|

市场调查报告书

商品编码

1850134

拉丁美洲的物联网安全:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Latin America IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

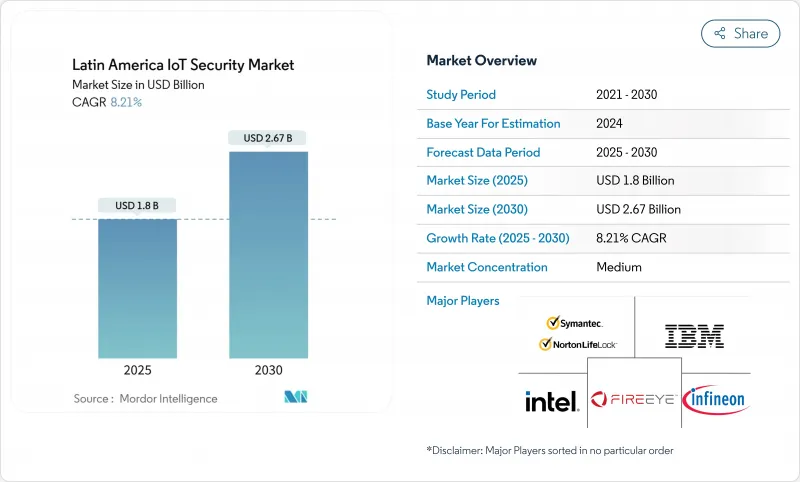

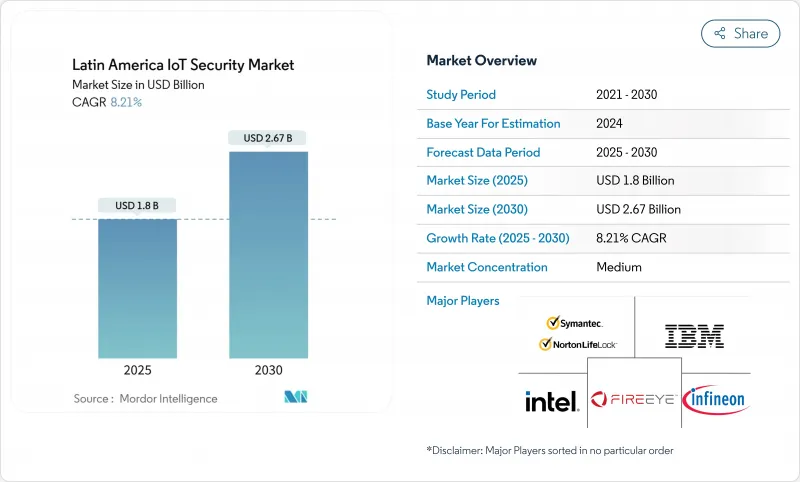

拉丁美洲物联网安全市场规模预计在 2025 年达到 18 亿美元,在 2030 年达到 26.7 亿美元,复合年增长率为 8.21%。

巴西智慧城市监控计画的扩展、智利对关键基础设施强制实施的零信任规则以及墨西哥 5G 的快速推出将推动保护连网型设备的支出。随着企业面临创纪录的医疗保健资料外洩事件,到 2024 年将有 1.824 亿人面临风险,投资将加速成长,而半导体短缺和碎片化的隐私法将在短期内限制部署速度。行动通讯业者增加 NB-IoT 网路增强合同,反映出一种策略转变,即捆绑安全服务,以实现连接升级的收益。区域製造商也在增加云端基础的威胁侦测订阅,以弥补对硬体级加密所需的加密晶片的有限存取。

拉丁美洲物联网安全市场趋势与洞察

智慧监控城市建设(巴西PAC4.0)

巴西的PAC 4.0计画要求市政当局使用强加密、微分段和基于人工智慧的异常检测技术来保护视讯感测器和资料湖。该市的采购遵循国际标准,要求供应商对设备进行ISO/IEC 27001认证。邻近的首都城市正在复製采购模板,以扩大其端点和网路存取控制覆盖范围。整合商报告称,监控合约指定了集中式安全营运仪表板,可以即时关联OT和IT事件。防篡改审核追踪的要求正在推动对安全硬体模组的需求,但由于全球加密晶片短缺,这些模组仍然供不应求。

通讯业者NB-IoT 网路强化提升销售

行动通讯业者现在将反诈骗API、安全引导和SIM卡级加密与每次NB-IoT电路启动打包在一起,将连线转变为安全增强型服务。四家墨西哥通讯业者于2024年联合推出了开放式网关安全API,早期采用者的银行利用这些工具将SIM卡交换诈骗事件减少了两位数。随着5G独立核心网路的上线,哥伦比亚和智利也出现了类似的服务。通讯业者,这些服务可以提高每位用户平均收益,同时锁定企业客户多年。

加密晶片供不应求(FAB转向AI)

代工厂正在将产能转向利润率更高的人工智慧加速器,并限制安全元件的出货量,这些元件在硬体层面保护物联网凭证。设备製造商面临超过40週的前置作业时间,迫使许多製造商交付带有纯软体密钥储存的电路板,而攻击者可以绕过这些密钥储存。可信任平台模组价格上涨高达70%,这推高了材料成本,并挤压了为市政计划供货的本地原始设备製造商的净利率。由于一些买家推迟部署直到供应稳定,供应商正在推迟累计端点安全的收益。政府正在考虑暂时免除进口关税,以鼓励加快从其他地区采购。

細項分析

网路安全,包括边界防火墙和安全网关,仍然是日益增长的设备群的基本保障,预计到2024年将创造6.84亿美元的市场规模,占拉丁美洲物联网安全市场份额的38%。预计2030年,云端安全市场规模将成长至4.38亿美元,复合年增长率为11.20%。混合工作模式也刺激了对整合本地部署和SaaS控制的零信任网路存取解决方案的需求。

云端原生平台现已将状态管理、执行时间保护和软体材料清单扫描捆绑到单一订阅中,从而减少了工具的无序扩张。微软的韧体分析预览强调了跨装置、网路和云端的深度程式码视觉性的转变。分析师预计,随着这些整合产品的成熟,拉丁美洲物联网安全市场将重新平衡,儘管网路设备在云端覆盖范围仍然有限的棕地工业场所可能仍将受到欢迎。

2024年,身分和存取管理工具市场规模将累计4.32亿美元,占拉丁美洲物联网安全市场规模的24%。这些工具构成了数百万个连接到企业云端的感测器的身份验证基础。安全和漏洞管理将成为成长最快的细分市场,复合年增长率为12.50%,反映出在备受瞩目的勒索软体事件发生后,董事会层级对持续风险评估的兴趣日益浓厚。自动化SBOM产生将成为主流采购标准,确保产品符合欧盟《网路弹性法案》的要求。

入侵防御系统非常适合需要确定性延迟和即时资料包阻止的生产线。资料遗失保护在医疗保健领域正获得监管支持,因为洩漏电子健康记录将面临巨额罚款。统一威胁管理套件受到中型企业的青睐,因为这些企业无力为每一层防护组成专门的团队。在合规性要求日益严格的背景下,将遥测技术整合到这些模组中的供应商将占据有利地位,从而获得交叉销售收益。

拉丁美洲物联网安全市场按安全类型(例如网路安全、端点安全)、解决方案(例如身分和存取管理 (IAM)、入侵防御系统 (IPS))、最终用户(例如医疗保健、製造业)、部署模式和地区细分。市场预测以美元计算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 智慧监控城市发展(巴西PAC 4.0)

- 面向通讯业者的 NB-IoT 网路增强提升销售

- 智利关键基础设施法强制实施零信任

- 物联网保险 - 保费折扣

- Edge——Linux 的开放原始码SBOM 工具

- 市场限制

- 加密晶片供不应求(从 FAB 到 AI 的转变)

- 拉丁美洲地区隐私製度碎片化

- 具有不可修补韧体的传统 3G 设备

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按安全类型

- 网路安全

- 端点安全

- 应用程式安全

- 云端安全

- 其他的

- 按解决方案

- 身分和存取管理 (IAM)

- 入侵防御系统(IPS)

- 预防资料外泄(DLP)

- 统一威胁管理 (UTM)

- 安全性和漏洞管理 (SVM)

- 网路安全取证(NSF)

- 其他的

- 按部署模型

- 本地部署

- 云

- 杂交种

- 按最终用户

- 卫生保健

- 製造业

- 公用事业

- BFSI

- 零售

- 政府

- 其他的

- 按地区

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 其他拉丁美洲地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Cisco Systems Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Kaspersky Lab

- NortonLifeLock Inc.(Symantec)

- FireEye Inc.

- Sophos Group plc

- Infineon Technologies AG

- ARM Ltd.

- Gemalto NV(Thales Group)

- AWS(IoT Device Defender)

- Oracle Corp.(IoT Cloud Security)

- Rapid7 Inc.

- Tenable Inc.

- Telefonica Tech(LA)

- Amrica Mvil IoT Security

- WurldTech(Security for OT)

第七章 市场机会与未来展望

The Latin America IoT security market size is valued at USD 1.8 billion in 2025 and will reach USD 2.67 billion by 2030, advancing at an 8.21% CAGR.

Expanding smart-city surveillance programs in Brazil, mandatory Zero-Trust rules for Chilean critical infrastructure, and rapid 5G rollouts across Mexico propel spending on connected-device protection. Investments accelerate as enterprises confront record healthcare breaches that exposed 182.4 million people in 2024, while semiconductor shortages and fragmented privacy laws temper near-term deployment velocity. Rising NB-IoT network hardening contracts signed by mobile operators reflect a strategic shift toward bundled security services that monetize connectivity upgrades. Regional manufacturers also increase cloud-based threat-detection subscriptions to compensate for limited access to crypto-chips required for hardware-level encryption.

Latin America IoT Security Market Trends and Insights

Roll-out of Smart-Surveillance Cities (Brazil PAC 4.0)

Brazil's PAC 4.0 program obliges municipalities to protect video sensors and data lakes with strong encryption, micro-segmentation, and AI-driven anomaly detection. City procurements reference international standards, prompting vendors to certify devices for ISO / IEC 27001 compliance. Neighbouring capitals replicate procurement templates, enlarging the addressable base for endpoint and network-access controls. Integrators report that surveillance contracts specify centralised security-operations dashboards able to correlate OT and IT events in real time. The requirement for tamper-proof audit trails also drives demand for secure hardware modules that remain scarce due to global crypto-chip shortages.

Telco NB-IoT Network Hardening Upsell

Mobile operators now package fraud-prevention APIs, secure bootstrapping, and SIM-level encryption with every NB-IoT line activation, turning connectivity into a security-enhanced service. Mexico's four carriers jointly unveiled Open Gateway security APIs in 2024, and early adopter banks use these tools to cut SIM-swap fraud incidents by double digits. Similar offerings appear in Colombia and Chile as 5G standalone cores come online. Contract terms increasingly bundle AI-based threat scoring engines that analyse signalling traffic to block botnet formation. For operators, these services raise average revenue per user while locking in enterprise customers for multiyear periods.

Crypto-Chip Supply Crunch (FAB Shift to AI)

Foundries redirect capacity toward high-margin AI accelerators, limiting secure element shipments that protect IoT credentials at hardware level. Device makers face lead-times that exceed 40 weeks, forcing many to ship boards equipped with software-only key storage that attackers can bypass. Price hikes of up to 70% for trusted-platform modules inflate bill-of-materials costs, squeezing margins for local OEMs supplying municipal projects. Some buyers postpone rollouts until supply stabilises, translating into slower endpoint security revenue recognition for vendors. Governments consider temporary import-tariff waivers to encourage rapid sourcing from alternate geographies.

Other drivers and restraints analyzed in the detailed report include:

- Zero-Trust Mandate in Chile Critical-Infra Law

- IoT Insurance-Premium Discounts

- Fragmented Privacy Regimes Across Latin America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Network Security generated USD 684 million in 2024, equal to 38% of the Latin America IoT security market share, as perimeter firewalls and secure gateways remained baseline safeguards for expanding device fleets. The Cloud Security segment is forecast to add USD 438 million by 2030, climbing at an 11.20% CAGR as enterprises migrate workloads and insist on policy consistency across multi-cloud tenancy. Hybrid work models also fuel demand for zero-trust network-access solutions that blend on-premises and SaaS controls.

Cloud-native platforms now bundle posture management, runtime protection, and software bill-of-materials scanning in one subscription, reducing tool sprawl. Microsoft's firmware analysis preview underscores a pivot toward deep code visibility that spans device, network, and cloud layers. As these converged offerings mature, analysts expect the Latin America IoT security market to rebalance, yet network appliances will still sell into brownfield industrial sites where cloud reach remains limited.

Identity and Access Management tools booked USD 432 million in 2024, translating to 24% contribution to the Latin America IoT security market size. They form the authentication backbone for millions of sensors plugging into corporate clouds. Security and Vulnerability Management grows fastest at a 12.50% CAGR, reflecting heightened board-level focus on continuous exposure scoring after high-profile ransomware incidents. Automated SBOM generation enters mainstream procurement criteria, aligning products with forthcoming EU Cyber Resilience Act requirements.

Intrusion Prevention Systems stay relevant for manufacturing lines that demand deterministic latency and immediate packet blocking. Data Loss Protection enjoys regulatory pull in healthcare where electronic patient-record breaches carry steep fines. Consolidated threat-management bundles gain traction among mid-tier firms that cannot staff specialist teams for each protection layer. Vendors that integrate telemetry across these modules position themselves to capture cross-sell revenue streams as compliance obligations tighten.

Latin America IoT Security Market Segmented by Type of Security (Network Security, Endpoint Security and More), Solutions (Identity and Access Management (IAM), Intrusion Prevention System (IPS) and More), End-User (Healthcare, Manufacturing and More), by Deployment Model and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Kaspersky Lab

- NortonLifeLock Inc. (Symantec)

- FireEye Inc.

- Sophos Group plc

- Infineon Technologies AG

- ARM Ltd.

- Gemalto NV (Thales Group)

- AWS (IoT Device Defender)

- Oracle Corp. (IoT Cloud Security)

- Rapid7 Inc.

- Tenable Inc.

- Telefonica Tech (LA)

- Amrica Mvil IoT Security

- WurldTech (Security for OT)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Roll-out of Smart-Surveillance Cities (Brazil PAC 4.0)

- 4.2.2 Telco NB-IoT Network Hardening Upsell

- 4.2.3 Zero-Trust Mandate in Chile Critical-Infra Law

- 4.2.4 IoT Insurance-Premium Discounts

- 4.2.5 Open-source SBOM Tooling in Edge-Linux

- 4.3 Market Restraints

- 4.3.1 Crypto-chip Supply Crunch (FAB shift to AI)

- 4.3.2 Fragmented Privacy Regimes across LATAM

- 4.3.3 Legacy 3G Devices with Un-patchable Firmware

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Security

- 5.1.1 Network Security

- 5.1.2 Endpoint Security

- 5.1.3 Application Security

- 5.1.4 Cloud Security

- 5.1.5 Others

- 5.2 By Solutions

- 5.2.1 Identity and Access Management (IAM)

- 5.2.2 Intrusion Prevention System (IPS)

- 5.2.3 Data Loss Protection (DLP)

- 5.2.4 Unified Threat Management (UTM)

- 5.2.5 Security and Vulnerability Management (SVM)

- 5.2.6 Network Security Forensics (NSF)

- 5.2.7 Others

- 5.3 By Deployment Model

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By End-User

- 5.4.1 Healthcare

- 5.4.2 Manufacturing

- 5.4.3 Utilities

- 5.4.4 BFSI

- 5.4.5 Retail

- 5.4.6 Government

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Colombia

- 5.5.5 Chile

- 5.5.6 Peru

- 5.5.7 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Microsoft Corporation

- 6.4.4 Palo Alto Networks Inc.

- 6.4.5 Fortinet Inc.

- 6.4.6 Check Point Software Technologies Ltd.

- 6.4.7 Trend Micro Inc.

- 6.4.8 Kaspersky Lab

- 6.4.9 NortonLifeLock Inc. (Symantec)

- 6.4.10 FireEye Inc.

- 6.4.11 Sophos Group plc

- 6.4.12 Infineon Technologies AG

- 6.4.13 ARM Ltd.

- 6.4.14 Gemalto NV (Thales Group)

- 6.4.15 AWS (IoT Device Defender)

- 6.4.16 Oracle Corp. (IoT Cloud Security)

- 6.4.17 Rapid7 Inc.

- 6.4.18 Tenable Inc.

- 6.4.19 Telefonica Tech (LA)

- 6.4.20 Amrica Mvil IoT Security

- 6.4.21 WurldTech (Security for OT)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment