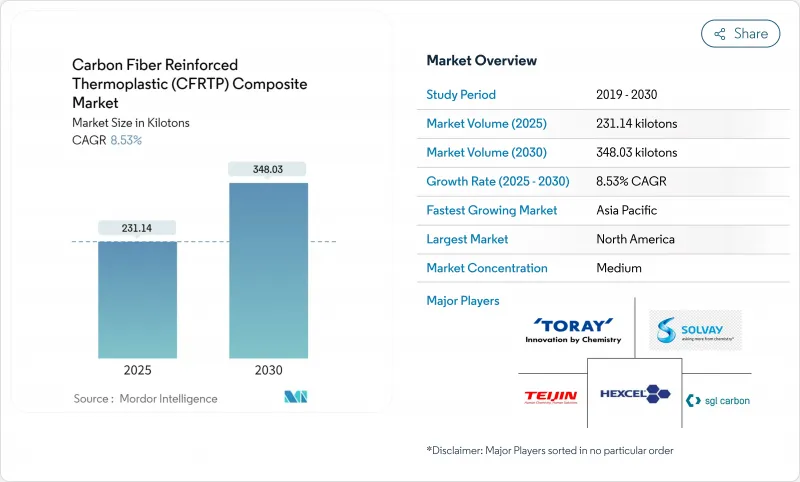

碳纤维增强热塑性 (CFRTP) 复合材料市场规模预计在 2025 年为 231.14 千吨,预计到 2030 年将达到 348.03 千吨,预测期内(2025-2030 年)的复合年增长率为 8.53%。

这一强劲增长反映了该材料兼具航太级强度重量比和完全可回收性的能力,这与交通运输、能源和建筑行业的脱碳目标相一致。电动车产量的上升、商用飞机製造率的回升以及蓬勃发展的储氢计画推动了需求的成长。同时,节能纤维生产和积层製造领域的突破性创新正在降低进入门槛,区域性回收法规正在为供应商创造新的收益来源。随着综合性现有企业为抵御区域性产能扩张和专业回收商的衝击而争夺市场份额,竞争日益激烈。

全球碳纤维增强热塑性 (CFRTP) 复合材料市场趋势与洞察

轻型电动车结构需求激增

汽车製造商越来越多地将碳纤维热塑性塑胶用于电池机壳、车身面板和底盘零件,以延长续航里程并缩短充电时间。该材料的可逆熔化特性支持使用后回收,并符合中国和欧盟目前正在製定的循环经济法规。车队营运商受益于更便捷的维修,因为损坏的零件可以重新加热和再形成,而无需更换。特斯拉在其人形机器人中采用碳纤维复合材料,凸显了其在汽车以外的多功能性,并暗示了其扩展到多个移动平台的潜力。中国将在2024年消耗6.9万吨碳纤维,显示亚洲的需求基础正在持续成长。

加速民航机生产扩张

机身原始设备製造商正在重组其供应链,以满足737 MAX和787梦幻飞机的生产目标,从而满足用于降低燃油消耗的二级结构复合材料的需求。赫氏在第一季的财务业绩中报告销售额下降,但重申了对轻质热塑性解决方案的投资。电动飞机的转变将推动热塑性塑胶的应用,因为基质材料可用于绝缘线路并整合防冰加热器。欧洲热塑性复合材料研究中心(TPRC)下属的倡议加速了大批量零件的认证,缩短了从设计到飞行的时间表。与金属相比,热塑性塑胶卓越的抗疲劳性能可延长维修间隔,此优势在新冠疫情爆发后受到航空公司的高度重视。

初期投资和製造成本高

高压釜、压机和自动纤维铺放单元每条生产线的成本可能超过3000万美元,阻碍了价格敏感产业的进入,并减缓了其应用。西格里碳素公司(SGL Carbon)报告称,2024年碳纤维销售额下降了35.2%,因为需求波动导致高固定成本资产利用不足。利默里克大学示范的等离子和微波加热技术可将能耗降低高达70%,但商业化仍需数年时间。由于原始纤维仍然比铝和钢更昂贵,复合材料尚未被经济型汽车采用。只有当产量允许工具摊销时,经济效益才会改善,这导致原始设备製造商(OEM)在下游需求得到确认之前犹豫不决。

細項分析

到2024年,PAN基牌号将占总产量的78.12%,这印证了其成熟的生产线和航太的悠久历史。其高拉伸模量使设计人员能够在满足安全裕度的同时减轻结构重量。随着现有企业维修连续生产线以提高产量,PAN基碳纤维增强热塑性复合材料市场规模预计将以7.9%的复合年增长率稳定成长。经济高效的再加热循环可降低废品率,并增强工厂经济效益。

包括再生纤维在内的其他原料的复合年增长率为9.71%,在原料中最高。目前,再生纤维的拉伸强度可达原生纤维的93.6%,这拓宽了其在二次负荷路径中的适用性。 Syensqo和Trillium正在探索的生物基丙烯腈,标誌着公司将长期转向更环保的原料。利基沥青基材料具有类似金属的导电性,有助于电池组的温度控管。虽然产量较低,但高昂的定价平衡了供应限制,并维持了相当吸引人的利润率。

到2024年,PEEK将占据34.51%的市场份额,以9.82%的复合年增长率引领成长,这得益于其250°C的连续使用温度和化学惰性。碳纤维增强热塑性复合材料市场的主导地位将在对可燃性和烟雾毒性有严格规定的领域尤为突出,例如喷气发动机和海上平台。医疗设备应用将实现收益多元化,并分散各行业的风险。

成本敏感型产业依赖聚氨酯 (PU)、聚醚砜 (PES) 和聚醚酰亚胺 (PEI),这些材料以降低峰值温度来换取价格。这些树脂用于中等负载的内装面板和家用电器。目前正在研发的生物基聚醚酰亚胺 (PEI) 可以在不牺牲机械性能的情况下,增加永续性的差异化优势。树脂复合材料製造商正在添加奈米填料,以增强导电性,并在航太系统中建造整合除冰层。

碳纤维增强热塑性复合材料市场报告按原材料(PAN基、沥青基、其他)、树脂(PEEK、PU、其他)、製造工艺(模压成型、AFP/铺带、其他)、终端用户行业(航太和国防、汽车、其他)和地区(亚太地区、北美、其他)细分。市场预测以千吨为单位。

区域分析

到2024年,北美将占据36.19%的市场份额,这得益于美国航太和国防综合体以及加拿大的MRO中心的支持。东丽、赫氏和索尔维等公司在当地的布局缩短了前置作业时间,并保护了专案免受地缘政治风险的影响。 《通膨控制法》下的政府补贴鼓励了国内氢气罐的生产,从而刺激了下游需求。

到2030年,亚太地区的复合年增长率将达到9.21%,位居榜首。中国正在加大电动车产量,目前拥有多条千吨级碳纤维生产线,正在减少先前对进口的依赖。日本的先驱企业东丽和帝人正在将其产能翻一番,以支持该地区的风电和海上计划。韩国正在利用其电子技术,将EMI屏蔽复合材料整合到5G基础设施中。

欧洲市场需求强劲,但监管方面也面临新的阻力。德国汽车产业仍然是最大的消费国,但即将出台的可回收性法规正推动热塑性塑胶替代品的快速普及。荷兰热塑性复合材料研究中心支援原始设备製造商和供应商之间的研发合作。北欧风能投资和法国航太丛集抵消了一般工业需求的疲软。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 轻型电动车结构需求激增

- 加速民航机生产

- 全球更严格的排放法规和回收义务

- 在建筑业的使用日益增多

- 氢气压力容器计画快速扩大规模

- 市场限制

- 初期投资和製造成本高

- 大型热成型压机产能的局限性

- 航太供应链武器化的风险

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(数量)

- 按原料

- 聚丙烯腈(PAN)基碳纤维增强复合材料(CFRTP)

- 沥青基碳纤维增强复合材料(CFRTP)

- 其他原料(再生碳纤维等)

- 按树脂

- 聚醚醚酮(PEEK)

- 聚氨酯(PU)

- 聚醚砜(PES)

- 聚醚酰亚胺(PEI)

- 其他(聚酰胺、聚碳酸酯等)

- 按製造工艺

- 压缩/冲压成型

- 自动纤维铺放/铺带

- 射出成型和包覆成型

- 积层製造(碳纤维长丝)

- 按最终用户产业

- 航太和国防

- 车

- 建造

- 电气和电子

- 风力发电机

- 海洋

- 运动器材

- 其他最终用户产业(医疗保健等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Arkema

- ARRIS Composites, Inc.

- Avient Corporation

- BASF

- Celanese Corporation

- DuPont

- Gurit Services AG, Zurich

- Hexcel Corporation

- Markforged

- Mitsubishi Chemical Corporation

- Quickstep

- SABIC

- SGL Carbon

- Syensqo

- Teijin Limited

- Toray Industries Inc.

- Victrex plc

第七章 市场机会与未来展望

The Carbon Fiber Reinforced Thermoplastic Composite Market size is estimated at 231.14 kilotons in 2025, and is expected to reach 348.03 kilotons by 2030, at a CAGR of 8.53% during the forecast period (2025-2030).

Robust growth reflects the material's ability to pair aerospace-grade strength-to-weight ratios with full recyclability, aligning with decarbonization targets across transportation, energy, and construction. Rising electric-vehicle production, a rebound in commercial aircraft build rates, and fast-moving hydrogen storage programs form the core demand pillars. At the same time, breakthroughs in energy-efficient fiber production and additive manufacturing lower entry barriers, while regional recycling mandates open fresh revenue pools for suppliers. Competitive intensity is building as integrated incumbents defend share against regional capacity buildouts and specialist recyclers.

Global Carbon Fiber Reinforced Thermoplastic (CFRTP) Composite Market Trends and Insights

Surging Demand for Lightweight EV Structures

Automakers increase carbon fiber thermoplastic use in battery enclosures, body panels, and chassis members to extend driving range and cut charging time. The material's reversible melt behavior supports end-of-life recycling, satisfying circular-economy rules now unfolding in China and the European Union. Fleet operators benefit from easier repair because damaged parts can be reheated and reshaped instead of replaced. Tesla's application of carbon fiber composites in its humanoid robot underscores versatility beyond vehicles, suggesting spillover into multiple mobility platforms. China consumed 69,000 metric tons of carbon fiber in 2024, evidence of a deepening Asian demand base.

Accelerating Commercial Aircraft Production Ramp-ups

Airframe OEMs are rebuilding supply chains to meet higher 737 MAX and 787 Dreamliner output targets, sustaining composite demand for secondary structures that cut fuel burn. Hexcel reaffirmed investment in lightweight thermoplastic solutions in its Q1 2025 earnings report, despite lower top-line sales. The shift to more-electric aircraft fosters thermoplastic adoption because the matrix insulates wiring and integrates anti-icing heaters. European initiatives under the ThermoPlastic Composites Research Center (TPRC) accelerate certification of large-volume parts, shortening design-to-flight timelines. Superior fatigue resistance over metals lengthens service intervals, an advantage keenly valued by airlines after COVID-19 disruptions.

High Initial Investment and Manufacturing Cost

Autoclaves, compression presses, and automated fiber placement cells can top USD 30 million per line, curbing entry and slowing adoption in price-sensitive segments. SGL Carbon reported a 35.2% sales drop in its Carbon Fibers unit in 2024, citing demand swings that leave high fixed-cost assets under-utilized. Plasma + microwave heating demonstrated at the University of Limerick cuts energy up to 70%, yet commercial readiness remains several years out. Raw fiber remains costlier than aluminum or steel, keeping composites out of economy-class vehicles. Economics improve only when volumes amortize tooling, thus OEMs hesitate until downstream demand is locked.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Emission and Recyclability Mandates

- Rapid Scale-up of Hydrogen Pressure-Vessel Programs

- Limited Large-scale Thermoforming Press Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PAN-based grades delivered 78.12% of 2024 volume, underlining their entrenched production lines and aerospace heritage. High tensile modulus lets designers trim structural weight while meeting safety margins. The carbon fiber reinforced thermoplastic composite market size for PAN-based grades is projected to expand at a stable 7.9% CAGR as incumbents retrofit continuous lines for higher throughput. Cost-effective reheat cycles improve scrap rates, enhancing plant economics.

Other Raw Materials, including recycled fiber, register a 9.71% CAGR-the highest within raw materials-as end-users adopt circular procurement goals. Recycled fiber now retains 93.6% of virgin tensile strength, widening suitability for secondary load paths. Bio-sourced acrylonitrile under study by Syensqo and Trillium signals a longer-term pivot to greener feedstocks. Niche pitch-based grades serve thermal management in battery packs because of metal-like conductivity. Though volume small, premium pricing balances supply constraint, keeping margins attractive.

PEEK secured 34.51% 2024 share and leads growth at 9.82% CAGR thanks to 250 °C continuous-use temperature and chemical inertness. The carbon fiber reinforced thermoplastic composite market share advantage strengthens where flammability and smoke toxicity rules are strict, notably in jet engines and offshore platforms. Medical device usage diversifies revenue, spreading risk across sectors.

Cost-focused segments rely on PU, PES, or PEI which trade peak temperature for price. These resins feed interior panels and consumer electronics where operating loads are moderate. Bio-based PEI under exploration could add a sustainability differentiator without forfeiting mechanical properties. Resin formulators also blend nano-fillers to enhance conductivity, fostering integrated de-icing layers in aerospace systems.

The Carbon Fiber Reinforced Thermoplastic Composite Market Report is Segmented by Raw Material (PAN-Based, Pitch-Based, and More), Resin (PEEK, PU, and More), Manufacturing Process (Compression Molding, AFP/Tape Laying, and More), End-User Industry (Aerospace and Defense, Automotive, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Volume (Kilotons).

Geography Analysis

North America held 36.19% share in 2024, anchored by the United States' aerospace and defence complex and supported by Canada's MRO hubs. Local presence of Toray, Hexcel, and Solvay shortens lead times, safeguarding programs against geopolitical risk. Government grants under the Inflation Reduction Act encourage domestic hydrogen tank production, widening downstream pull.

Asia-Pacific posts the fastest 9.21% CAGR to 2030. China scales electric-vehicle output and now hosts multiple kiloton-scale carbon fiber lines, reducing earlier import dependence. Japanese pioneers Toray and Teijin double capacity to serve regional wind and marine projects. South Korea leverages electronics know-how to integrate EMI-shielding composites into 5G infrastructure.

Europe mixes strong demand with new regulatory headwinds. Germany's auto base remains the largest segment consumer, but looming recyclability rules fast-track thermoplastic substitution. The ThermoPlastic Composites Research Center in the Netherlands anchors R&D alliances across OEMs and suppliers. Nordic wind investments and French aerospace clusters offset softness in general industrial demand.

- Arkema

- ARRIS Composites, Inc.

- Avient Corporation

- BASF

- Celanese Corporation

- DuPont

- Gurit Services AG, Zurich

- Hexcel Corporation

- Markforged

- Mitsubishi Chemical Corporation

- Quickstep

- SABIC

- SGL Carbon

- Syensqo

- Teijin Limited

- Toray Industries Inc.

- Victrex plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for lightweight EV structures

- 4.2.2 Accelerating commercial aircraft production ramp-ups

- 4.2.3 Stringent global emission and recyclability mandates

- 4.2.4 Incresaing usage in the construction sector

- 4.2.5 Rapid scale-up of hydrogen pressure-vessel programs

- 4.3 Market Restraints

- 4.3.1 High initial investment and manufacturing cost

- 4.3.2 Limited large-scale thermoforming press capacity

- 4.3.3 Supply-chain weaponisation risk in aerospace

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrylonitrile (PAN)-based Carbon Fiber Reinforced Composites (CFRTP)

- 5.1.2 Pitch-based Carbon Fiber Reinforced Composites (CFRTP)

- 5.1.3 Other Raw Materials (Recycled Carbon Fibers, etc.)

- 5.2 By Resin

- 5.2.1 Polyether Ether Ketone (PEEK)

- 5.2.2 Polyurethane (PU)

- 5.2.3 PolyetherSulfone (PES)

- 5.2.4 Polyetherimide (PEI)

- 5.2.5 Others (Polyamide, Polycarbonate, etc.)

- 5.3 By Manufacturing Process

- 5.3.1 Compression and Stamp Moulding

- 5.3.2 Automated Fibre Placement / Tape Laying

- 5.3.3 Injection and Over-Moulding

- 5.3.4 Additive Manufacturing (Carbon Fiber-filled filaments)

- 5.4 By End-user Industry

- 5.4.1 Aerospace and Defence

- 5.4.2 Automotive

- 5.4.3 Construction

- 5.4.4 Electrical and Electronics

- 5.4.5 Wind Turbines

- 5.4.6 Marine

- 5.4.7 Sporting Equipments

- 5.4.8 Other End-user Industries (Healthcare, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 ARRIS Composites, Inc.

- 6.4.3 Avient Corporation

- 6.4.4 BASF

- 6.4.5 Celanese Corporation

- 6.4.6 DuPont

- 6.4.7 Gurit Services AG, Zurich

- 6.4.8 Hexcel Corporation

- 6.4.9 Markforged

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Quickstep

- 6.4.12 SABIC

- 6.4.13 SGL Carbon

- 6.4.14 Syensqo

- 6.4.15 Teijin Limited

- 6.4.16 Toray Industries Inc.

- 6.4.17 Victrex plc

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment