|

市场调查报告书

商品编码

1850988

中国金融科技:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)China Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

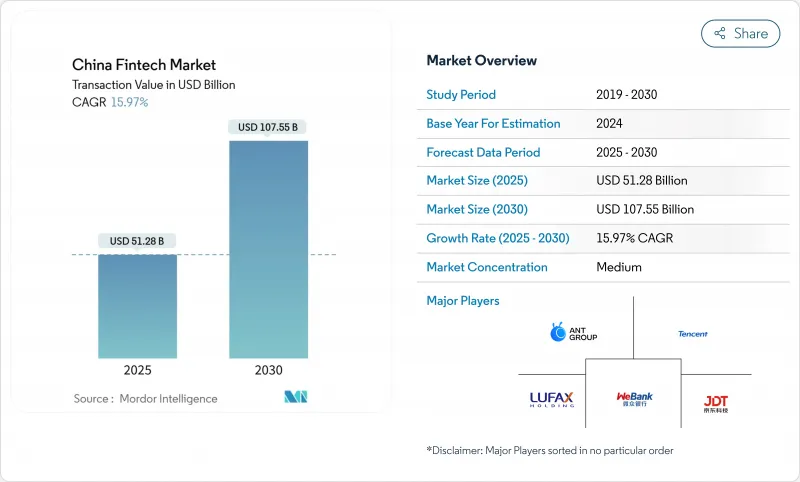

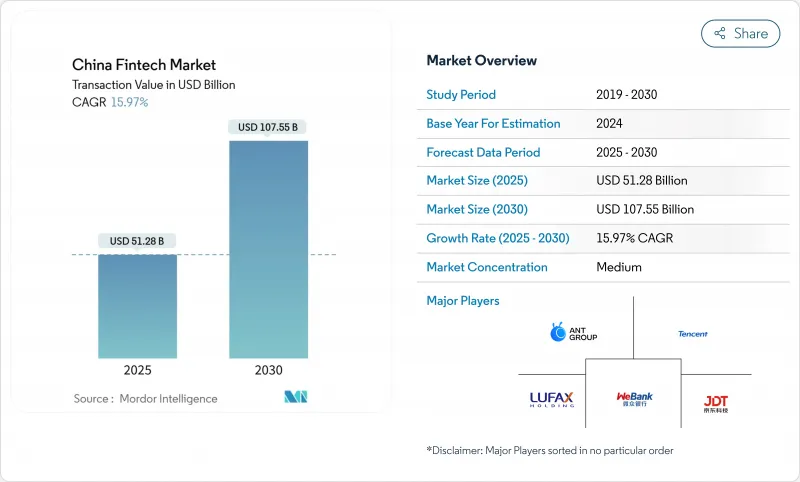

中国金融科技市场预计到 2025 年将达到 512.8 亿美元,到 2030 年将达到 1,075.5 亿美元,年复合成长率为 15.97%。

这项发展动能主要受以下三个因素驱动:(1) 数位人民币在全国范围内的推广,正在建构超越传统行动电子钱包的新型支付管道;(2) 现有银行正转向云端原生架构,以确保银行即服务 (BaaS) 的收入;(3) 监管环境正迅速从以交易量为导向的策略转向以 API主导的永续增长。竞争压力正从客户获取转向资料层整合,信用评分、智能投顾和承保等环节都在转移到人工智慧引擎。二、三线城市的新兴通路正在推动交易量的成长,而无需像以往那样依赖实体分店网路来扩大其覆盖范围。同时,银联和万事达卡之间的国际支付互通性正在扩大中国金融科技市场跨境业务的潜在规模。

中国金融科技市场趋势与洞察

中国人民银行电子人民币的推出加速了数位支付。

截至2024年5月,数位人民币链的交易量呈现显着成长,较去年同期成长显着。电子人民币的分阶段推广设计允许在基础行动装置上使用卡片支付,取消了以往电子钱包对智慧型手机的限制。因此,截至2024年4月,15.3%的农村网路用户表示已使用电子人民币,开拓了新的消费群。商业银行正依照中国人民银行的双层模式推广电子人民币,有效地将传统分店转型为金融科技节点,并加强中国金融科技市场的整体数位化。

网联的强制清算增加了第三方支付量

集中清算将降低商家的接取成本,进而帮助小型服务商发展并提振消费者信心。中国人民银行数据显示,到2024年,60岁以上用户的行动支付普及率将成长46%。统一的诈欺监控规则将使平台能够将资源集中于附加价值服务而非基础支付,从而提升中国金融科技市场的钱包吞吐量。

资料安全法加强跨境资料传输

将于2025年1月生效的新网路资料安全管理条例规定,对外传输资料前必须进行国内安全审查。虽然2024年3月豁免资料量已提高至每年10万笔记录,但基于SaaS的金融科技公司仍需对其资料集进行分段并审核。合规成本分散了工程人才,使其无法专注于前端创新,从而降低了中国金融科技市场的短期成长潜力。

细分市场分析

数位支付将占据中国金融科技市场最大份额,预计2024年将达到59.1%。支付宝和微信支付占据了行动钱包交易的主要份额,它们的集中度巩固了规模经济。支付宝+跨国扩张已涵盖70个市场,进一步扩大了其覆盖范围。然而,支付宝+在一线城市的渗透率已趋于平缓,同时,将增值型小额保险和投资模组整合到同一钱包的趋势也日益明显。

新银行预计将成为成长最快的领域,到2030年复合年增长率预计将达到19.63%。微众银行目前拥有3亿帐户拥有者,同时维持远低于上市银行的营运成本资产比率。云端原生核心加速了新银行的发展,因为新产品的边际成本接近零。这种转变也提高了仍在运作传统大型主机的区域性银行的竞争力,促使它们转向银行即服务(BaaS)伙伴关係,以此作为在金融科技市场中防御的手段。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国人民银行推出电子人民币加速了二、三线城市数位支付的普及

- NetsUnion的支付外包业务增加了第三方支付量

- 中小企业资金筹措缺口推动P2P和供应链金融科技借贷平台的发展

- 财富管理互联计画促进智能投顾的普及

- 针对私人医疗保险的税收优惠将推动保险科技的成长

- 日本银行升级云端原生核心以扩充BaaS/API使用

- 市场限制

- 资料安全法将收紧SaaS金融科技领域的跨境资料传输。

- 小额信贷不良债务率上升对资本充足率带来压力。

- 行动支付饱和度限制了交易量成长

- 价值/供应链分析

- 监管或技术前景

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资和资金筹措趋势分析

第五章 市场规模与成长预测

- 按服务方案

- 数位支付

- 数位借贷和金融

- 数位投资

- 保险科技

- 新银行

- 最终用户

- 零售

- 公司

- 透过使用者介面

- 行动应用

- 网页/浏览器

- POS/物联网设备

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ant Group(Alipay)

- Tencent Holdings(Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology(JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers(UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

第七章 市场机会与未来展望

The China fintech market is valued at USD 51.28 billion in 2025 and is on track to climb to USD 107.55 billion by 2030, advancing at a 15.97% CAGR.

Momentum comes from three converging forces: (1) nationwide rollout of the digital yuan, which is triggering a new payment rail beyond traditional mobile wallets; (2) a pivot by incumbent banks toward cloud-native architecture that unlocks bank-as-a-service revenue; and (3) fast-maturing regulation that replaced volume-chasing tactics with sustainable, API-driven growth. Competitive pressure is shifting from customer acquisition to data-layer integration such as credit scoring, robo-advice, and underwriting all move onto AI engines. New distribution corridors in tier-2/3 cities are lifting transaction volumes without the physical branch networks that previously capped reach. Meanwhile, international payment interoperability through UnionPay and Mastercard is widening the addressable cross-border pool for the Chinese fintech market.

China Fintech Market Trends and Insights

PBOC e-CNY roll-out accelerating digital payments adoption

Transaction value on the digital yuan chain experienced significant growth by May 2024, showcasing a substantial increase compared to the previous year. The wallet's tiered design permits card-based usage on basic handsets, removing the smartphone requirement that limited earlier wallets. As a result, 15.3% of rural internet users reported e-CNY usage by April 2024, unlocking a fresh cohort of consumers. Commercial banks distribute the currency under a PBOC dual-layer model, effectively converting legacy branches into fintech nodes and reinforcing digitalization throughout the China fintech market.

NetsUnion clearing mandate boosting third-party payment volumes

Centralized clearing lowered merchant integration costs, aiding smaller providers and boosting consumer confidence. PBOC data shows a 46% jump in users aged 60+ adopting mobile payments in 2024. Uniform fraud-monitoring rules now let platforms turn resources toward value-added services rather than basic settlement, lifting overall wallet throughput across the China fintech market.

Data Security Law tightening cross-border data transfers

New Network Data Security Management Regulations, effective January 2025, require domestic security reviews before external data transfers. Although March 2024 adjustments raised exemptions to 100,000 records per year, SaaS fintech's must still segment datasets and stage audits. Compliance overhead diverts engineering talent away from front-end innovation, trimming the near-term growth slope for the China fintech market.

Other drivers and restraints analyzed in the detailed report include:

- SME financing gap driving P2P & supply-chain fintech platforms

- Wealth Management Connect schemes fueling robo-advisor uptake

- Rising NPL ratio in micro-lending elevating capital-adequacy burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital Payments held a 59.1% share of the market in 2024, giving the category the largest stake in the China fintech market size. Alipay and WeChat Pay collectively process a major share of mobile wallet flows, a concentration that cements their scale economics. Cross-border expansion through Alipay+ across 70 markets further extends reach. Nevertheless, penetration in tier-1 cities is flattening, and incremental growth is tilting toward value-added micro-insurance and investment modules housed within the same wallets.

Neobanking is projected to record a 19.63% forecast CAGR through 2030, the fastest in the sector. WeBank now serves 300 million account holders while maintaining an operating cost-to-asset ratio well below joint-stock banks. Cloud-native cores mean the marginal cost of new products approaches zero, accelerating the neobank flywheel. The shift also raises the competitive bar for regional banks that still run legacy mainframes, nudging them toward BaaS partnerships as a defensive posture within the China fintech market.

The China Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ant Group (Alipay)

- Tencent Holdings (Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology (JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers (UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 PBOC e-CNY Roll-out Accelerating Digital Payments Adoption Across Tier-2/3 Cities

- 4.2.2 NetsUnion Clearing Mandate Boosting Third-Party Payment Volumes

- 4.2.3 SME Financing Gap Driving P2P & Supply-Chain Fintech Lending Platforms

- 4.2.4 Wealth Management Connect Schemes Fueling Robo-advisor Uptake

- 4.2.5 Commercial Health Insurance Tax Incentives Propelling InsurTech Growth

- 4.2.6 Cloud-native Core Upgrades by Joint-stock Banks Expanding BaaS/API Consumption

- 4.3 Market Restraints

- 4.3.1 Data Security Law Tightening Cross-border Data Transfers for SaaS Fintechs

- 4.3.2 Rising NPL Ratio in Micro-lending Elevating Capital-adequacy Burdens

- 4.3.3 Saturation of Mobile Payments Limiting Incremental Volume Growth

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Ant Group (Alipay)

- 6.4.2 Tencent Holdings (Tenpay)

- 6.4.3 WeBank Co. Ltd.

- 6.4.4 Lufax Holding Ltd.

- 6.4.5 JD Technology (JD Digits)

- 6.4.6 Ping An OneConnect Bank

- 6.4.7 ZhongAn Online P&C Insurance

- 6.4.8 Futu Holdings Ltd.

- 6.4.9 Tiger Brokers (UP Fintech)

- 6.4.10 360 DigiTech Inc.

- 6.4.11 LexinFintech Holdings Ltd.

- 6.4.12 Qudian Inc.

- 6.4.13 Xiaomi Finance

- 6.4.14 Lakala Payment Corp.

- 6.4.15 UnionPay Merchant Services

- 6.4.16 Airwallex

- 6.4.17 XTransfer Ltd.

- 6.4.18 Du Xiaoman Financial

- 6.4.19 Suning Finance

- 6.4.20 Wanda Fintech Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment