|

市场调查报告书

商品编码

1851093

语音生物辨识:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Voice Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

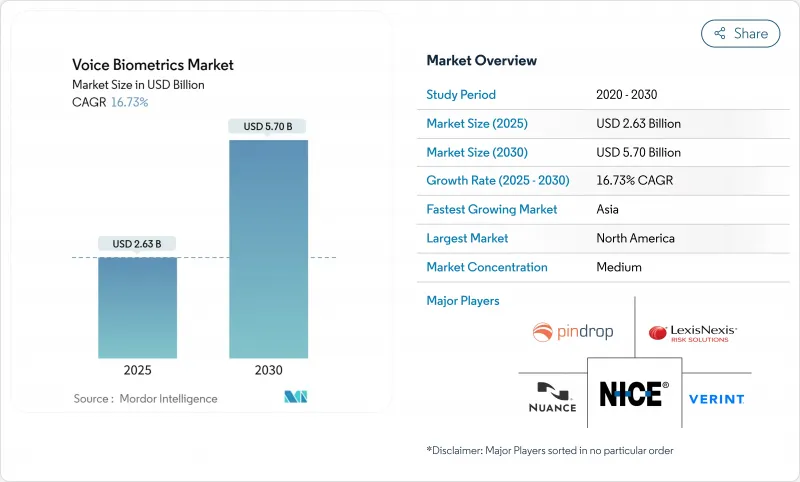

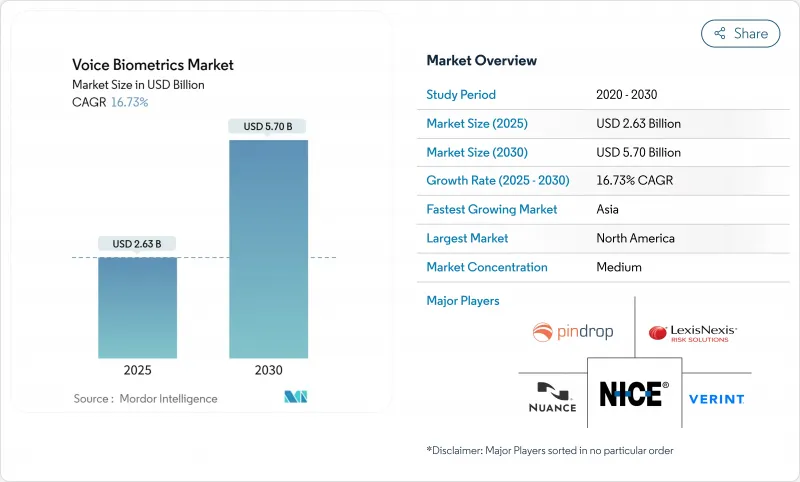

预计到 2025 年,语音生物辨识市场规模将达到 26.3 亿美元,到 2030 年将达到 57 亿美元,年复合成长率为 16.73%。

随着网路犯罪分子利用人工智慧、社交工程和合成语音等技术来削弱密码的可靠性,对即时语音认证的需求日益增长。金融机构、通讯业者和政府机构正在积极应对,以即时语音认证取代基于知识的问答。 5G网路覆盖范围的扩大、智慧型手机中边缘人工智慧晶片的普及以及云端推理成本的下降也推动了语音认证的普及。监管机构将声纹归类为敏感个人数据,要求企业将隐私设计实践与反身分分析结合。随着平台厂商将生物辨识技术整合到零信任套件中,以及专业公司提供深度造假侦测模组和针对低资源方言最佳化的多语言模型,供应商整合正在发生。

全球语音生物辨识市场趋势与洞察

行动银行迈向无密码认证

银行和电子钱包供应商正在用语音提示取代静态密码,以减少登入放弃率并阻止帐户盗用诈骗。 81%的客服中心负责人已经实施或计划实施语音认证,其中像爱尔兰银行这样的大型机构已投资3600万美元,将语音提示嵌入到其互动式语音应答选单中。这种方法非常适合小萤幕环境,因为在小萤幕上打字速度慢且容易出错,而且通话期间的持续认证可以缩短处理时间并省去一次性验证码。

监管机构对强客户认证施加压力

诸如PSD2、印度储备银行指南以及美国即时支付系统等法规要求金融公司至少使用两种独立因素来验证使用者身分。语音生物辨识技术在不增加客户额外硬体的情况下,为合规性增添了一层独特的保障。欧盟人工智慧法将语音检验列为高风险类别,要求服务提供者记录模型管治、偏差测试和事件回应,从而加快了认证平台的采购。

多语言和方言丰富模型中的偏差

学术基准测试显示,少数族裔(包括少数口音、性别和年龄族群)的词彙错误率更高,引发了关于公平性的争论。这种差异会削弱信任,阻碍大众接受新知识,并可能违反《平等指令》。目前,供应商正在扩充其训练语料库,定期进行偏见审核,并发布透明的模型卡,以消除监管机构和民间社会观察家的疑虑。

细分市场分析

到2024年,被动检验在语音生物辨识市场的比重将不到20%,但预计其成长速度将超过主动验证市场,复合年增长率(CAGR)将达到18.8%。被动验证的优点在于能够在自然对话过程中验证来电者身份,无需预先编写脚本,平均处理时间最多可缩短45秒。科罗拉多一家信用社在用小键盘问答取代脚本问答后,节省了大量时间。主动验证方法仍保持着62%的市场份额,因为强制性短语能够提供强大的审核追踪,这对于高价值传输和政府审批至关重要。混合验证技术正在兴起,只有在风险评分超过可接受的阈值时才会触发主动验证机制。

被动式解决方案受益于边缘设备上即时讯号处理和说话者分割技术的进步。持续的会话内监控也有助于侦测帐户共用和胁迫行为。同时,主动式引擎透过缩短密码短语和在支援的行动装置上实现无提示身份验证而不断创新。这两个细分领域透过帮助企业兼顾安全性和易用性,从而增强了语音生物辨识市场。

以核心语音特征提取库和模型管理主机为驱动的软体,在2024年仍将占支出的70%。然而,专业服务预计将以18.5%的复合年增长率增长,这反映出对数十种语言的引擎进行微调、连接到传统IVR平台以及执行深度造假攻击的红队测试的需求。电信业务流程外包商正与专业演算法供应商合作,提供包含託管、调优和持续诈欺监控的承包服务包。

顾问也会指导客户了解不断变化的隐私法律,起草资料保护影响评估报告,并设计同意流程。託管服务协议还包括针对资料外洩事件的快速回应团队和季度偏差报告。随着此类协议的成熟,与诈欺损失减少挂钩的基于结果的定价模式将更加普遍,服务收入也将更深入地融入语音生物辨识市场。

语音辨识生物辨识市场按类型(主动生物辨识与被动生物辨识)、部署模式(本地部署与云端部署)、公司规模(中小企业与大型企业)、最终用户产业(银行、金融服务和保险等)、应用(诈骗侦测与预防等)以及地区进行细分。市场预测以美元计价。

区域分析

北美占据语音生物辨识市场最大份额,这主要得益于银行、信用卡网路和医疗保健机构的早期应用。联邦法规将声纹归类为敏感标识符,促使供应商采用符合 FedRAMP 认证的云端技术和加密技术以支援政府审核。企业网路安全预算正在推动客服中心的现代化,进一步刺激了市场需求。创业投资也在支持语音安全领域的新创新兴企业,从而促进了本地创新。

亚太地区成长最快。印度的统一支付介面和智慧型手机的快速普及为跨语言、包容性的身份验证创造了沃土。中国正在其超级应用生态系统中推广说话者验证,东协通讯业者正在引入语音活体检测技术来遏制SIM卡交换诈骗。区域资料在地化法律鼓励合资企业在境内部署相关模式,进而刺激国内能力发展。

欧洲拥有先进的基础设施和全球最严格的隐私保护框架之一。人工智慧法律将说话者识别列为高风险技术,促使企业采购具备可解释推理和详细审核日誌的认证套件。爱尔兰银行3,400万欧元(3,600万美元)的投资计画等措施表明,在合规性和客户便利性之间,预算正在不断投入。

拉丁美洲和非洲的绝对支出水准较低,但成长潜力巨大。巴西和南非的通讯业者正在部署语音互动语音应答(IVR)系统,以减轻客服人员的工作量并验证预付用户。独立基地台的部署改善了4G网路覆盖,并实现了云端推理。各地口音的多样性和语言资源匮乏等挑战,可以透过迁移学习和区域资料集来解决,从而扩大语音生物辨识市场的覆盖范围。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 行动银行迈向无密码认证

- 监管机构对加强客户身分验证施加压力(PSD2、RBI、FedNow)

- 深度造假激增诈骗客服中心升级

- 金融科技主导新兴亚洲支付业务快速成长

- 企业中零信任架构的采用率不断提高。

- 电信业者降低语音互动语音应答(IVR)成本的任务

- 市场限制

- 多语言和方言丰富模型中的偏差

- 资料居住法规限制了云端采用

- 远端识别与验证(视讯通话)中的声学波动

- 智慧家庭中背景音讯的高误报率

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 投资分析

第五章 市场规模与成长预测

- 按身份验证类型

- 主动生物辨识技术

- 被动式生物识别

- 按组件

- 软体/SDK

- 服务(整合、咨询、管理)

- 按部署模式

- 云

- 本地部署

- 按公司规模

- 小型企业

- 大公司

- 透过通道/网路基地台

- 互动式语音应答/客服中心

- 行动应用

- 网路和自助服务终端

- 智慧型设备/物联网

- 透过使用

- 诈欺检测与预防

- 客户身份验证和身份识别

- 支付和交易安全

- 劳动力管理/逻辑访问

- 按最终用途行业划分

- 银行、金融服务和保险

- 政府和执法部门

- 电讯和资讯技术

- 卫生保健

- 零售、电子商务与消费品

- 运输与物流

- 其他(教育、酒店管理)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN-5

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nuance Communications Inc.

- NICE Ltd

- Verint Systems Inc.

- Pindrop Security Inc.

- LexisNexis Risk Solutions Inc.

- LumenVox LLC

- Phonexia sro

- Auraya Inc.

- Aculab Plc

- Uniphore Software Systems

- SESTEK

- VoicePIN.com Sp. z oo

- Illuma

- BioCatch Ltd.

- Reality Defender

- Sensory Inc.

- Neustar Inc.

- Veridas

- ID R&D Inc.

- Synaptics Inc.

第七章 市场机会与未来展望

The voice biometrics market is valued at USD 2.63 billion in 2025 and is forecast to reach USD 5.70 billion by 2030, advancing at a 16.73% CAGR.

Demand is rising because cyber-criminals now weaponize artificial intelligence, social engineering, and synthetic speech, rendering passwords unreliable. Financial institutions, telecom operators, and government agencies respond by replacing knowledge-based questions with real-time voice verification. Wider 5G coverage, edge AI chips in smartphones, and lower cloud inference costs also sustain adoption. Regulatory authorities classify voiceprints as sensitive personal data, so organizations must combine privacy-by-design practices with anti-spoofing analytics. Vendor consolidation is underway as platform players integrate biometrics into zero-trust toolkits, while specialist firms supply deepfake detection modules and multilingual models tuned for low-resource dialects.

Global Voice Biometrics Market Trends and Insights

Transition to password-less authentication in mobile banking

Banks and e-wallet providers substitute static passwords with voiceprints to decrease abandonment during log-in and to stop account-takeover fraud. 81% of contact-center leaders already deploy or plan voice verification, and flagship institutions such as Bank of Ireland invested USD 36 million to embed voice checks into interactive voice response menus. The method suits small screens where typing is slow and error-prone, while continuous authentication during a call trims handle time and removes one-time codes.

Regulatory pressure for strong customer authentication

Rules such as PSD2, the Reserve Bank of India's guidelines, and US instant-payment rails oblige financial firms to prove user identity with at least two independent factors. Voice biometrics adds an inherent layer that satisfies compliance without extra hardware for customers. The EU Artificial Intelligence Act labels voice verification a high-risk category, obliging providers to document model governance, bias testing, and incident response, accelerating procurement of certified platforms.

Bias in multilingual and dialect-rich models

Academic benchmarks show higher word-error rates for under-represented accents, genders, and age groups, triggering fairness debates. Disparities erode trust, slow public roll-outs, and may breach equality directives. Vendors now widen training corpora, run periodic bias audits, and issue transparent model cards to reassure regulators and civil-society observers.

Other drivers and restraints analyzed in the detailed report include:

- Deepfake-driven contact-center upgrades

- Fintech-led payment growth in emerging Asia

- Data-residency rules limiting cloud deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passive verification analyzed less than 20% of the voice biometrics market in 2024, yet is forecast to grow faster than the headline rate, moving at 18.8% CAGR. Its appeal lies in authenticating callers during natural conversation, eliminating scripted phrases, and shaving up to 45 seconds from average handle-time. The Credit Union of Colorado confirmed time savings after replacing keypad questions. Active methods retain 62% leadership because mandated phrases deliver robust audit trails critical for high-value transfers and government clearances. Hybrid stacks are emerging that trigger active fallback only when risk scores exceed tolerance.

Passive solutions benefit from advances in real-time signal processing and speaker diarization running on edge devices. Continuous monitoring throughout a session also helps detect account sharing and coercion. Meanwhile, active engines innovate with shorter passphrases and promptless verification on supported handsets. The two branches together reinforce the voice biometrics market as enterprises mix assurance and usability.

Software still provided 70% of spending in 2024 thanks to core speech-feature extraction libraries and model-management consoles. Yet professional and managed services are projected to advance 18.5% CAGR, reflecting the need to fine-tune engines for dozens of languages, connect to legacy IVR platforms, and run red-team tests against deepfake attacks. Telecom-business-process outsourcers partner with niche algorithm suppliers to offer turnkey packages that bundle hosting, tuning, and continuous fraud monitoring.

Consultants also steer clients through evolving privacy law, draft data-protection-impact assessments, and design consent flows. Managed-service contracts include rapid-response teams for breach events and quarterly bias reporting. As these engagements mature, outcome-based pricing linked to fraud-loss reduction gains traction, embedding service revenue deeper into the voice biometrics market.

Voice Recognition Biometrics Market It Segmented by Type (Active Biometrics and Passive Biometrics), Deployment Model (On-Premises and Cloud), Enterprise Size (Small and Medium Enterprises and Large Enterprises), End-Use Industry (Banking, Financial Services and Insurance, and More), Application (Fraud Detection and Prevention and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds the largest portion of the voice biometrics market owing to early adoption by banks, card networks, and healthcare providers. Federal rules classify voiceprints as sensitive identifiers, so vendors deploy FedRAMP-authorized clouds and encryption to satisfy agency audits. Contact-center modernization funded under corporate cyber-resilience budgets further boosts demand. Venture capital also backs speech-security startups, keeping innovation local.

Asia Pacific is the swiftest-growing region. India's unified-payments interface and rapid smartphone uptake create fertile ground for inclusive, language-agnostic authentication. China scales speaker recognition across super-app ecosystems, while ASEAN telcos embed voice liveness to curb SIM-swap fraud. Regional data-localization laws encourage joint ventures that host models inside national borders, stimulating domestic capacity.

Europe combines advanced infrastructure with the world's strictest privacy framework. The Artificial Intelligence Act designates speaker recognition as high-risk, so enterprises procure certified toolkits with explainable inference and detailed audit logs. Investment announcements such as Bank of Ireland's EUR 34 million (USD 36 million) program show that budget still flows where compliance and customer convenience intersect.

Latin America and Africa trail in absolute spend but present sizable upside. Telecom operators in Brazil and South Africa deploy voice-enabled IVR to cut agent workload and verify prepaid subscribers. Independent tower roll-outs have improved 4G coverage, enabling cloud inference. Local accent diversity and low-resource languages are challenges that vendors address through transfer learning and regional datasets, thereby extending reach of the voice biometrics market.

- Nuance Communications Inc.

- NICE Ltd

- Verint Systems Inc.

- Pindrop Security Inc.

- LexisNexis Risk Solutions Inc.

- LumenVox LLC

- Phonexia s.r.o.

- Auraya Inc.

- Aculab Plc

- Uniphore Software Systems

- SESTEK

- VoicePIN.com Sp. z o.o.

- Illuma

- BioCatch Ltd.

- Reality Defender

- Sensory Inc.

- Neustar Inc.

- Veridas

- ID R&D Inc.

- Synaptics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Transition to Password-less Authentication in Mobile Banking

- 4.2.2 Regulatory Pressure for Strong Customer Authentication (PSD2, RBI, FedNow)

- 4.2.3 Surge in Deep-Fake Fraud Driving Contact-Center Upgrades

- 4.2.4 Rapid FinTech-Led Payment Growth in Emerging Asia

- 4.2.5 Growing Adoption of Zero-Trust Architecture in Enterprises

- 4.2.6 Voice-Enabled IVR Cost-Saving Mandates in Telcos

- 4.3 Market Restraints

- 4.3.1 Bias in Multilingual & Dialect-Rich Models

- 4.3.2 Data-Residency Regulations Limiting Cloud Deployment

- 4.3.3 Acoustic Variability in Remote ID&V (Video Calls)

- 4.3.4 High False-Accept Rate from Background Speech in Smart Homes

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Authentication Type

- 5.1.1 Active Biometrics

- 5.1.2 Passive Biometrics

- 5.2 By Component

- 5.2.1 Software/SDK

- 5.2.2 Services (Integration, Consulting, Managed)

- 5.3 By Deployment Model

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Enterprise Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 By Channel/Access Point

- 5.5.1 IVR/Contact Center

- 5.5.2 Mobile Apps

- 5.5.3 Web and Kiosk

- 5.5.4 Smart Devices/IoT

- 5.6 By Application

- 5.6.1 Fraud Detection and Prevention

- 5.6.2 Customer Authentication and IDandV

- 5.6.3 Payments and Transaction Security

- 5.6.4 Workforce Management/Logical Access

- 5.7 By End-use Industry

- 5.7.1 Banking, Financial Services and Insurance

- 5.7.2 Government and Law Enforcement

- 5.7.3 Telecom and IT

- 5.7.4 Healthcare

- 5.7.5 Retail, E-commerce and CPG

- 5.7.6 Transport and Logistics

- 5.7.7 Others (Education, Hospitality)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 United Kingdom

- 5.8.3.2 Germany

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Nordics

- 5.8.3.7 Rest of Europe

- 5.8.4 APAC

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN-5

- 5.8.4.6 Australia

- 5.8.4.7 New Zealand

- 5.8.4.8 Rest of APAC

- 5.8.5 Middle East

- 5.8.5.1 GCC

- 5.8.5.2 Turkey

- 5.8.5.3 Rest of Middle East

- 5.8.6 Africa

- 5.8.6.1 South Africa

- 5.8.6.2 Nigeria

- 5.8.6.3 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Nuance Communications Inc.

- 6.4.2 NICE Ltd

- 6.4.3 Verint Systems Inc.

- 6.4.4 Pindrop Security Inc.

- 6.4.5 LexisNexis Risk Solutions Inc.

- 6.4.6 LumenVox LLC

- 6.4.7 Phonexia s.r.o.

- 6.4.8 Auraya Inc.

- 6.4.9 Aculab Plc

- 6.4.10 Uniphore Software Systems

- 6.4.11 SESTEK

- 6.4.12 VoicePIN.com Sp. z o.o.

- 6.4.13 Illuma

- 6.4.14 BioCatch Ltd.

- 6.4.15 Reality Defender

- 6.4.16 Sensory Inc.

- 6.4.17 Neustar Inc.

- 6.4.18 Veridas

- 6.4.19 ID R&D Inc.

- 6.4.20 Synaptics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment