|

市场调查报告书

商品编码

1848035

英国农业机械:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United Kingdom Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

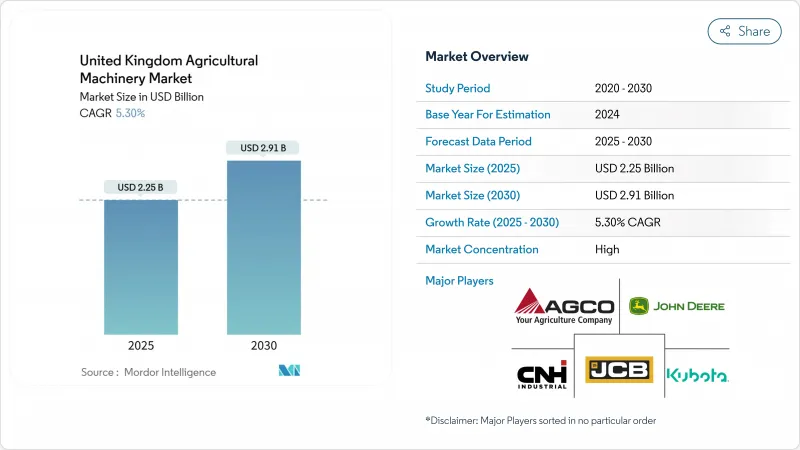

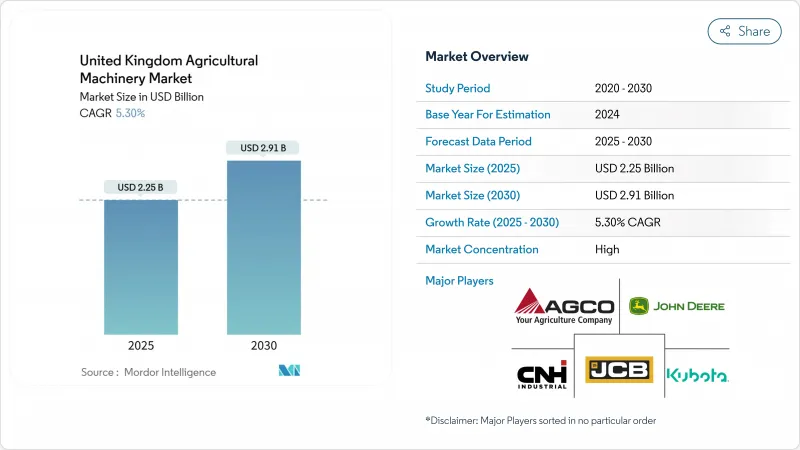

英国农业机械市场预计到 2025 年将达到 22.5 亿美元,到 2030 年将达到 29.1 亿美元,在预测期内将以 5.3% 的强劲复合年增长率成长。

这一上升趋势凸显了该行业在英国脱欧后的限制、持续的劳动力短缺以及农场自动化加速发展等挑战下的韧性。未来五年,农业设备和技术基金将促进机械采购。该基金是一项5,000万英镑(约6,300万美元)的津贴计划,可直接抵销提高生产力机械的购买成本。清洁能源2030行动计画也将影响需求,对低排放气体和氢动力拖拉机的投资将协助英国在2030年实现净零排放目标。同时,在智慧机器2035策略的支持下,农业机器人测试基地的扩建正在促进快速原型开发,并吸引各研究丛集之间的技术合作。

英国农业机械市场趋势与洞察

劳动力短缺加速了机械化进程

英国超过40%的农场报告劳动力短缺,这一数字推动了对可替代人工的自主和半自动机器的资本支出。季节性工人签证已延长至2029年,惠及4.5万名工人,同时政府政策也投资5,000万英镑(约6,300万美元)用于自动化,以减少对移民劳工的长期依赖。 Fieldwork Robotics公司的覆盆子采摘系统展示了连续运作和媲美人类的作业效率如何改变商业格局,使机器人技术更具优势。不断上涨的劳动成本促使人们对能够长时间运作且只需少量人工干预的设备提出更高的要求,从而增强了英国农业机械市场的需求。

政府对农业机械的补贴和税收优惠

农业设备与技术基金将为每位申请者提供1,000至25,000英镑(1,250至31,250美元)的资助,而提高农场生产力计划将为机器人和精准系统津贴高达500,000英镑(625,000美元)的资助。每项津贴项目必须使用五年,从而为设备供应商提供可预测的需求週期。津贴评分框架优先考虑碳减排和动物福利指标,引导采购倾向于配备丰富感测器的农机具、自动导航系统和低压缩解决方案。这些奖励将直接促进英国农业机械市场的整体设备周转率,尤其有利于那些历来推迟大额投资的中小农。

较高的初始投资和维护成本

英格兰及威尔斯特许会计师协会指出,儘管现金流良好,大型生产商仍在推迟机械采购,反映出单位成本上升和资金筹措收紧。 AGCO公司2025年第一季营收下降30%,显示注重成本的买家正在削减资本预算。由于现代联合收割机和拖拉机需要专用诊断软体、云端服务订阅和专业技术人员,维护负担日益加重。即使有津贴,生命週期成本对许多小型企业来说仍然难以承受,这导致英国农业机械市场扩张的预期下降。

细分市场分析

到2024年,拖拉机将占英国农业机械市场的55.2%。该细分市场的成长仍然与设备更换和马力升级密切相关,自动驾驶和远端资讯处理技术的整合将成为标配。在拖拉机市场中,100马力以下的车型占据了大部分销量,但马力更高的车型(150马力以上)由于其高价和全端式技术,获得了不成比例的收入份额。迪尔公司所占的多数市占率凸显了整合导航、互联互通和售后服务网路对于降低英国农业机械市场整体拥有成本的重要性。

预计到2030年,灌溉设备将以8.2%的复合年增长率实现最强劲的成长,这直接源自于降雨量的不确定性和日益严格的取水许可製度。中心支轴式喷灌系统结合土壤湿度感测器,有助于农场遵守英国环境署的水资源管理指令,而滴灌技术在高价值园艺领域也日益普及。精准灌溉透过减少径流和投入浪费,协助实现生态再生目标,凸显了气候变迁如何推动英国农业机械市场的产品多元化。收割机、牧草设备和耕耘机的需求也保持稳定,但农场日益重视水资源管理才是推动灌溉设备成长的主要动力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 劳动力短缺加速了机械化进程

- 政府对农业机械的补贴和税收优惠

- 精密农业数位化需求

- 可再生农业奖励推动对低压缩设备的需求

- 扩大农业机器人测试场地将促进原型的应用。

- 净零排放电气化政策推动电动拖拉机销售

- 市场限制

- 高昂的初始成本和维修成本

- 互联机械的网路安全与资料隐私风险

- 由于农村地区电网容量有限,导致电气设备引进延迟

- 英国脱欧后认证的差距可能会增加合规成本。

- 监管状态

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 按机器类型

- 联结机

- 不到50马力

- 50-100马力

- 100-150马力

- 150马力或以上

- 装置

- 犁

- 光环

- 耕耘机和耕耘机

- 其他设备(播种机、滚筒等)

- 灌溉机械

- 喷水灌溉

- 滴灌

- 其他灌溉设备(中心支轴式喷灌系统、微型喷灌等)

- 收割机

- 联合收割机

- 饲料收割机

- 其他收割机(马铃薯收割机、甜菜收割机等)

- 干草和饲料机械

- 割草机和压扁机

- 打包机

- 其他干草饲料机械(耙草机、翻晒机)

- 其他机械

- 联结机

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Claas KGaA mbH

- JC Bamford Excavators Ltd.

- Kuhn Group(Bucher Industries AG)

- SDF Group SpA

- Bernard Krone Holding SE & Co. KG

- Horsch Maschinen GmbH

- Amazone-Werke H. Dreyer SE & Co. KG

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- LEMKEN GmbH & Co. KG

- Vaderstad Group

第七章 市场机会与未来展望

The United Kingdom agricultural machinery market size stands at USD 2.25 billion in 2025 and is projected to advance to USD 2.91 billion by 2030, delivering a steady 5.3% CAGR during the forecast period.

This upward trajectory underscores the sector's resilience amid post-Brexit regulation, persistent labor shortages, and accelerating on-farm automation. Over the next five years, equipment purchases will be buoyed by the Farming Equipment and Technology Fund, a GBP 50 million (USD 63 million) grant program that directly offsets capital costs for productivity-enhancing machinery. Demand is also influenced by the Clean Power 2030 Action Plan, which channels investment toward low-emission electric and hydrogen tractors that help farms meet the national net-zero target for 2030. Meanwhile, the Expansion of agri-robotics testbeds, supported by the Smart Machines Strategy 2035, is fostering rapid prototype adoption and attracting technology partnerships across research clusters.

United Kingdom Agricultural Machinery Market Trends and Insights

Shortage of labor accelerating mechanization

More than 40% of British farms report an insufficient workforce, a figure that has intensified capital outlays toward autonomous and semi-autonomous machinery capable of substituting manual labor. Seasonal-worker visas have been extended to 45,000 positions through 2029, yet government policy is simultaneously investing GBP 50 million (USD 63 million) in automation to reduce long-term reliance on migrant labor. Fieldwork Robotics' raspberry-picking system exemplifies how continuous operation and human-comparable throughput shift return-on-investment calculations in favor of robotics. As labor costs rise, specification requirements move toward equipment that can work longer hours with limited oversight, reinforcing demand across the United Kingdom agricultural machinery market.

Government grant schemes and tax relief on farm machinery

The Farming Equipment and Technology Fund awards between GBP 1,000 and GBP 25,000 (USD 1,250 to USD 31,250) per applicant, while the Improving Farm Productivity program finances up to GBP 500,000 (USD 625,000) for robotics and precision systems. Each funded item must remain in use for five years, providing equipment suppliers with predictable demand cycles. Grant scoring frameworks prioritize carbon reduction and animal welfare metrics, steering purchases toward sensor-rich implements, autonomous guidance, and low-compaction solutions. These incentives directly lift overall equipment turnover within the United Kingdom agricultural machinery market, especially for small and mid-sized farms that historically delayed high-ticket investments.

High upfront and maintenance costs

The Institute of Chartered Accountants in England and Wales notes that large producers are delaying equipment purchases despite healthy cash flows, reflecting rising unit prices and tighter financing. AGCO Corporation's Q1 2025 revenue fell 30%, a signal that cost-sensitive buyers are pruning capital budgets. Maintenance burdens compound the hurdle modern combines and tractors require proprietary diagnostic software, cloud subscriptions, and specialized technicians. Even with grant offsets, many small operations find lifecycle costs prohibitive, trimming projected expansion of the United Kingdom agricultural machinery market.

Other drivers and restraints analyzed in the detailed report include:

- Regenerative-farming incentives driving low-compaction equipment demand

- Net-Zero electrification mandates catalyzing electric tractor purchases

- Cybersecurity and data privacy risks in connected machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors accounted for a 55.2% share of the United Kingdom agricultural machinery market in 2024. Segment expansion remains tethered to replacement cycles and horsepower upgrades, with autonomous and telematics integration becoming default specifications. Within tractors, models under 100 horsepower dominate volume, yet high-horsepower units above 150 horsepower capture disproportionate revenue due to their premium pricing and full-stack technology. Deere & Company's majority share highlights the importance of integrated guidance, connectivity, and after-sales networks that lower the total cost of ownership across the United Kingdom agricultural machinery market.

Irrigation equipment posted an 8.2% CAGR outlook through 2030, the strongest among all categories, and a direct response to unpredictable rainfall and tightening abstraction permits. Pivot systems coupled with soil-moisture sensors help farms align with the Environment Agency's water-management directives, while drip technology gains traction in high-value horticulture. Precision irrigation supports regenerative objectives by reducing runoff and input waste, underscoring how climate volatility drives product diversification within the United Kingdom agricultural machinery market size framework. Harvesters, forage machinery, and tillage implements also report steady demand, but their growth trails irrigation as water stewardship rises on farm agendas.

The United Kingdom Agricultural Machinery Market Report is Segmented by Machinery Type (Tractor, Equipment, Irrigation Machinery, Harvesting Machinery, Haying and Forage Machinery, and Other Machinery Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- Claas KGaA mbH

- J.C. Bamford Excavators Ltd.

- Kuhn Group (Bucher Industries AG)

- SDF Group S.p.A.

- Bernard Krone Holding SE & Co. KG

- Horsch Maschinen GmbH

- Amazone-Werke H. Dreyer SE & Co. KG

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- LEMKEN GmbH & Co. KG

- Vaderstad Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shortage of labor accelerating mechanization

- 4.2.2 Government grant schemes and tax relief on farm machinery

- 4.2.3 Demand for precision agriculture and digitalization

- 4.2.4 Regenerative-farming incentives driving low-compaction equipment demand

- 4.2.5 Expansion of agri-robotics testbeds boosting prototype uptake

- 4.2.6 Net-Zero electrification mandates catalyzing electric tractor purchases

- 4.3 Market Restraints

- 4.3.1 High upfront and maintenance costs

- 4.3.2 Cybersecurity and data privacy risks in connected machinery

- 4.3.3 Rural grid-capacity limits slowing electric-equipment adoption

- 4.3.4 Post-Brexit certification divergence escalating compliance costs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Tractor

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 100 HP

- 5.1.1.3 100 to 150 HP

- 5.1.1.4 Above 150 HP

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment (Seed Drills, Rollers, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery (Center Pivot Systems, Micro Sprinklers, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery (Potato Harvesters, Beet Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers and Conditioners

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery (Rakes, Tedders)

- 5.1.6 Other Machinery Types

- 5.1.1 Tractor

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 Claas KGaA mbH

- 6.4.6 J.C. Bamford Excavators Ltd.

- 6.4.7 Kuhn Group (Bucher Industries AG)

- 6.4.8 SDF Group S.p.A.

- 6.4.9 Bernard Krone Holding SE & Co. KG

- 6.4.10 Horsch Maschinen GmbH

- 6.4.11 Amazone-Werke H. Dreyer SE & Co. KG

- 6.4.12 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.13 LEMKEN GmbH & Co. KG

- 6.4.14 Vaderstad Group