|

市场调查报告书

商品编码

1849870

触控萤幕控制器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

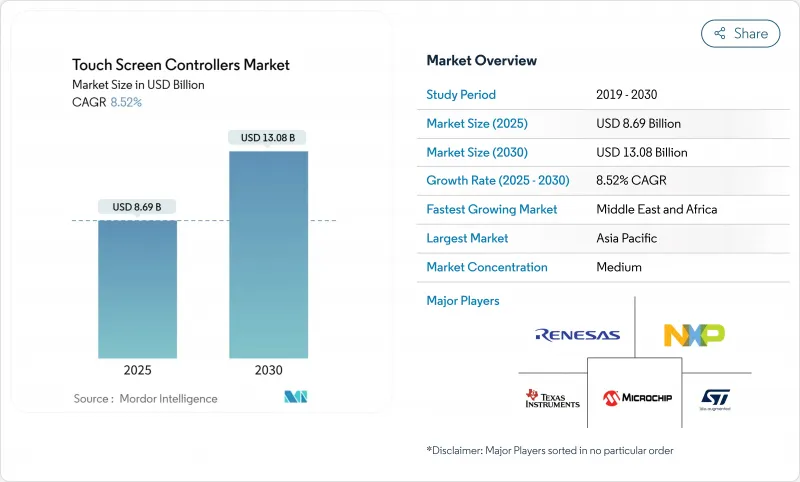

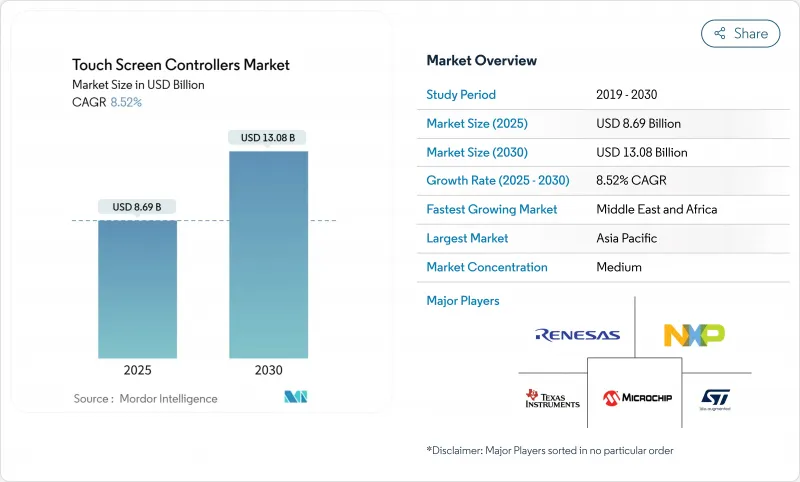

触控萤幕控制器市场规模预计在 2025 年达到 86.9 亿美元,到 2030 年将达到 130.8 亿美元,复合年增长率为 8.52%。

成长的动力来自于智慧型手机中多点触控介面的日益普及、更大的汽车显示器以及产业向投射电容式 (PCAP) 面板的转变。在供应方面,触控和显示器驱动IC(TDDI) 的整合减少了元件数量并实现了更薄的设备外形,而持续的晶圆级约束则支援高价位的汽车和医疗解决方案。零售自动化、需要超低功耗 32 位元控制器的可穿戴产品,以及驱动复杂边缘侦测和防手掌误触控制器演算法的柔性 OLED 萤幕的日益普及,都增强了需求。由于电子製造地高度集中,亚太地区正迎来最强劲的发展势头,而中东和非洲则透过智慧城市计划和自助结帐系统的推出释放新的机会。

全球触控萤幕控制器市场趋势与洞察

柔性OLED智慧型手机显示器中多点触控电容技术的采用

智慧型手机製造商正在将显示器延伸至曲面边缘和折迭式铰链链,这增加了触控通道布线和防手掌误触逻辑的复杂性。控制器必须处理不规则表面上不同的压力输入,同时最大限度地降低寄生电容。 2025 年展出的氧化物面板展示了整合式触控路径,可在萤幕占比达到 90% 或更高的窄边框中保持信噪比。边缘屏蔽和局部驱动波形的专利组合正在触控萤幕控制器市场中打造一个高端市场,使供应商能够将其 IP 专门用于大批量旗舰设备,从而收益。

欧洲车载资讯娱乐系统升级至 2 级 ADAS

汽车仪錶板采用 34 吋曲面面板,整合了丛集、导航和媒体控制功能。这需要控制器具备宽动作温度、严格的 EMI 抗扰度和容错韧体。像 ATMXT3072M1 这样的装置采用 112 个可重构通道和独特的互电容撷取方案,可将讯号杂讯比 (SNR) 提高 15 dB,即使在动力传动系统和 ADAS 雷达的电磁应力下也能确保可靠侦测。显示器上方嵌入的触觉旋钮可恢復触觉回馈,提高驾驶注意力得分,并对控制器的扫描迴路施加额外的延迟限制。

55nm混合讯号晶圆供应链收紧

由于汽车 MCU 和工业IoT的需求与消费级触控晶片竞争,关键 55nm 节点的晶圆代工配额依然紧张。控制器製造商越来越多地签订多年期合约以确保产能,这导致营运资金被转移,设计週期被延长。一些公司正在针对 65nm 或 40nm 体硅 CMOS 製程重新设计产品,但这种移植可能会增加维修成本并增加晶粒尺寸。恩智浦揭露的配额有限,凸显了整个触控萤幕控制器市场近期的供应风险。

細項分析

电容式将在2024年占据触控萤幕控制器市场份额的71.5%,这反映出其在行动电话、平板电脑和汽车驾驶座领域的强劲应用。电容式透过盖板玻璃感应,支援超过10个触控点,在耐用性、光学清晰度和手势丰富性方面具有关键的设计优势。该细分市场受益于向整合TDDI晶片的持续过渡,该晶片可减少边框数量和模组厚度。相反,电阻式产品继续在手套式工厂主机和POS终端中采用,但由于PCAP价格下跌,其出货量成长正在放缓。

到2030年,红外线控制器的复合年增长率将达到10.8%,达到最高水准。边框式发射器/接收器阵列使整合商能够以适中的成本将产品扩展到100英寸以上,这对于教室、数位电子看板和重型资讯亭来说是一个关键优势。红外线LED驱动器效率的提升,加上改进的凝视引导演算法,正在降低延迟并提高对环境光的耐受性,从而鼓励学校董事会和公司会议室考虑互动式墙。这种动态将保持触控萤幕控制器市场的技术多样性,供应商将同时提供PCAP、红外线以及利基声学或光学成像解决方案的产品线。

由于 I2C通讯协定具有两线式的简单性、低引脚数以及适用于系统晶片)环境的多主控功能,预计到 2024 年其收入将成长 43%。智慧型手机、穿戴式装置和许多汽车显示器都依赖 I2C 实现控制器和主处理器之间的低杂讯、低功耗通讯。 SPI 在频宽要求不断提高的平板电脑和高解析度平板电脑中蓬勃发展,而 UART 则用于需要极少韧体更新的传统工业设备。

USB 凭藉其即插即用的特性以及支援触控笔资料和悬停感应的高吞吐量,正在快速成长,复合年增长率高达 9.2%。自助服务终端、医疗推车和可拆卸显示器的 ODM 对其标准连接器和与主机无关的枚举流程青睐有加。白牌 PC 製造商也青睐 USB 触控技术,因为它避免了增加桥接 IC 的成本。这种介面灵活性拓宽了应用范围,扩大了触控萤幕控制器市场的规模,并迫使供应商提供多介面韧体以实现无缝的现场重新配置。

区域分析

由于密集的零件供应链、高技能的劳动力以及政府对半导体自给自足的奖励,亚太地区将在2024年占据全球销售额的61.8%。中国拥有主要的控制器IC晶圆厂和下游模组组装商,为本土智慧型手机和消费性电子巨头提供产品。像敦泰这样的区域供应商持续创新,推出满足汽车可靠性目标的整合显示和触控解决方案。韩国和日本凭藉其在OLED和氧化物TFT方面的专业知识引领产业,为柔性和折迭式设备贡献高价值的控制器插座。

北美排名第二,这得益于汽车电子、医疗影像处理和工业自动化领域的平台创新。硅谷设计中心正专注于人工智慧增强讯号处理,以过滤复杂的噪音环境。零售连锁店正在加速自助结帐设备的安装,确保了对控制器单元的额外需求。该地区严格的网路安全要求正推动人们对内建于触控控制器的硬体加速加密技术产生浓厚兴趣。

欧洲严重依赖德国、法国和瑞典的汽车生产群集。严格的功能安全和电磁相容性标准导致设计时间更长,但也为合格供应商创造了市场空间。欧盟范围内对 2 级和 3 级 ADAS 的推动,推动了采用更高通道数控制器的更大驾驶座显示器的发展,从而增加了触控萤幕控制器市场的应用多样性。

到2030年,中东和非洲地区的复合年增长率将达到10.2%,居世界之冠。海湾经济体的智慧城市专案正在订购触控式自助服务终端、数位电子看板和支付终端。零售和酒店业正在采用互动式系统,以减少服务等待时间。小型国内整合商正在透过全球经销商采购控制器,并活性化本地设计活动。

在南美,随着银行升级ATM和教室技术,巴西和阿根廷市场呈现温和扩张态势。货币波动和关税结构正在影响采购週期,而智慧型手机普及率的提高则推动了售后市场对翻新级触控模组的需求。区域合作将拓宽触控萤幕控制器市场的地域覆盖范围,并减少对亚洲产品的过度依赖。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 柔性OLED智慧型手机显示器中多点触控电容式的采用

- 欧洲车载资讯娱乐系统升级至 2 级 ADAS

- 北美劳动力短缺导致自助结帐系统POS机数量激增

- 携带式医学影像设备的小型化

- 符合工业 4.0 标准的坚固型 PCAP 面板在中国取代了薄膜小键盘

- 触控智慧型手錶转向低功耗 32 位元控制器

- 市场限制

- 55nm混合讯号晶圆供应链凝聚力

- 24 吋及更大尺寸汽车电容式显示器的 EMI/ESD 合规性问题

- 与印度白牌平板电脑製造商的控制器智慧财产权诉讼

- 由于面板製造商的垂直整合,平均售价下降

- 产业生态系统分析

- 技术概述(控制器架构和感测演算法)

- 监管环境(EMC 和汽车级标准)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 依技术

- 阻力型

- 电容式(投射式和表面式)

- 表面声波

- 红外线的

- 光学成像

- 按介面

- I2C

- SPI

- USB

- UART

- 透过接触点

- 单点触控

- 多点触控

- 按显示尺寸

- 小于5英寸

- 5到10英寸

- 10吋或以上

- 按最终用户产业

- 家电

- 工业和製造业

- 医疗保健和医疗设备

- 零售和 POS 终端

- 车

- 银行和金融亭

- 其他(航空、教育)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家(丹麦、瑞典、挪威、芬兰)

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NXP Semiconductors

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd.

- Texas Instruments Incorporated

- Analog Devices Inc.

- STMicroelectronics

- Microchip Technology Inc.

- Cypress(Infineon Technologies AG)

- Synaptics Incorporated

- Goodix Technology Inc.

- FocalTech Systems Co. Ltd.

- MELFAS Co. Ltd.

- Elan Microelectronics Corp.

- Novatek Microelectronics Corp.

- Ilitek I-SFT Technology Inc.

- Silicon Labs

- Himax Technologies Inc.

- Semtech Corporation

- Broadcom Inc.

- PixArt Imaging Inc.

- ROHM Semiconductor

- AMS OSRAM AG

- Raydium Semiconductor Corp.

第七章 市场机会与未来展望

The touch screen controllers market size is estimated at USD 8.69 billion in 2025 and is projected to reach USD 13.08 billion by 2030, reflecting an 8.52% CAGR.

Growth is propelled by rising adoption of multi-touch interfaces in smartphones, larger in-vehicle displays, and industrial migration to projected capacitive (PCAP) panels. On the supply side, integrated touch-and-display driver ICs (TDDI) are trimming component counts and enabling thinner device profiles, while ongoing wafer-level constraints encourage premium-priced automotive and medical solutions. Demand is reinforced by retail automation, wearables that require ultra-low-power 32-bit controllers, and expanding use of flexible OLED screens that push controller algorithms toward complex edge detection and palm rejection. Regional momentum is greatest in Asia Pacific because of its dense electronics manufacturing base, with incremental opportunities building in the Middle East and Africa through smart-city projects and self-checkout deployments.

Global Touch Screen Controllers Market Trends and Insights

Multi-touch Capacitive Adoption in Flexible OLED Smartphone Displays

Smartphone makers are stretching displays over curved edges and foldable hinges, raising complexity for touch-channel routing and palm-rejection logic. Controllers must process variable pressure inputs over irregular surfaces while minimizing parasitic capacitance. Oxide-based panels showcased in 2025 demonstrated integrated touch paths that sustain signal-to-noise ratios at narrow bezels above 90% screen-to-body levels. Patent portfolios around edge shielding and localized drive waveforms create a premium tier inside the touch screen controllers market, where suppliers monetize specialized IP against high-volume flagship handsets.

In-Vehicle Infotainment Upgrades with Level-2 ADAS in Europe

Car dashboards now host curved 34-inch panels that merge cluster, navigation, and media controls. Controllers, therefore, need wide operating temperatures, stringent EMI resilience, and fault-tolerant firmware. Devices such as the ATMXT3072M1 adopt 112 reconfigurable channels and proprietary mutual-cap acquisition schemes that raise SNR by 15 dB, ensuring reliable detection under electromagnetic stress from powertrains and ADAS radars. Haptic knobs embedded atop displays restore tactile feedback, improving driver attention scores and placing additional latency constraints on the controller's scan loop.

55 nm Mixed-Signal Wafer Supply-Chain Tightness

Foundry allocations at key 55 nm nodes remain strained because automotive MCU and industrial IoT demand compete with consumer touch chips. Controller makers increasingly sign multi-year take-or-pay contracts to guarantee capacity, diverting working capital and elongating design cycles. Some firms are redesigning products for 65 nm or 40 nm bulk CMOS, though such porting introduces requalification costs and can raise die size. NXP's disclosure of limited allocation windows underscores near-term supply risk across the touch screen controllers market.

Other drivers and restraints analyzed in the detailed report include:

- Self-Checkout POS Proliferation amid North-American Labor Shortages

- Industry 4.0 Rugged PCAP Panels Replacing Membrane Keypads in China

- EMI/ESD Compliance Issues for >24" Capacitive Automotive Displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Capacitive solutions captured 71.5% of the touch screen controllers market share in 2024, reflecting strong adoption in phones, tablets, and vehicle cockpits. Their ability to sense through cover-glass and to support ten-plus touch points secures design wins where durability, optical clarity, and gesture richness matter. The segment benefits from ongoing migration to integrated TDDI chips that lower bezel count and shrink module thickness. Conversely, resistive products continue serving glove-based factory consoles and point-of-sale terminals, though incremental volumes decline as PCAP pricing falls.

Infrared controllers post the highest 10.8% CAGR to 2030. Bezel-mounted emitter-receiver arrays let integrators scale beyond 100 inches at moderate cost, a key advantage for classrooms, digital signage, and heavy-duty kiosks. Efficiency gains in IR LED drivers combined with refined line-of-sight algorithms are reducing latency and improving ambient light immunity, prompting education boards and corporate meeting rooms to consider interactive walls. This dynamic keeps technology diversity alive inside the touch screen controllers market, encouraging vendors to maintain parallel product lines across PCAP, IR, and niche acoustic or optical imaging solutions.

The I2C protocol delivered 43% revenue in 2024 thanks to its two-wire simplicity, low pin count, and multi-master capability, catering to system-on-chip environments. Smartphones, wearables, and many automotive displays rely on I2C for low-noise, low-power communication between the controller and host processor. SPI holds steady in panel PCs and higher-resolution tablets where bandwidth requirements rise, while UART persists in legacy industrial terminals seeking minimal firmware updates.

USB emerges as the fastest-growing at a 9.2% CA,GR given its plug-and-play nature and high throughput that supports stylus data and hover sensing. ODMs targeting kiosks, medical carts, and detachable monitors appreciate the standard connector and host-agnostic enumeration process. White-box PC makers also favor USB touch due to the cost avoidance of additional bridge ICs. This interface flexibility widens application reach, adds volumes to the touch screen controllers market, and pressures vendors to supply multi-interface firmware capable of seamless field reconfiguration.

The Touch Screen Controllers Market Report is Segmented by Technology (Resistive, Capacitive, and More), Interface (I2C, SPI, USB, and UART), Touch Points (Single-Touch, and Multi-Touch), Display Size (Less Than 5 Inch, 5-10 Inch, and Above 10 Inch), End-User Industry (Consumer Electronics, Industrial and Manufacturing, Retail and POS Terminals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 61.8% revenue in 2024, supported by dense component supply chains, skilled labor, and government incentives for semiconductor self-sufficiency. China hosts major controller IC fabs plus downstream module assemblers that feed local smartphone and appliance giants. Regional suppliers such as FocalTech continue to innovate with integrated display-and-touch solutions that meet automotive reliability goals focaltech-electronics.com. South Korea and Japan contribute leading OLED and oxide TFT expertise, fueling high-value controller sockets in flexible and foldable devices.

North America ranks second, driven by platform innovation in automotive electronics, medical imaging, and industrial automation. Silicon Valley design centers emphasize AI-enhanced signal processing that filters complex noise environments. Retail chains accelerate self-checkout installations, securing additional controller unit demand. Robust cybersecurity requirements in this region elevate interest in hardware-accelerated encryption embedded within touch controllers.

Europe follows closely and relies heavily on automotive production clusters in Germany, France, and Sweden. Stringent functional-safety and electromagnetic-compatibility norms lengthen design timelines yet create defendable niches for certified suppliers. EU-wide push toward Level-2 and Level-3 ADAS drives larger cockpit displays that utilize high-channel-count controllers, enriching application diversity in the touch screen controllers market.

The Middle East and Africa region posts the fastest 10.2% CAGR through 2030. Smart-city programs in Gulf economies order touch-enabled kiosks, digital signage, and payment terminals. Retail and hospitality segments adopt interactive systems that shorten service queues. Smaller domestic integrators procure controllers via global distributors, raising local design activity.

South America shows gradual expansion, with Brazil and Argentina upgrading banking ATMs and classroom technology. Currency volatility and tariff structures influence procurement cycles, yet growing smartphone penetration nourishes aftermarket demand for repair-grade touch modules. Collective regional progress broadens the geographic footprint of the touch screen controllers market, mitigating overreliance on Asia-based output.

- NXP Semiconductors

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd.

- Texas Instruments Incorporated

- Analog Devices Inc.

- STMicroelectronics

- Microchip Technology Inc.

- Cypress (Infineon Technologies AG)

- Synaptics Incorporated

- Goodix Technology Inc.

- FocalTech Systems Co. Ltd.

- MELFAS Co. Ltd.

- Elan Microelectronics Corp.

- Novatek Microelectronics Corp.

- Ilitek I-SFT Technology Inc.

- Silicon Labs

- Himax Technologies Inc.

- Semtech Corporation

- Broadcom Inc.

- PixArt Imaging Inc.

- ROHM Semiconductor

- AMS OSRAM AG

- Raydium Semiconductor Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multi-Touch capacitive Adoption in Flexible OLED Smartphone Displays

- 4.2.2 In-Vehicle Infotainment Upgrades with Level-2 ADAS in Europe

- 4.2.3 Self-Checkout POS Proliferation amid North-American Labor Shortages

- 4.2.4 Hand-held Medical Imaging Devices Miniaturization

- 4.2.5 Industry 4.0 Rugged PCAP Panels Replacing Membrane Keypads in China

- 4.2.6 Touch-Enabled Smartwatch Shift Driving Low-Power 32-bit Controllers

- 4.3 Market Restraints

- 4.3.1 55 nm Mixed-Signal Wafer Supply-Chain Tightness

- 4.3.2 EMI/ESD Compliance Issues for Above 24-inch capacitive Automotive Displays

- 4.3.3 Controller-IP Litigation with Indian White-Box Tablet Makers

- 4.3.4 ASP Erosion from Panel-Maker Vertical Integration

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook (Controller Architectures and Sensing Algorithms)

- 4.6 Regulatory Outlook (EMC and Automotive-Grade Standards)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Resistive

- 5.1.2 capacitive (Projected and Surface)

- 5.1.3 Surface Acoustic Wave

- 5.1.4 Infrared

- 5.1.5 Optical Imaging

- 5.2 By Interface

- 5.2.1 I2C

- 5.2.2 SPI

- 5.2.3 USB

- 5.2.4 UART

- 5.3 By Touch Points

- 5.3.1 Single-Touch

- 5.3.2 Multi-Touch

- 5.4 By Display Size

- 5.4.1 Less than 5 Inch

- 5.4.2 5 - 10 Inch

- 5.4.3 Above 10 Inch

- 5.5 By End-user Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Industrial and Manufacturing

- 5.5.3 Healthcare and Medical Devices

- 5.5.4 Retail and POS Terminals

- 5.5.5 Automotive

- 5.5.6 Banking and Financial Kiosks

- 5.5.7 Others (Aviation, Education)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 Southeast Asia

- 5.6.3.6 Australia

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Gulf Cooperation Council Countries

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 NXP Semiconductors

- 6.4.2 Renesas Electronics Corporation

- 6.4.3 Samsung Electronics Co. Ltd.

- 6.4.4 Texas Instruments Incorporated

- 6.4.5 Analog Devices Inc.

- 6.4.6 STMicroelectronics

- 6.4.7 Microchip Technology Inc.

- 6.4.8 Cypress (Infineon Technologies AG)

- 6.4.9 Synaptics Incorporated

- 6.4.10 Goodix Technology Inc.

- 6.4.11 FocalTech Systems Co. Ltd.

- 6.4.12 MELFAS Co. Ltd.

- 6.4.13 Elan Microelectronics Corp.

- 6.4.14 Novatek Microelectronics Corp.

- 6.4.15 Ilitek I-SFT Technology Inc.

- 6.4.16 Silicon Labs

- 6.4.17 Himax Technologies Inc.

- 6.4.18 Semtech Corporation

- 6.4.19 Broadcom Inc.

- 6.4.20 PixArt Imaging Inc.

- 6.4.21 ROHM Semiconductor

- 6.4.22 AMS OSRAM AG

- 6.4.23 Raydium Semiconductor Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment