|

市场调查报告书

商品编码

1850262

暖通空调服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

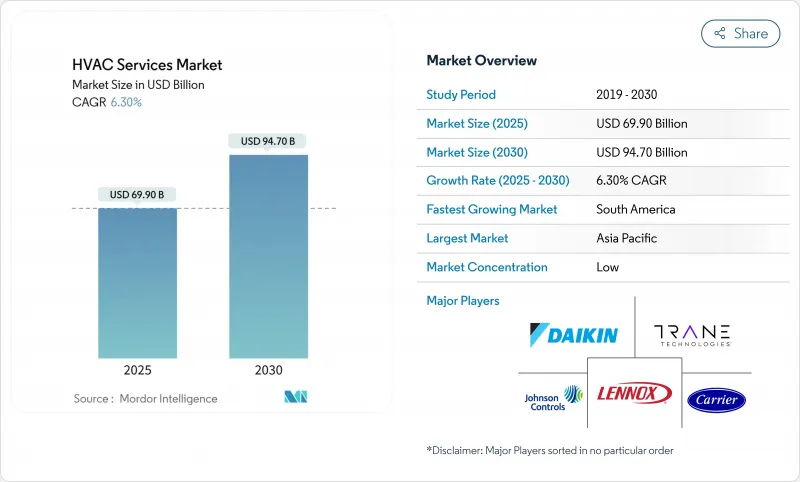

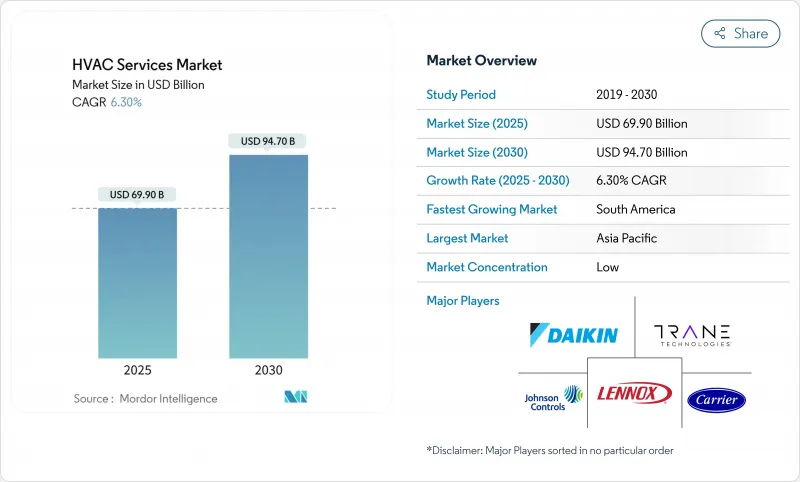

预计到 2025 年,暖通空调服务市场规模将达到 699 亿美元,到 2030 年将扩大到 947 亿美元,复合年增长率为 6.30%。

需求主要源自于超大规模资料中心的建置、由氢氟碳化合物(HFC)减排政策推动的维修浪潮,以及将被动维修转变为预测性服务合约的数位化。亚太地区的经济成长势头、快速的都市化以及数据中心的蓬勃发展,巩固了该地区的收入领先地位。同时,全球各地的超大规模营运商正推动暖通空调(HVAC)服务市场向专业冷却、液冷温度控管以及保障正常运作的订阅定价模式转型。儘管现有供应商正透过物联网分析平台实现装置量客户群的获利,并将故障维修服务转变为持续的最佳化服务,但技术纯熟劳工短缺和投入成本上涨正威胁着净利率。因此,竞争压力有利于那些能够将规模化采购与强大的内部培训相结合,从而抵御工资上涨并从规模较小的竞争对手手中夺取市场份额的公司。

全球暖通空调服务市场趋势与洞察

新兴国家建设活动的扩张

亚太和拉丁美洲加速的都市化推动了新建项目的涌现,进而带动了暖通空调(HVAC)服务市场的安装和试运行需求。建筑许可中纳入的能源效率标准正促使人们将生命週期支出从紧急维修转向预防性保养和性能合约。在印度和巴西,政府的绿建筑奖励措施鼓励早期采用高效暖通空调系统,促使开发商在设计阶段就签订服务合约。能够在交付时整合数位化监控的供应商,可以在建筑物的整个生命週期内获得类似年金的收入。加州向Lincus公司提供的176万美元津贴,用于直流供电的商用系统,体现了政策制定者对依赖专业服务技术的下一代系统的承诺。

超大规模资料中心建置的扩展

超大规模资料中心需要复杂的、通常基于液体的冷却系统,传统机械承包商若不大幅提升自身技能,则难以满足需求。冷却能耗可能占资料中心电力预算的50%之多,因此,效率是营运商整体拥有成本的核心组成部分,也是选择服务供应商的关键因素。因此,暖通空调服务市场青睐那些拥有先进流体处理技术和人工智慧主导的监控能力的公司,这些能力能够预测故障发生前的热点区域。特灵科技与LiquidStack的合作,展现了原始设备製造商(OEM)如何与液体冷却专家携手合作,加速自身能力的提升。预计到2024年初,资料中心资本支出将激增185%,达到540亿美元,将确保专业服务需求的强劲成长。

技术纯熟劳工短缺和工资上涨

全球暖通空调服务市场需要新增11万名技术人员,但目前从业人员中已有半数超过45岁。服务提供者目前的平均年薪为59,620美元,而资料中心专业的薪资则高得多。随着物联网平台融合IT和OT,需要兼具机器和数位技术的混合技能,人才缺口将更加严峻。那些投资内部培训机构的公司能够维持服务品质和运作的保障,而资金不足的竞争对手则面临客户流失的风险。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴国家建设活动增加

- 超大规模资料中心扩建

- 强制逐步减少冷媒的使用推动了对维修的需求。

- 经合组织成员国的老旧建筑需要维修。

- 利用远距离诊断和机器人技术降低服务成本

- 暖通空调即服务合约释放年金收入潜力

- 市场限制

- 技术纯熟劳工短缺和工资上涨

- 暖通空调零件供应的不确定性和材料价格上涨

- 互联建筑系统中的网路安全风险

- 订阅模式的颠覆性变革对利润率带来压力

- 价值/供应链分析

- 监管环境

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与併购格局

第五章 市场规模与成长预测

- 按安装类型

- 新建工程

- 建筑改装

- 按服务类型

- 安装和更换服务

- 维护和维修服务

- 能源效率和维修服务

- 暖通空调控制系统升级与集成

- 咨询及其他服务

- 依系统类型

- 暖气服务

- 冷冻服务

- 通风和室内空气品质服务

- 综合建筑管理服务

- 最终用户

- 住房

- 商业的

- 产业

- 透过使用

- 资料中心

- 医疗机构

- 教育机构

- 饭店及休閒

- 零售空间

- 政府及公共建筑

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 比荷卢经济联盟

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Johnson Controls International PLC

- Carrier Global Corporation

- Daikin Industries Ltd.

- Trane Technologies plc

- Lennox International Inc.

- Honeywell International Inc.

- Siemens AG

- LG Electronics Inc.

- Electrolux AB

- Robert Bosch GmbH

- Fujitsu General Ltd.

- Nortek Global HVAC

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- Danfoss A/S

- GREE Electric Appliances Inc.

- Midea Group Co. Ltd.

- Johnson Service Group plc

- Comfort Systems USA, Inc.

- EMCOR Group Inc.

第七章 市场机会与未来展望

The HVAC services market size reached USD 69.90 billion in 2025 and is projected to advance to USD 94.70 billion by 2030, translating to a 6.30% CAGR-evidence that the HVAC services market remains resilient despite refrigerant phase-downs, talent shortages, and supply volatility.

Demand stems from hyperscale data-center construction, a wave of retrofits triggered by mandatory HFC reductions, and digitization that converts reactive fixes into predictive service contracts. Asia-Pacific's economic momentum, rapid urbanization, and data-center boom secure the region's leadership in revenue terms, while hyperscale operators everywhere are propelling the HVAC services market toward specialized cooling, liquid-based thermal management, and subscription pricing for uptime assurance. Established providers are monetizing their installed base through IoT-enabled analytics platforms that transform break-fix visits into continuous optimization services, yet skilled-labor scarcity and input-cost inflation threaten margins. Competitive pressure therefore favors companies that combine scale procurement with strong in-house training, allowing them to absorb wage inflation while capturing share from smaller rivals.

Global HVAC Services Market Trends and Insights

Growing Construction Activity in Emerging Economies

Accelerating urbanization across Asia-Pacific and Latin America sustains new building pipelines that automatically translate into installation and commissioning demand for the HVAC services market. Energy-efficiency codes now embedded in building permits shift lifetime spending toward preventive maintenance and performance contracts rather than emergency repairs. Government green-building incentives in India and Brazil reward early adoption of high-efficiency HVAC, nudging developers to lock in service contracts during the design phase. Providers able to embed digital monitoring at handover secure annuity-style revenue across a building's lifecycle. California's USD 1.76 million grant to Lincus for DC-powered commercial HVAC validates policymaker commitment to next-generation systems that depend on specialist service expertise

Expansion of Hyperscale Data-Center Build-Outs

Hyperscale facilities require precise, often liquid-based cooling that traditional mechanical contractors cannot service without significant up-skilling. Cooling can reach 50% of a data center's power budget, making efficiency gains central to operators' total cost of ownership and a decisive service-provider selection factor . The HVAC services market therefore rewards firms with advanced fluid-handling skills and AI-driven monitoring that predict hot-spots before failures occur. Trane Technologies' collaboration with LiquidStack illustrates how OEMs partner with liquid-cooling experts to accelerate capability build-out. Data-center capital outlays surged 185% to USD 54 billion in early 2024, guaranteeing a robust pipeline of specialized service demand.

Skilled-Labor Shortages and Escalating Wage Bills

The HVAC services market needs an additional 110,000 technicians worldwide, while half the current workforce is already older than 45 . Providers now pay USD 59,620 on average, with specialized data-center roles commanding far higher compensation, squeezing smaller contractors that lack tiered pricing power. The talent gap becomes more acute as IoT platforms converge IT and OT, demanding hybrid mechanical-digital skills. Companies funding in-house academies can maintain service quality and uptime guarantees, while less capitalized rivals risk client attrition.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Refrigerant Phase-Downs Driving Retrofit Demand

- Aging Building Stock in OECD Markets Requiring Upgrades

- Volatile HVAC Component Supply & Material Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Johnson Controls International PLC

- Carrier Global Corporation

- Daikin Industries Ltd.

- Trane Technologies plc

- Lennox International Inc.

- Honeywell International Inc.

- Siemens AG

- LG Electronics Inc.

- Electrolux AB

- Robert Bosch GmbH

- Fujitsu General Ltd.

- Nortek Global HVAC

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- Danfoss A/S

- GREE Electric Appliances Inc.

- Midea Group Co. Ltd.

- Johnson Service Group plc

- Comfort Systems USA, Inc.

- EMCOR Group Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing construction activity in emerging economies

- 4.2.2 Expansion of hyperscale data-center build-outs

- 4.2.3 Mandatory refrigerant phase-downs driving retrofit demand

- 4.2.4 Aging building stock in OECD markets requiring upgrades

- 4.2.5 Remote diagnostics and robotics lowering service costs

- 4.2.6 HVAC-as-a-Service contracts unlocking annuity revenues

- 4.3 Market Restraints

- 4.3.1 Skilled-labor shortages and escalating wage bills

- 4.3.2 Volatile HVAC component supply and material inflation

- 4.3.3 Cyber-security risks in connected building systems

- 4.3.4 Subscription-based disruptors compressing margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and M&A Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Implementation Type

- 5.1.1 New Construction

- 5.1.2 Retrofit Buildings

- 5.2 By Service Type

- 5.2.1 Installation and Replacement Services

- 5.2.2 Maintenance and Repair Services

- 5.2.3 Energy-Efficiency and Retrofit Services

- 5.2.4 HVAC Controls Upgrade and Integration

- 5.2.5 Consulting and Other Services

- 5.3 By System Type

- 5.3.1 Heating Services

- 5.3.2 Cooling Services

- 5.3.3 Ventilation and IAQ Services

- 5.3.4 Integrated Building-Management Services

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.5 By Application Vertical

- 5.5.1 Data Centers

- 5.5.2 Healthcare Facilities

- 5.5.3 Educational Institutions

- 5.5.4 Hospitality and Leisure

- 5.5.5 Retail Spaces

- 5.5.6 Government and Public Buildings

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Mexico

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Benelux

- 5.6.3.5 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Carrier Global Corporation

- 6.4.3 Daikin Industries Ltd.

- 6.4.4 Trane Technologies plc

- 6.4.5 Lennox International Inc.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Siemens AG

- 6.4.8 LG Electronics Inc.

- 6.4.9 Electrolux AB

- 6.4.10 Robert Bosch GmbH

- 6.4.11 Fujitsu General Ltd.

- 6.4.12 Nortek Global HVAC

- 6.4.13 Mitsubishi Electric Corporation

- 6.4.14 Rheem Manufacturing Company

- 6.4.15 Danfoss A/S

- 6.4.16 GREE Electric Appliances Inc.

- 6.4.17 Midea Group Co. Ltd.

- 6.4.18 Johnson Service Group plc

- 6.4.19 Comfort Systems USA, Inc.

- 6.4.20 EMCOR Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment