|

市场调查报告书

商品编码

1849966

欧洲汽车租赁:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Vehicle Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

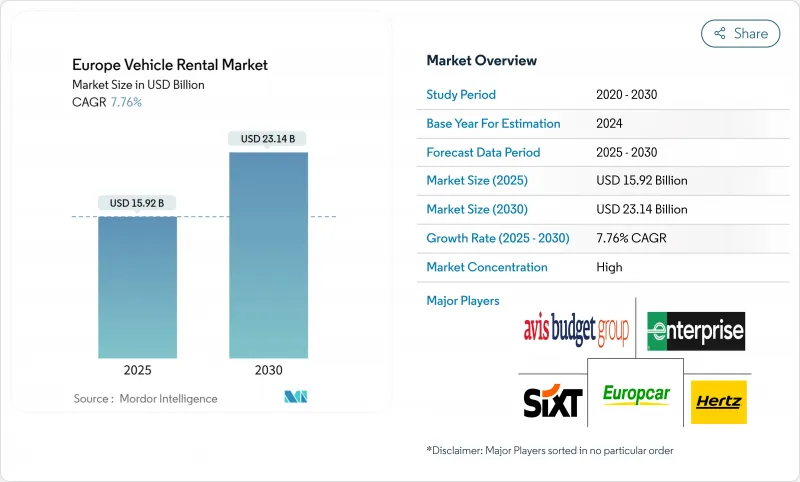

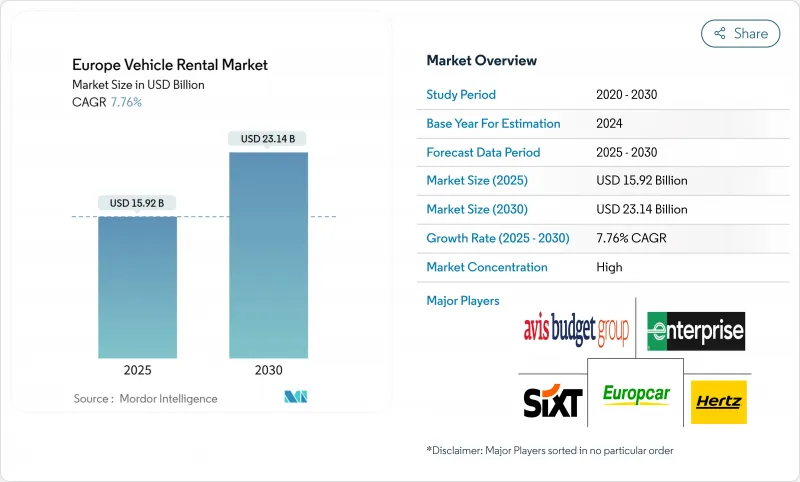

欧洲汽车租赁市场预计到 2025 年将创造 159.2 亿美元的收入,到 2030 年将达到 231.4 亿美元,年复合成长率为 7.76%。

市场成长主要得益于数位化预订管道的快速转型、订阅服务的普及以及租赁车辆电气化的加速发展。营运商正投资于以用户为中心的行动平台,这些平台整合了动态定价、会员奖励和辅助销售,从而提升了平均交易额。随着欧盟「Fit-for-55」目标的临近,电气化正从试点阶段走向大规模应用,但充电基础设施和残值风险仍不容忽视。地中海旅游业的復苏导致旺季车辆供应趋紧,而企业永续性政策则引导市场对低碳旅游方案的需求。

欧洲汽车租赁市场趋势与洞察

数位原民旅行者的激增推动了线上预订量的成长。

线上交易正以每年 11.2% 的速度成长,动态定价和便利的行动行程正在重塑欧洲汽车租赁市场。西欧超过 85% 的智慧型手机普及率使得即时比价成为可能,帮助那些以数位化为先导的营运商获得更高的价格并降低获客成本。数位化预订通常能透过演算法主导的提升销售将平均收入提高 23%,促使传统品牌加快 API 连接和应用程式重新设计。随着消费者对不透明定价的接受度降低,透明的数位化工作流程对于品牌股权至关重要。

欧盟「Fit for 55」强制令加速车辆电气化进程

「Fit-for-55」标准中提出的零排放车队目标,促使各大租赁集团制定了多年资本投资计划,其中许多集团的目标是到2030年实现50%至70%的车辆电气化。欧盟创新基金和欧盟委员会拨款10亿欧元用于基础设施和自动驾驶试点计画的汽车行动计划,部分抵消了前期的高昂成本。像Alval的Vehicle-to-Grid)计画这样的伙伴关係——该计画旨在建造70万个充电桩——体现了整个生态系统的融合。

欧盟更严格的消费者保护法规增加了合规成本。

欧盟进行的一项「小型抽查」显示,仅45%的中介网站完全合规,迫使业者对其后端预订引擎进行全面改造,规范保险揭露,并取消预先勾选的附加元件。小型企业在成本与收入方面受到的影响尤其严重,这将加速市场整合,但最终将提振消费者信心。

细分市场分析

到 2024 年,欧洲汽车租赁市场规模将主要依赖线下管道,但随着智慧型手机用户优先考虑即时确认和透明定价,线上入口网站将加速扩张,到 2024 年市场份额将达到 65.20%。线下预订仍吸引企业差旅部门和直接到店的客户,但随着网路和行动介面日趋成熟,其市占率正逐年下降。

预计到2030年,线上平台将以11.20%的复合年增长率成长,这主要得益于它们越来越多地采用人工智慧引擎,以同步即时需求和空席状况,从而提高产量比率并促进提升销售。用户数预计将从2023年的6,300万增加到2027年的8,000万以上,显示欧洲汽车租赁市场正在向数据主导生态系统演进。与航空公司和线上旅行社(OTA)的API伙伴关係将扩大覆盖范围,而浮动定价将缓解旺季车辆短缺问题,并实现车辆稀缺的商业化。

到2024年,机场门市将占据55.10%的市场。特许经营费通常高达毛利的12%,会降低净利率,但车辆数量有保障。受都市区拥堵费和消费者偏好本地取车的推动,包括郊区枢纽和宅配服务在内的非机场门市预计将超越欧洲整体汽车租赁市场的成长速度。

预计到 2030 年,非机场领域将以 7.50% 的复合年增长率成长,因为对于希望抓住本地需求和偏好便利都市区位置的企业客户而言,非机场领域具有战略意义,同时还能降低与机场营运相关的高成本。

预计到2024年,30天或以下的短期租赁仍将占据70.25%的市场份额,主要反映在休閒和商务旅游方面。然而,订阅模式正在模糊租赁和租约之间的界限,将固定期限合约转变为包含维护、保险以及在某些情况下包含收费的按月协议。目前,订阅模式在欧洲汽车租赁市场的需求成长中占了两位数的份额。

随着企业重新评估其车队,到 2030 年,长期经营租赁也将以 38.55% 的复合年增长率成长。租赁公司正在利用远端资讯处理技术来管理里程限制,满足客户的灵活性需求,同时实现较高的残值回收率。

欧洲汽车租赁市场按预订类型(线下与线上)、租赁管道(机场内与机场外)、租赁期限(短期与长期)、用途(休閒/旅游、其他)、车辆级别(经济型、紧凑型、其他)、动力传动系统(内燃机、其他)、服务模式(传统汽车租赁、其他)、最终用户和国家进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位原民旅行者的激增推动了西欧各地的线上预订。

- 欧盟「Fit-for-55」计画加速汽车租赁业者的车辆电气化进程

- 城市中心订阅式汽车服务模式的兴起

- 企业永续性计画优先考虑低碳租赁方案

- 地中海旅游业復苏带动休閒租赁市场成长。

- 电动车充电基础设施的快速扩张促进了车辆电气化。

- 市场限制

- 欧盟严格的消费者保护和价格透明度规定推高了合规成本。

- 电动车的快速普及正在改变内燃机汽车的残值,降低车队投资报酬率(ROI)。

- 都市区汽车共享和叫车蚕食城市租车市场

- 电动车购置成本上升和充电基础设施投资增加,对资本配置构成压力。

- 监理与技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按预订类型

- 离线

- 在线的

- 租赁频道

- 机场内部

- 机场外

- 按租赁期限

- 短期(最多 30 天)

- 长期租赁(30天或以上)

- 透过使用

- 休閒/旅游

- 商业/企业

- 按车辆类别

- 经济

- 袖珍的

- SUV 与跨界车

- 豪华/高级

- 轻型商用货车和卡车

- 按动力传动系统

- 内燃机(ICE)

- 混合动力电动车(HEV/PHEV)

- 电池电动车(BEV)

- 按服务模式

- 传统车辆租赁

- 车辆订阅

- 汽车共享

- 最终用户

- 自驾

- 包含驱动程式

- 企业车辆外包

- 按地区

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 北欧国家(瑞典、挪威、丹麦、芬兰)

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、船队投资)

- 市占率分析

- 公司简介(包括全球概览、市场层级概览、核心业务部门、财务状况、策略资讯、市场排名/份额、产品和服务、近期发展动态)

- Europcar Mobility Group

- Enterprise Holdings Inc.

- SIXT SE

- Avis Budget Group Inc.

- Hertz Global Holdings Inc.

- OK Mobility Group

- Goldcar Rental SL

- Auto Europe LLC

- Buchbinder Rent-a-Car

- BlaBlaCar

- Ayvens

- Finn Auto GmbH

- Leasys SpA

- Ubeeqo Carsharing GmbH

- Green Motion International

- Share Now GmbH

- DRIVALIA Car Rental

- Dollar Thrifty Automotive Group

- National Car Rental

- Alamo Rent A Car

- ACE Rent A Car

第七章 市场机会与未来展望

The Europe vehicle rental market generated USD 15.92 billion in 2025 and is on track to reach USD 23.14 billion by 2030, expanding at a 7.76% CAGR.

The market's growth is underpinned by a rapid shift to digital booking channels, proliferating subscription offers, and accelerating electrification of rental fleets. Operators are investing in user-centric mobile platforms that bundle dynamic pricing, loyalty benefits, and ancillary sales, thereby lifting average transaction values. Electrification is moving from pilot to scale as EU Fit-for-55 targets approach, even though charging infrastructure and residual-value risks remain material. A rebound in Mediterranean tourism has tightened peak-season vehicle supply, while corporate sustainability policies are steering demand toward low-carbon packages.

Europe Vehicle Rental Market Trends and Insights

Surge in Digital-Native Travellers Boosting Online Bookings

Online transactions are growing at an 11.2% annual clip, reshaping the Europe vehicle rental market through dynamic pricing and frictionless mobile journeys. Western Europe's 85%+ smartphone penetration enables real-time comparison, helping digital-first operators secure premium rates and reduce acquisition costs. Digital bookings typically generate 23% higher average receipts thanks to algorithm-driven upselling, prompting legacy brands to accelerate API connectivity and app redesigns. As customer tolerance for opaque pricing falls, transparent digital workflows have become central to brand equity.

EU Fit-for-55 Mandates Accelerating Fleet Electrification

Zero-emission fleet targets embedded in Fit-for-55 have triggered multiyear capex plans among leading rental groups, many aiming for 50-70% electrification by 2030. Higher upfront costs are partially offset by EU innovation funds and the European Commission's EUR 1 billion automotive action-plan allocation to infrastructure and autonomous pilots. Partnerships such as Arval's vehicle-to-grid build-out, targeting 700,000 charge points, illustrate ecosystem convergence.

Stricter EU Consumer-Protection Rules Inflating Compliance Costs

An EU "mini-sweep" showed only 45% of intermediary sites are fully compliant, compelling operators to overhaul back-end booking engines, standardise insurance disclosures, and eliminate pre-ticked add-ons. Smaller firms face disproportionately higher cost-to-income impacts, accelerating market consolidation but ultimately enhancing consumer confidence.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Subscription-Based "Car-as-a-Service" Models

- Corporate Sustainability Programmes Favouring Low-Carbon Rentals

- Volatile ICE Residual Values Amid Rapid EV Uptake

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe vehicle rental market size tilted heavily toward offline channels in 2024, yet online portals are scaling faster and command 65.20% market share in 2024 as smartphone-enabled users value instant confirmation and transparent pricing. Offline bookings continue to appeal to corporate travel desks and walk-up customers but are losing share each year as web and mobile interfaces mature.

Online platforms is expected to foresee a growth of 11.20% CAGR by 2030 owing to increasingly embed artificial-intelligence engines that synchronise real-time demand with fleet availability, lifting yield and supporting ancillary upsell. Users are expected to rise from 63 million in 2023 to more than 80 million by 2027, illustrating how the Europe vehicle rental market is evolving into a data-driven ecosystem. API partnerships with airlines and OTAs extend reach, while variable pricing smooths peak-season shortages and monetises vehicle scarcity.

On-airport stations accounted for 55.10% market share in 2024 because of captive travellers accept premium pricing. Concession fees, often as high as 12% of gross revenue, reduce margins but guarantee volume. Off-airport outlets, including suburban hubs and delivery-to-door concepts, are forecast to outpace overall Europe vehicle rental market growth, supported by urban congestion charges and consumers' preference for local pickups.

The off-airport segment is expected to register a CAGR of 7.50% by 2030, as it is becoming increasingly strategic for operators seeking to mitigate the high costs associated with airport operations while capturing local demand and corporate accounts that prefer convenient urban locations.

Short-term hires of up to 30 days stayed dominant with 70.25% Market share in 2024 with , mirroring leisure travel and corporate trips. However, the subscription segment is eroding the boundary between rental and leasing, converting fixed-term contracts into rolling monthly agreements that include maintenance, insurance, and sometimes charging. Subscriptions now represent a double-digit share of incremental Europe vehicle rental market demand.

Longer operating leases are also expanding at 38.55% CAGR through 2030 as corporates rethink fleet ownership. Rental companies leverage telematics to manage mileage caps and predictive servicing, ensuring high residual-value recovery while fulfilling clients' flexibility requirements.

The Vehicle Rental Market in Europe Report is Segmented by Booking Type (Offline and Online), Rental Channel (On-Airport and Off-Airport), Rental Duration (Short Term and Long Term), Application Type (Leisure/Tourism and More), Vehicle Class (Economy, Compact, and More), Powertrain (ICE, and More), Service Model (Traditional Car Rental and More), End-User, and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Europcar Mobility Group

- Enterprise Holdings Inc.

- SIXT SE

- Avis Budget Group Inc.

- Hertz Global Holdings Inc.

- OK Mobility Group

- Goldcar Rental S.L.

- Auto Europe LLC

- Buchbinder Rent-a-Car

- BlaBlaCar

- Ayvens

- Finn Auto GmbH

- Leasys S.p.A.

- Ubeeqo Carsharing GmbH

- Green Motion International

- Share Now GmbH

- DRIVALIA Car Rental

- Dollar Thrifty Automotive Group

- National Car Rental

- Alamo Rent A Car

- ACE Rent A Car

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in digital-native travellers boosting online bookings across Western Europe

- 4.2.2 EU Fit-for-55 mandates accelerating fleet electrification among rental operators

- 4.2.3 Rise of subscription-based car-as-a-service models in urban centres

- 4.2.4 Corporate sustainability programmes favouring low-carbon rental packages

- 4.2.5 Mediterranean tourism rebound inflating leisure-rental volumes

- 4.2.6 Rapid expansion of EV charging infrastructure enabling fleet electrification

- 4.3 Market Restraints

- 4.3.1 Stricter EU consumer-protection & pricing-transparency rules inflating compliance costs

- 4.3.2 Volatile ICE residual values amid rapid EV uptake denting fleet ROI

- 4.3.3 Urban car-sharing & ride-hailing cannibalising intra-city rentals

- 4.3.4 High EV acquisition costs and charging infrastructure investments straining capital allocation

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Booking Type

- 5.1.1 Offline

- 5.1.2 Online

- 5.2 By Rental Channel

- 5.2.1 On-Airport

- 5.2.2 Off-Airport

- 5.3 By Rental Duration

- 5.3.1 Short-Term ( up to 30 days)

- 5.3.2 Long-Term / Operating Lease (over 30 days)

- 5.4 By Application

- 5.4.1 Leisure / Tourism

- 5.4.2 Business / Corporate

- 5.5 By Vehicle Class

- 5.5.1 Economy

- 5.5.2 Compact

- 5.5.3 SUVs & Crossovers

- 5.5.4 Luxury / Premium

- 5.5.5 Light Commercial Vans & Trucks

- 5.6 By Powertrain

- 5.6.1 Internal Combustion Engine (ICE)

- 5.6.2 Hybrid Electric Vehicle (HEV/PHEV)

- 5.6.3 Battery Electric Vehicle (BEV)

- 5.7 By Service Model

- 5.7.1 Traditional Car Rental

- 5.7.2 Vehicle Subscription

- 5.7.3 Car Sharing

- 5.8 By End-User

- 5.8.1 Self-Driven

- 5.8.2 Chauffeur-Driven

- 5.8.3 Corporate Fleet Outsourcing

- 5.9 By Geography

- 5.9.1 Germany

- 5.9.2 United Kingdom

- 5.9.3 France

- 5.9.4 Spain

- 5.9.5 Italy

- 5.9.6 Netherlands

- 5.9.7 Nordics (Sweden, Norway, Denmark, Finland)

- 5.9.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Fleet Investments)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments}

- 6.4.1 Europcar Mobility Group

- 6.4.2 Enterprise Holdings Inc.

- 6.4.3 SIXT SE

- 6.4.4 Avis Budget Group Inc.

- 6.4.5 Hertz Global Holdings Inc.

- 6.4.6 OK Mobility Group

- 6.4.7 Goldcar Rental S.L.

- 6.4.8 Auto Europe LLC

- 6.4.9 Buchbinder Rent-a-Car

- 6.4.10 BlaBlaCar

- 6.4.11 Ayvens

- 6.4.12 Finn Auto GmbH

- 6.4.13 Leasys S.p.A.

- 6.4.14 Ubeeqo Carsharing GmbH

- 6.4.15 Green Motion International

- 6.4.16 Share Now GmbH

- 6.4.17 DRIVALIA Car Rental

- 6.4.18 Dollar Thrifty Automotive Group

- 6.4.19 National Car Rental

- 6.4.20 Alamo Rent A Car

- 6.4.21 ACE Rent A Car

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment