|

市场调查报告书

商品编码

1851035

自助式商业智慧:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Self-service BI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

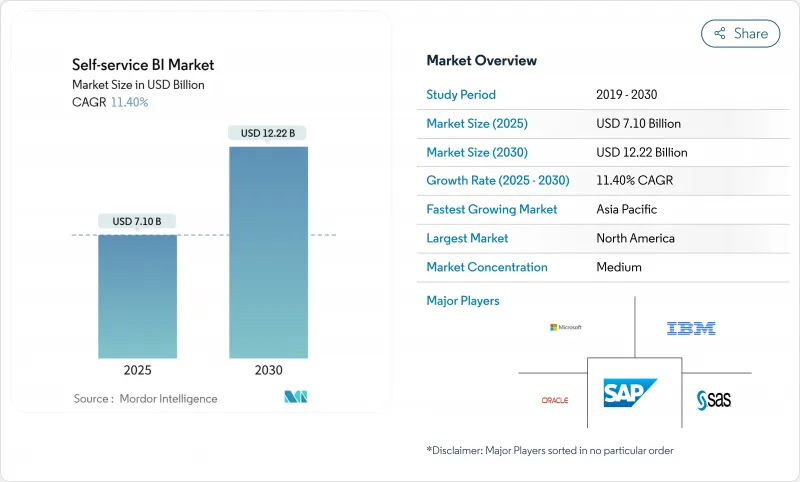

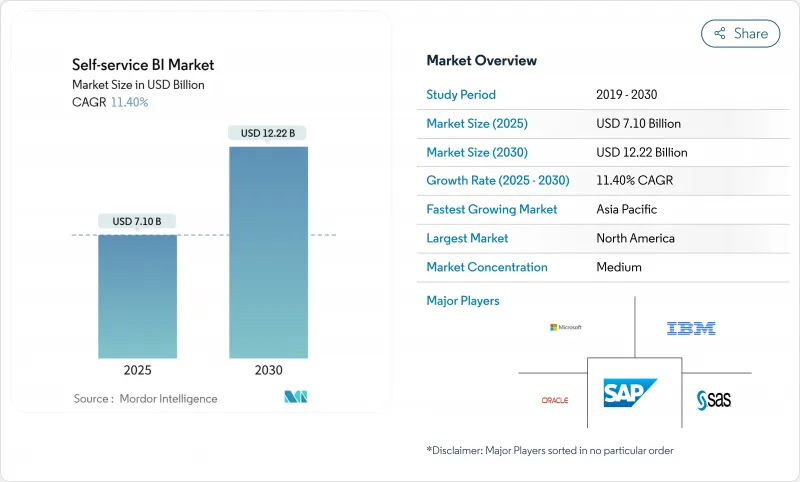

预计到 2025 年,自助式 BI 市场价值将达到 71 亿美元,到 2030 年将达到 122.2 亿美元,复合年增长率为 11.47%。

企业正在扩展低程式码分析,整合生成式人工智慧,并将工作负载迁移到云端资料仓储,以缩短洞察週期,并让IT人员腾出时间从事策略性工作。北美公司在采用这些技术方面处于领先地位,因为它们已经证明,直观的工具可以将彙报积压减少约三分之一。但随着亚太地区云端基础设施的成熟,亚太地区的公司正迅速迎头赶上。供应商正竞相整合自然语言查询以支援多语言环境,这项功能已经引起了欧洲用户的兴趣。同时,监管压力和影子IT事件促使人们更加关注管治,从而推动了买家对兼具开放架构和自动化控制的平台的需求。

全球自助式商业智慧市场趋势与洞察

利用低程式码/无程式码工具实现分析民主化

低程式码介面使业务人员无需依赖开发人员即可建立仪表板,这种转变在北美最为显着。随着非专业资料科学家将他们的领域知识与简化的工具结合,挖掘出传统 BI 团队经常忽略的模式,分析任务的效率提高了 74%。将民主化与强大的语义层结合的公司正在减少积压工作的交接,并在工作时间内交付洞察,这仍然是一项至关重要的倡议。这种文化转变正在扩展平台评估标准,从功能丰富性转向非技术人员的易用性,推动平台围绕直观的拖放式创作和应用内指导进行整合。

云端基础的资料仓储日益普及,加速了自助式服务的采用。

亚太地区的企业正透过消除限制 BI 并发性的瓶颈并将资料迁移到云端,实现跨越式发展。云端资料仓储细分市场的复合年增长率高达 27.64%,使分析团队能够查询新资料而无需排队等待作业,并将报告时间缩短多达 40%。将自助式部署与资料仓储现代化结合的企业,其洞察速度可比孤立的部署方式快三倍。这些资料仓储内建的集中式管治也提高了资料质量,并确保了跨部门指标的一致性。

未受管理的可见性工具所带来的影子 IT 风险

使用核准的工具会导致关键绩效指标 (KPI) 不一致,并洩露敏感资料集,不合规的公司平均每次事件损失 103 万美元。行销和财务部门经常违规,因为他们会透过快速迭代绕过 IT 部门。同类最佳公司实施目录主导的管治、自动化资料沿袭和基于角色的存取控制,以在保持敏捷性的同时降低风险,其采用率比全面封锁方法高出 45%。

细分市场分析

软体仍是主要的收入驱动因素,但服务收入正以15.2%的复合年增长率加速成长。将平台购买与培训计画结合的组织,其采用率比仅购买工具的组织高出45%。市场需求正转向持续的赋能订阅服务,涵盖资料素养提升和管治审核。因此,实施专家正在打包行业特定的操作手册,并将仪表板与行业关键绩效指标 (KPI) 相匹配,以加快价值实现速度。预计到2030年,自助式商业智慧 (BI) 即服务市场规模将达到32亿美元,反映出市场对人工专业知识和自动化技术的持续需求。

同时,软体供应商优先考虑人工智慧功能的对等性,透过增加自然语言查询(NLQ)、自动化洞察和嵌入式模式来保持竞争力。持续的更新促使企业倾向于模组化架构,这种架构允许他们在不破坏语义层的情况下更换分析引擎。这种方法可以缓解对供应商锁定的担忧,并支援随着人工智慧能力的成熟而不断发展的混合工具环境。

云端采用在用户数量和发展势头方面均占据主导地位,目前占收入的 73%,用户数量正以 13.5% 的复合年增长率增长。规模经济使中型企业无需资本支出即可部署企业级分析,从而与大型企业站在了同一起跑线上。此外,分散式团队现在能够在共用工作空间中即时协作,并加快回馈循环。安全态势也不断提升,静态资料加密、私人连结和区域资料中心现在已通过大多数监管机构的审核,从而缓解了先前对公有云的担忧。

在资料驻留要求严格的监管产业中,本地部署解决方案依然占据主导地位。然而,即便在这些产业,混合架构也十分常见,敏感资料表保留在本地,而聚合模型则同步到云端以供更广泛使用。预计在预测期内,随着超大规模资料中心将商业智慧 (BI) 与储存和人工智慧 (AI) 服务紧密整合,它们将占据超过 80% 的云端自助式 BI 市场份额。

自助式商业智慧市场按组件(软体和服务)、部署模式(云端/按需和本地部署)、应用(销售和行销管理、客户参与和分析、诈欺和安全管理等)、最终用户行业(银行、金融服务和保险、医疗保健、製造业等)、组织规模(大型企业和中小企业)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区占据自助式商业智慧市场42%的份额,这主要得益于低程式码平台的早期应用以及主要供应商的存在。金融服务和医疗保健机构正在将自然语言查询融入日常工作流程,并拥有成熟的管治方案,以增强用户参与度并遏制影子IT事件。研发投资的重点在于提升人工智慧的可解释性,使系统能够在法规环境下为推荐结果提供合理的依据。儘管跨境数据共用规则仍然是观点,但该地区先进的云端基础设施持续吸引许多创新分析新兴企业,这些公司正在不断扩展其平台生态系统。

亚太地区是成长最快的区域,复合年增长率达13.77%。中国、印度、日本和澳洲的需求强劲,国内云端巨头和超大规模资料中心业者大规模企业纷纷投资资料中心。该地区的中小型企业正利用行动优先分析来应对桌面电脑短缺的问题,智慧型手机仪錶板已成为许多第一线员工的主要互动介面。资料管治人才短缺问题依然存在,促使各国政府和学术机构推出认证项目,以期从2027年起缓解这一难题。日本和韩国的製造业正在加速采用预测性维护技术,这与工业4.0蓝图相符。同时,新加坡等金融中心正优先发展客户分析,以提升其在亚太地区的银行服务竞争力。

在欧洲,严格的资料隐私法正在推动云端技术的稳定普及。企业透过选择支援精细化授权管理和本地资料处理的平台,在实现民主化的同时兼顾GDPR合规性。多语言自然语言介面尤其受到重视,先导计画显示,非技术人员的参与度提高了50%。随着监管机构明确加密和本地容错移转符合主权要求,西欧的云端迁移正在加速。东欧正迅速追赶,数位转型资金正涌入波兰、罗马尼亚和捷克共和国。零售业和离散製造业占据了大部分需求,但开放原始码替代方案正受到那些担心被专有软体锁定的机构的青睐。

南美洲和中东/非洲地区仍处于起步阶段,但展现出巨大潜力。巴西和墨西哥在拉丁美洲引领商业智慧(BI)的普及,主要得益于通讯业者和银行寻求即时客户视图的需求。在中东,波湾合作理事会成员国政府走在投资前沿,利用商业智慧来支持其多元化发展策略和智慧城市倡议。非洲的普及程度较为分散,南非在企业应用方面处于领先地位,而尼日利亚和肯亚则凭藉其金融科技生态系统正在迅速发展。在桌上型电脑普及率较低的地区,行动仪錶板正在弥补基础设施的不足。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在北美利用低程式码/无程式码工具实现分析民主化

- 亚太地区云端基础资料仓储的激增将推动自助服务模式的普及。

- 在欧洲整合生成式人工智慧以进行自然语言查询

- 银行、金融服务和零售业对SaaS供应商提供的嵌入式分析的需求

- 中型企业的数据素养培训计画正在兴起。

- 日益严格的资料驻留合规法规推动在地化商业智慧平台(中东和非洲)的发展

- 市场限制

- 不受控制的资料视觉化工具造成的影子IT风险

- 新兴国家资料管治人才短缺

- 从传统 BI 系统迁移到自助服务堆迭的成本很高。

- 由于专有语义层而导致的供应商锁定问题令人担忧

- 价值/供应链分析

- 技术展望

- 监理展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 软体

- 服务

- 按部署模式

- 云端/按需

- 本地部署

- 透过使用

- 销售和行销管理

- 客户参与与分析

- 诈欺和安全控制

- 预测性资产保全

- 风险与合规管理

- 供应链与采购

- 营运管理

- 按最终用户行业划分

- BFSI

- 零售与电子商务

- 卫生保健

- 製造业

- 通讯

- 媒体与娱乐

- 运输与物流

- 能源与公共产业

- 政府和国防部

- 按组织规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corporation

- SAP SE

- Salesforce(Tableau)

- Qlik Tech Intl.

- IBM Corporation

- Oracle Corporation

- SAS Institute

- MicroStrategy Inc.

- TIBCO Software

- Zoho Corporation(Analytics)

- Amazon Web Services(QuickSight)

- Google LLC(Looker)

- Domo Inc.

- Sisense Inc.

- ThoughtSpot Inc.

- Pyramid Analytics

- Yellowfin BI

- GoodData Corp.

- Board International

- Infor(Birst)

- Alibaba Cloud(Quick BI)

- Dundas Data Visualization

- SentryOne(BI Sentry)

- Phocas Software

第七章 市场机会与未来展望

The self-service BI market size is estimated at USD 7.10 billion in 2025 and is forecast to reach USD 12.22 billion by 2030, reflecting an 11.47% CAGR.

Firms are scaling low-code analytics, embedding generative AI, and shifting workloads to cloud data warehouses, which shortens insight cycles and frees IT staff for strategic work. North American organizations lead adoption after proving that intuitive tools can cut reporting backlogs by roughly one-third, while Asia-Pacific businesses are catching up fast as cloud infrastructure matures. Vendors are racing to integrate natural-language querying that supports multilingual environments, a capability already boosting engagement among European users. Meanwhile, heightened attention to governance, driven by regulatory pressure and shadow-IT incidents, is steering purchasing toward platforms that pair open architectures with automated control features.

Global Self-service BI Market Trends and Insights

Democratization of analytics via low-code/no-code tools

Low-code interfaces let business professionals create dashboards without relying on developers, a shift most visible in North America where 80% of executives credit wider data access for faster decisions. Productivity for analytical tasks has risen 74% as citizen data scientists pair domain knowledge with simplified tooling, unearthing patterns traditional BI teams often overlook. Companies that married democratization with robust semantic layers cut backlog hand-offs and delivered insight within the operational window where actions still matter. This cultural change is expanding platform evaluation criteria from feature depth to the ease of onboarding non-technical staff, driving platform consolidation around intuitive drag-and-drop authoring and in-app guidance.

Surge in cloud-based data warehouses accelerating self-service adoption

Asia-Pacific organizations are leapfrogging legacy stacks by landing data in the cloud, eliminating bottlenecks that once restricted BI concurrency. With the cloud warehouse segment itself climbing at 27.64% CAGR, analytics teams now query fresh data without queuing jobs, shrinking report time by as much as 40%. Firms that align self-service rollouts with warehouse modernization gain triple-speed time-to-insight compared with siloed deployments. Centralized governance baked into these warehouses also raises data quality, enabling consistent metrics across departments.

Shadow-IT risks from uncontrolled visualization tools

Unvetted tool adoption has generated conflicting KPIs and exposed sensitive datasets, costing non-compliant firms USD 1.03 million on average per incident. Marketing and finance units are frequent offenders because rapid iterations tempt them to sidestep IT. Best-in-class enterprises deploy catalog-driven governance, automated lineage, and role-based access that preserve agility yet curb risk, yielding 45% higher adoption than blanket lockdown approaches.

Other drivers and restraints analyzed in the detailed report include:

- Integration of generative AI for natural-language querying

- Embedded analytics demand from SaaS vendors

- Shortage of data-governance talent in emerging economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software segment continues to anchor revenue, yet services revenue is compounding faster at 15.2% CAGR. Organizations that pair platform purchases with training programs report adoption rates 45% higher than tool-only buyers. Demand is shifting toward continuous enablement subscriptions that cover data-literacy upskilling and governance audits. As a result, implementation specialists are packaging industry-specific playbooks, aligning dashboards with vertical KPIs, and expediting time-to-value. The self-service BI market size for services is projected to reach USD 3.2 billion by 2030, reflecting sustained appetite for human expertise alongside automation.

Software vendors, meanwhile, prioritize AI feature parity, adding NLQ, automated insights, and embedded modes to remain competitive. The relentless update cadence pushes enterprises to favor modular architectures that let them swap analytic engines without ripping out semantic layers. This posture mitigates vendor lock-in concerns and supports mixed-tool environments that evolve as AI capabilities mature.

Cloud deployments own both usage and momentum, commanding 73% of current revenue and adding users at a 13.5% CAGR. Economies of scale let mid-market firms implement enterprise-grade analytics without capital outlay, leveling the playing field with larger peers. Moreover, distributed teams can collaborate on shared workspaces in real time, accelerating feedback loops. Security postures have evolved; encryption-at-rest, private links, and regional data centers now satisfy most regulatory audits, tempering earlier reservations about public cloud.

On-premises solutions persist in heavily regulated verticals where data residency is mandatory. Yet even there, hybrid designs are common: sensitive tables stay onsite while aggregated models sync to the cloud for broad exploration. Over the forecast period, the self-service BI market share for cloud is expected to edge past 80% as hyperscalers integrate BI tightly with their storage and AI services.

Self Service BI Market is Segmented by Component (Software and Services), Deployment Model (Cloud / On-Demand and On-Premises), Application (Sales and Marketing Management, Customer Engagement and Analysis, Fraud and Security Management and More), End-User Industry (BFSI, Healthcare, Manufacturing and More), Organization Size ( Large Enterprises and SMEs), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 42% of self-service BI market revenue, buoyed by early adoption of low-code platforms and the presence of leading vendors. Financial services and healthcare providers there embed natural-language querying in day-to-day workflows, keeping user sentiment high and shadow-IT incidents under control through mature governance programs. R&D investments focus on advanced AI explainability, preparing systems to justify recommendations in regulated settings. Cross-border data-sharing rules remain a watchpoint, yet the region's sophisticated cloud infrastructure continues to attract innovative analytics startups that expand platform ecosystems.

Asia-Pacific is the fastest growing territory, advancing at a 13.77% CAGR. China, India, Japan, and Australia demonstrate vigorous demand as domestic cloud giants and hyperscalers alike pour capital into data centers. SMEs in the region use mobile-first analytics to overcome desktop scarcity, with smartphone dashboards becoming the primary interface for many field employees. Talent shortages in data governance persist, prompting governments and academia to launch certification programs that should ease constraints after 2027. Manufacturing adoption is strong in Japan and South Korea, where predictive maintenance aligns with Industry 4.0 roadmaps, while financial hubs like Singapore emphasize customer analytics to differentiate regional banking services.

Europe shows steady uptake shaped by strict privacy statutes. Organizations balance democratization with GDPR compliance by opting for platforms that support fine-grained consent management and local data processing. Multilingual natural-language interfaces are especially valued, lifting engagement among non-technical staff by 50% in pilot projects. Western European cloud migration is accelerating after regulators clarified that encryption and local failover meet sovereignty requirements. Eastern Europe is catching up quickly as digital transformation funding flows into Poland, Romania, and the Czech Republic. Retail and discrete manufacturing dominate demand, though open-source alternatives gain traction in institutions wary of proprietary lock-in.

South America, the Middle East, and Africa remain early-stage yet promising. Brazil and Mexico head Latin American adoption, with telecom operators and banks seeking real-time customer views. Gulf Cooperation Council governments anchor investment in the Middle East, leveraging BI to support diversification agendas and smart-city initiatives. African uptake is fragmented; South Africa leads enterprise deployments, while Nigeria and Kenya show momentum through fintech ecosystems. Across these regions, cloud solutions enjoy preference owing to limited legacy estates, and mobile dashboards bridge infrastructure gaps in areas where desktop penetration is low.

- Microsoft Corporation

- SAP SE

- Salesforce (Tableau)

- Qlik Tech Intl.

- IBM Corporation

- Oracle Corporation

- SAS Institute

- MicroStrategy Inc.

- TIBCO Software

- Zoho Corporation (Analytics)

- Amazon Web Services (QuickSight)

- Google LLC (Looker)

- Domo Inc.

- Sisense Inc.

- ThoughtSpot Inc.

- Pyramid Analytics

- Yellowfin BI

- GoodData Corp.

- Board International

- Infor (Birst)

- Alibaba Cloud (Quick BI)

- Dundas Data Visualization

- SentryOne (BI Sentry)

- Phocas Software

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Democratization of Analytics via Low-code/No-code Tools in North America

- 4.2.2 Surge in Cloud-based Data Warehouses Accelerating Self-service Adoption in APAC

- 4.2.3 Integration of Generative AI for Natural-Language Querying in Europe

- 4.2.4 Embedded Analytics Demand from SaaS Vendors in BFSI & Retail

- 4.2.5 Rising Data-Literacy Programs Among Mid-Sized Enterprises

- 4.2.6 Regulatory Push for Data-Residency Compliance Driving Localized BI Platforms (MEA)

- 4.3 Market Restraints

- 4.3.1 Shadow-IT Risks from Uncontrolled Data Visualization Tools

- 4.3.2 Shortage of Data Governance Talent in Emerging Economies

- 4.3.3 High Migration Cost from Legacy BI to Self-service Stacks

- 4.3.4 Vendor Lock-in Concerns with Proprietary Semantic Layers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Model

- 5.2.1 Cloud / On-Demand

- 5.2.2 On-Premises

- 5.3 By Application

- 5.3.1 Sales and Marketing Management

- 5.3.2 Customer Engagement and Analysis

- 5.3.3 Fraud and Security Management

- 5.3.4 Predictive Asset Maintenance

- 5.3.5 Risk and Compliance Management

- 5.3.6 Supply Chain and Procurement

- 5.3.7 Operations Management

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Retail and E-commerce

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 Telecommunications

- 5.4.6 Media and Entertainment

- 5.4.7 Transportation and Logistics

- 5.4.8 Energy and Utilities

- 5.4.9 Government and Defense

- 5.5 By Organization Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium-sized Enterprises (SMEs)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 SAP SE

- 6.4.3 Salesforce (Tableau)

- 6.4.4 Qlik Tech Intl.

- 6.4.5 IBM Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 SAS Institute

- 6.4.8 MicroStrategy Inc.

- 6.4.9 TIBCO Software

- 6.4.10 Zoho Corporation (Analytics)

- 6.4.11 Amazon Web Services (QuickSight)

- 6.4.12 Google LLC (Looker)

- 6.4.13 Domo Inc.

- 6.4.14 Sisense Inc.

- 6.4.15 ThoughtSpot Inc.

- 6.4.16 Pyramid Analytics

- 6.4.17 Yellowfin BI

- 6.4.18 GoodData Corp.

- 6.4.19 Board International

- 6.4.20 Infor (Birst)

- 6.4.21 Alibaba Cloud (Quick BI)

- 6.4.22 Dundas Data Visualization

- 6.4.23 SentryOne (BI Sentry)

- 6.4.24 Phocas Software

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment