|

市场调查报告书

商品编码

1846214

汽车和交通运输连接器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive And Transportation Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

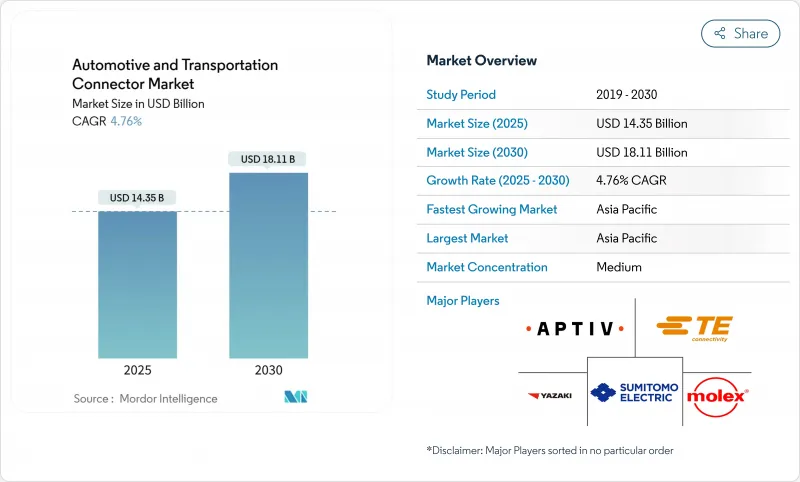

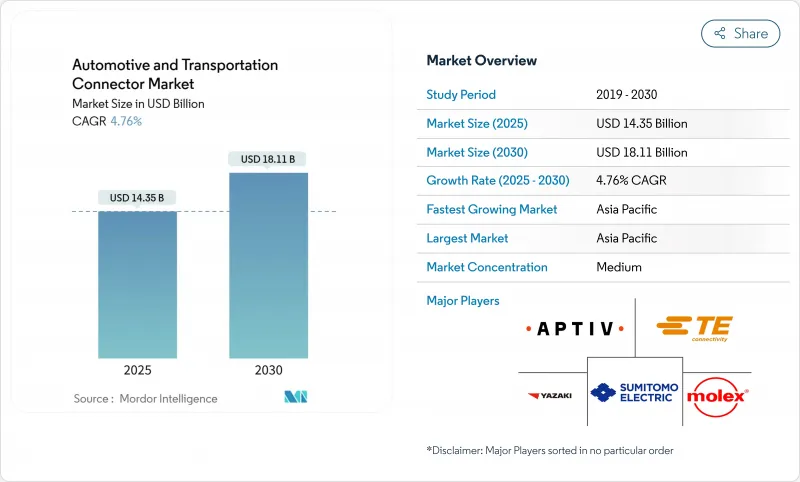

预计到 2025 年,汽车和运输连接器市场规模将达到 143.5 亿美元,到 2030 年将达到 181.1 亿美元,复合年增长率为 4.76%。

如今,推动成长的不再是销量,而是设计复杂性,这主要是为了支援高压电动动力传动系统、自动驾驶所需的多Gigabit资料交换以及快速变化的全球法令遵循。需求分为两部分:一部分是支援成熟车身线束的传统线对板接口,另一部分是分区车辆架构所需的高级高密度接口。汽车製造商向软体定义平台的转型促使他们更加关注数据速率性能,而受地缘政治因素影响的采购政策则迫使设计工程师对多个地区的供应商进行资格认证。这些因素共同推高了高可靠性密封、电磁屏蔽和温度控管等方面的开发成本,而拥有这些领域专业知识的供应商可以显着提升每辆车的价值。

全球汽车和交通运输连接器市场趋势与洞察

电气化浪潮正在刺激高压连接器的需求。

电动车所需的铜材用量几乎是同类燃油车型的三倍,这也推动了连接器电流和爬电距离设计标准的快速提升。 TE Connectivity 的 AMP+ 系列连接器已支援 800V 架构,并采用防触电外壳和最佳化的绝缘路径,可承受超过 350A 的充电电流。随着电流的不断增长,电解冷却连接器组件应运而生,以确保在超快速充电过程中的热极限。能够兼顾介电强度、抗振性和自动化生产能力的供应商,在全球电动车专案中逐渐成为首选供应商。

ADAS与资讯娱乐系统的整合推动高速资料连接器的发展

自动驾驶原型每天产生超过 4TB 的数据,因此需要连接器系统能够承受高振动,同时以低于 1dB 的插入损耗传输 20GHz 讯号。 Aptiv 的 H-MTD 微型同轴电缆产品系列可在密封的汽车外壳内满足 56Gbps 的传输要求,与传统的 FAKRA 设计相比,尺寸较小。乙太网路标准(例如 1000BASE-T1)将线束简化为单对双绞线,有助于高阶车辆实现轻量化目标。可靠的连接器电磁干扰 (EMI) 性能直接影响着基于摄影机的感测器融合的精度,而这正是 L3 级自动驾驶的基础。

铜价波动推高零件成本

据美国地质调查局称,铜供应量落后于电气化需求,矿石品位下降推高了采矿成本,预计到2024年,铜价将平均达到每吨8,490美元。因此,连接器组件成本的调整频率更高,工程团队正在测试用于非关键电源引脚的铝合金,儘管其导电性仍然较低。目前,回收铜占全球铜消费量的32%,但由于汽车级清洁度的限制,回收铜仍是一种不常见的做法。

细分市场分析

儘管线对基板设计在2024年将占总收入的39.66%,巩固了其在仪表板领域的永恆地位,但汽车和交通连接器市场目前正将研发重心放在高压组件上,预计到2030年,高压组件的复合年增长率将达到9.45%。高电流连接器将受益于工作电压为800V的碳化硅逆变器,这需要更大的爬电间隙和液冷引脚。随着雷达和摄影机数量的增加,射频和同轴连接器的重要性也再次凸显。像JAE这样的供应商正在其200A CHAdeMO插头中整合电磁锁定和紧急断开功能,以满足全球安全标准。

儘管标准ECU封装仍倾向于基板对基板夹层结构,但Zone Hardware已实现了每英吋超过120针的封装密度。将讯号和50A刀片整合于单一接头内的混合式外壳减少了SKU数量,并简化了自动化贴片流程。因此,模组整合商将连接器视为功能子系统,而非通用紧固点,从而维持了汽车和运输连接器市场的高端定价。

到2024年,车身布线和配电将占总支出的38.25%,而ADAS和自动驾驶电子设备将因摄影机、雷达和雷射雷达感测器的日益普及而以12.23%的复合年增长率增长。这一成长趋势使得ADAS连接成为专业供应商实现利润成长的最快途径。随着身临其境型显示器和无线升级需要多Gigabit骨干网,驾驶座娱乐平台也将紧跟其后。

随着电动车数量的成长,汽车和交通运输用动力传动系统和电池系统连接器的市场规模预计将同步成长,为屏蔽式高压介面的规模经济提供了广阔的空间。同时,安全模组将冗余电源引脚整合到单一外壳中,在满足 ISO 26262 诊断要求的同时,最大限度地减少了空间占用。

区域分析

亚太地区预计到2024年将占全球销售额的45.31%,这反映了其作为全球最大汽车组装基地和成长最快的电动车丛集的地位。中国整车製造商对高压连接器和电池管理连接器的需求集中,而日本和韩国则为全球高端汽车製造商提供精密闆对基板基板和同轴连接器。印尼乘用车产量预计到2024年将达到140万辆,这凸显了东南亚作为二级生产中心的崛起,并刺激了当地连接器模具製造的发展,即便美国采购法规收紧了对中国製造零件的认证标准。

北美市场对高阶卡车的需求依然强劲,尤其青睐防护等级超过IP68的密封圆形电源连接器。 《通膨抑制法案》为国内电池工厂提供奖励,刺激了高压端子的本地供应。预计加拿大铜产量将在2024年达到508,250吨,确保区域冲压厂的原料供应,从而规避价格波动风险。此外,由于美国计画于2027年实施的零件含量限制将禁止使用中国製造的车载资讯服务模组,连接器製造商也面临加速采用双重采购模式的局面。

在欧洲,先进的电动车生产面临进口车激增带来的成本压力。德国在2024年生产了135万辆电动车,但欧盟製造商当年却失去了53,669个工作机会。欧盟委员会的战略对话计画正利用「地平线」计画的资金投资于可互通的10BASE-T1S网络,以减轻线束重量;与此同时,中东和非洲的计划将利用海湾地区的智慧城市投资和南非的出口合约。英国承诺从2027年起将工业用电价格降低25%,旨在恢復连接器冲压产业的竞争力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电气化推动高压连接器的需求

- ADAS和资讯娱乐系统的整合驱动高速资料连接器

- 转型为区域E/E架构推动高密度板边连接器的发展

- 安全关键合规性(ISO 26262、UN R155)驱动可靠性需求

- 向Gigabit乙太网路和FAKRA-Mini同轴介面的迁移

- 内燃机汽车中48V子系统的兴起

- 市场限制

- 铜价波动导致零件成本增加

- 强製在地采购,限制低成本采购

- 因连接器密封和压接不良而召回

- 车载无线感测器节点的增加减少了硬布线埠的数量。

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 线对基板连接器

- 基板对基板连接器

- 线对线连接器

- 高压/电动车连接器

- 射频和同轴连接器

- 模组化/混合连接器

- 透过使用

- 安全与保障

- 车身线路和电源分配

- 驾驶座、连网和娱乐 (CCE)

- 动力传动系统和电池系统

- 高级驾驶辅助/自动驾驶

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型/大型商用车辆

- 摩托车

- 透过促销

- 内燃机汽车

- 油电混合车

- 插电式混合动力汽车

- 纯电动车

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- TE Connectivity

- Yazaki Corporation

- Aptiv PLC

- Amphenol Corporation

- Molex(Koch Industries)

- Sumitomo Electric Industries

- Lear Corporation

- Leoni AG

- Korea Electric Terminal(KET)

- Rosenberger Hochfrequenztechnik

- Luxshare Precision Industry

- JST Mfg.

- HARTING Technology Group

- Furukawa Electric

- ITT Cannon

- Hirose Electric

- Japan Aviation Electronics(JAE)

第七章 市场机会与未来展望

The automotive and transportation connector market size stands at USD 14.35 billion in 2025 and is tracking a 4.76% CAGR that will lift revenue to USD 18.11 billion by 2030.

Growth now hinges less on sheer unit volume and more on the design complexity that supports high-voltage electrified powertrains, multi-gigabit data exchange for automated driving, and fast-evolving global compliance regimes. Demand bifurcates between legacy wire-to-board formats that anchor mature body-wiring looms and advanced high-density interfaces required for zonal vehicle architectures. Automakers' shift to software-defined platforms keeps data-rate performance in focus, while sourcing policies shaped by geopolitical concerns push design engineers to qualify multiple regional supply bases. These crosscurrents elevate development spending on high-reliability seals, electromagnetic shielding, and thermal management, allowing suppliers that master these disciplines to capture outsized value per vehicle.

Global Automotive And Transportation Connector Market Trends and Insights

Electrification Surge Spurring High-Voltage Connector Demand

Electric vehicles require nearly three times more copper than comparable combustion models, driving a parallel jump in connector amperage and creepage design discipline. TE Connectivity's AMP+ range already supports 800 V architectures, using touch-safe housings and optimized insulation paths that withstand charging currents above 350 A . Immersion-cooled connector assemblies are emerging as currents climb, ensuring thermal limits during ultra-fast charging sessions. Suppliers capable of balancing dielectric strength, vibration resistance, and automated manufacturability gain preferred-source status among global EV programs.

ADAS and Infotainment Integration Driving High-Speed Data Connectors

Autonomous prototypes generate over 4 TB of data per day, dictating connector systems that endure high vibration while transmitting 20 GHz signals at under-1 dB insertion loss. Aptiv's H-MTD miniature coax family meets 56 Gbps requirements within a sealed automotive housing, shrinking footprint versus legacy FAKRA designs. Ethernet shifts such as 1000BASE-T1 simplify wiring harnesses to a single twisted pair, supporting weight reduction targets on premium vehicles. Reliable connector EMI performance directly shapes camera-based sensor fusion accuracy that underpins level-3 autonomy.

Copper-Price Volatility Inflating BOM Costs

Global copper supply lags electrification demand, and the US Geological Survey notes declining ore grades lift extraction costs, contributing to price swings that averaged USD 8,490 per tonne in 2024. Connector bills of material are therefore indexed more frequently, and engineering teams test aluminum alloys for non-critical power pins even though conductivity remains lower. Recycling now covers 32% of worldwide copper consumption, but automotive-grade cleanliness limits still confine the practice .

Other drivers and restraints analyzed in the detailed report include:

- Shift to Zonal Architectures Boosting High-Density Board-Edge Connectors

- Safety-Critical Compliance Heightening Reliability Needs

- Local-Sourcing Mandates Limiting Procurement Flexibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wire-to-board designs kept 39.66% of 2024 revenue, confirming their evergreen role in instrumentation panels, yet the automotive and transportation connector market now directs major R&D toward high-voltage assemblies that will grow 9.45% CAGR to 2030. The high-current category benefits from silicon-carbide inverters operating at 800 V, which demand reinforced creepage gaps and liquid-cooled pins. RF & coax connectors also gain renewed relevance as radar and camera counts increase. Suppliers such as JAE incorporate electromagnetic locks and emergency unmating in 200 A CHAdeMO plugs to satisfy global safety codes.

Standard ECU packaging still leans on board-to-board mezzanine decks, but zonal hardware elevates density beyond 120 pins per inch. Hybrid housings that mix signal and 50 A blades inside one header reduce SKU count and simplify automated pick-and-place. As a result, module integrators now treat the connector as a functional sub-system rather than a commodity fastening point, sustaining premium pricing inside the automotive and transportation connector market.

Body wiring and power distribution commanded 38.25% of 2024 spend, yet ADAS and autonomous electronics will log a 12.23% CAGR as camera, radar, and lidar sensor proliferation intensifies. That uptrend positions ADAS connectivity as the fastest pathway to margin expansion for specialized suppliers. Cockpit entertainment platforms follow closely because immersive displays and over-the-air upgrades need multi-gigabit backbones.

The automotive and transportation connector market size for powertrain and battery systems is projected to climb in tandem with EV unit growth, opening space for scale economies on shielded high-voltage interfaces. Meanwhile, safety-security modules integrate redundant power pins within a single housing, limiting space overhead while meeting ISO 26262 diagnostics requirements.

The Automotive and Transportation Connector Market Report is Segmented by Product Type (Wire-To-Board Connectors, Board-To-Board Connectors, and More), Application (Safety and Security, Body Wiring and Power Distribution, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion, Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 45.31% of 2024 revenue, reflecting its position as both the world's largest vehicle assembly hub and the fastest-growing electric-mobility cluster. Chinese OEMs generate concentrated demand for high-voltage and battery-management connectors, while Japan and Korea supply precision board-to-board and coaxial formats for global premium nameplates. Indonesia's passenger-car output of 1.4 million units in 2024 underscored Southeast Asia's rise as a secondary production base that stimulates local connector tooling even as US sourcing rules tighten qualification paths for Chinese-made parts.

North America maintains premium-truck demand that favors sealed circular power connectors rated beyond IP68. The Inflation Reduction Act channels incentives into domestic battery plants, spurring localized high-voltage terminal supply. Canadian copper output of 508,250 tonnes in 2024 shores up raw-material availability for regional stamping operations that hedge price shocks. Connector makers also confront upcoming U.S. content rules slated for 2027 that bar Chinese telematics modules, accelerating dual-source qualifications.

Europe combines advanced EV production with cost pressure from surging imports. Germany built 1.35 million electric cars in 2024, yet EU manufacturers lost 53,669 jobs in the same year. The European Commission's Strategic Dialogue is funneling Horizon funds into interoperable 10BASE-T1S networking to cut harness weight, while Middle East and African projects tap Gulf smart-city investments and South-African export contracts. The UK's pledge to lower industrial power tariffs by 25% from 2027 aims to restore connector stamping competitiveness.

- TE Connectivity

- Yazaki Corporation

- Aptiv PLC

- Amphenol Corporation

- Molex (Koch Industries)

- Sumitomo Electric Industries

- Lear Corporation

- Leoni AG

- Korea Electric Terminal (KET)

- Rosenberger Hochfrequenztechnik

- Luxshare Precision Industry

- JST Mfg.

- HARTING Technology Group

- Furukawa Electric

- ITT Cannon

- Hirose Electric

- Japan Aviation Electronics (JAE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification Surge Spurring High-Voltage Connector Demand

- 4.2.2 ADAS and Infotainment Integration Driving High-Speed Data Connectors

- 4.2.3 Shift to Zonal E/E Architectures Boosting High-Density Board-Edge Connectors

- 4.2.4 Safety-Critical Compliance (ISO 26262, UN R155) Heightening Reliability Needs

- 4.2.5 Migration to Gigabit Ethernet and FAKRA-Mini Coax Interfaces

- 4.2.6 Emerging 48 V Sub-Systems in ICE Vehicles

- 4.3 Market Restraints

- 4.3.1 Copper-Price Volatility Inflating BOM Costs

- 4.3.2 Local-Sourcing Mandates Limiting Low-Cost Procurement

- 4.3.3 Recalls from Connector Seal or Crimp Failures

- 4.3.4 Rising In-Vehicle Wireless Sensor Nodes Reducing Hard-Wired Ports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Wire-to-Board Connectors

- 5.1.2 Board-to-Board Connectors

- 5.1.3 Wire-to-Wire Connectors

- 5.1.4 High-Voltage/EV Connectors

- 5.1.5 RF & Coax Connectors

- 5.1.6 Modular/Hybrid Connectors

- 5.2 By Application

- 5.2.1 Safety and Security

- 5.2.2 Body Wiring and Power Distribution

- 5.2.3 Cockpit, Connectivity and Entertainment (CCE)

- 5.2.4 Powertrain and Battery Systems

- 5.2.5 Advanced Driver-Assistance/Autonomous

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Two-Wheelers

- 5.4 By Propulsion

- 5.4.1 Internal-Combustion Engine Vehicles

- 5.4.2 Hybrid Electric Vehicles

- 5.4.3 Plug-in Hybrid Electric Vehicles

- 5.4.4 Battery Electric Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Amphenol Corporation

- 6.4.5 Molex (Koch Industries)

- 6.4.6 Sumitomo Electric Industries

- 6.4.7 Lear Corporation

- 6.4.8 Leoni AG

- 6.4.9 Korea Electric Terminal (KET)

- 6.4.10 Rosenberger Hochfrequenztechnik

- 6.4.11 Luxshare Precision Industry

- 6.4.12 JST Mfg.

- 6.4.13 HARTING Technology Group

- 6.4.14 Furukawa Electric

- 6.4.15 ITT Cannon

- 6.4.16 Hirose Electric

- 6.4.17 Japan Aviation Electronics (JAE)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment