|

市场调查报告书

商品编码

1851199

美国暖通空调服务:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

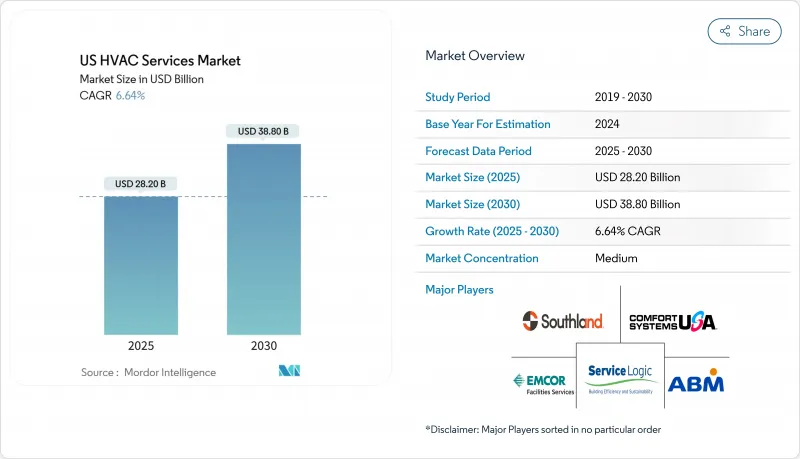

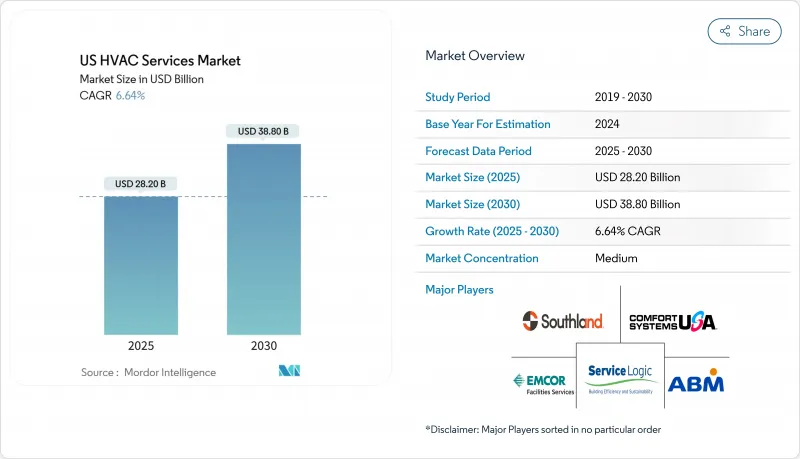

美国暖通空调服务市场预计到 2025 年将达到 282 亿美元,到 2030 年将扩大到 388 亿美元,复合年增长率为 6.6%。

这一增长反映了市场对老旧设备更换的持续需求、强劲的在建项目储备以及不断降低节能改造成本的政策奖励。 2025年4月,新开工建设项目较上季成长9.9%,推动了商业、住宅和工业计划安装合约的强劲成长。联邦政府的退税和各州根据《通货膨胀控制法案》提供的奖励继续刺激房主维修和热泵的普及。同时,智慧建筑控制系统和低全球暖化潜势(GWP)冷媒的普及也创造了合规主导的服务机会,从而提升了我们的经常性收入。然而,熟练技术人员的持续短缺导致劳动力供应紧张,推高了工资水平,并挤压了小型承包商的生存空间。

美国暖通空调服务市场趋势与洞察

建设活动成长

2025年4月非住宅建筑开工量激增9.9%,显示材料成本上涨并未阻碍计划推进,尤其是资料中心、医疗保健和教育设施专案。这一成长带动了美国暖通空调服务市场的稳定安装和试运行活动,这些活动将在专案投入营运后转化为长期维护收入。随着公共建设项目超过私人建设项目,服务供应商开始关注政府维修的激增。具备多工种能力的承包商已做好准备,承接机械+控制系统的捆绑式项目,从而提升暖通空调服务市场的交叉销售潜力。

老旧暖通空调设备装置量大

超过90%的美国家庭使用的空调设备已接近其15-20年的典型使用寿命,这导致了大量的维修工作。对于商用设备而言,R-410A冷媒即将被淘汰,加剧了升级改造的延迟,推高了维护成本,并加速了设备更换的决策。那些将冷媒转换专业知识与能源效率合约结合的服务商能够获得多年期合约。这些合约反过来又能确保持续的收入,并扩大其在美国暖通空调服务市场的份额。

认证暖通空调技术人员短缺

儘管每年约有42,500个职缺,但毕业生数量远不及新建和维修工程的需求。到2023年,平均薪资将达到57,300美元,这将推高营运成本并降低净利率,尤其对中小企业而言更是如此。公共部门的学徒计画旨在弥补这一缺口,但所需的前置作业时间意味着,未来十年招聘仍将是一个策略瓶颈。那些建立了内部培训机构和清晰职涯发展路径的公司拥有较高的员工留存率,从而缓解了美国暖通空调服务市场的这种压力。

细分市场分析

到2024年,预防性保养合约将占总收入的39%,这凸显了业主对可预测成本管理和运作保障的偏好。如今,商业客户组合中已整合了设备分析技术,可根据运作运行时间数据而非日历週期安排服务访问,从而提高了合约续约率并提升了单位平均收入。受合规压力和在动态能源收费系统下优化负载曲线的需求驱动,能源管理和监控服务正以8.2%的复合年增长率快速成长。将监控与性能保证相结合的承包商正在美国暖通空调服务市场中占据越来越大的份额。

安装合约与建筑支出仍然密切相关,而紧急维修服务在尖峰负载事件和极端天气期间需求激增。设计工程的范围正在扩大,涵盖脱碳蓝图和生命週期成本分析。业主越来越多地将机械、控制和永续性审核捆绑在同一供应商处,这使得全方位服务公司更具战略意义。这些合约通常为期三到五年,有助于稳定现金流、增强客户留存率并提升市场竞争力。

建筑管理系统 (BMS) 和自动化服务是成长最快的细分市场,复合年增长率 (CAGR) 达 9.1%,这主要得益于对故障检测和数据主导优化日益增长的需求。暖气服务则呈现出显着的区域差异,其中热泵的普及在北部各州增长最快,因为这些地区的电气化激励措施降低了成本溢价。

通风和室内空气品质 (IAQ) 行业受益于学校和商业办公场所中居住者增强的健康意识。冷冻服务因改用 A2L 冷媒而面临更高的遵循成本,促使企业投资于专用工具。加州的一项示范计画检验了蓄热改造的维修,该计画实现了 13% 的节能和 46%的尖峰负载转移,蓄热改造正成为以绩效为导向的承包商的额外收入来源。随着控制设备与机械系统的整合,服务供应商能够获得额外的整合费用,并在美国暖通空调 (HVAC) 服务市场中打造差异化服务组合。

美国暖通空调服务市场按服务类别(设计与工程、合约安装及其他)、目标系统类型(暖气、维修、冷冻/冷气服务及其他)、最终用户(住宅、商业及其他)和合约模式(企划为基础(一次性)及其他)进行细分。市场规模和预测均以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建设活动成长

- 老旧暖通空调设备装置量大

- 联邦和州政府收紧能源效率标准

- 利用智慧/物联网扩充服务模式

- 透过通货膨胀控制法奖励电气化

- 私募股权整合建构一站式服务网络

- 市场限制

- 高昂的初始安装和维修成本

- 认证暖通空调技术人员短缺

- 冷媒转型和不断上涨的合规成本

- 各州许可证和授权法规五花八门

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类别

- 设计与工程

- 安装合约

- 预防性保养合约

- 紧急维修服务

- 能源管理和监控服务

- 依目标系统类型

- 暖气(炉子、锅炉、热泵)服务

- 冷气/空调服务

- 通风和室内空气品质服务

- 冷冻服务

- 控制、楼宇管理系统和自动化服务

- 最终用户

- 住房

- 商业的

- 商业的

- 机构(教育、医疗、政府机构)

- 按合约模式

- 企划为基础的(一次性)

- 常规服务合约

- 按地区(美国人口普查地区)

- 东北

- 中西部

- 南部

- 西

第六章 竞争情势

- 市场集中度分析

- 策略性倡议和併购

- 市占率分析

- 公司简介

- EMCOR Services

- Comfort Systems USA

- Service Logic

- Southland Industries

- ACCO Engineered Systems

- TDIndustries

- ABM Technical Solutions

- United Mechanical

- J&J Air Conditioning

- National HVAC Services

- Lennox International

- Nortek Global HVAC

- Carrier Corporation

- Goodman Manufacturing

- Trane Technologies

- Johnson Controls

- Daikin Applied Americas

- Mechanical Services of America

- One Hour Heating and Air Conditioning

- ARS/Rescue Rooter

- McKinstry

第七章 市场机会与未来展望

The US HVAC services market size reached USD 28.2 billion in 2025 and is projected to climb to USD 38.8 billion by 2030, advancing at a 6.6% CAGR.

The expansion reflects persistent demand for replacement of aging equipment, a robust construction pipeline, and sustained policy incentives that lower the cost of energy-efficient upgrades. Construction starts rose 9.9% month-over-month in April 2025, reinforcing a solid flow of installation contracts across commercial, residential, and industrial projects. Federal rebates under the Inflation Reduction Act, paired with state-level incentives, continue to stimulate homeowner retrofits and heat-pump adoption . Parallel shifts toward smart building controls and lower-GWP refrigerants are creating compliance-driven service opportunities that lift the recurring revenue mix. At the same time, a persistent shortage of skilled technicians tightens labor supply, lifts wages, and pressures small contractors, a dynamic that supports consolidation plays by capital-rich operators.

US HVAC Services Market Trends and Insights

Growth in Construction Activity

A 9.9% jump in nonresidential starts during April 2025 demonstrates that elevated materials costs have not derailed project pipelines, particularly in data centers, health care, and education facilities. The expansion funnels steady installation and commissioning work into the US HVAC services market, then converts into long-tail maintenance revenue once operations commence. As public construction outpaces private builds, service providers note a surge in government office retrofits, while data-center investment pushes premium demand for precision cooling. Contractors leveraging multi-trade capabilities position themselves for bundled mechanical-plus-controls scopes, reinforcing cross-sell potential in the US HVAC services market.

Large Installed Base of Aging HVAC Equipment

More than 90% of US households rely on equipment approaching the end of typical 15-20 year life cycles, creating predictable retrofit workstreams. On the commercial side, deferred upgrades are compounded by the impending phase-down of R-410A, which raises maintenance costs and accelerates replacement decisions. Service providers that combine refrigerant conversion expertise with energy-performance contracting secure multi-year engagements. In turn, those agreements lock in recurring revenue and boost wallet share within the US HVAC services market.

Shortage of Certified HVAC Technicians

Roughly 42,500 openings emerge each year, yet graduation pipelines lag the needs of new construction and retrofit workloads. Median wages hit USD 57,300 in 2023, lifting operating costs and eroding margins, especially for small businesses. Public-sector apprenticeship programs aim to fill the gap, but required lead times mean hiring remains a strategic bottleneck through the decade. Firms that build in-house academies and defined career ladders enjoy higher retention and mitigate this drag on the US HVAC services market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Federal & State Energy-Efficiency Standards

- Expansion of Smart/IoT-Enabled Service Models

- Rising Refrigerant Transition & Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Preventive maintenance contracts held 39% of 2024 revenue, underscoring owner preference for predictable cost management and uptime protection. Commercial portfolios now embed equipment analytics that schedule service visits based on real-time runtime data rather than calendar intervals, which increases contract renewal rates and raises average revenue per unit. Energy-management and monitoring services are expanding at an 8.2% CAGR, fueled by compliance pressures and the need to optimize load profiles under dynamic utility tariffs. Contractors that couple monitoring with performance guarantees deepen wallet share inside the US HVAC services market.

Installation contracting remains correlated with construction spending, while emergency repair services thrive during peak-load events and extreme weather. Design engineering scopes are broadening to include decarbonization road-mapping and lifecycle cost analysis. Owners increasingly bundle mechanical, controls, and sustainability audits under a single provider, elevating the strategic relevance of full-service firms. As those contracts typically span three to five years, they stabilize cash flow and reinforce client captivity, which strengthens competitive positions across the US HVAC services market.

Cooling services accounted for 41% revenue in 2024, a figure that continues to climb as cooling-degree days trend upward in nearly all US climate zones.[3] Building-management system (BMS) and automation services compose the fastest-growing slice at a 9.1% CAGR, aligned with rising demand for fault detection and data-driven optimization. Heating services exhibit pronounced regional differences; heat-pump adoption is growing fastest in northern states where electrification incentives narrow the cost premium.

Ventilation and indoor-air-quality (IAQ) scopes benefit from occupant-health imperatives in schools and commercial offices. Refrigeration services face higher compliance spend due to the switch to A2L refrigerants, which is prompting specialized tool investments. Thermal-energy-storage retrofits, validated by California demonstrations that achieved 13% savings and 46% peak-load shifting, are emerging as ancillary revenue streams for performance-oriented contractors.As controls converge with mechanical systems, service providers capture incremental integration fees and create differentiated bundles within the US HVAC services market.

US HVAC Services Market is Segmented by Service Category (Design and Engineering, Installation Contracting and More), by System Type Served (Heating, Services, Cooling / Air-Conditioning Services and More ), by End User (Residential, and Commercial, and More), by Contract Model (Project-Based (One-Off), and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- EMCOR Services

- Comfort Systems USA

- Service Logic

- Southland Industries

- ACCO Engineered Systems

- TDIndustries

- ABM Technical Solutions

- United Mechanical

- J&J Air Conditioning

- National HVAC Services

- Lennox International

- Nortek Global HVAC

- Carrier Corporation

- Goodman Manufacturing

- Trane Technologies

- Johnson Controls

- Daikin Applied Americas

- Mechanical Services of America

- One Hour Heating and Air Conditioning

- ARS/Rescue Rooter

- McKinstry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Construction Activity

- 4.2.2 Large Installed Base of Aging HVAC Equipment

- 4.2.3 Stricter Federal & State Energy-Efficiency Standards

- 4.2.4 Expansion of Smart/IoT-Enabled Service Models

- 4.2.5 Inflation Reduction Act Incentives for Electrification

- 4.2.6 Private-Equity Roll-ups Creating One-Stop Service Networks

- 4.3 Market Restraints

- 4.3.1 High Up-Front Installation & Retrofit Costs

- 4.3.2 Shortage of Certified HVAC Technicians

- 4.3.3 Rising Refrigerant Transition & Compliance Costs

- 4.3.4 Patchwork State Licensing & Permitting Rules

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Service Category

- 5.1.1 Design and Engineering

- 5.1.2 Installation Contracting

- 5.1.3 Preventive Maintenance Contracts

- 5.1.4 Emergency Repair Services

- 5.1.5 Energy-Management and Monitoring Services

- 5.2 By System Type Served

- 5.2.1 Heating (Furnace, Boiler, Heat Pump) Services

- 5.2.2 Cooling / Air-Conditioning Services

- 5.2.3 Ventilation and IAQ Services

- 5.2.4 Refrigeration Services

- 5.2.5 Controls, BMS and Automation Services

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional (Education, Healthcare, Govt)

- 5.4 By Contract Model

- 5.4.1 Project-Based (One-off)

- 5.4.2 Recurring Service Agreements

- 5.5 By Geography (US Census Regions)

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 South

- 5.5.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and M&A

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 EMCOR Services

- 6.4.2 Comfort Systems USA

- 6.4.3 Service Logic

- 6.4.4 Southland Industries

- 6.4.5 ACCO Engineered Systems

- 6.4.6 TDIndustries

- 6.4.7 ABM Technical Solutions

- 6.4.8 United Mechanical

- 6.4.9 J&J Air Conditioning

- 6.4.10 National HVAC Services

- 6.4.11 Lennox International

- 6.4.12 Nortek Global HVAC

- 6.4.13 Carrier Corporation

- 6.4.14 Goodman Manufacturing

- 6.4.15 Trane Technologies

- 6.4.16 Johnson Controls

- 6.4.17 Daikin Applied Americas

- 6.4.18 Mechanical Services of America

- 6.4.19 One Hour Heating and Air Conditioning

- 6.4.20 ARS/Rescue Rooter

- 6.4.21 McKinstry

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment