|

市场调查报告书

商品编码

1851124

美国自助仓储:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United States Self-Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

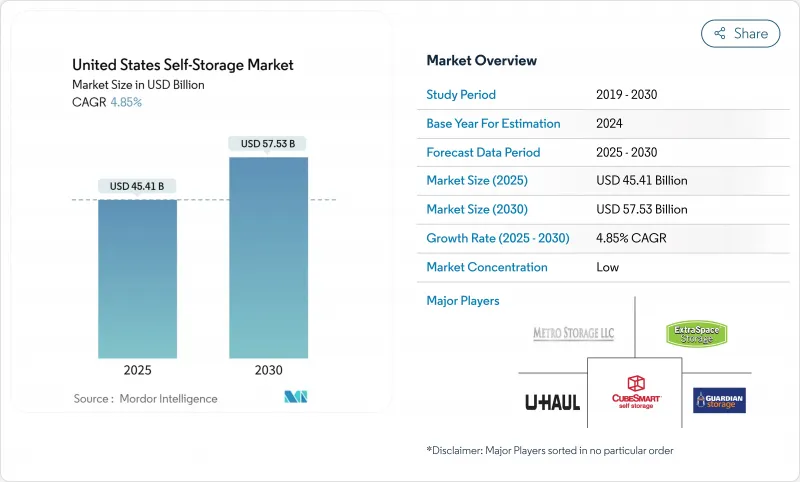

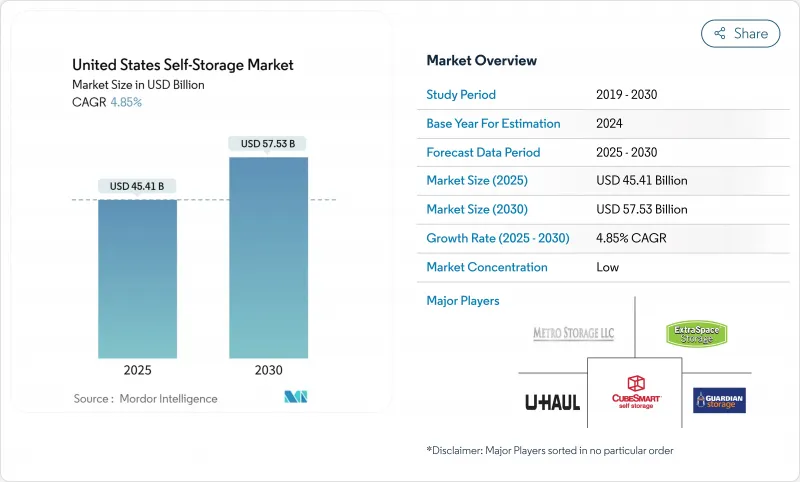

美国自助仓储市场预计到 2025 年将达到 454.1 亿美元,到 2030 年将达到 575.3 亿美元,年复合成长率为 4.85%。

都市区成长、居住空间日益萎缩以及不断发展的电子商务生态系统对微型履约以及数位化预订平台的兴起,增强了房地产市场的结构韧性和定价能力。随着上市房地产投资信託基金(REITs)不断深化市场渗透并规范技术应用,机构投资者持续重塑着市场竞争动态;同时,在人口密集地区,分区限制和建筑成本上涨限制了新增供应。

美国自助仓储市场趋势与洞察

都市化加速和住房面积缩小

房屋供应缺口达385万套,而都会区人口成长率仅1.1%,加剧了空间紧张的局面,促使居住者转向外部储存解决方案。相对于人口成长而言,住房供应有限,导致位于市中心的储存设施租金居高不下,确保了其利用率在传统搬迁高峰期之外也能持续成长。限制新建房屋的城市规划无意中增加了长期储存需求,并凸显了高密度储存设施对营运商的重要性。

电子商务对微型仓配的需求日益增长

电子商务营运商正日益将美国自助仓储市场打造为经济实惠的城市微型仓库网络,推动该业务部门以5.8%的复合年增长率成长。基于货柜的仓储设施为季节性库存提供了灵活的存放空间,并能快速进入市场,满足了拥挤都市区当日送达的需求。与纯粹的个人使用模式相比,采用便于物流配送布局和延长开放时间的仓储设施能够带来更高的每平方英尺收益。

城市中心的分区与土地利用法规

像帕斯科县这样的城市製定了严格的设计和景观标准,迫使开发人员转向监管较为宽鬆的郊区。审批延误增加了运输成本,抑制了需求最高地区的供应成长,提高了现有设施的运转率,但也降低了扩张潜力。

细分市场分析

2024年,个人用户将占美国自助仓储市场的73%,为市场提供可靠的收入来源,满足人们应对人生大事的储存需求。然而,随着线上零售商利用都市区仓储单位缩短配送距离,企业用户正以5.8%的复合年增长率快速成长。预计到2030年,美国自助仓储市场中由企业租户占据的份额将持续成长,这预示着市场将持续向商业用途转变。

当日配送范围的扩大,使得靠近消费者的库存节点的重要性日益凸显。那些能够设计灵活的单元组合、整合全天候数位化服务并提供装卸货平台的营运商,更有可能从小型企业客户那里获得更高的每平方英尺收益。

面积较小的储物单位(小于100平方英尺)将在2024年占总收入的44%,这得益于都市区高密度和高周转率。所有尺寸的恆温储物柜的复合年增长率将达到5.9%,优于非恆温储物柜,因为租户愿意为温湿度控制支付20%至50%的溢价。环境、社会和治理(ESG)要求将推动机构投资者对节能型、整合太阳能的暖通空调系统的需求,这可能会提高这些高端储物单元在美国自助仓储市场的份额。

能源管理技术的进步降低了营业成本,使营运商能够在不损害利润的情况下维持高价,而强调电子设备和文件保护的行销宣传活动进一步巩固了家庭和企业的需求。

美国自助仓储公司按使用者类型(个人和企业)、单元面积(小型,小于100平方英尺;中型,101-200平方英尺;其他)、物业类型(专用设施、改造后的商业建筑;其他)、预订管道(线下、线上聚合平台和营运商入口网站)、租期(短期、长期)和地区进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 都市化进程与居住空间萎缩

- 电子商务中对微型仓配的需求日益增长

- 居民流动性和移民率不断上升

- 对不良零售/办公资产进行适应性再利用

- 按需储存平台的兴起

- 仓储需要减少因天气原因造成的损失。

- 市场限制

- 城市中心的分区与土地利用管制

- 土地和建筑成本上涨

- 对能源密集型气候单元的ESG审查

- REIT整合带来的利润率压力

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 价格分析(租金/平方英尺)

- 基准化分析营运指标

第五章 市场规模与成长预测

- 依使用者类型

- 个人

- 商业

- 按单位大小

- 小于100平方英尺(小型)

- 101-200平方英尺(中等大小)

- 超过 200 平方英尺(大型/车辆)

- 空调储物柜

- 按属性类型

- 专用设施

- 商业建筑改建

- 容器/行动网站

- 透过预订管道

- 线下(到店/打电话)

- 线上聚合商和运营商入口网站

- 按使用期限

- 短期(少于6个月)

- 长期(6个月或以上)

- 按地区

- 东北

- 中西部

- 南部

- 西

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Metro Storage LLC

- Guardian Storage Solutions

- CubeSmart LP

- Extra Space Storage Inc.

- U-Haul International Inc.

- Life Storage Inc.

- National Storage Affiliates Trust

- Public Storage

- StorageMart

- Simply Self Storage Management LLC

- KO Storage

- Global Self Storage Inc.

- Prime Storage Group

- Storage Asset Management LLC

- SmartStop Self Storage REIT Inc.

- A-American Self Storage

- StorQuest Self Storage

- Safeguard Self Storage

- SpareBox Storage

- Mini U Storage

第七章 市场机会与未来展望

The United States self-storage market size generated USD 45.41 billion in 2025 and is projected to reach USD 57.53 billion by 2030, advancing at a 4.85% CAGR.

Sustained demand stems from urban population growth, shrinking living spaces, and the expanding e-commerce ecosystem that needs micro-fulfillment hubs. Rising adoption of climate-controlled units, adaptive reuse of vacant retail and office buildings, and digital booking platforms add structural resilience and pricing power. Institutional capital continues to reshape competitive dynamics as public REITs deepen market penetration and standardize technology adoption, while zoning constraints and construction-cost inflation temper new supply in densely populated corridors.

United States Self-Storage Market Trends and Insights

Increased Urbanization & Shrinking Dwelling Size

Housing underproduction of 3.85 million units and 1.1% metropolitan population growth magnify space constraints, pushing residents toward external storage solutions. Limited housing supply relative to population gains sustains premium rents for centrally located facilities, ensuring utilization beyond traditional moving spikes. Urban zoning that limits new housing inadvertently lifts long-term storage demand, reinforcing the importance of high-density footprints for operators.

Growth in E-commerce Micro-Fulfillment Demand

E-commerce businesses increasingly deploy the United States self-storage market as an affordable urban micro-warehouse network, driving the business segment's 5.8% CAGR. Container-based sites offer flexible staging for seasonal inventory and rapid market entry, complementing same-day delivery expectations in congested metro areas. Facilities that integrate fulfillment-friendly layouts and extended access hours achieve higher revenue per square foot compared with purely personal-use models.

Zoning & Land-Use Restrictions in Urban Cores

Cities such as Pasco County impose stringent design and landscaping standards, steering developers to less regulated suburbs. Approval delays inflate carrying costs and curb supply growth where demand is strongest, elevating occupancy in existing facilities but reducing incremental expansion potential.

Other drivers and restraints analyzed in the detailed report include:

- Rising Residential Mobility & Migration Rates

- Adaptive Reuse of Distressed Retail/Office Assets

- Escalating Land & Construction Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal customers accounted for 73% of the United States self-storage market in 2024, providing a dependable revenue floor rooted in life-event storage needs. Business users, however, are scaling at 5.8% CAGR as online retailers leverage urban units to shorten delivery distances. The United States self-storage market size attributable to business tenants is projected to expand by 2030, signaling a durable shift toward commercial utilization.

Expanding same-day delivery commitments elevate the importance of near-consumer inventory nodes. Operators that design flexible unit mixes, integrate 24/7 digital access, and provide loading docks position themselves to capture structurally higher revenue per square foot from small-business clients.

Small units (<=100 sq ft) captured 44% of 2024 revenue, benefiting from urban density and high turnover. Climate-controlled lockers-spanning all size bands-registered a 5.9% CAGR, outpacing non-conditioned counterparts due to tenant willingness to pay 20-50% premiums for temperature and humidity control. The United States self-storage market share for these premium units is set to climb as ESG mandates drive institutional investors toward energy-efficient, solar-integrated HVAC systems.

Energy management advancements moderate operating costs, allowing operators to maintain premium pricing without margin erosion. Marketing campaigns that highlight protection benefits for electronics and documents further solidify demand among both households and businesses.

United States Self Storage Companies is Segmented by User Type (Personal and Business), Unit Size (<= 100 Sq Ft (Small), 101-200 Sq Ft (Medium), and More), Property Type (Purpose-Built Facilities, Converted Commercial Buildings, and More), Booking Channel (Offline, Online Aggregators & Operator Portals), End-Use Duration (Short-Term, Long-Term), and by Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Metro Storage LLC

- Guardian Storage Solutions

- CubeSmart LP

- Extra Space Storage Inc.

- U-Haul International Inc.

- Life Storage Inc.

- National Storage Affiliates Trust

- Public Storage

- StorageMart

- Simply Self Storage Management LLC

- KO Storage

- Global Self Storage Inc.

- Prime Storage Group

- Storage Asset Management LLC

- SmartStop Self Storage REIT Inc.

- A-American Self Storage

- StorQuest Self Storage

- Safeguard Self Storage

- SpareBox Storage

- Mini U Storage

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased urbanization and shrinking dwelling size

- 4.2.2 Growth in e-commerce micro-fulfilment demand

- 4.2.3 Rising residential mobility and migration rates

- 4.2.4 Adaptive reuse of distressed retail/office assets

- 4.2.5 Emergence of on-demand valet storage platforms

- 4.2.6 Weather-related loss-mitigation storage needs

- 4.3 Market Restraints

- 4.3.1 Zoning and land-use restrictions in urban cores

- 4.3.2 Escalating land and construction costs

- 4.3.3 ESG scrutiny on energy-intensive climate units

- 4.3.4 Margin pressure from REIT consolidation wave

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Pricing Analysis (Rent / sq-ft)

- 4.9 Operational Metrics Benchmarking

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Unit Size

- 5.2.1 ? 100 sq ft (Small)

- 5.2.2 101-200 sq ft (Medium)

- 5.2.3 > 200 sq ft (Large/Vehicle)

- 5.2.4 Climate-controlled lockers

- 5.3 By Property Type

- 5.3.1 Purpose-built facilities

- 5.3.2 Converted commercial buildings

- 5.3.3 Container-based/mobile sites

- 5.4 By Booking Channel

- 5.4.1 Offline (walk-in / phone)

- 5.4.2 Online aggregators and operator portals

- 5.5 By End-use Duration

- 5.5.1 Short-term (< 6 months)

- 5.5.2 Long-term (> 6 months)

- 5.6 By Region

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global level overview, market level overview, core segments, financials as available, strategic information, market rank/share for key companies, products and services, and recent developments)

- 6.4.1 Metro Storage LLC

- 6.4.2 Guardian Storage Solutions

- 6.4.3 CubeSmart LP

- 6.4.4 Extra Space Storage Inc.

- 6.4.5 U-Haul International Inc.

- 6.4.6 Life Storage Inc.

- 6.4.7 National Storage Affiliates Trust

- 6.4.8 Public Storage

- 6.4.9 StorageMart

- 6.4.10 Simply Self Storage Management LLC

- 6.4.11 KO Storage

- 6.4.12 Global Self Storage Inc.

- 6.4.13 Prime Storage Group

- 6.4.14 Storage Asset Management LLC

- 6.4.15 SmartStop Self Storage REIT Inc.

- 6.4.16 A-American Self Storage

- 6.4.17 StorQuest Self Storage

- 6.4.18 Safeguard Self Storage

- 6.4.19 SpareBox Storage

- 6.4.20 Mini U Storage

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment