|

市场调查报告书

商品编码

1911500

欧洲暖通空调服务市场:市占率分析、产业趋势与统计、成长预测(2026-2031年)Europe HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

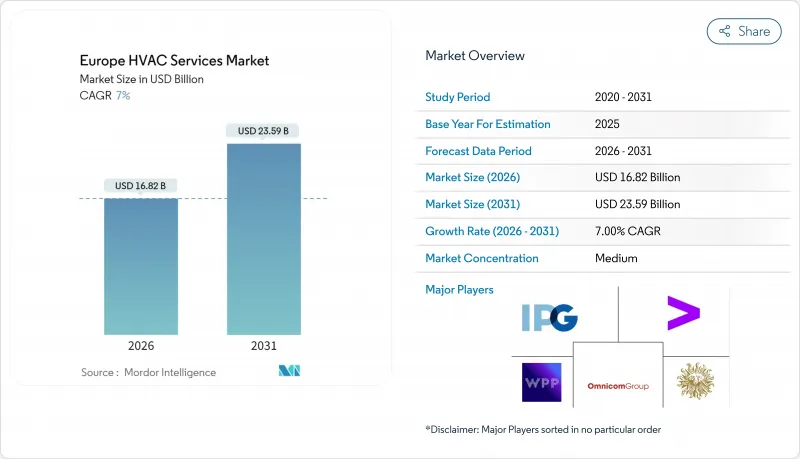

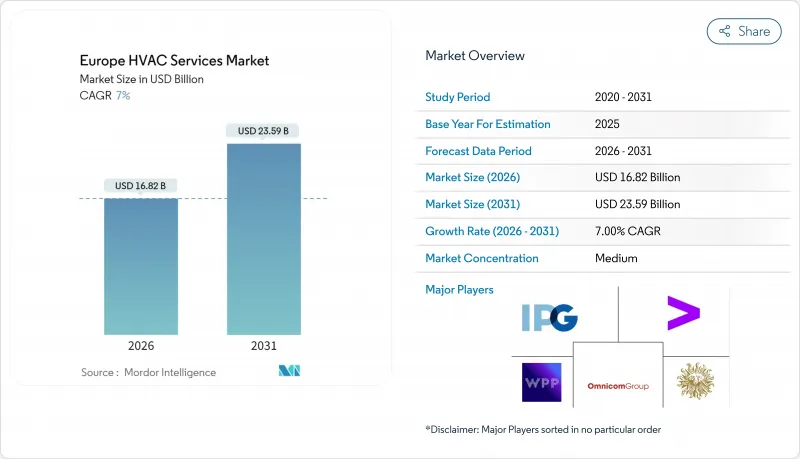

欧洲暖通空调服务市场预计将从 2025 年的 157.2 亿美元成长到 2026 年的 168.2 亿美元,预计到 2031 年将达到 235.9 亿美元,2026 年至 2031 年的复合年增长率为 7.0%。

这一成长动能主要得益于旨在强制脱碳的立法力度加大、热泵的日益普及以及对预测性维护需求的不断增长,以降低能源消耗和停机时间。更严格的氟碳排放法规、不断上涨的铜价以及区域劳动力短缺都带来了成本压力,与此同时,资产所有者正在加速采用数位化服务,以寻求精简营运预算的方法。博世以81亿美元收购江森自控-日立合资企业后,竞争持续加剧,此次收购重组了博世在欧洲的住宅和小规模商业服务网络。成长机会主要集中在与欧盟维修计划「翻新浪潮」(Renovation Wave)相关的维修项目、北欧地区的区域供热系统升级以及为超大规模数据中心提供的精密冷却合同,这些合同优先考虑的是保证运作而非成本最小化。

欧洲暖通空调服务市场趋势与洞察

欧盟强制维修计画推动了对服务需求的加速成长

「维修浪潮」政策要求成员国在2030年前对能源效率最低的16%的非住宅建筑维修,并要求在2024年12月前在290千瓦以上的设施中安装建筑自动化控制系统。这项监管措施迫使业主从被动维护转向基于绩效的服务合同,以确保节能效果。将能源审核、资金筹措援助和数位化性能追踪纳入日常暖通空调工作的承包商正在赢得长期多年合约。德国和荷兰的领先采用者报告称,由于客户优先考虑承包规方案而非低小时费率,他们的利润率更高。

热泵更换热潮重塑了服务组合要求

到2024年,欧洲的热泵安装量将超过2,150万台,每次更换都需要经过A2L冷媒和智慧家庭整合训练的技术人员。服务内容也从燃烧安全检查转向冷媒洩漏检测和韧体更新。自1990年代以来,瑞典已将建筑供暖排放减少了95%,这表明热泵的广泛应用如何在几十年内彻底改变服务模式。为了脱颖而出,供应商现在提供远端监控和五年保固的组合服务,从而提升每位客户的终身价值。

合格冷媒气体技术人员短缺限制了应变能力。

将于2025年生效的新规将要求所有使用R-454B或R-32冷媒的现场技术人员必须持有有效的认证。然而,欧盟目前仍缺少8万名技术人员。这项短缺导致荷兰等需求旺盛地区的人事费用上涨了15%至20%,并造成部分计划因找不到合格人员而延误数週。儘管博世等公司目前正在赞助速成课程和行动训练实验室,但技能缺口不太可能在2027年之前得到弥补。

细分市场分析

预计到2025年,维护和维修领域将占欧洲暖通空调服务市场的53.55%,其主要收入来源是对超出负载运转能力的系统进行强制性检查。虽然稳定的装置容量能够带来持续的收入,但利润来源正逐渐转向软体平台。只有当感测器分析侦测到性能异常时,才会派遣技术人员。智慧互联的运维正以10.38%的复合年增长率成长,并利用边缘设备提前数天预测故障,从而减少高达25%的技术人员上门服务。供应商正在投资数位双胞胎技术,以可视化气流和能源负荷,并提供运转率保证,从而获得远高于传统服务费用的利润率。儘管对传统维护的需求依然旺盛,但其成长速度未能跟上通货膨胀的步伐,促使供应商转向提供打包服务,例如远端监控、零件物流和合规性报告。

预测性维护也在改变劳动力组成。现场团队现在配备了数据分析师,他们会在派遣机械专家之前分析异常警报。这种新模式集中管理软体授权、现场存取和监管文件,从而提高了每位客户的收入份额。更深入的订阅合约降低了客户流失率,锁定了稳定的收入来源,提升了掌握互联技术的服务公司的价值。同时,那些仍坚持传统故障维修模式的公司面临价格侵蚀和被数位化竞争对手收购的风险,这些竞争对手正在迅速整合欧洲暖通空调服务市场。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟维修波指令

- 热泵更换热潮

- 节能维修的需求日益增长

- 资料中心冷却需求快速成长

- 碳排放金融计划

- 利用数位双胞胎进行预测性维护

- 市场限制

- 氟碳气体认证工程师短缺

- 物联网维修旧有系统成本高

- 冷媒供应链波动

- 连网暖通空调系统的网路安全隐患

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按服务类型

- 维护/修理

- 安装

- 智慧互联运维

- 按实现类型

- 新建工程

- 现有建筑物的维修

- 按最终用户行业划分

- 住宅

- 非住宅

- 商业的

- 产业

- 公共和公共机构

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 丹麦

- 挪威

- 瑞典

- 芬兰

- 冰岛

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Johnson Controls International PLC

- Carrier Corporation

- Daikin Industries Ltd

- Vaillant Group

- Aggreko PLC

- Aermec SpA

- Trane Technologies plc

- Bosch Thermotechnology GmbH

- Siemens Building Technologies

- Honeywell International Inc.

- BDR Thermea Group

- Ingersoll Rand PLC

- Crystal Air Holdings Limited

- Klima Venta

- IAC Vestcold AS

- Airedale International Air Conditioning Ltd

- Envirotec Limited

- Kospel SA

- Spectrum Engineering Limited

- Pentair Inc.

第七章 市场机会与未来展望

The Europe HVAC services market is expected to grow from USD 15.72 billion in 2025 to USD 16.82 billion in 2026 and is forecast to reach USD 23.59 billion by 2031 at 7.0% CAGR over 2026-2031.

Momentum comes from binding decarbonization laws, widespread heat-pump rollouts, and growing demand for predictive maintenance that lowers both energy use and service downtime. Tightening F-gas regulations, record copper prices, and regional labour shortages add cost pressure, yet they simultaneously accelerate digital service uptake as asset owners look for ways to stretch operating budgets. Competitive intensity keeps rising after Bosch's USD 8.1 billion purchase of the Johnson Controls-Hitachi JV, which reshapes residential and light-commercial service networks across the continent. Growth opportunities concentrate in retrofit packages tied to the EU Renovation Wave, district-heating upgrades in the Nordics, and precision-cooling contracts for hyperscale data centers that value guaranteed uptime over cost minimization.

Europe HVAC Services Market Trends and Insights

EU Renovation Wave mandates drive service demand acceleration

The Renovation Wave compels member states to refurbish the worst-performing 16% of non-residential buildings by 2030 and to install building-automation controls in sites above 290 kW by December 2024. Compliance pushes owners to shift from reactive maintenance toward outcome-based service contracts that guarantee energy savings. Contractors that layer energy audits, financing support, and digital performance tracking onto routine HVAC tasks lock in long multiyear deals. Early adopters in Germany and the Netherlands report higher margins because clients value turnkey compliance more than low hourly rates.

Heat-pump replacement boom reshapes service portfolio requirements

Europe's installed base surpassed 21.5 million units in 2024, and each replacement calls for technicians trained on A2L refrigerants and smart-home integration. Service visits shift from combustion safety checks to refrigerant leak detection and firmware updates. Sweden's 95% cut in building-heating emissions since the 1990s shows how widespread heat-pump adoption can transform service patterns for decades. Vendors now bundle remote monitoring and five-year warranties to differentiate, raising per-customer lifetime value.

Shortage of F-gas-certified technicians constrains capacity

New 2025 rules force every field technician who handles R-454B or R-32 to carry updated certification, yet 80,000 vacancies remain unfilled across the bloc. Backlogs push labour rates up 15-20% in hot spots such as the Netherlands, and some projects stall for weeks until a licensed crew becomes available. Companies including Bosch now sponsor accelerated courses and mobile training labs, but the skills gap is unlikely to close before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Growing demand for energy-efficient retrofits transforms business models

- Data-center cooling surge creates a specialized service niche

- High IoT retrofit costs limit smart-service adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Maintenance and repair held 53.55% of Europe HVAC services market share in 2025, anchored by mandatory inspections on systems above specified capacity thresholds. The stable installed base delivers recurring revenue, yet profit pools shift toward software-enabled platforms that dispatch technicians only when sensor analytics flag performance drift. Smart-connected operations and maintenance, expanding at 10.38% CAGR, leverages edge devices that predict faults days in advance and trims labour truck rolls by up to 25%. Vendors invest in digital twins to visualize airflow and energy loads so they can offer uptime guarantees that boost margins far above traditional service rates. While the legacy maintenance cohort remains sizable, its growth lags inflation, nudging providers to bundle remote monitoring, parts logistics, and compliance reporting.

Predictive maintenance also changes workforce composition. Field teams now include data analysts who interpret anomaly alerts before dispatching mechanical specialists. The new model increases wallet share per client because a single provider manages software licenses, on-site visits, and regulatory paperwork. As subscription arrangements deepen, customer churn rates fall, locking revenue streams and raising enterprise valuations for service firms that master connectivity. Conversely, companies that cling to break-fix models face eroding prices and potential acquisition by digitally enabled rivals eager to consolidate the Europe HVAC services market.

The Europe HVAC Services Market Report is Segmented by Type of Service (Maintenance and Repair, Installation, Smart-Connected OandM), Implementation Type (New Construction, Retrofit Buildings), End-User Industry (Residential, Non-Residential Including Commercial, Industrial, Public and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Johnson Controls International PLC

- Carrier Corporation

- Daikin Industries Ltd

- Vaillant Group

- Aggreko PLC

- Aermec SpA

- Trane Technologies plc

- Bosch Thermotechnology GmbH

- Siemens Building Technologies

- Honeywell International Inc.

- BDR Thermea Group

- Ingersoll Rand PLC

- Crystal Air Holdings Limited

- Klima Venta

- IAC Vestcold AS

- Airedale International Air Conditioning Ltd

- Envirotec Limited

- Kospel SA

- Spectrum Engineering Limited

- Pentair Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Renovation Wave mandates

- 4.2.2 Heat-pump replacement boom

- 4.2.3 Growing demand for energy-efficient retrofits

- 4.2.4 Data-center cooling demand surge

- 4.2.5 Carbon-linked financing schemes

- 4.2.6 Digital twin-driven predictive maintenance

- 4.3 Market Restraints

- 4.3.1 Shortage of F-gas-certified technicians

- 4.3.2 High IoT retrofit costs for legacy systems

- 4.3.3 Refrigerant supply-chain volatility

- 4.3.4 Cyber-security concerns in connected HVAC

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Service

- 5.1.1 Maintenance and Repair

- 5.1.2 Installation

- 5.1.3 Smart-connected OandM

- 5.2 By Implementation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit Buildings

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.3.2.1 Commercial

- 5.3.2.2 Industrial

- 5.3.2.3 Public and Institutional

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Nordic

- 5.4.6.1 Denmark

- 5.4.6.2 Norway

- 5.4.6.3 Sweden

- 5.4.6.4 Finland

- 5.4.6.5 Iceland

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Carrier Corporation

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Vaillant Group

- 6.4.5 Aggreko PLC

- 6.4.6 Aermec SpA

- 6.4.7 Trane Technologies plc

- 6.4.8 Bosch Thermotechnology GmbH

- 6.4.9 Siemens Building Technologies

- 6.4.10 Honeywell International Inc.

- 6.4.11 BDR Thermea Group

- 6.4.12 Ingersoll Rand PLC

- 6.4.13 Crystal Air Holdings Limited

- 6.4.14 Klima Venta

- 6.4.15 IAC Vestcold AS

- 6.4.16 Airedale International Air Conditioning Ltd

- 6.4.17 Envirotec Limited

- 6.4.18 Kospel SA

- 6.4.19 Spectrum Engineering Limited

- 6.4.20 Pentair Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment