|

市场调查报告书

商品编码

1850991

美国垂直农业:市场份额分析、行业趋势和成长预测(2025-2030 年)United States Vertical Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

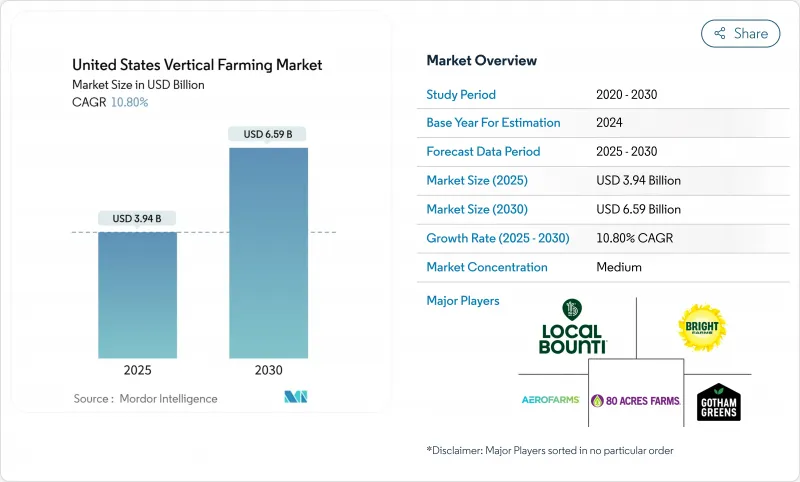

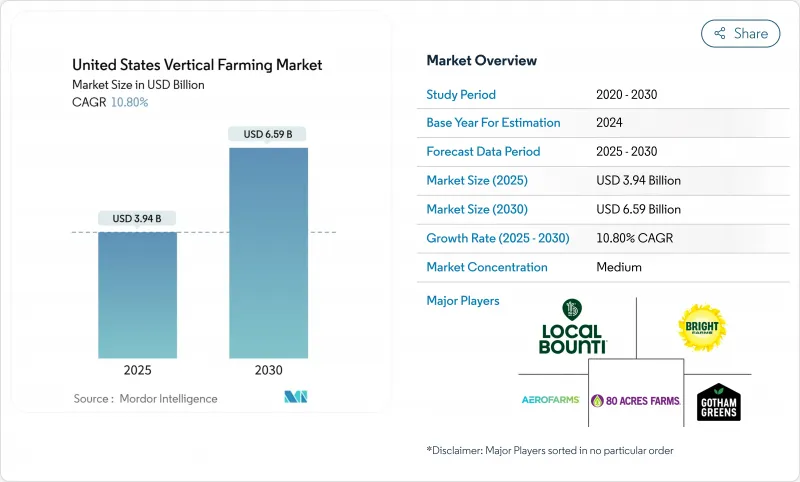

预计到 2025 年,垂直农业市场规模将达到 39.4 亿美元,并以 10.8% 的复合年增长率成长,到 2030 年将达到 65.9 亿美元。

这一成长率表明,产业成长更依赖技术主导的效率提升,而非激进的产能扩张。 2024 年的市场整合凸显了这一转变,大型创投支持的营运商即便筹集了大量资金,也难以涵盖高昂的营运成本。先进的气候控制、LED 照明以及采用人工智慧的模组化仓库改造,能够降低能耗并缩短计划,从而为管理规范的营运商带来成本优势。联邦政府对城市农业的补贴、各州鼓励节水系统的抗旱法规,以及消费者对无农药农产品的高端需求,都支撑着强劲的需求前景。市场竞争较为温和,五大企业的市占率不足总销售额的一半,使得区域性专业企业得以蓬勃发展。

美国垂直农业市场趋势与洞察

对本地种植、不含农药的农产品的需求不断增长

哥本哈根大学进行的感官研究表明,其口感与有机种植的田间作物不相上下,赢得了消费者的认可。 Gotham Greens 在美国东北部 850 多家超级市场销售优质绿叶蔬菜,并透过将本地新鲜度与品牌信誉相结合来保持盈利。例如,80 Acres Farms 为中西部 316 家门市供货,每年运送 1,000 万份餐食,各大超市都在加深与其的供应协议。企业咖啡简餐店也顺应了零售业的发展动能。 AeroFarms 与 Costco 续签了 2025 年的生鲜食品供应协议。

城市致力于减少食物里程,保持食物新鲜。

现今,城市正将垂直农场视为保障粮食安全的关键资产。位于乔治亚门罗市的Gotham Greens公司占地21万平方英尺的温室,使90%的美国消费者能够在一天之内透过卡车运输收到农产品,增强了低温运输的韧性。 AutoStore和OnePointOne在亚利桑那州的门市利用高密度机器人技术,在15天内完成从播种到上架的整个农产品配送过程。纽约州核准一座占地38.5万平方英尺的“超级农场”,该农场每年将生产800万磅农产品,并实现碳负排放。

高资本支出和高能耗营运支出

典型的多层农场建设成本约为每平方英尺1000美元,电力费用可占每月总支出的40%。 Bowery Farming和Plenty在融资总额超过16亿美元后申请破产,凸显了在扩大规模之前延迟降低成本的风险。与批发电价挂钩的动态照明系统可降低高达18%的电费。像Gotham Greens这样的营运商透过选择低成本电力供应地点并在其13个设施中采用标准化设计来维持盈利。

细分市场分析

凭藉成熟的供应链和成熟的设计,水耕技术将在2024年占据垂直农业市场收入的68.0%。儘管基数较小,气耕到2030年仍将维持18.4%的复合年增长率,因为95%的用水效率目标在干旱地区引起了监管机构的关注。物联网营养感测器正在提高两种系统的施肥精度,并有助于缩小成本差距。

精准影像处理可在数小时内通知种植者作物是否有营养胁迫,进一步减少浪费。因此,种植者将与能够调节光照、灌溉和收割的整合软体展开竞争,而不是与栽培基质竞争。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对本地种植、不含农药的农产品的需求不断增长

- 一个优先考虑减少食品里程和保证食品新鲜度的城市

- 节水农业在干旱管理的应用

- 企业与校园永续食品政策

- 税收优惠和机会区贷款

- 人工智慧驱动的作物建模可降低营运成本

- 市场限制

- 高资本支出和高能耗密集型支出

- 经济上可行的作物种类仍然有限。

- 电力价格波动对利润率带来压力

- 中欧地区熟练劳动力短缺

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过生长机制

- 气耕

- 水耕法

- 水耕法

- 按结构

- 建筑式垂直农场

- 货柜农场

- 仓库式垂直农场

- 按作物类型

- 绿叶蔬菜

- 香草和微型菜苗

- 水果和浆果

- 花卉和观赏植物

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AeroFarms

- BrightFarms(Cox Enterprises)

- Gotham Greens

- 80 Acres Farms

- Freight Farms, Inc.

- Altius Farms(Jewish Family Service of Colorado)

- Local Bounti

- Pure Green Farms

- Square Roots

- Oishii

- Eden Green Technology

第七章 市场机会与未来展望

The vertical farming market reached USD 3.94 billion in 2025 and is forecast to grow at a 10.8% CAGR, hitting USD 6.59 billion by 2030.

The expansion rate signals that industry growth now depends on technology-driven efficiency rather than aggressive capacity build-outs. Market consolidation during 2024 underscored this shift, with large, venture-backed operators unable to cover high operating costs despite substantial fundraising. Artificial-intelligence-enabled climate control advanced LED lighting, and modular warehouse conversions are lowering energy use and shortening project timelines, giving disciplined players a cost advantage. Federal grants for urban agriculture, state-level drought regulations that favor water-frugal systems, and premium retail demand for pesticide-free produce together sustain a solid demand outlook. The competitive intensity remains moderate because the largest five firms hold less than half of the total revenue, allowing regional specialists to flourish.

United States Vertical Farming Market Trends and Insights

Rising Demand for Locally-Grown Pesticide-Free Produce

Year-round, pesticide-free food now earns premium shelf prices, and sensory studies from the University of Copenhagen show taste parity with organic field crops, lifting consumer acceptance. Gotham Greens sells premium leafy greens through more than 850 Northeast supermarkets and maintains profitability by pairing local freshness with brand trust. Large grocers deepen supply contracts at 80 Acres Farms, for example, supplies 316 Midwestern stores, shipping 10 million servings annually. Corporate cafeterias echo retail momentum; AeroFarms renewed its Costco fresh-produce program in 2025.

Urban Focus on Food-Mile Reduction and Freshness

Cities now treat vertical farms as critical food security assets. Gotham Greens' 210,000-square-foot Monroe, Georgia greenhouse places 90% of U.S. consumers within a one-day truck reach, strengthening cold-chain resilience. AutoStore and OnePointOne's Arizona site delivers crops in 15 days from seed to shelf using high-density robotics. New York State approved a 385,000-square-foot "GigaFarm" that will output 8 million lb of produce yearly while operating at carbon-negative status.

High CAPEX and Energy-Intensive OPEX

A typical multilevel farm costs about USD 1,000 per ft2 to build, and electricity accounts for up to 40% of monthly expenses. Bowery Farming and Plenty both filed for bankruptcy after raising more than USD 1.6 billion combined, underlining the risk when cost reductions lag scale-up. Dynamic lighting tied to wholesale power prices can trim bills by up to 18%. Operators such as Gotham Greens remain profitable by choosing low-cost power locations and standardizing designs across 13 facilities.

Other drivers and restraints analyzed in the detailed report include:

- Water-Efficient Agriculture Amid Drought Policies

- Corporate and Campus Sustainability Food Mandates

- Economically Viable Crop Range Remains Narrow

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydroponics held 68.0% of the vertical farming market revenue in 2024, supported by mature supply chains and proven designs. Aeroponics, though representing a smaller base, will log an 18.4% CAGR to 2030 as 95% water-efficiency targets catch regulators' attention in drought zones. The IoT nutrient sensors sharpen dosing accuracy across both systems, helping close the cost gap.

Precision imaging now notifies growers of nutrient stress within hours, further reducing waste. Operators, therefore, compete less on growth medium and more on integrated software that orchestrates lighting, fertigation, and harvesting.

The United States Vertical Farming Market Report is Segmented by Growth Mechanism (Aeroponics, Hydroponics, and Aquaponics), by Structure (Building-Based Vertical Farms, Shipping-Container Farms, and More), and by Crop Type (Leafy Greens, Herbs and Microgreens, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AeroFarms

- BrightFarms (Cox Enterprises)

- Gotham Greens

- 80 Acres Farms

- Freight Farms, Inc.

- Altius Farms (Jewish Family Service of Colorado)

- Local Bounti

- Pure Green Farms

- Square Roots

- Oishii

- Eden Green Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for locally-grown pesticide-free produce

- 4.2.2 Urban focus on food-mile reduction and freshness

- 4.2.3 Water-efficient agriculture amid drought policies

- 4.2.4 Corporate and campus sustainability food mandates

- 4.2.5 Tax incentives and Opportunity-Zone financing

- 4.2.6 AI-driven crop modeling lowers OPEX

- 4.3 Market Restraints

- 4.3.1 High CAPEX and energy-intensive OPEX

- 4.3.2 Economically viable crop range remains narrow

- 4.3.3 Electricity-price volatility hurts margins

- 4.3.4 Shortage of CEA-skilled workforce

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Growth Mechanism

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.2 By Structure

- 5.2.1 Building-based Vertical Farms

- 5.2.2 Shipping-Container Farms

- 5.2.3 Warehouse-based Vertical Farms

- 5.3 By Crop Type

- 5.3.1 Leafy Greens

- 5.3.2 Herbs and Microgreens

- 5.3.3 Fruits and Berries

- 5.3.4 Flowers and Ornamentals

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AeroFarms

- 6.4.2 BrightFarms (Cox Enterprises)

- 6.4.3 Gotham Greens

- 6.4.4 80 Acres Farms

- 6.4.5 Freight Farms, Inc.

- 6.4.6 Altius Farms (Jewish Family Service of Colorado)

- 6.4.7 Local Bounti

- 6.4.8 Pure Green Farms

- 6.4.9 Square Roots

- 6.4.10 Oishii

- 6.4.11 Eden Green Technology