|

市场调查报告书

商品编码

1851075

欧洲自行车:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

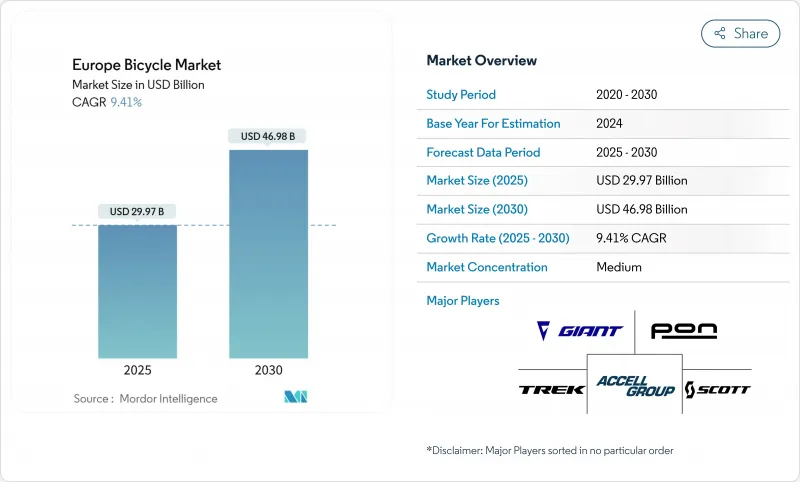

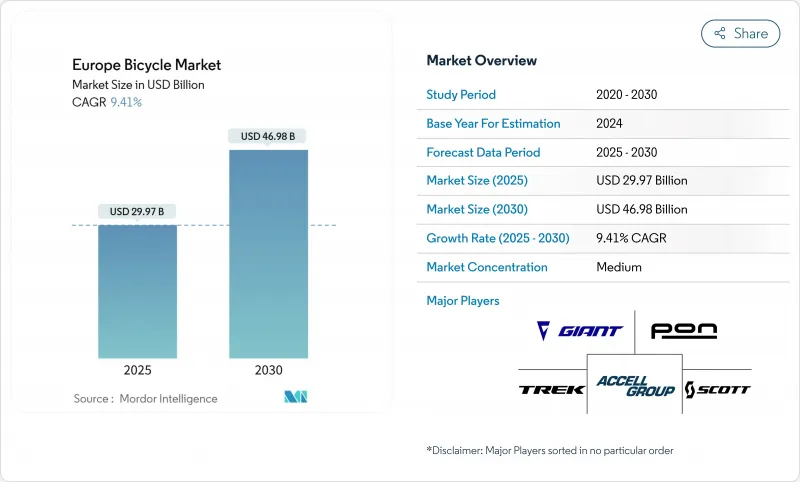

预计到 2025 年,欧洲自行车市场价值将达到 299.7 亿美元,到 2030 年将达到 469.8 亿美元,年复合成长率为 9.41%。

市场扩张的驱动力来自非洲大陆向永续城市交通的转型,政府基础设施投资和企业健康计画也为解决交通拥堵和环境问题提供了支持。消费者的偏好正在发生变化,尤其转向高端和专业领域,例如电动自行车,消费者愿意为先进的功能和技术投资。此外,自行车在健身和休閒活动中的日益普及,以及人们环保意识的增强,使得自行车既成为一种休閒选择,也成为一种永续的交通解决方案。强大的分销网络为市场带来益处,包括传统的实体零售商、自行车专卖店和不断发展的线上销售管道。此外,自行车设计、材料和製造流程的创新不断提升产品的耐用性和性能,满足休閒骑乘者和自行车爱好者的多样化需求。

欧洲自行车市场趋势与洞察

城市交通拥挤加剧促使人们选择骑自行车进行日常通勤。

欧洲都市区的交通拥堵已达到危机级别,促使各城市将自行车出行视为解决「最后一公里」出行难题的关键方案。欧盟委员会城市交通专家小组于2025年2月发布的建议强调,应在永续城市交通规划中发展自行车基础设施。布鲁塞尔等城市透过「美好出行」(Good Move)计画等措施取得了成功,该计画旨在2030年将汽车交通量减少24%。将自行车出行与公共运输结合,既能减轻公共交通网络的压力,又能扩大其覆盖范围,从而提高效率。随着市政当局在城市中心实施低排放气体区和无车区,以及停车费和拥堵费的上涨,自行车出行正成为城市交通系统中经济效益显着且必不可少的组成部分。在拥有完善交通网络的都市区,自行车基础设施的建设已显着改善了空气品质并降低了噪音水平。此外,投资兴建专用自行车道和安全自行车停车设施的城市也报告称,市民满意度有所提高,且汽车出行向自行车出行的模式转换更大。

健康意识的增强和健身趋势推动了自行车运动的发展

疫情后人们健康意识的提高加速了积极交通途径的转变,骑自行车作为健身活动和永续的通勤方式越来越受欢迎。企业社会福利计画也顺应了这一趋势,将自行车补贴、里程报销和骑行津贴纳入更广泛的社会福利中。例如,SAP 透过为员工购买自行车和电动自行车提供经济奖励,以及提供公司内部停车和维修设施,来支援员工骑乘。这些机构激励措施刺激了对高端自行车和装备的需求,在市场上创造了一个新的价值主导细分市场。同时,城市中心也正在投资建造自行车基础设施,例如专用自行车道和安全的自行车存放处,以支持这种模式转换。随着人们的优先事项不断变化,以预防性医疗保健和工作与生活平衡为中心,骑自行车正日益融入现代生活方式,尤其是在欧洲大都会圈。骑自行车融入日常生活促使製造商开发创新产品,从先进的安全功能到性能增强技术,以满足休閒和专业骑乘者的需求。

摩托车和快速公车系统等其他交通途径会降低自行车普及率。

在欧洲主要城市,发达的公共交通网络对自行车行程构成了竞争。拥有完善快速公车系统的城市面临着整合方面的挑战,因为自行车出行往往与享受补贴的公共交通系统竞争,而非作为解决「最后一公里」出行问题的补充方案。摩托车和Scooter共享服务在南欧市场广受欢迎,吸引了那些担心骑乘体力消耗和天气影响的消费者。综合出行即服务平台的出现为自行车出行提供了一个契机,使其能够成为综合交通解决方案的一部分,而非一种独立的出行选择。交通管理部门正致力于开发基础设施,以实现自行车出行与公共交通之间的无缝衔接,例如在车站设置安全的自行车停车处,以及在列车上配备专用自行车车厢。市政当局也在推行相关政策,透过统一的支付系统和互联的路线规划应用程式来促进多模态的整合。

细分市场分析

预计到2024年,电动自行车市占率将达到48.76%,并在2030年之前以11.01%的复合年增长率持续成长。电动式自行车之所以能占据市场领先地位,是因为它们能够有效解决骑乘中常见的难题,例如爬坡、长途骑行和体力消耗,尤其是在城市交通中,因此越来越受到主流消费者的青睐。先进的电池技术和更高的马达效率使电动自行车更加可靠,也更经济实惠,适合日常使用。消费者对环保效益的认识不断提高,以及政府对永续交通解决方案的奖励,进一步加速了电动自行车在各个年龄层中的普及。

山地自行车/全地形车和公路车/城市车分别在休閒和传统通勤领域保持着稳固的地位,但正面临着来自新兴电动自行车日益激烈的竞争。混合动力自行车继续吸引那些注重多功能性和均衡性能的消费者,它们提供多用途功能,而无需电动系统带来的额外复杂性和成本。这些传统自行车类别的持久流行得益于其低维护成本和对注重健身的消费者的吸引力。此外,轻量化材料和零件技术的进步也提升了这些传统自行车的骑乘体验。

标准自行车将继续保持市场主导地位,预计到2024年将占据86.56%的市场。消费者在大多数骑行场景下仍然选择传统自行车,因为它们性能可靠、经久耐用且经济实惠。充足的零件供应和完善的售后服务网络也提升了传统自行车的吸引力,尤其是在自行车基础设施发达的地区。儘管传统自行车在市场上占据稳固地位,但折迭式自行车市场展现出巨大的成长潜力,预计到2030年将以10.44%的复合年增长率成长。这主要得益于铰链机构和先进车架材料的创新,这些创新成功解决了过去的性能瓶颈,同时最大限度地减轻了重量。

欧洲主要城市人口密度不断上升,居住空间日益有限,这持续推动折迭式自行车的需求成长。这种多功能交通工具为公寓居住者提供了一种节省空间的出行方式和便捷的存放方案,消除了户外停车常伴随的盗窃和天气损坏风险。折迭式机制与电动式自行车技术的成功融合,巩固了折迭式自行车市场的成长势头,开闢了一个高端细分市场,尤其吸引那些既追求紧凑存放又希望拥有更长续航里程的都市区通勤者。此外,市政政策鼓励推广永续的替代交通途径,以及混合交通方式(将自行车与公共交通结合)的日益普及,也推动了这一趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 日益严重的城市交通拥堵促使人们选择骑自行车进行日常通勤。

- 日益增强的健康意识和健身趋势正在推动自行车运动的发展。

- 政府日益增多的倡议推动了永续交通途径的普及。

- 环保意识的增强和对永续性的关注正在推动自行车的兴起。

- 企业健康计画鼓励员工骑自行车

- 燃油成本上涨使骑自行车成为一种经济的交通途径方式。

- 市场限制

- 摩托车和高速铁路等其他交通途径会降低自行车的使用率。

- 假冒自行车氾滥对市场扩张产生了负面影响。

- 电动式自行车价格上涨阻碍了其在各个地区消费者的广泛普及。

- 乡村地区道路基础设施不足会影响骑乘舒适度。

- 监管环境

- 技术进步

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 道路/城市

- 山地/全地形

- 杂交种

- 电动自行车

- 其他类型

- 有意为之

- 常规的

- 折迭式的

- 最终用户

- 男性

- 女士

- 孩子

- 透过分销管道

- 线下零售店

- 线上零售商

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 荷兰

- 波兰

- 比利时

- 瑞典

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Trek Bicycle Corporation

- Accell Group NV

- Giant Manufacturing Co. Ltd

- Pon Holdings BV

- Scott Sports SA

- Decathlon SA

- Merida Industry Co. Ltd

- Pending System GmbH & Co. KG

- Canyon Bicycles GmbH

- Riese & Muller GmbH

- Orbea S. Coop.

- ZEG Zweirad-Einkaufs-Genossenschaft eG

- myStromer AG

- KTM Fahrrad GmbH

- Brompton Bicycle Ltd

- VanMoof

- Specialized Bicycle Components Inc.

- Cycles Follis

- Cycleurope AB

- Simplon Fahrrad GmbH

第七章 市场机会与未来展望

The Europe bicycle market, valued at USD 29.97 billion in 2025, is expected to reach USD 46.98 billion by 2030, growing at a CAGR of 9.41%.

The market's expansion is driven by the continent's shift toward sustainable urban mobility, supported by government infrastructure investments and corporate wellness programs addressing traffic congestion and environmental concerns. Consumer preferences are evolving toward premium and specialized segments, particularly in e-bikes, where buyers demonstrate willingness to invest in advanced features and technology. Additionally, the increasing adoption of cycling for fitness and leisure activities, combined with growing environmental consciousness, positions bicycles as both a recreational choice and a sustainable transportation solution. The market benefits from a robust distribution network, encompassing traditional brick-and-mortar retailers, specialized bicycle shops, and growing online sales channels. Furthermore, innovations in bicycle design, materials, and manufacturing processes continue to enhance product durability and performance, meeting the diverse needs of both casual riders and cycling enthusiasts.

Europe Bicycle Market Trends and Insights

Growing Traffic Congestion in Cities Drives Adoption of Bicycles for Daily Commuting

Urban congestion in European metropolitan areas has reached critical levels, prompting cities to adopt cycling as a primary solution for first- and last-mile connectivity. The European Commission's Expert Group on Urban Mobility recommendations in February 2025 emphasize cycling infrastructure development within Sustainable Urban Mobility Plans . Cities like Brussels demonstrate successful implementation through initiatives such as the Good Move plan, which aims to reduce car traffic by 24% by 2030 . The integration of cycling with public transport systems creates efficiency gains by reducing pressure on transit networks while extending their reach. As municipalities implement low-emission zones and car access restrictions in city centers, coupled with rising parking costs and congestion charges, cycling has become both an economically advantageous and necessary component of urban mobility systems. The adoption of cycling infrastructure has shown measurable improvements in air quality and noise reduction in urban areas where comprehensive networks have been implemented. Additionally, cities that have invested in dedicated cycling lanes and secure bicycle parking facilities report increased citizen satisfaction and higher rates of modal shift from private vehicles to bicycles.

Rising Health Consciousness and Fitness Trends Accelerate Cycling Activities

Post-pandemic health awareness has accelerated the shift toward active transportation, with cycling gaining traction as both a fitness activity and a sustainable commuting solution. Corporate wellness programs increasingly reflect this trend by offering bike subsidies, mileage reimbursements, and cycling allowances as part of broader employee benefits. For example, SAP supports employee cycling through financial incentives for purchasing bicycles and e-bikes, as well as providing on-site parking and maintenance facilities. This institutional encouragement has fueled demand for premium bicycles and gear, creating new value-driven segments in the market. Simultaneously, urban centers are investing in cycling infrastructure, such as dedicated bike lanes and secure storage, to support this modal shift. As priorities continue to evolve around preventive healthcare and work-life balance, cycling is becoming firmly embedded in the modern lifestyle, particularly in Europe's metropolitan areas. The integration of cycling into daily routines has also prompted manufacturers to develop innovative products that cater to both recreational and professional cyclists, from advanced safety features to performance-enhancing technologies.

Alternative Transportation Options Such as Motorcycles and Rapid Transit Systems Reduce Bicycle Adoption Rates

The extensive public transport networks in major European cities create competition for bicycle adoption, particularly where metro and bus systems provide faster travel times and protection from weather during longer commutes. Cities with comprehensive rapid transit systems face integration challenges, as cycling often competes with subsidized public transport instead of serving as a complementary first-and-last-mile solution. In Southern European markets, motorcycle and scooter sharing services have gained popularity by offering motorized transport that attracts consumers concerned about physical effort and weather exposure while cycling. The emergence of integrated mobility-as-a-service platforms presents opportunities for cycling to become part of comprehensive transport solutions rather than a standalone option. Transportation authorities are working to develop infrastructure that enables seamless transitions between cycling and public transit through secure bike parking facilities at stations and bike-friendly carriages on trains. Municipal governments are also implementing policies to encourage multimodal transport integration through unified payment systems and coordinated route planning applications.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Government Initiatives Promote Adoption of Sustainable Transportation

- Growing Environmental Awareness and Focus on Sustainability Boost Bicycle Adoption

- Proliferation of Fake Bicycle Products Negatively Impacts Market Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The electric bicycle segment commands a dominant 48.76% market share in 2024 and is expected to expand at a CAGR of 11.01% through 2030. This market leadership position is driven by increasing mainstream acceptance, especially in urban transportation where electric assistance effectively addresses common cycling barriers like hills, distance, and physical effort. The integration of advanced battery technology and improved motor efficiency has made e-bikes more reliable and cost-effective for daily use. Consumer awareness of environmental benefits and government incentives for sustainable transportation solutions further accelerate e-bike adoption across various demographics.

Mountain/All-Terrain and Road/City bicycles maintain their established positions in recreational and traditional commuting segments respectively, though they increasingly compete with the rising e-bike category. Hybrid bicycles continue to appeal to consumers who prioritize versatility and balanced performance, offering multi-purpose functionality without the additional complexity and cost of electric systems. The enduring popularity of these conventional bicycle categories is supported by their lower maintenance requirements and appeal to fitness-oriented consumers. Additionally, improvements in lightweight materials and component technology enhance the riding experience across these traditional segments.

Regular bicycles maintain their market dominance with an 86.56% share in 2024, as consumers consistently choose traditional bicycle formats for their proven performance, long-term durability, and cost-effectiveness across most cycling applications. The widespread availability of spare parts and established service networks further reinforces the appeal of traditional bikes, particularly in regions with well-developed cycling infrastructure. While conventional bikes retain their strong market position, the folding bike segment demonstrates significant growth potential with a projected CAGR of 10.44% through 2030, driven by innovations in hinge mechanisms and advanced frame materials that successfully address historical performance limitations while minimizing weight concerns.

The rising urban population density and limited living spaces in major European cities continue to fuel the demand for folding bikes, as these versatile vehicles provide space-efficient transportation and convenient storage solutions for apartment dwellers, eliminating worries about theft and weather damage associated with outdoor parking. The successful integration of folding mechanisms with electric bike technology has established a premium market segment that particularly appeals to urban commuters seeking both compact storage capabilities and extended travel range, strengthening the growth trajectory of the folding bike category. This trend is further supported by municipal policies promoting sustainable transportation alternatives and the increasing adoption of mixed-mode commuting, where cyclists combine bike travel with public transit.

The Europe Bicycle Market Report is Segmented by Product Type (Road/City, Mountain/All-Terrain, Hybrid, E-Bicycle, and Other Types), Design (Regular and Folding), End User (Men, Women and Children), Distribution Channel (Offline Retail Stores and Online Retail Stores), and Geography (Germany, United Kingdom, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trek Bicycle Corporation

- Accell Group NV

- Giant Manufacturing Co. Ltd

- Pon Holdings BV

- Scott Sports SA

- Decathlon SA

- Merida Industry Co. Ltd

- Pending System GmbH & Co. KG

- Canyon Bicycles GmbH

- Riese & Muller GmbH

- Orbea S. Coop.

- ZEG Zweirad-Einkaufs-Genossenschaft eG)

- myStromer AG

- KTM Fahrrad GmbH

- Brompton Bicycle Ltd

- VanMoof

- Specialized Bicycle Components Inc.

- Cycles Follis

- Cycleurope AB

- Simplon Fahrrad GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Traffic Congestion in Cities Drives Adoption of Bicycles for Daily Commuting

- 4.2.2 Rising Health Consciousness and Fitness Trends Accelerate Cycling Activities

- 4.2.3 Increasing Government Initiatives Promote Adoption of Sustainable Transportation

- 4.2.4 Growing Environmental Awareness and Focus on Sustainability Boost Bicycle Adoption

- 4.2.5 Implementation Of Corporate Wellness Programs Promotes Bicycle Usage Among Employees

- 4.2.6 Escalating Fuel Costs Make Bicycles an Economical Transportation Choice

- 4.3 Market Restraints

- 4.3.1 Alternative Transportation Options Such as Motorcycles and Rapid Transit Systems Reduce Bicycle Adoption Rates

- 4.3.2 Proliferation of Fake Bicycle Products Negatively Impacts Market Expansion

- 4.3.3 Elevated Prices of Electric Bicycles Limit Widespread Consumer Acceptance Across Regions

- 4.3.4 Inadequate Road Infrastructure in Rural Regions Affects Bicycle Riding Experience

- 4.4 Regulatory Landscape

- 4.5 Technological Advancements

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End-User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Children

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Poland

- 5.5.8 Belgium

- 5.5.9 Sweden

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trek Bicycle Corporation

- 6.4.2 Accell Group NV

- 6.4.3 Giant Manufacturing Co. Ltd

- 6.4.4 Pon Holdings BV

- 6.4.5 Scott Sports SA

- 6.4.6 Decathlon SA

- 6.4.7 Merida Industry Co. Ltd

- 6.4.8 Pending System GmbH & Co. KG

- 6.4.9 Canyon Bicycles GmbH

- 6.4.10 Riese & Muller GmbH

- 6.4.11 Orbea S. Coop.

- 6.4.12 ZEG Zweirad-Einkaufs-Genossenschaft eG)

- 6.4.13 myStromer AG

- 6.4.14 KTM Fahrrad GmbH

- 6.4.15 Brompton Bicycle Ltd

- 6.4.16 VanMoof

- 6.4.17 Specialized Bicycle Components Inc.

- 6.4.18 Cycles Follis

- 6.4.19 Cycleurope AB

- 6.4.20 Simplon Fahrrad GmbH