|

市场调查报告书

商品编码

1850118

自动化软体市场:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Marketing Automation Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

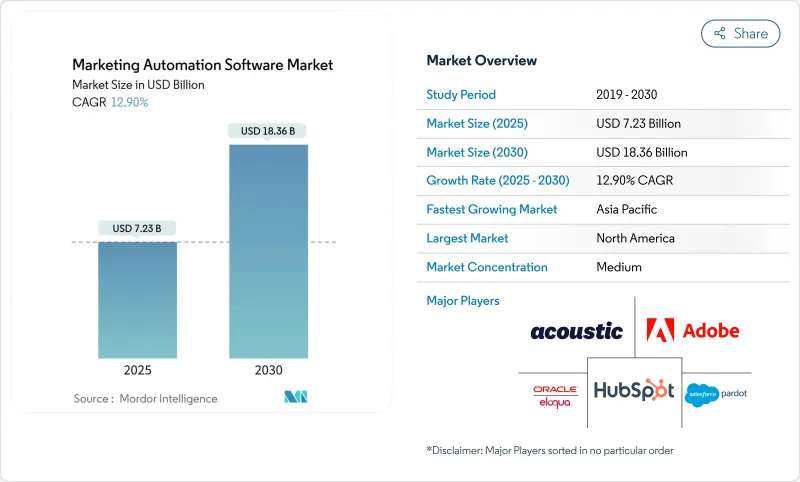

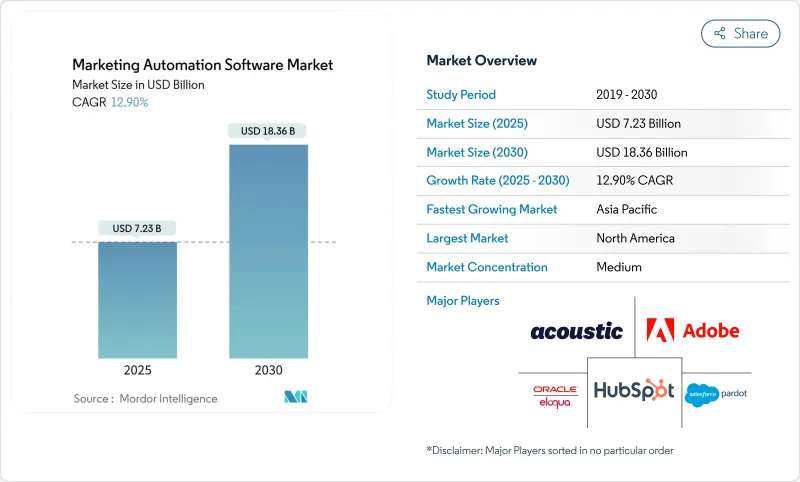

预计到 2025 年全球行销自动化软体市场规模将达到 72.3 亿美元,到 2030 年将达到 183.6 亿美元,复合年增长率高达 12.9%。

这一成长反映了企业迅速转向人工智慧主导的互动中心,这些中心可连接现有的CRM系统,并跨通路编配即时宣传活动。不断发展的生成式人工智慧如今可以创建文案、选择优惠讯息,并将交付时间精确到毫秒,使品牌能够在不增加员工数量的情况下扩展「一对一」通讯。日益严格的隐私保护条例也迫使企业实现同意追踪和资料沿袭的自动化。同时,中阶市场买家正在利用云端订阅模式来避免资本支出并扩大用户群,加剧了行销自动化软体市场各个细分市场的供应商竞争。

全球行销自动化软体市场趋势与洞察

新兴亚洲中小企业优先采用云端运算技术

亚太地区中小企业目前将其年收入的3-5%用于数位升级,并将云端原生行销堆迭视为其成长计画的关键。地区政策制定者正在起草“人工智慧基本法”,以资助员工技能提升、降低合规风险并减少新员工入职摩擦。 2024年,製造业在智慧工厂系统上的支出将成长48%,这将带来对与上游生产数据同步的面向客户的自动化系统的溢出需求。这些利多因素将共同推动亚洲高成长经济体的营销自动化软体市场。

人工智慧驱动的超个人化可提高宣传活动报酬率

生成式人工智慧消除了限制客户特定通讯的内容瓶颈。早期采用者已开始缩短宣传活动启动週期,并将预算重新投入预测意图和自动产生资产的预测模型。全球人工智慧专利数量的激增(年增 62.7%)为此能力提供了支持。供应商正在将大规模语言模型协同测试捆绑到其核心平台中,以加速采用,并显着提升开启率、转换率和生命週期价值。

重工业製造业中多供应商行销技术堆迭的整合开销

工厂营运商运行传统的 ERP 和车间系统,这些系统转子週期较长,资料模型也各不相同,需要大量的介面工作才能整合现代互动工具。与待开发区部署相比,整合计划可能会使预算增加高达 60%,导致价值实现时间过长,并让注重成本的製造业买家望而却步。

細項分析

至2024年,软体将占总收入的69.2%,凸显其作为行销自动化软体市场切入点的地位。然而,随着人工智慧模组、资料清理室和全通路中心的日益普及,越来越多的公司正在与专业合作伙伴合作,进行整合、优化和管治。因此,预计到2030年,服务的复合年增长率将达到14.0%,超过产品,并在行销自动化软体市场中占据更大的份额。

咨询团队目前承担了计划总成本的30-40%,这反映了从以许可证为中心的交易转变为以结果为中心的专案的转变。Oracle2025财年第二季的云端服务营收为59亿美元,反映了平台采用所带来的售后价值创造的巨大潜力。

由于资讯长重视弹性、自动修补程式和快速添加人工智慧功能,预计到2024年,云端订阅将占支出的66.3%,复合年增长率为13.9%。因此,与云端服务相关的行销自动化软体市场规模每季都在扩大。然而,银行、通讯业者和公共部门组织仍然将敏感资料集储存在本地,这导致了混合模式的出现,这些模式将非个人识别资讯 (PII) 工作负载迁移到公有云,同时将核心帐本固定在私有基础设施中。微软预测2024年的云端收入为1374亿美元,这表明市场对其互动套件所需的可扩展后端的需求根深蒂固。

行销自动化软体市场按元件(软体、服务)、配置(云端基础、本地部署)、组织规模(大型企业、中小型企业)、应用程式(宣传活动管理、电子邮件行销等)、最终用户垂直领域(金融服务、保险、零售、电子商务等)和地区细分。市场预测以美元计算。

区域分析

2024年,北美市场占总营收的37.5%,这得益于其成熟的云端基础设施、蓬勃发展的创业融资环境以及财富500强负责人的先发优势。 2025年即将生效的州级隐私法将加速采用包含同意编配的平台,从而巩固而非扼杀自动化。该地区丰富的合作伙伴生态系统也为该地区带来了另一个优势,这将缩短实施週期。

亚太地区是成长最快的地区,年增率高达 15.8%。这得益于云端运算价格的日益亲民以及数位原民中小企业数量的不断增长。韩国的人工智慧税额扣抵和半导体出口计划等政府激励措施正在推动基础设施建设,并降低即时个人化工作负载的延迟。中国 13 亿微信用户正在扩大嵌入式小程式自动化的受众群体,从而推动该平台相对于传统管道的成长率。

欧洲、拉丁美洲以及中东和非洲共同构成了多元化商业机会的基础。在欧盟,GDPR的影响力使合规职能成为重中之重,而行销人才的短缺则阻碍了全面部署。拉丁美洲的公司正在从本地迁移到云端套件,而沿岸地区的银行正在试行人工智慧聊天主导的入职培训,以覆盖银行帐户。总而言之,儘管宏观环境存在差异,但这些趋势显示行销自动化软体市场的收益仍将持续成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 亚洲新兴国家中小企业云端运算采用率激增

- 利用人工智慧驱动的超个人化来提高宣传活动报酬率

- 可组合的 CDP 和 CRM 套件集成

- BFSI 中合规主导的全通路部署

- 中国当地微信小程式自动化应用热潮

- 市场限制

- 重工业製造业中的多供应商MarTech堆迭整合开销

- 欧洲、中东和非洲地区中型企业行销营运人才短缺

- SaaS 订阅疲劳导致中小企业工具放弃率上升

- 价值链分析

- 技术展望

- 产业生态系统分析

- 数位转型与 CRM 融合的影响

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模与成长预测(价值)

- 按组件

- 软体

- 服务

- 按部署

- 云端基础

- 本地部署

- 按组织规模

- 大公司

- 小型企业

- 按用途

- 宣传活动管理

- 电子邮件行销

- 潜在客户管理

- 分析和报告

- 社群媒体行销

- 行动行销

- 集客式行销

- 销售支援

- 其他用途

- 按最终用户

- BFSI

- 零售与电子商务

- 资讯科技和通讯

- 卫生保健

- 製造业

- 媒体和娱乐

- 政府

- 教育

- 其他最终用户领域

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 新加坡

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- Vendor Positioning Analysis

- 公司简介

- HubSpot, Inc.

- Adobe Systems Inc.

- Oracle Corporation(Eloqua)

- Acoustic LP

- Salesforce Inc.(Pardot and Marketing Cloud)

- Microsoft Corporation

- IBM Corporation

- ActiveCampaign LLC

- Klaviyo Inc.

- Act-On Software

- SAP SE

- SugarCRM Inc.(Salesfusion)

- Zoho Corp.(Zoho Marketing Autom.)

- Mailchimp(Intuit)

- Keap

- Omnisend

- Thryv Holdings

- Drip

- Oracle NetSuite

- Braze Inc.

第七章 市场机会与未来展望

The global marketing automation software market size stands at USD 7.23 billion in 2025 and is on track to reach USD 18.36 billion by 2030, reflecting a solid 12.9% CAGR.

This growth mirrors enterprises' rapid pivot toward AI-driven engagement hubs that bolt onto existing CRM systems and orchestrate real-time campaigns across channels. Advancing generative AI now writes copy, selects offers and times delivery in milliseconds, letting brands scale "one-to-one" messaging without ballooning headcount. Demand also rises as privacy regulations tighten, pushing firms to automate consent tracking and data lineage. Meanwhile, mid-market buyers rely on cloud subscription models to bypass capital outlays, widening the user base and intensifying vendor competition in every region of the marketing automation software market.

Global Marketing Automation Software Market Trends and Insights

SMB-first cloud adoption surge across emerging Asia

Small and medium enterprises in Asia-Pacific now devote 3-5% of annual revenue to digital upgrades, positioning cloud-native marketing stacks as an essential plank of growth plans. Regional policymakers draft "AI Basic Laws" and fund workforce skilling, lowering compliance risk and reducing onboarding friction for newcomers. Manufacturing outlays on smart-factory systems rose 48% in 2024, creating spill-over demand for customer-facing automation that syncs with upstream production data. These tailwinds jointly lift the marketing automation software market across high-growth Asian economies.

AI-powered hyper-personalization boosting campaign ROI

Generative AI removes the content bottleneck that once limited customer-specific messaging. Early adopters already compress campaign launch cycles and re-route budgets toward predictive models that anticipate intent and auto-generate assets, a capability underpinned by soaring global AI patent activity (+62.7% YoY). Vendors bundle large-language-model co-pilots into core platforms, accelerating usage and adding measurable lift in open rates, conversions and lifetime value.

Multi-vendor MarTech stack integration overheads in heavy-industry manufacturing

Plant operators run legacy ERP and shop-floor systems with long rotor cycles and bespoke data models, so layering in modern engagement tools demands extensive interface work. Integration projects inflate budgets by up to 60% versus green-field deployments, lengthening time-to-value and dampening appetite among cost-sensitive manufacturing buyers.

Other drivers and restraints analyzed in the detailed report include:

- Integration of composable CDPs with CRM suites

- Compliance-led omnichannel expansion in BFSI

- Mid-market talent shortage in marketing ops across EMEA

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 69.2% revenue in 2024, underscoring its role as the entry ticket to the marketing automation software market. Yet as AI modules, data-clean rooms and omnichannel hubs proliferate, enterprises increasingly contract specialized partners for integration, optimization and governance. Consequently, services are forecast to clock a 14.0% CAGR, outpacing product, and capturing a larger slice of the marketing automation software market size by 2030.

Consulting teams now absorb 30-40% of total project spend, reflecting the move from license-centric deals to outcome-centric programs. Oracle's cloud services revenue of USD 5.9 billion in Q2 FY2025 illustrates the scale of post-sale value creation that accompanies platform uptake.

Cloud subscriptions held 66.3% of 2024 spend and will advance at 13.9% CAGR as CIOs prize elasticity, auto-patching and rapid AI feature drops. The marketing automation software market size linked to cloud offerings therefore widens each quarter. Nevertheless, banks, telcos and public bodies still keep sensitive datasets on-premise, giving rise to hybrid models that shuttle non-PII workloads to public clouds while anchoring core ledgers on private infrastructure. Microsoft tallied USD 137.4 billion in cloud revenue in 2024, evidence of entrenched demand for scalable back-ends that power engagement suites.

Marketing Automation Software Market is Segmented by Component (Software, Services), Deployment (Cloud-Based, On-Premises), Organization Size (Large Enterprises, Smes), Application (Campaign Management, Email Marketing, and More), End-User Vertical (BFSI, Retail and E-Commerce, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 37.5% of 2024 revenue, sustained by mature cloud infrastructure, an active venture funding scene and early-mover advantage among Fortune 500 marketers. Sweeping state-level privacy acts effective in 2025 accelerate adoption of platforms with in-built consent orchestration, further entrenching automation rather than curtailing it. The region additionally benefits from dense partner ecosystems that shorten implementation cycles.

Asia-Pacific is the fastest-growing territory, expanding 15.8% per year as cloud affordability intersects with large digitally native SME populations. Government incentives, such as Korea's AI tax credits and semiconductor export programs, add infrastructure depth and lower latency for real-time personalization workloads. China's 1.3 billion WeChat users amplify the addressable audience for embedded mini-app automation, translating into outsized platform growth relative to legacy channels.

Europe, South America, the Middle East and Africa together form a diversified opportunity base. In the EU, GDPR heritage keeps compliance features top-of-mind, yet a shortage of marketing operations talent inhibits full-scale rollouts. Latin American firms leapfrog on-premise by moving straight to cloud suites, while Gulf-region banks pilot AI chat-led onboarding to reach unbanked segments. Collectively, these trends channel incremental revenue into the marketing automation software market despite heterogeneous macro conditions.

- HubSpot, Inc.

- Adobe Systems Inc.

- Oracle Corporation (Eloqua)

- Acoustic L.P.

- Salesforce Inc. (Pardot and Marketing Cloud)

- Microsoft Corporation

- IBM Corporation

- ActiveCampaign LLC

- Klaviyo Inc.

- Act-On Software

- SAP SE

- SugarCRM Inc. (Salesfusion)

- Zoho Corp. (Zoho Marketing Autom.)

- Mailchimp (Intuit)

- Keap

- Omnisend

- Thryv Holdings

- Drip

- Oracle NetSuite

- Braze Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in SMB-first Cloud Adoption Surge Across Emerging Asia

- 4.2.2 AI-Powered Hyper-Personalization Boosting Campaign ROI

- 4.2.3 Integration of Composable CDPs with CRM Suites

- 4.2.4 Compliance-Led Omnichannel Expansion in BFSI

- 4.2.5 Adoption of WeChat Mini-App Automation Boom in Mainland China

- 4.3 Market Restraints

- 4.3.1 Multi-Vendor MarTech Stack Integration Overheads in Heavy-Industry Manufacturing

- 4.3.2 Mid-Market Talent Shortage in Marketing Ops Across EMEA

- 4.3.3 SaaS Subscription Fatigue Driving Higher Tool Churn in SMBs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Industry Ecosystem Analysis

- 4.7 Impact of Digital-Transformation Shift and CRM Convergence

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud-based

- 5.2.2 On-Premise

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Application

- 5.4.1 Campaign Management

- 5.4.2 Email Marketing

- 5.4.3 Lead Management

- 5.4.4 Analytics and Reporting

- 5.4.5 Social Media Marketing

- 5.4.6 Mobile Marketing

- 5.4.7 Inbound Marketing

- 5.4.8 Sales Enablement

- 5.4.9 Other Applications

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 Retail and E-commerce

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Manufacturing

- 5.5.6 Media and Entertainment

- 5.5.7 Government

- 5.5.8 Education

- 5.5.9 Other End-user Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Nordics

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Singapore

- 5.6.3.6 Indonesia

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Israel

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Nigeria

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Positioning Analysis

- 6.5 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.5.1 HubSpot, Inc.

- 6.5.2 Adobe Systems Inc.

- 6.5.3 Oracle Corporation (Eloqua)

- 6.5.4 Acoustic L.P.

- 6.5.5 Salesforce Inc. (Pardot and Marketing Cloud)

- 6.5.6 Microsoft Corporation

- 6.5.7 IBM Corporation

- 6.5.8 ActiveCampaign LLC

- 6.5.9 Klaviyo Inc.

- 6.5.10 Act-On Software

- 6.5.11 SAP SE

- 6.5.12 SugarCRM Inc. (Salesfusion)

- 6.5.13 Zoho Corp. (Zoho Marketing Autom.)

- 6.5.14 Mailchimp (Intuit)

- 6.5.15 Keap

- 6.5.16 Omnisend

- 6.5.17 Thryv Holdings

- 6.5.18 Drip

- 6.5.19 Oracle NetSuite

- 6.5.20 Braze Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment