|

市场调查报告书

商品编码

1851237

汽车连接器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

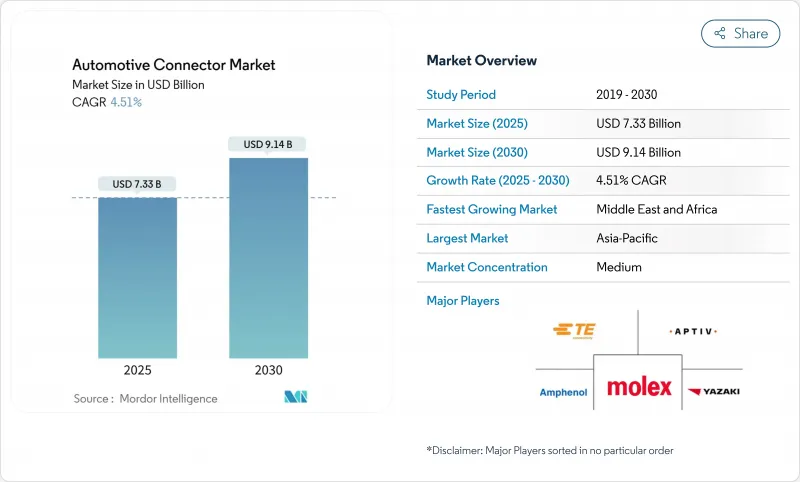

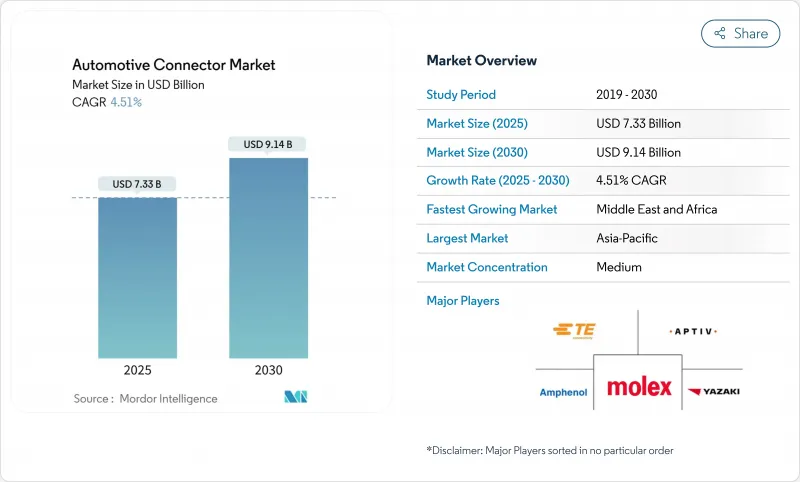

预计到 2025 年,汽车连接器市场规模将达到 73.3 亿美元。

预计到 2030 年,该市场规模将达到 91.4 亿美元,年复合成长率为 4.51%,因为汽车平台正在向电气化和软体定义架构转型。

这是因为与内燃机动力传动系统相关的需求趋于平稳,而高压高速资料互连的需求却在不断增长。从分散式ECU向分区电子结构的转变正在缩短线束长度并减轻车辆重量。日益复杂的连接器使那些不具备高密度混合讯号能力的传统供应商面临被淘汰的风险。更严格的安全法规、资料丰富的ADAS功能以及800V电池系统正在推动对密封式高性能介面的需求成长,这些介面能够传输电力和多Gigabit讯号,同时满足IP67/IP6K9K标准。随着OEM厂商对容错链路、空中升级和网路安全资料路径的需求不断增长,那些能够将半导体级製造精度与软体整合支援相结合的供应商将成为最终的赢家。

全球汽车连接器市场趋势与洞察

加速电气化和高压电动动力传动系统总成

向 48V 和 800V 电气架构的转变从根本上改变了连接器的要求,以支援电动涡轮增压、能量回收煞车以及超越传统 12V 系统的高功率充电功能。 Aptiv 的高压互连产品目前支援 400V 至 1000V 的电压范围,电流承载能力高达 250A,满足了产业向更快充电和更高效率转型的需求。

48V轻混系统的出现带来了双电压架构的挑战,对连接器提出了更高的要求,以安全地分离和管理12V旧有系统和48V电源传输网路。 TE Connectivity的AMP+HVA 280系统正是这一发展趋势的体现,它整合了高压互锁和两级浮动锁存器,可在高达850V的应用中提供更高的安全性。随着这股电气化浪潮从乘用车扩展到商用车,伊顿的电源连接解决方案能够实现大型应用中的高效能传输,并支援更广泛的交通电气化需求。在单一车辆内管理多个电压域的复杂性,推动了对能够保持隔离、提供诊断功能并确保在各种运行条件下故障安全运行的精密连接器系统的需求。

加强全球安全和排放法规

法律规范日益强制要求配备先进的安全系统,例如欧盟要求新车必须具备自动紧急煞车和前向碰撞警报,这直接推动了连接器对感测器整合和即时数据处理的需求。美国国家公路交通安全管理局 (NHTSA) 推动的车对车通讯标准也对能够支援 5.9GHz DSRC 和蜂窝 V2X通讯协定的高频率、低延迟连接器提出了新的要求。 CISPR 25 电磁相容性标准也日益严格,尤其是在 10GHz 以上的传导辐射方面,这迫使连接器製造商整合先进的屏蔽和滤波功能。

随着软体定义汽车的普及,这些需求也日益凸显,因为空中升级和持续监控系统需要具备更高讯号完整性和网路安全安全功能的连接器。中国的新能源汽车指令和加州的先进清洁汽车II法规在连接器规格方面造成了区域差异,尤其是在电池管理系统和充电基础设施方面,这迫使全球供应商开发能够适应不同法规环境且兼顾成本效益的平台灵活解决方案。

铜和金属商品价格波动剧烈

供应紧张以及可再生能源和电动汽车行业需求的激增推高了铜价,给汽车连接器供应链带来了巨大的成本压力。电动车所需的铜远高于传统的内燃机汽车,每辆电动车大约需要83公斤铜,而传统汽车只需23公斤。 Copperweld的双金属解决方案,包括铜包铝和铜包钢导体,预计在保持电气性能的同时,将铜的使用量减少高达83%。铜矿开采集中在政治不稳定的地区,进一步加剧了供应链风险。同时,贸易摩擦和出口限制进一步加剧了价格波动,迫使汽车原始设备製造商(OEM)实施套期保值策略和签订长期供应合同,这可能会限制其在连接器采购和设计优化方面的灵活性。

细分市场分析

到2024年,动力传动系统应用仍将占据汽车连接器市场33.60%的最大份额,这反映出引擎管理、变速箱控制和燃油喷射系统在内燃机和混合动力传动系统中仍然至关重要。然而,在监管机构对先进安全功能的要求以及行业向更高水平车辆自动化迈进的推动下,高级驾驶辅助系统(ADAS)和自动驾驶系统将成为增长最快的细分市场,2025年至2030年的复合年增长率将达到17.8%。

随着安全气囊系统、电子稳定控制系统和碰撞避免技术的日益集成,安全应用将受益匪浅。同时,车身线束和配电系统也将适应区域架构的实施,将多种功能整合到更少、更精密的控制单元中。随着消费者对高阶配置的期望在所有车型领域不断提高,舒适性、便利性和娱乐系统也将稳步成长。同时,导航和仪表应用也将不断发展,以支援高解析度显示器和扩增实境介面。

电动车专用充电和能量管理应用的出现,代表着传统汽车连接器市场中一个全新的类别,凸显了产业向电动动力传动系统总成转型的根本性转变。这种细分市场的转变反映了汽车系统从机械系统向电子系统的更广泛过渡,传统的动力传动系统,因为这些系统需要同时即时处理来自多个感测器来源的资料。

到2024年,乘用车将占据汽车连接器市场54.20%的份额,这得益于其高产量和单车电子含量的不断提高。然而,摩托车将成为成长最快的细分市场,到2030年复合年增长率将达到11.5%。轻型商用车的需求将保持稳定,这主要得益于电子商务的成长和最后一公里配送的最佳化。同时,中型和重型商用车对先进车载资讯服务和车辆管理系统的需求日益增长,这需要坚固耐用、高性能的连接器解决方案。这些应用需要达到IP67/IP6K9K防护等级,并且能够在远超乘用车要求的极端温度范围内运行,因此商用车领域正在推动连接器耐久性和环境适应性的创新。

摩托车的成长反映了都市化趋势以及监管机构对拥挤城市中心电动交通的支持,从而催生了对小型、轻巧且针对空间受限应用优化的连接器的需求。随着营运商努力降低营运成本并遵守排放法规,商用车电气化正在加速。这推动了对支援快速充电和高能量密度电池系统的高压连接器的需求。随着自动驾驶技术沿着不同的发展路径前进,乘用车和商用车之间的差异将变得越来越重要,由于可控的驾驶环境和专用基础设施投资,商用车应用可能会更快地实现更高水准的自动化。

区域分析

亚太地区将继续保持领先地位,预计到2024年将占据汽车连接器市场38.60%的份额。这主要得益于其密集的电子供应链、全球最大的汽车产量以及各国支持电动车和电动巴士的政策。中国汽车製造商正在自主生产线束,并邀请二线连接器厂商在技术转移条款的框架下成立本地合资企业。日本现有企业正在推广CASE项目,例如住友商事的“30VISION”,并推出针对800V平台优化的紧凑型、低插入力连接器。韩国供应商正将其电池技术应用于支援电芯到电池组架构的大电流基板端子。东南亚国家通用压接的人事费用较低,但由于市场对能够抵御热带暴雨的IP67防护等级连接器的需求不断增长,东南亚汽车连接器市场正在价格分布扩张。

中东和非洲地区目前规模较小,但随着主权财富基金建造电动车工厂和充电走廊,预计2030年将达到15.20%的复合年增长率。沙乌地阿拉伯正在培育电动车丛集,并优先在当地采购高压电缆。利奥尼位于阿加迪尔的新工厂代表了北非地区线束产业的发展动能。极端高温和粉尘环境推动了对耐高温液晶聚合物(LCP)外壳和增强型垫片法兰的需求。区域性含量法规鼓励跨国公司对国产聚合物化合物进行认证,这提高了灵活性,但也增加了重复检验的必要性。

北美和欧洲是成熟且充满创新活力的地区。美国原始设备製造商 (OEM) 正在将免手动 3 级晶片组整合到高阶车型中,推动了 20Gbps 板级连接器和硅级洁净室製程的供应。欧洲的气候目标正在加速 400kW 快速充电站的建设,并强制要求使用内建温度感测器的 1000V 接触器。 TE Connectivity 的绿色库存计划可重复利用过剩库存,从而减少废弃物掩埋和碳排放。 2024 年供应链衝击促使镀锡和塑胶成型製程回流国内,确保了汽车连接器市场的策略自主性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速电气化和更高电压的电动动力传动系统

- 快速普及ADAS和自动驾驶功能

- 软体定义车辆需要高速资料链路。

- 加强全球安全和排放法规

- 向分区式电子/电气架构的转变将推动更高密度连接器的发展。

- 车载资讯娱乐和连接单元的普及

- 市场限制

- 铜和金属商品价格波动

- 高性能树脂(PPS、LCP)短缺

- 严苛汽车环境下的可靠性挑战

- 超过 10Gbps 讯号传输速度下的电磁干扰合规性挑战

- 价值/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(单位:美元)

- 透过使用

- 动力传动系统

- 安全保障

- 车身线路和电源分配

- 舒适、便利和娱乐

- 导航与仪器

- 高级驾驶辅助系统与自主系统

- 充电和能源管理(电动车)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车辆

- 摩托车

- 巴士和长途客车

- 依推进类型

- 内燃机(ICE)汽车

- 混合动力电动车(HEV)

- 插电式混合动力汽车(PHEV)

- 电池电动车(BEV)

- 燃料电池电动车(FCEV)

- 依连接器类型

- 线对线

- 线对基板

- 基板

- iO 和循环

- FFC/FPC 和微型

- 高速/高电压

- 连接密封件不包含在内

- 密封

- 不防水

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 印尼

- 越南

- 菲律宾

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc.(Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- JST Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

第七章 市场机会与未来展望

The automotive connector market size stands at USD 7.33 billion in 2025. It is forecast to reach USD 9.14 billion by 2030, advancing at a 4.51% CAGR as vehicle platforms move toward electrified and software-defined architectures.

Growth remains moderate on the surface, yet the mix changes quickly: demand linked to internal-combustion powertrains plateaus while high-voltage and high-speed data interconnects scale up. The shift from distributed ECUs to zonal electronic structures compresses harness length, trimming vehicle weight. It raises connector complexity, creating displacement risk for legacy suppliers that lack high-density, mixed-signal capabilities. Rigorous safety regulations, data-rich ADAS features, and 800 V battery systems propel orders for sealed, high-performance interfaces that carry power and multi-gigabit signals while meeting IP67/IP6K9K ratings. Suppliers that combine semiconductor-grade manufacturing precision with software integration support are positioned to win as OEMs demand fault-tolerant links, over-the-air updatability, and cyber-secure data paths.

Global Automotive Connector Market Trends and Insights

Accelerating Electrification and Higher-Voltage E-Powertrains

The transition to 48V and 800V electrical architectures fundamentally reshapes connector requirements, moving beyond traditional 12V systems to support electric turbocharging, regenerative braking, and high-power charging capabilities. Aptiv's high-voltage interconnects now support voltage ranges from 400V to 1000V with current capacities up to 250A, addressing the industry's shift toward faster charging and improved efficiency.

The emergence of 48V mild hybrid systems creates a dual-voltage architecture challenge, requiring connectors to safely isolate and manage 12V legacy systems and 48V power delivery networks. TE Connectivity's AMP+ HVA 280 system exemplifies this evolution, featuring integrated high-voltage interlocks and two-stage floating latches for enhanced safety in applications up to 850V. This electrification wave extends beyond passenger vehicles to commercial fleets, where Eaton's power connection solutions enable efficient energy transfer in heavy-duty applications, supporting the broader transportation electrification mandate. The complexity of managing multiple voltage domains within a single vehicle drives demand for sophisticated connector systems that can maintain isolation, provide diagnostic capabilities, and ensure fail-safe operation across diverse operating conditions.

Stricter Global Safety and Emission Mandates

Regulatory frameworks increasingly mandate advanced safety systems, with the EU requiring autonomous emergency braking and forward collision warning in new vehicles, directly driving connector demand for sensor integration and real-time data processing. The NHTSA's push for vehicle-to-vehicle communication standards creates new requirements for high-frequency, low-latency connectors capable of supporting 5.9 GHz DSRC and cellular V2X protocols. CISPR 25 electromagnetic compatibility standards have become increasingly stringent, particularly for conducted emissions above 10 GHz, forcing connector manufacturers to integrate advanced shielding and filtering capabilities.

The shift toward software-defined vehicles amplifies these requirements, as over-the-air updates and continuous monitoring systems demand connectors with enhanced signal integrity and cybersecurity features. China's New Energy Vehicle mandate and California's Advanced Clean Cars II regulation create regional variations in connector specifications, particularly for battery management systems and charging infrastructure, requiring global suppliers to develop platform-flexible solutions that can adapt to diverse regulatory environments while maintaining cost efficiency.

Volatile Copper and Metal Commodity Prices

Copper prices are rising, driven by supply constraints and surging demand from renewable energy and electric vehicle sectors, creating significant cost pressures across the automotive connector supply chain. Electric vehicles require significantly more copper than traditional ICE vehicles, with each EV containing approximately 83 kilograms of copper compared to 23 kilograms in conventional vehicles, amplifying the impact of price volatility on automotive connector costs. Copperweld's bimetallic solutions, including Copper-Clad Aluminum and Copper-Clad Steel conductors, offer potential alternatives that can reduce copper usage by up to 83% while maintaining electrical performance characteristics. The concentration of copper mining in politically unstable regions creates additional supply chain risks. At the same time, trade tensions and export restrictions further exacerbate price volatility, forcing automotive OEMs to implement hedging strategies and long-term supply contracts that may limit flexibility in connector sourcing and design optimization.

Other drivers and restraints analyzed in the detailed report include:

- Surge in In-Vehicle Infotainment and Connectivity Units

- Rapid ADAS and Autonomous Functionality Penetration

- Shortage of High-Performance Resins (PPS, LCP)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powertrain applications maintain the largest market share at 33.60% of the automotive connector market size in 2024, reflecting the continued importance of engine management, transmission control, and fuel injection systems across both ICE and hybrid powertrains. However, ADAS and autonomous systems emerge as the fastest-growing segment at 17.8% CAGR from 2025-2030, driven by regulatory mandates for advanced safety features and the industry's progression toward higher levels of vehicle automation.

Safety and security applications benefit from the increasing integration of airbag systems, electronic stability control, and collision avoidance technologies. At the same time, body wiring and power distribution segments adapt to zonal architecture implementations that consolidate multiple functions into fewer, more sophisticated control units. Comfort, convenience, and entertainment systems experience steady growth as consumer expectations for premium features expand across all vehicle segments. At the same time, navigation and instrumentation applications evolve to support high-resolution displays and augmented reality interfaces.

The emergence of charging and energy management applications specifically for electric vehicles represents a new category that didn't exist in traditional automotive connector markets, highlighting the industry's fundamental transformation toward electrified powertrains. This segmentation shift reflects the broader transition from mechanical to electronic vehicle systems, where traditional powertrain connectors face displacement by high-voltage, high-current solutions capable of managing battery systems, DC-DC converters, and regenerative braking networks. The rapid growth in ADAS applications creates opportunities for connector suppliers with expertise in high-frequency, low-latency transmission, as these systems require real-time processing of sensor data from multiple sources simultaneously.

Passenger cars command 54.20% of the automotive connector market share in 2024, benefiting from high production volumes and increasing electronic content per vehicle. Yet, two-wheelers represent the fastest-growing segment at 11.5% CAGR through 2030. Light commercial vehicles maintain steady demand driven by e-commerce growth and last-mile delivery optimization. Meanwhile, medium and heavy commercial vehicles increasingly adopt advanced telematics and fleet management systems that require ruggedized, high-performance connector solutions. The commercial vehicle segments drive innovation in connector durability and environmental resistance, as these applications demand IP67/IP6K9K ratings and operation across extreme temperature ranges that exceed passenger car requirements.

The growth in two-wheelers reflects urbanization trends and regulatory support for electric transportation in congested city centers, creating demand for compact, lightweight connectors optimized for space-constrained applications. Commercial vehicle electrification accelerates as fleet operators seek to reduce operating costs and meet emission regulations. This drives demand for high-voltage connectors supporting rapid charging and energy-dense battery systems. The segmentation between passenger and commercial vehicles becomes increasingly relevant as autonomous driving technologies develop along different trajectories, with commercial applications potentially achieving higher automation levels sooner due to controlled operating environments and dedicated infrastructure investments.

The Automotive Connector Market Report is Segmented by Application (Powertrain, Safety and Security, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE Vehicles, Hybrid Electric Vehicles, and More), Connector Type (Wire-To-Wire, Wire-To-Board, and More), Connection Sealing (Sealed and Unsealed), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 38.60% of the automotive connector market revenue in 2024, thanks to dense electronics supply chains, the world's highest vehicle output, and state policies favoring electric cars and buses. Chinese OEMs build zonal harnesses in-house, pulling tier-two connector makers into local joint ventures under technology-transfer clauses. Japanese incumbents pursue CASE programs such as Sumitomo's "30VISION," launching compact, low-insertion-force models optimized for 800 V platforms. Korean suppliers channel battery know-how into high-current board terminals that support cell-to-pack architectures. Southeast Asian nations offer lower labor costs for commodity crimping yet increasingly demand IP67 ratings for tropical downpours, widening the automotive connector market across price tiers.

The Middle East and Africa, while small today, are poised for a 15.20% CAGR through 2030 as sovereign wealth funds seed electric-vehicle plants and charging corridors. Saudi Arabia bankrolls EV clusters and sources high-voltage cabling locally; Leoni's new Agadir plant exemplifies North-African wire harness momentum. Harsh heat and dust provoke demand for high-temperature LCP housings and reinforced gasket flanges. Regional content rules push multinationals to qualify domestic polymer compounds, adding resilience yet demanding duplicate validation runs.

North America and Europe represent mature but innovation-rich arenas. United States OEMs integrate hands-free Level 3 stacks on premium trims, spurring the supply of 20 Gbps board connectors and silicon-grade cleanroom processes. Europe's climate targets accelerate 400 kW fast-charge hubs, obliging 1,000 V contactors with embedded temperature sensors. Both regions chase circular-economy mandates; TE Connectivity's Green Stock program repurposes excess inventory, cutting landfill waste and carbon footprints. Supply chain shocks during 2024 catalyzed the on-shoring of tin plating and plastic molding to secure strategic autonomy within the automotive connector market.

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc. (Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- J.S.T. Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating electrification and higher-voltage e-powertrains

- 4.2.2 Rapid ADAS and autonomous functionality penetration

- 4.2.3 Software-defined vehicles requiring high-speed data links

- 4.2.4 Stricter global safety and emission mandates

- 4.2.5 Shift to zonal e/e architectures driving high-density connectors

- 4.2.6 Surge in in-vehicle infotainment and connectivity units

- 4.3 Market Restraints

- 4.3.1 Volatile copper and metal commodity prices

- 4.3.2 Shortage of high-performance resins (PPS, LCP)

- 4.3.3 Reliability challenges in harsh automotive environments

- 4.3.4 EMI compliance hurdles at more than 10 Gbps signal speeds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Powertrain

- 5.1.2 Safety and Security

- 5.1.3 Body Wiring and Power Distribution

- 5.1.4 Comfort, Convenience and Entertainment

- 5.1.5 Navigation and Instrumentation

- 5.1.6 ADAS and Autonomous Systems

- 5.1.7 Charging and Energy Management (EV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.2.5 Bus and Coach

- 5.3 By Propulsion Type

- 5.3.1 Internal Combustion Engine (ICE) Vehicles

- 5.3.2 Hybrid Electric Vehicles (HEV)

- 5.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.3.4 Battery Electric Vehicles (BEV)

- 5.3.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.4 By Connector Type

- 5.4.1 Wire-to-Wire

- 5.4.2 Wire-to-Board

- 5.4.3 Board-to-Board

- 5.4.4 I/O and Circular

- 5.4.5 FFC/FPC and Micro

- 5.4.6 High-Speed / High-Voltage

- 5.5 By Connection Sealing

- 5.5.1 Sealed

- 5.5.2 Unsealed

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity Ltd

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Molex Inc. (Koch Industries)

- 6.4.5 Sumitomo Wiring Systems Ltd

- 6.4.6 Luxshare Precision Industry Co., Ltd

- 6.4.7 Hirose Electric Co., Ltd

- 6.4.8 J.S.T. Mfg Co., Ltd

- 6.4.9 Amphenol Corporation

- 6.4.10 Furukawa Electric Co., Ltd

- 6.4.11 Rosenberger Hochfrequenztechnik GmbH

- 6.4.12 Leoni AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment