|

市场调查报告书

商品编码

1850147

欧洲物联网安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

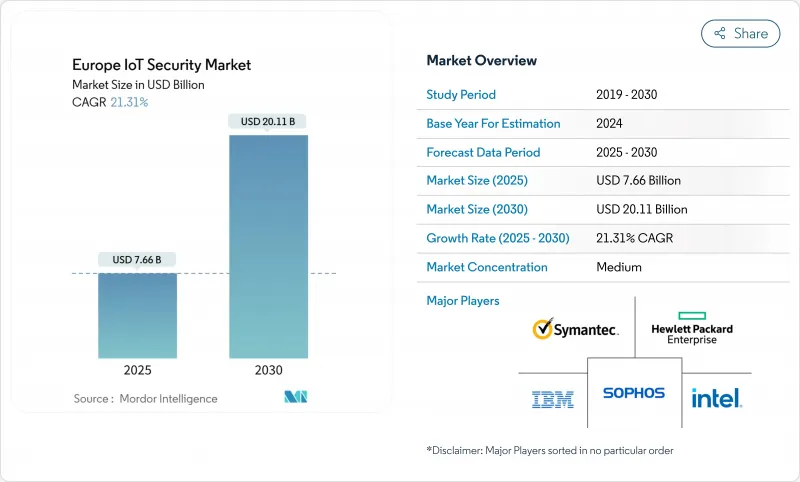

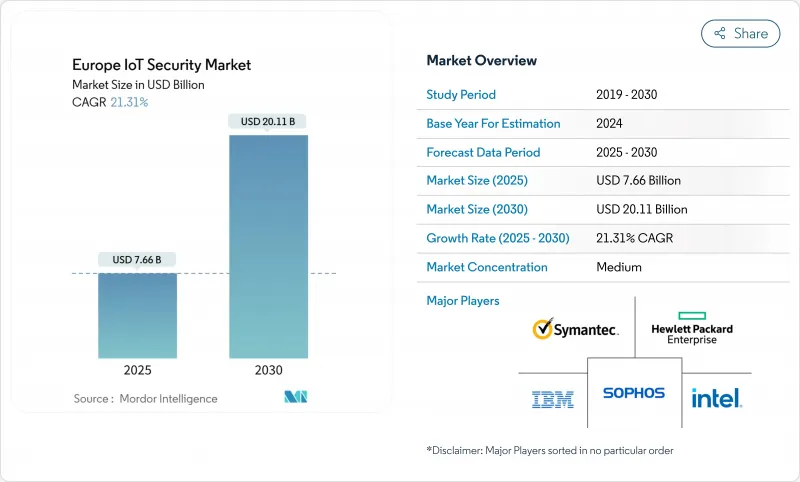

欧洲物联网安全市场预计到 2025 年将达到 76.6 亿美元,到 2030 年将达到 201.1 亿美元,复合年增长率为 21.3%。

针对连网型设备的网路攻击日益增加、监管要求日益严格,以及製造业快速采用工业4.0解决方案,都加速了企业对专业安全平台的投入。市场需求集中在以网路为中心的防御上,旨在保护操作技术;而对量子安全密码技术的投资则表明,企业已将长期韧性视为首要任务。提供混合云端边缘安全分析的供应商正日益受到企业的青睐,因为企业需要在资料主权规则和可扩展威胁情报需求之间取得平衡。来自利基新兴企业和半导体厂商日益激烈的竞争,迫使现有企业获得专业能力,尤其是在人工智慧驱动的侦测和安全元件设计方面。

欧洲物联网安全市场趋势与洞察

物联网终端数量的激增扩大了攻击面

从现在到2024年,欧洲企业将新增数百万个感测器、闸道器和机器人单元,将导致针对物联网的攻击激增107%。製造业已遭受超过500起勒索软体攻击,导致生产线中断,造成代价高昂的停机。传统棕地设备与基于IP的网路集成,正在打破传统的安全边界,迫使首席资讯安全官(CISO)部署可扩展的零信任代理和安全的设备管理迭加层。这推动了欧洲物联网安全市场对能够远端强制执行韧体完整性并检测异常行为的终端保护平台的需求。能够在不影响营运吞吐量的情况下监控异质设备的供应商,将在工业4.0采用者中获得竞争优势。

欧盟范围内的资料保护强制规定推动了安全支出。

NIS2 指令将于 2024 年 10 月生效,将资料外洩报告和风险管理义务扩展至欧洲约 35 万家机构。同时,《网路韧性法案》的实施要求製造商在产品设计中融入安全理念,并维护软体材料清单,否则将面临最高 1,500 万欧元的罚款。法国医疗机构和通讯业者在 2024 年发生多起数百万欧元的资料外洩事件后,已接受了法国国家资讯安全局 (ANSSI) 的严格审核。合规的紧迫性体现在预算即时分配,用于託管检测、漏洞管理和供应链评估解决方案,从而推动欧洲物联网安全市场的短期成长。

不同设备间安全标准分散

儘管 ETSI EN 303 645 标准定义了诸如移除预设密码等基本控制措施,但不同产业和国家认证系统的差异增加了复杂性。即将推出的欧盟网路安全认证计画虽然基于通用准则,但引入了新的认证等级,导致中小企业面临重复审计和不断上涨的咨询费用。根据 SMESEC计划,目前 43% 的网路攻击针对中小企业,而中小企业的设备组合涵盖消费和工业领域,这阻碍了其大规模安全措施的普及。

细分市场分析

到2024年,网路安全收入将占总收入的38.6%,这表明其在隔离工业流量和实施最小权限分段方面发挥着至关重要的作用。专为Modbus、PROFINET和OPC UA客製化的深度深度封包检测引擎可降低IT-OT骨干网路中的横向移动风险。在欧洲物联网安全市场,面向连接防御的通讯协定感知威胁分析预计将随着连接工厂车间自主移动机器人的5G专用网路的普及而同步成长。云端安全虽然目前规模较小,但随着企业将其资料管道迁移到超大规模和主权区域云,其复合年增长率将达到21.5%。整合了零信任网路和云端原生防火墙的安全存取服务边际(SASE)产品在2025年采购蓝图中排名靠前,有望使云端安全在2030年之前弥补其收入缺口。

智慧摄影机、穿戴式感测器和微服务的激增,需要持续的软体完整性检验,这推动了对终端和应用安全的需求。此外,在欧洲通用重要计划(IPCEI)共同资助的半导体专案的推动下,诸如PUF(物理不可复製函数)等嵌入式或晶片级控制技术正被整合到新型汽车和医疗保健设备中。能够提供涵盖这些层面的全面产品组合的供应商,预计将在欧洲物联网安全市场占据更大的份额。

到2024年,软体支出将占总支出的66.5%,因为企业更倾向于使用可扩展至数十万台设备的基于许可的分析引擎。行为异常检测、韧体更新的安全编配以及加密金钥生命週期管理等功能正越来越多地以容器化模组的形式提供,便于在Kubernetes丛集中部署。因此,将威胁情报来源和漏洞扫描器打包到统一主机中的平台供应商在欧洲物联网安全市场中获得了很高的续订率。

然而,由于缺乏内部专家的中小企业将威胁调查、事件回应和合规报告外包,服务类业务的复合年增长率 (CAGR) 最高,达到 22.8%。託管安全服务提供者 (MSSP) 将全天候监控、渗透测试和监管差距评估打包成极具吸引力的订阅模式,以满足资金预算紧张的企业的需求。能够将各种安全控制措施整合到复杂的棕地环境中,并记录符合网路安全法规的、不偏袒任何厂商的咨询顾问,预计将在欧洲物联网安全行业获得持续的需求。硬体销售依然强劲,这主要得益于高风险医疗植入和汽车电子控制单元 (ECU) 所强制要求的可信任平台模组和安全元件。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网终端数量的增加扩大了攻击面

- 欧盟范围内的资料保护强制规定加快了安全支出。

- 智慧工厂中工业物联网的快速应用

- 针对关键基础设施的复杂网路攻击

- 后量子密码技术计划

- 「地平线欧洲」计画和国家津贴帮助中小企业增强安全性

- 市场限制

- 异构设备间安全标准分散

- 遗留棕地资产整合成本高昂

- 欧洲中小企业物联网安全人才短缺

- 半导体供应链瓶颈减缓了安全元件的部署。

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按安全类型

- 网路安全

- 端点安全

- 应用程式安全

- 云端安全

- 嵌入式/晶片级安全

- 其他小众安全类型

- 透过解决方案

- 硬体

- 软体

- 服务

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- 汽车与运输

- 医疗保健和生命科学

- 政府和国防部

- 製造业和工业

- 能源与公共产业

- 其他终端用户产业

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- IBM Corporation

- Thales DIS(Gemalto)

- Fortinet Inc.

- Infineon Technologies AG

- Intel Corporation

- Sophos Group PLC

- Palo Alto Networks Inc.

- Hewlett Packard Enterprise Co.

- Broadcom Inc.(Symantec)

- Trend Micro Inc.

- Check Point Software Technologies Ltd.

- Kaspersky Lab

- ARM Ltd.

- Atos SE

- Siemens Digital Industries Software

- Avast PLC

- NXP Semiconductors NV

- Device Authority Ltd.

- Secure Thingz Ltd.

第七章 市场机会与未来展望

The Europe IoT Security market size is valued at USD 7.66 billion in 2025 and is forecast to reach USD 20.11 billion by 2030, registering a 21.3% CAGR.

Rising cyber-attacks on connected devices, stringent regulatory mandates and fast adoption of Industrie 4.0 solutions in manufacturing combine to accelerate spending on specialised security platforms. Demand concentrates on network-centric defences that safeguard operational technology, while quantum-safe cryptography investments signal long-term resilience priorities. Vendors offering hybrid cloud-edge security analytics gain traction as enterprises balance data-sovereignty rules with the need for scalable threat intelligence. Intensifying competition from niche start-ups and semiconductor players is prompting incumbents to acquire specialised capabilities, especially around AI-driven detection and secure-element design.

Europe IoT Security Market Trends and Insights

Proliferation of IoT Endpoints Enlarging Attack Surface

European enterprises added millions of sensors, gateways and robotics units during 2024, driving a 107% spike in IoT-focused attacks. Manufacturing recorded more than 500 ransomware incidents that disrupted discrete production lines and forced costly downtime. Legacy brownfield machinery integrating with IP-based networks dissolves traditional perimeters, compelling CISOs to deploy scalable zero-trust agents and secured device-management overlays. Demand for endpoint protection platforms that remotely enforce firmware integrity and detect anomalous behaviour therefore rises across the Europe IoT Security market. Vendors that can monitor heterogeneous devices without impacting operational throughput gain competitive advantage among Industrie 4.0 adopters.

EU-wide Data-Protection Mandates Accelerating Security Spend

The NIS2 Directive, effective from October 2024, extended breach-reporting and risk-management obligations to about 350,000 European organisations. Parallel enactment of the Cyber Resilience Act compels manufacturers to embed security-by-design and maintain software bills of materials, with fines reaching EUR 15 million. Healthcare and telecom operators in France already face active audits by ANSSI following several multi-million-record breaches during 2024. Compliance urgency is translating into immediate budget reallocations toward managed detection, vulnerability management and supply-chain assessment solutions, fuelling short-term growth across the Europe IoT Security market.

Fragmented Security Standards Across Heterogeneous Devices

While ETSI EN 303 645 defines baseline controls such as removal of default passwords, differing sectoral frameworks and national certification schemes add layers of complexity. The forthcoming EU Cybersecurity Certification Scheme builds on Common Criteria but introduces new assurance classes, leaving SMEs juggling overlapping audits and spiralling consultancy fees. The SMESEC project found that 43% of attacks now target small businesses whose device portfolios span consumer and industrial categories, delaying large-scale security roll-outs.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Industrial-IoT Adoption in Smart Factories

- Sophisticated Cyber-Attacks on Critical Infrastructure

- High Integration Cost for Legacy Brown-Field Assets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Network Security generated 38.6% revenue in 2024, underlining its foundational role in isolating industrial traffic and enforcing least-privilege segmentation. Deep-packet inspection engines tuned for Modbus, PROFINET and OPC UA mitigate lateral movement risks across converged IT-OT backbones. Inside the Europe IoT Security market size for connectivity defences, protocol-aware threat analytics are expected to grow parallel to 5G private networks that connect autonomous mobile robots on factory floors. Cloud Security, although smaller today, grows at 21.5% CAGR as enterprises shift data pipelines to hyperscale and sovereign regional clouds. Secure access service edge (SASE) offerings that converge zero-trust networking and cloud-native firewalls rank high on 2025 procurement roadmaps, positioning Cloud Security to narrow the revenue gap before 2030.

Demand for Endpoint and Application Security follows the proliferation of smart cameras, wearable sensors and micro-services that require continuous software-integrity validation. Embedded or chip-level controls such as physically unclonable functions (PUFs) appear in new automotive and healthcare devices, with semiconductor programmes co-funded under the Important Project of Common European Interest (IPCEI) fuelling uptake. Vendors delivering holistic portfolios across these layers will capture a larger slice of the Europe IoT Security market.

Software accounted for 66.5% of total spending in 2024 because enterprises prefer licence-based analytics engines that scale across hundreds of thousands of devices. Behavioural anomaly detection, secure orchestration of firmware updates and cryptographic key-lifecycle management are increasingly delivered as containerised modules easy to deploy in Kubernetes clusters. Consequently, platform suppliers that package threat intelligence feeds and vulnerability scanners within a unified console retain high renewal rates across the Europe IoT Security market size.

Services, however, post the fastest 22.8% CAGR as SMEs lacking in-house specialists outsource threat hunting, incident response and compliance reporting. Managed security service providers (MSSPs) bundle 24X7 monitoring, penetration testing and regulatory gap assessments into subscription models attractive under tight capital budgets. Vendor-agnostic consultants that can integrate disparate security controls inside complex brownfield environments and document Cyber Resilience Act compliance are poised for sustained demand within the Europe IoT Security industry. Hardware sales remain steadier, anchored by trusted-platform modules and secure elements mandated for high-risk medical implants and automotive ECUs.

The Europe IoT Security Market Report is Segmented by Security Type (Network Security, Endpoint Security, Application Security, and More), Solution (Hardware, Software, and Services), Deployment Mode (On-Premise and Cloud), End-User Industry (Automotive and Transportation, Healthcare and Life Sciences, Government and Defence, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- IBM Corporation

- Thales DIS (Gemalto)

- Fortinet Inc.

- Infineon Technologies AG

- Intel Corporation

- Sophos Group PLC

- Palo Alto Networks Inc.

- Hewlett Packard Enterprise Co.

- Broadcom Inc. (Symantec)

- Trend Micro Inc.

- Check Point Software Technologies Ltd.

- Kaspersky Lab

- ARM Ltd.

- Atos SE

- Siemens Digital Industries Software

- Avast PLC

- NXP Semiconductors N.V.

- Device Authority Ltd.

- Secure Thingz Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IoT endpoints enlarging attack surface

- 4.2.2 EU-wide data-protection mandates accelerating security spend

- 4.2.3 Rapid industrial-IoT adoption in smart factories

- 4.2.4 Sophisticated cyber-attacks on critical infrastructure

- 4.2.5 Post-quantum-ready cryptography initiatives

- 4.2.6 Horizon Europe and national grants subsidising SME security upgrades

- 4.3 Market Restraints

- 4.3.1 Fragmented security standards across heterogeneous devices

- 4.3.2 High integration cost for legacy brown-field assets

- 4.3.3 Scarcity of IoT-security talent in European SMBs

- 4.3.4 Semiconductor supply-chain bottlenecks delaying secure-element roll-outs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Security Type

- 5.1.1 Network Security

- 5.1.2 Endpoint Security

- 5.1.3 Application Security

- 5.1.4 Cloud Security

- 5.1.5 Embedded/Chip-level Security

- 5.1.6 Other Niche Security Types

- 5.2 By Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By End-User Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Government and Defence

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Energy and Utilities

- 5.4.6 Other End-User Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Thales DIS (Gemalto)

- 6.4.4 Fortinet Inc.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Intel Corporation

- 6.4.7 Sophos Group PLC

- 6.4.8 Palo Alto Networks Inc.

- 6.4.9 Hewlett Packard Enterprise Co.

- 6.4.10 Broadcom Inc. (Symantec)

- 6.4.11 Trend Micro Inc.

- 6.4.12 Check Point Software Technologies Ltd.

- 6.4.13 Kaspersky Lab

- 6.4.14 ARM Ltd.

- 6.4.15 Atos SE

- 6.4.16 Siemens Digital Industries Software

- 6.4.17 Avast PLC

- 6.4.18 NXP Semiconductors N.V.

- 6.4.19 Device Authority Ltd.

- 6.4.20 Secure Thingz Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment