|

市场调查报告书

商品编码

1848304

淀粉衍生物:市占率分析、产业趋势、统计、成长预测(2025-2030)Starch Derivatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

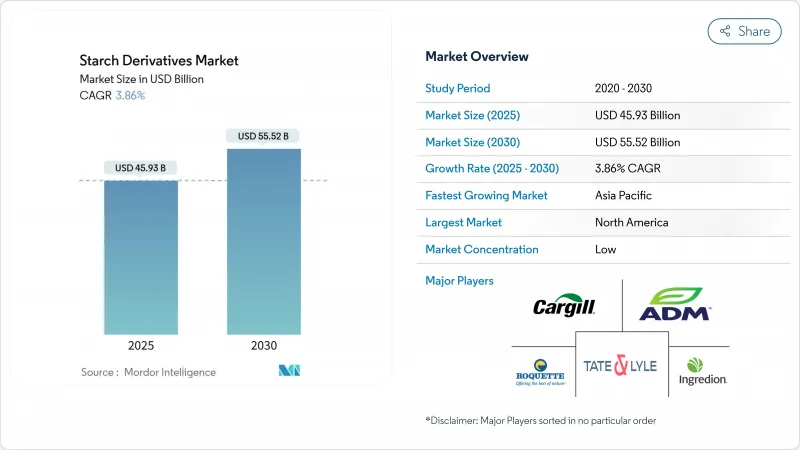

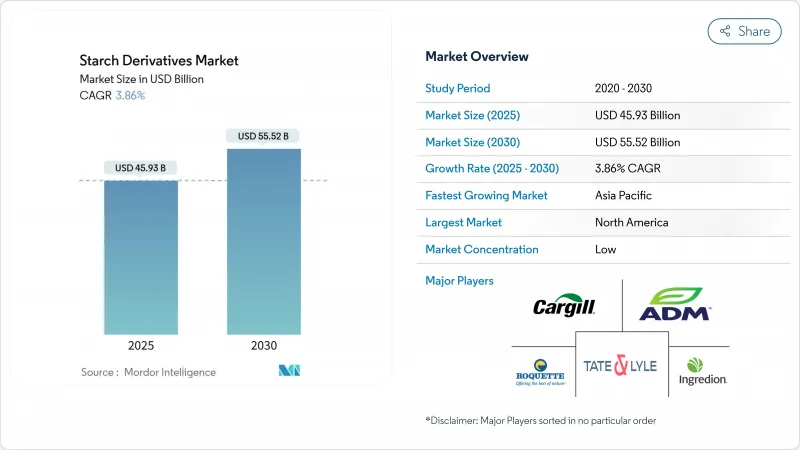

预计到 2025 年淀粉衍生物市场规模将达到 459.3 亿美元,到 2030 年将达到 555.2 亿美元,复合年增长率为 3.86%。

缓慢而稳定的扩张反映了从大宗商品到高价特种衍生品的转变。监管机构目前更青睐植物来源原料,使得麦芽糊精、环糊精和葡萄糖浆在食品、饮料和药品配方中的应用更加广泛。酶法加工的投资持续成长,该技术可以减少能源消耗并简化环境法规的合规性。北美供应商受益于成熟的食品药物管理局(FDA) 框架,而亚太地区製造商则透过统一的安全标准和日益增长的膳食补充剂需求获得了发展动力。在所有地区,洁净标示和非基因定位已不再是可有可无的选择,而已成为面向全球食品和药品客户的品牌原料供应商的关键竞争优势。

全球淀粉衍生物市场趋势与洞察

食品和饮料中对天然甜味剂的需求不断增长

法律规范越来越青睐天然甜味剂而非合成替代品,例如 FDA 的公认安全 (GRAS) 称号,简化了淀粉基甜味剂系统的核准途径。 FDA 将麦芽糊精归类为无糖碳水化合物聚合物,其葡萄糖当量为 20 或更低,这使其在食品应用方面比合成替代品更具优势。偏好向天然成分的转变推动了整个饮料类别的改性倡议,对淀粉衍生的质构剂产生了持续的需求,这些质构剂既能保持口感,又能减少合成添加剂的含量。这种趋势从食品和饮料延伸到机能性食品,在这些食品中,洁净标示要求推动了天然衍生淀粉改质剂的使用,而不是化学加工的替代品。监管机构对成分透明度的重视加强了淀粉衍生物在需要天然成分标籤的应用中的竞争地位。

烘焙和糖果业对淀粉基葡萄糖浆的需求量很大

烘焙和糖果甜点应用充分利用了葡萄糖浆独特的功能特性,尤其是其抑制结晶和延长保质期的能力,同时又符合食品安全法规。联合国粮农组织的《食品转码器》标准将葡萄糖浆认定为加工食品中不可或缺的功能性成分,支持其在全球市场的推广。酵素法加工的创新使得葡萄糖浆的生产能够调整葡萄糖当量值,使製造商能够针对特定应用优化甜度和褐变特性,同时保持法规合规性。在高端糖果甜点领域,欧洲食品安全框架更倾向于使用天然葡萄糖浆而非合成替代品,这为市场差异化创造了机会。应用的技术复杂性和监管要求构成了进入壁垒,使得拥有核准配方的现有企业能够扩展到邻近类别,同时保持定价权。

农业原材料成本波动影响产业盈利

原物料价格波动显着影响淀粉衍生物的盈利,农业市场受天气干扰和地缘政治紧张局势的影响,进而影响全球供应链。根据美国农业部 (USDA) 的作物报告,主要淀粉产区的产量差异很大,直接影响下游加工商的原料供应和定价。玉米粉市场对农业政策和贸易限制的变化特别敏感,价格波动对综合加工商的利润带来压力。主要农业产区的天气干扰迫使製造商维持高存量基准,增加了营运成本需求并降低了营运灵活性。政府的农业支持计画和贸易政策进一步增加了原材料价格的不确定性,需要采取复杂的对冲策略来管理成本波动。

細項分析

环糊精预计将成为一个快速成长的细分市场,到2030年复合年增长率将达到5.13%,这得益于FDA核准其用于医药领域,其独特的分子结构能够提高药物溶解度并控制释放製剂。 FDA已认可环糊精是药物传输系统中的安全辅料,这支持了其在多个治疗类别中的商业性潜力。麦芽糊精的市占率在2024年将达到34.36%,这反映了其作为填充剂和风味载体的多功能性,并且在食品应用中已确立了GRAS地位。葡萄糖浆在烘焙食品领域保持稳定的需求,这得益于粮农组织食品转码器标准对其在加工食品中的功能性益处的认可。糊精受益于其在黏合剂和可生物降解包装领域不断扩大的工业应用,而环境法规也倾向于天然替代品。

近期,环糊精类药物製剂已获得监管部门核准,标誌着该领域已发展成为一个先进的药物递送平台,其应用范围涵盖多个治疗领域。环糊精类药物市场正日益体现出监管合规性要求,而非传统的商品类别。由于技术差异化和成熟的核准途径,特种衍生物的价格更高。改质环糊精因其增强的溶解性而获得监管部门的认可,为特定用途衍生物在医药和营养保健品市场创造了机会。

木薯是成长最快的原料,到2030年复合年增长率将达到4.88%,这得益于其天然无麸质特性以及对全球市场洁净标示法规的合规性。玉米凭藉其成熟的美国农业部 (USDA) 品质标准和完善的供应链基础设施,确保始终如一的品质和合规性,到2024年将以63.22%的市场份额占据市场主导地位。小麦衍生品在欧洲市场用于特殊应用,欧盟品质标准支持其在食品应用领域的高端定位。马铃薯淀粉在需要优异成膜性的应用中价格较高,其功能优势也受到监管机构的认可。米淀粉在亚洲市场的重要性日益凸显,当地食品安全法规支持其在传统和现代食品领域的应用。

供应源多元化策略体现了监管风险管理的考量,企业需要持有多个供应商的核准,以确保供应链在监管变化的情况下仍能保持韧性。比较不同淀粉来源的监管状况,为市场区隔创造了机会,有机和非基因改造认证能够在註重健康的消费者群体中实现高端定位。农业投入品和加工方法的法律规范日益影响供应商的选择决策,拥有全面合规计画的供应商更受青睐。

区域分析

北美将在2024年维持市场领先地位,市占率达36.23%。这得益于其全面的FDA法规结构,该框架为食品和药品用淀粉衍生物的核准建立了清晰的路径。该地区受益于美国农业部(美国)的农业品质标准,确保了原材料的稳定供应,并建立了良好的生产规范,从而增强了出口竞争力。稳定的药品应用监管为北美供应商带来了竞争优势,而FDA的核准途径则使其在全球市场上占据了优势地位。该地区成熟的法规环境支持特种应用领域的创新,同时保持了确保消费者权益的安全标准。

亚太地区将成为成长最快的地区,到2030年复合年增长率将达到5.23%,这得益于东协市场监管协调倡议,旨在为淀粉衍生物创建标准化的核准途径。区域食品安全框架日益与国际标准接轨,在确保产品品质和安全的同时,降低了跨国供应商的合规成本。该地区的成长反映了在认可国际品质标准的法律规范的支持下,製药生产能力不断增强。政府推动食品加工工业化的措施将创造对技术先进、符合不断变化的安全要求的淀粉衍生物的需求。

欧洲正呈现稳定成长态势,这得益于欧洲食品安全局(EFSA)的全面安全评估,该评估为食品和製药业的淀粉衍生物应用制定了明确的指导方针。该地区严格的法律规范设置了准入门槛,同时透过经批准的产品系列和全面的合规计画保护了现有供应商。欧盟环境法规更青睐可生物降解的淀粉基材料,而非石油基替代品,为永续包装应用创造了市场机会。该地区对永续性的关注正在推动监管机构对符合循环经济原则和环境保护标准的天然淀粉改质产品的支持。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 食品和饮料中对天然甜味剂的需求不断增加

- 烘焙和糖果甜点业对淀粉基葡萄糖浆的需求不断增加

- 高果糖玉米糖浆 (HFCS) 在饮料配方中的应用日益增多

- 淀粉衍生物的多功能优势

- 对洁净标示和非基因改造成分的需求不断增长

- 淀粉酶处理技术的进步。

- 市场限制

- 农业原物料价格波动影响产业盈利

- 食用高果糖玉米糖浆带来的健康问题

- 消费者越来越拒绝人工添加剂

- 各种淀粉添加剂的过敏风险及标籤要求

- 供应链分析

- 监理展望

- 波特五力模型

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 葡萄糖浆

- 高果糖玉米糖浆(HFCS)

- 麦芽糊精

- 环糊精

- 糊精

- 其他的

- 按来源

- 玉米

- 小麦

- 马铃薯

- 木薯

- 其他的

- 按形式

- 粉末

- 液体

- 按用途

- 食品/饮料

- 麵包店

- 糖果甜点

- 饮料

- 其他的

- 製药

- 个人护理和化妆品

- 动物饲料

- 其他的

- 食品/饮料

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Inc.

- Tate & Lyle Plc

- Roquette Freres SA

- Sudzucker AG

- Angel Starch & Food Pvt Ltd

- Tereos SA

- Royal Avebe

- Grain Processing Corp.

- Universal Starch Chem Allied Ltd.

- Gujarat Ambuja Exports Limited

- Thai Wah Public Co.

- Qingdao CBH Co.

- Matsutani Chemical Industry Co., Ltd.

- DSM-Firmenich

- Sunar Group

- Shandong Baolingbao

- Crespel & Deiters GmbH & Co. KG

- Bharat Starch

第七章 市场机会与未来展望

The starch derivatives market size is valued at USD 45.93 billion in 2025 and is forecast to reach USD 55.52 billion by 2030, advancing at a 3.86% CAGR.

Moderate but steady expansion reflects the transition from bulk commodities to specialty derivatives that command premium pricing. Regulatory agencies now favor plant-based inputs, enabling broader use of maltodextrin, cyclodextrin, and glucose syrups in food, beverage, and pharmaceutical formulations. Investment continues to move toward enzymatic processing that lowers energy use and simplifies compliance with environmental rules. North American suppliers benefit from a mature Food and Drug Administration (FDA) framework, while Asia-Pacific manufacturers gain momentum through harmonized safety standards and rising nutraceutical demand. Across all regions, clean-label and non-GMO positioning is no longer optional; it has become a key competitive lever for branded ingredient suppliers that target global food and drug customers.

Global Starch Derivatives Market Trends and Insights

Growing Demand for Natural Sweeteners in Food and Beverage

Regulatory frameworks increasingly favor naturally-derived sweeteners over synthetic alternatives, with the FDA's Generally Recognized as Safe (GRAS) designation streamlining approval pathways for starch-based sweetening systems. The FDA's classification of maltodextrin as a non-sweet saccharide polymer with dextrose equivalent below 20 positions it advantageously against synthetic alternatives in food applications. Consumer preference shifts toward natural ingredients drive reformulation initiatives across beverage categories, creating sustained demand for starch-derived texturizing agents that maintain mouthfeel while reducing synthetic additive content. The trend extends beyond beverages into functional foods, where clean-label requirements drive specification of naturally-derived starch modifications over chemically-processed alternatives. Regulatory bodies' emphasis on ingredient transparency strengthens the competitive position of starch derivatives in applications requiring natural ingredient declarations.

High Demand for Starch-Based Glucose Syrup in Bakery and Confectionary

Bakery and confectionery applications leverage glucose syrups' unique functional properties, particularly their ability to control crystallization and extend shelf life while maintaining compliance with food safety regulations. The FAO's Codex Alimentarius standards recognize glucose syrups as essential functional ingredients in processed foods, supporting their adoption across global markets. Enzymatic processing innovations enable glucose syrup production with tailored dextrose equivalent values, allowing manufacturers to optimize sweetness intensity and browning characteristics for specific applications while maintaining regulatory compliance. European food safety frameworks favor naturally-derived glucose syrups over synthetic alternatives in premium confectionery segments, creating market differentiation opportunities. The application's technical complexity and regulatory requirements create barriers to entry, enabling established players with approved formulations to maintain pricing power while expanding into adjacent categories.

Volatility in Agricultural Raw Material Costs Affect Industry Profitability

Raw material price volatility significantly impacts starch derivative profitability, with agricultural commodity markets subject to weather-related disruptions and geopolitical tensions affecting global supply chains. USDA crop reports indicate significant yield variations in key starch-producing regions, directly affecting raw material availability and pricing for downstream processors. Corn starch markets demonstrate particular sensitivity to agricultural policy changes and trade regulations, with price fluctuations creating margin pressure for integrated processors. Weather-related disruptions in key agricultural regions force manufacturers to maintain higher inventory levels, increasing working capital requirements and reducing operational flexibility. Government agricultural support programs and trade policies create additional uncertainty in raw material pricing, requiring sophisticated hedging strategies to manage cost volatility.

Other drivers and restraints analyzed in the detailed report include:

- Increased Adoption of High Fructose Corn Syrup (HFCS) in Beverage Formulation

- Amplifying Demand for Clean Label and Non-GMO Ingredients

- Rising Consumer Shift Away from Artificial Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cyclodextrin emerges as the fastest-growing segment with 5.13% CAGR through 2030, driven by FDA approvals for pharmaceutical applications where its unique molecular structure enables drug solubility enhancement and controlled release formulations. The FDA's recognition of cyclodextrins as safe excipients in drug delivery systems supports commercial viability across multiple therapeutic categories. Maltodextrin commands 34.36% market share in 2024, reflecting its versatility as a bulking agent and flavor carrier with established GRAS status across food applications. Glucose syrups maintain steady demand in bakery applications, supported by FAO Codex standards that recognize their functional benefits in processed foods. Dextrins benefit from expanding industrial uses in adhesives and biodegradable packaging, where environmental regulations favor naturally-derived alternatives.

Recent regulatory approvals for cyclodextrin-based pharmaceutical formulations demonstrate the segment's evolution toward sophisticated drug delivery platforms, with applications extending across multiple therapeutic areas. The type segmentation increasingly reflects regulatory compliance requirements rather than traditional commodity categories, with specialty derivatives commanding premium pricing through technical differentiation and established approval pathways. Modified cyclodextrins receive regulatory recognition for enhanced solubility properties, creating opportunities for application-specific derivatives in pharmaceutical and nutraceutical markets.

Tapioca represents the fastest-growing source at 4.88% CAGR through 2030, benefiting from its naturally gluten-free properties and compliance with clean-label regulations across global markets. Maize dominates with a 63.22% market share in 2024, supported by established USDA quality standards and a comprehensive supply chain infrastructure that ensures consistent quality and regulatory compliance. Wheat-based derivatives serve specialized applications in European markets, where EU quality standards support premium positioning in food applications. Potato starch commands premium pricing in applications requiring superior film-forming properties, supported by regulatory recognition of its functional benefits. Rice starch gains importance in Asian markets, where local food safety regulations support its use in traditional and modern food applications.

Source diversification strategies reflect regulatory risk management considerations, with companies maintaining multiple source approvals to ensure supply chain resilience despite regulatory changes. The comparative regulatory status of different starch sources creates market segmentation opportunities, with organic and non-GMO certifications enabling premium positioning in health-conscious consumer segments. Regulatory frameworks governing agricultural inputs and processing methods increasingly influence source selection decisions, favoring suppliers with comprehensive compliance programs.

The Starch Derivatives Market Report Segments the Industry Into Type (Glucose Syrup, High Fructose Corn Syrup, Maltodextrin, and More), Source (Maize, Wheat, Tapioca, Potato, and Other Sources), Form (Powder and Liquid), Application (Food and Beverage, Pharmaceutical Industry, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and More). The Report Offers the Market Size in Terms of Value (USD).

Geography Analysis

North America maintains market leadership with 36.23% share in 2024, supported by comprehensive FDA regulatory frameworks that establish clear pathways for starch derivative approval across food and pharmaceutical applications. The region benefits from USDA agricultural quality standards that ensure consistent raw material supply and established good manufacturing practices that support export competitiveness. Regulatory stability in pharmaceutical applications creates competitive advantages for North American suppliers, with FDA approval pathways enabling premium positioning in global markets. The region's mature regulatory environment supports innovation in specialty applications while maintaining safety standards that ensure consumer protection.

Asia-Pacific emerges as the fastest-growing region with 5.23% CAGR through 2030, driven by regulatory harmonization initiatives across ASEAN markets that create standardized approval pathways for starch derivatives. Regional food safety frameworks increasingly align with international standards, reducing compliance costs for multinational suppliers while ensuring product quality and safety. The region's growth reflects expanding pharmaceutical manufacturing capabilities supported by regulatory frameworks that recognize international quality standards. Government initiatives promoting food processing industrialization create demand for technically sophisticated starch derivatives that comply with evolving safety requirements.

Europe demonstrates steady growth supported by comprehensive EFSA safety assessments that establish clear guidelines for starch derivative applications across food and pharmaceutical sectors. The region's stringent regulatory framework creates barriers to entry while protecting established suppliers with approved product portfolios and comprehensive compliance programs. EU environmental regulations favor biodegradable starch-based materials over petroleum-based alternatives, creating market opportunities for sustainable packaging applications. The region's focus on sustainability drives regulatory support for naturally-derived starch modifications that comply with circular economy principles and environmental protection standards.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Ingredion Inc.

- Tate & Lyle Plc

- Roquette Freres S.A.

- Sudzucker AG

- Angel Starch & Food Pvt Ltd

- Tereos S.A.

- Royal Avebe

- Grain Processing Corp.

- Universal Starch Chem Allied Ltd.

- Gujarat Ambuja Exports Limited

- Thai Wah Public Co.

- Qingdao CBH Co.

- Matsutani Chemical Industry Co., Ltd.

- DSM-Firmenich

- Sunar Group

- Shandong Baolingbao

- Crespel & Deiters GmbH & Co. KG

- Bharat Starch

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Natural Sweeteners in Food and Beverage

- 4.2.2 High Demand for Starch-Based Glucose Syrup in Bakery and Confectionary

- 4.2.3 Increased Adoption of High Fructose Corn Syrup (HFCS) in Beverage Formulation

- 4.2.4 Multi-Functional Benefits Associated with Starch Derivatives

- 4.2.5 Amplifying Demand for Clean Label and Non-GMO Ingredients

- 4.2.6 Technological Advancements in Enzymatic Processing of Starch

- 4.3 Market Restraints

- 4.3.1 Volatility in Agricultural Raw Material Costs Affect Industry Profitability

- 4.3.2 Health Concerns Linked to High Fructose Corn Syrup Consumption

- 4.3.3 Rising Consumer Shift Away from Artificial Additives

- 4.3.4 Allergy Risks and Labeling Requirements for Various Starch Additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Glucose Syrups

- 5.1.2 High Fructose Corn Syrup (HFCS)

- 5.1.3 Maltodextrin

- 5.1.4 Cyclodextrin

- 5.1.5 Dextrins

- 5.1.6 Others

- 5.2 By Source

- 5.2.1 Maize

- 5.2.2 Wheat

- 5.2.3 Potato

- 5.2.4 Tapioca

- 5.2.5 Others

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.1.1 Bakery

- 5.4.1.2 Confectionary

- 5.4.1.3 Beverage

- 5.4.1.4 Others

- 5.4.2 Pharmaceutial

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Animal Feed

- 5.4.5 Others

- 5.4.1 Food and Beverage

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 Ingredion Inc.

- 6.4.4 Tate & Lyle Plc

- 6.4.5 Roquette Freres S.A.

- 6.4.6 Sudzucker AG

- 6.4.7 Angel Starch & Food Pvt Ltd

- 6.4.8 Tereos S.A.

- 6.4.9 Royal Avebe

- 6.4.10 Grain Processing Corp.

- 6.4.11 Universal Starch Chem Allied Ltd.

- 6.4.12 Gujarat Ambuja Exports Limited

- 6.4.13 Thai Wah Public Co.

- 6.4.14 Qingdao CBH Co.

- 6.4.15 Matsutani Chemical Industry Co., Ltd.

- 6.4.16 DSM-Firmenich

- 6.4.17 Sunar Group

- 6.4.18 Shandong Baolingbao

- 6.4.19 Crespel & Deiters GmbH & Co. KG

- 6.4.20 Bharat Starch