|

市场调查报告书

商品编码

1850179

欧洲智慧製造:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

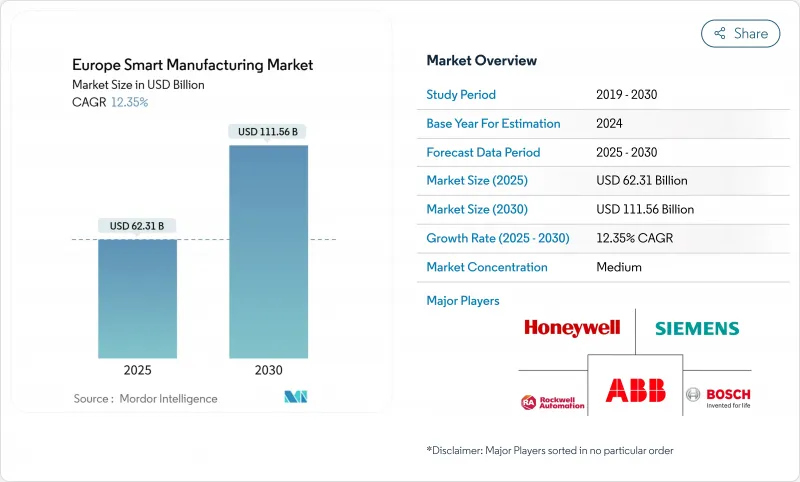

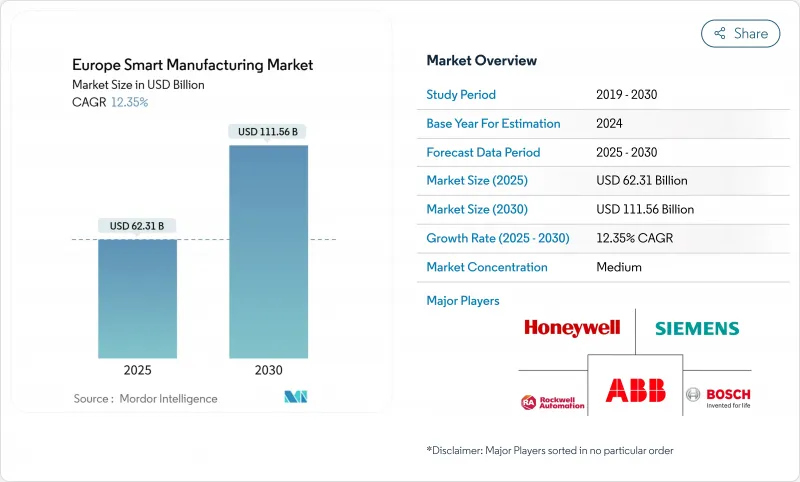

欧洲智慧製造市场预计到 2025 年将达到 623.1 亿美元,到 2030 年将达到 1,115.6 亿美元,年复合成长率为 12.35%。

人事费用通膨不断攀升、诸如2,000亿欧元(2,130亿美元)的InvestAI计画等高额公共资金投入,以及网路安全法规日益增长的监管压力,都在加速互联製造技术的应用。工业机器人持续支援工厂车间自动化,而边缘人工智慧和数数位双胞胎的部署则能释放即时流程洞察,进而提升资产利用率。企业可以透过建构融合控制硬体、工业物联网连接和分析软体的平台型生态系统,降低能耗并满足净零排放的要求。随着现有企业吸收人工智慧专家,以及各国政府将财政奖励与保护区域资料主权挂钩,竞争日益激烈,欧洲智慧製造市场也因此成为经济韧性的重要战略支柱。

欧洲智慧製造市场趋势与洞察

欧盟工业4.0资金筹措计划

强劲的欧洲资金为数位转型释放了前所未有的资本。德国的「製造X」(Manufacturing-X)计画提供1.5亿欧元(1.6亿美元)用于建造可互通的工业数据空间,而更广泛的「人工智慧投资」(InvestAI)架构正在调动2,000亿欧元(2,130亿美元)用于整个人工智慧基础设施建设。针对中小企业的配套补助降低了进入门槛。英国的「智慧製造」(Made Smarter)试点计画已向350个技术计划注入了2,200万英镑(2,800万美元),创造了1,600个新的就业机会。创投的动能紧接着公共资金的推动,德国人工智慧驱动的製造业Start-Ups数量激增67%,而超大规模资料中心业者。这些资金流动使欧洲智慧製造市场成为亚洲契约製造的可靠替代方案,同时保护了该地区的技术主权。

人事费用上升推动工厂自动化

到2024年,欧盟平均每小时人事费用将年增5%,达到33.5欧元(35.7美元),这将进一步拉大西欧与低工资地区之间的Delta。卢森堡的平均每小时工资为55.2欧元(58.8美元),在欧盟国家中位居榜首,这使得高端生产商更迫切地需要实现自动化,从而提升竞争力。此外,雇主还面临严重的人才缺口:在21个国家接受调查的公司中,75%的公司表示难以填补技术职缺。这些相互交织的压力正将自动化从一种可有可无的效率提升措施转变为一种必需品,加速智慧製造市场中重复性工作的机器人和电脑视觉系统替代进程。

网路安全和资料主权问题

《网路韧性法案》要求进行风险分级合规性评估,并可处以最高 1,500 万欧元(1,600 万美元)或全球营业额 2.5% 的罚款。 GDPR 和 NIS 2 法规的重迭实施,加剧了文件编制工作量,尤其对于网路安全团队有限的中小型企业而言更是如此。对资料传输至欧盟以外地区的担忧,减缓了向託管于欧盟以外的超大规模平台过渡的步伐,迫使供应商提供主权云端和边缘分析设备。这些合规成本延长了引进週期,并限制了欧洲智慧製造市场的短期成长。

细分市场分析

到2024年,工业机器人将占据欧洲智慧製造市场28%的份额,这主要得益于汽车组装自动化和标准化焊接单元的普及。发那FANUC)进军西班牙市场,标誌着南欧尚未开发的丛集正在蓬勃发展,其防爆协作喷涂机器人将开拓危险环境应用领域。数位双胞胎和模拟平台正以16.8%的复合年增长率快速成长,它们融合了基于实体的模型和人工智慧技术,能够预测资产运作状况并缩短试运行週期。模拟与製造执行系统(MES)的融合实现了闭合迴路最佳化,使数位双胞胎成为欧洲智慧製造市场成长最快的驱动力。

随着工厂向以乙太网路为基础的现场汇流排迁移,自动化控制系统(PLC、SCADA、DCS)正在升级。诸如HoneywellExperion Operations Assistant等人工智慧增强型人机介面(HMI)层能够提供情境化建议,从而减少警报疲劳。製造执行系统(MES)透过Valmet-FactoryPal等收购迅速发展,为OEE仪錶板提供指导性洞察。积层製造在备件履约占有一席之地,在该领域,几何复杂性比批量经济更为重要。这些不断扩展的工具集为欧洲智慧製造市场带来了多元化的收入来源。

欧洲智慧製造市场按技术(自动化控制系统、工业机器人等)、组件(硬体、软体、服务)、终端用户产业(汽车、航太与国防、化工与石化等)以及国家进行细分。市场规模和预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟工业4.0资助计划

- 劳动成本压力不断增加,推动工厂自动化

- 工业物联网连接的快速普及

- 净零排放目标加速能源优化解决方案

- 在欧洲中小企业引入边缘人工智慧品质检测

- 部署工业级 5G 专用网络

- 市场限制

- 网路安全和资料主权问题

- 高水准的棕地整合资本支出

- 中东欧电厂中碎片化的传统机器通讯协定

- 数位双胞胎工程人才短缺

- 价值/供应链分析

- 监管情势(欧盟数字十年、Gaia-X)

- 科技展望(工业物联网、数位双胞胎、5G、边缘人工智慧)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 自动化控制系统(PLC、SCADA、DCS)

- 工业机器人

- 工业IoT平台

- 人机介面(HMI)

- 製造执行系统(MES)

- 产品生命週期管理(PLM)

- 数位双胞胎与仿真

- 积层製造/3D列印

- 按组件

- 硬体

- 感应器

- 控制器/IPC

- 边缘运算设备

- 机器视觉系统

- 机器人技术

- 软体

- SCADA及HMI软体

- 分析和人工智慧软体

- ERP和PLM软体

- 服务

- 整合与咨询

- 维护和支援

- 託管服务

- 硬体

- 按最终用户行业划分

- 车

- 航太与国防

- 化工和石油化工产品

- 食品/饮料

- 製药和生物技术

- 金属和采矿

- 电子和半导体

- 石油和天然气

- 公共产业和能源

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 瑞典

- 波兰

- 比利时

- 奥地利

- 瑞士

- 挪威

- 芬兰

第六章 竞争情势

- 市场集中度

- 策略趋势

- Market-share Analysis

- 公司简介

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- General Electric Co.

- Robert Bosch GmbH

- FANUC Corporation

- IBM Corporation

- Dassault Systems SE

- SAP SE

- Mitsubishi Electric Corp.

- KUKA AG

- Yokogawa Electric Corp.

- PTC Inc.

- Hexagon AB

- Omron Corp.

- Beckhoff Automation GmbH

- Endress+Hauser AG

第七章 市场机会与未来展望

Europe smart manufacturing market size is currently valued at USD 62.31 billion in 2025 and is forecast to reach USD 111.56 billion by 2030, expanding at a 12.35% CAGR.

Intensifying labor-cost inflation, high-profile public funding such as the EUR 200 billion (USD 213 billion) InvestAI program, and escalating regulatory pressure under the Cyber Resilience Act collectively accelerate adoption of connected production technologies. Industrial robotics continues to anchor plant-floor automation, while edge AI and digital-twin deployments unlock real-time process insights that magnify asset utilization. Enterprises pursue platform-based ecosystems that fuse control hardware, IIoT connectivity, and analytics software so they can curb energy consumption and comply with net-zero mandates. The competitive field tightens as incumbents absorb AI specialists, and governments link fiscal incentives to local data-sovereignty safeguards, turning the Europe smart manufacturing market into a strategic pillar of economic resilience.

Europe Smart Manufacturing Market Trends and Insights

EU Industry-4.0 Funding Schemes

Robust European funding unlocks unprecedented capital for digital transformation. Germany's Manufacturing-X program supplies EUR 150 million (USD 160 million) to create interoperable industrial data spaces, while the broader InvestAI architecture mobilizes EUR 200 billion (USD 213 billion) across AI infrastructure. SME access to matching grants lowers entry barriers; the UK's Made Smarter pilot has already funnelled GBP 22 million (USD 28 million) into 350 technical projects that generated 1,600 new jobs. Venture momentum follows public outlays, illustrated by Germany's 67% jump in AI-enabled manufacturing start-ups and hyperscaler commitments from AWS, Microsoft, and Apple. These capital flows position the Europe smart manufacturing market as a credible alternative to Asian contract manufacturing while defending regional technology sovereignty.

Rising Labor-Cost Pressure Driving Factory Automation

Average EU hourly labor costs climbed 5% year over year to EUR 33.5 (USD 35.7) in 2024, widening the delta between Western Europe and lower-wage regions. Luxembourg tops the bloc at EUR 55.2 (USD 58.8) per hour, sharpening competitive urgency for automation among premium producers. Employers also confront an acute talent gap: 75% of firms surveyed across 21 countries report difficulty filling skilled roles. These intertwined pressures convert automation from a discretionary efficiency lever into an existential requirement, accelerating replacement of repetitive tasks with robotics and computer-vision systems across the Europe smart manufacturing market.

Cyber-Security and Data-Sovereignty Concerns

The Cyber Resilience Act enforces risk-tiered conformity assessments and may levy penalties up to EUR 15 million (USD 16 million) or 2.5% of global turnover. Overlapping GDPR and NIS 2 rules escalate documentation workloads, especially for SMEs with limited cyber teams. Fear of extraterritorial data transfer slows migration to hyperscale platforms hosted outside the EU, compelling suppliers to offer sovereign clouds or edge-analytics appliances. These compliance costs elongate deployment cycles and temper the near-term growth pace of the Europe smart manufacturing market

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of IIoT Connectivity

- Net-Zero Mandates Accelerating Energy-Optimization Solutions

- High Brown-Field Integration CAPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial robotics held 28% of Europe smart manufacturing market share in 2024, supported by automotive final-assembly automation and standardized welding cells. FANUC's expansion in Spain signals pursuit of underserved Southern European clusters, while its explosion-proof collaborative paint robot opens hazardous-environment applications. Digital twin & simulation platforms are scaling at a 16.8% CAGR, embedding physics-based models alongside AI to forecast asset behaviour and shrink commissioning intervals. Simulation convergence with MES unlocks closed-loop optimisation, positioning digital twins as the fastest lever inside the Europe smart manufacturing market.

Automation control systems (PLC, SCADA, DCS) experience replacement demand as plants migrate to Ethernet-based fieldbuses. AI-augmented HMI layers such as Honeywell's Experion Operations Assistant surface contextual recommendations that cut alarm fatigue. MES penetration quickens through acquisitions like Valmet-FactoryPal, enriching OEE dashboards with prescriptive insights. Additive manufacturing maintains a niche foothold in spare-parts fulfillment, where geometry complexity outweighs volume economics. This broadening toolset cements diversified revenue streams across the Europe smart manufacturing market.

Europe Smart Manufacturing Market is Segmented by Technology (Automation Control Systems, Industrial Robotics, and More), Component (Hardware, Software, Services), End-User Industry (Automotive, Aerospace and Defense, Chemicals and Petrochemicals, and More), and Country. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- General Electric Co.

- Robert Bosch GmbH

- FANUC Corporation

- IBM Corporation

- Dassault Systems SE

- SAP SE

- Mitsubishi Electric Corp.

- KUKA AG

- Yokogawa Electric Corp.

- PTC Inc.

- Hexagon AB

- Omron Corp.

- Beckhoff Automation GmbH

- Endress+Hauser AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Industry-4.0 funding schemes

- 4.2.2 Rising labor-cost pressure driving factory automation

- 4.2.3 Rapid adoption of IIoT connectivity

- 4.2.4 Net-zero mandates accelerating energy-optimisation solutions

- 4.2.5 Edge-AI quality-inspection deployment in European SMEs

- 4.2.6 Industrial-grade 5G private-network roll-outs

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-sovereignty concerns

- 4.3.2 High brown-field integration CAPEX

- 4.3.3 Fragmented legacy machine protocols in CEE plants

- 4.3.4 Scarcity of digital-twin engineering talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (EU Digital Decade, Gaia-X)

- 4.6 Technological Outlook (IIoT, Digital Twin, 5G, Edge-AI)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Automation Control Systems (PLC, SCADA, DCS)

- 5.1.2 Industrial Robotics

- 5.1.3 Industrial IoT Platforms

- 5.1.4 Human-Machine Interface (HMI)

- 5.1.5 Manufacturing Execution System (MES)

- 5.1.6 Product Lifecycle Management (PLM)

- 5.1.7 Digital Twin and Simulation

- 5.1.8 Additive Manufacturing / 3-D Printing

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 Sensors

- 5.2.1.2 Controllers / IPC

- 5.2.1.3 Edge-Computing Devices

- 5.2.1.4 Machine-Vision Systems

- 5.2.1.5 Robotics

- 5.2.2 Software

- 5.2.2.1 SCADA and HMI Software

- 5.2.2.2 Analytics and AI Software

- 5.2.2.3 ERP and PLM Software

- 5.2.3 Services

- 5.2.3.1 Integration and Consulting

- 5.2.3.2 Maintenance and Support

- 5.2.3.3 Managed Services

- 5.2.1 Hardware

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Chemicals and Petrochemicals

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals and Biotechnology

- 5.3.6 Metals and Mining

- 5.3.7 Electronics and Semiconductors

- 5.3.8 Oil and Gas

- 5.3.9 Utilities and Energy

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Netherlands

- 5.4.8 Sweden

- 5.4.9 Poland

- 5.4.10 Belgium

- 5.4.11 Austria

- 5.4.12 Switzerland

- 5.4.13 Norway

- 5.4.14 Finland

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market-share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 General Electric Co.

- 6.4.8 Robert Bosch GmbH

- 6.4.9 FANUC Corporation

- 6.4.10 IBM Corporation

- 6.4.11 Dassault Systems SE

- 6.4.12 SAP SE

- 6.4.13 Mitsubishi Electric Corp.

- 6.4.14 KUKA AG

- 6.4.15 Yokogawa Electric Corp.

- 6.4.16 PTC Inc.

- 6.4.17 Hexagon AB

- 6.4.18 Omron Corp.

- 6.4.19 Beckhoff Automation GmbH

- 6.4.20 Endress+Hauser AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment