|

市场调查报告书

商品编码

1851829

欧洲自助仓储:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Self-storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

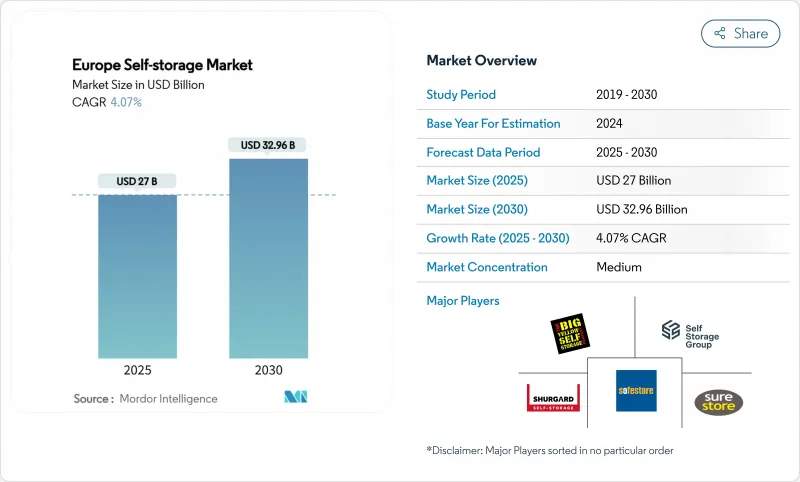

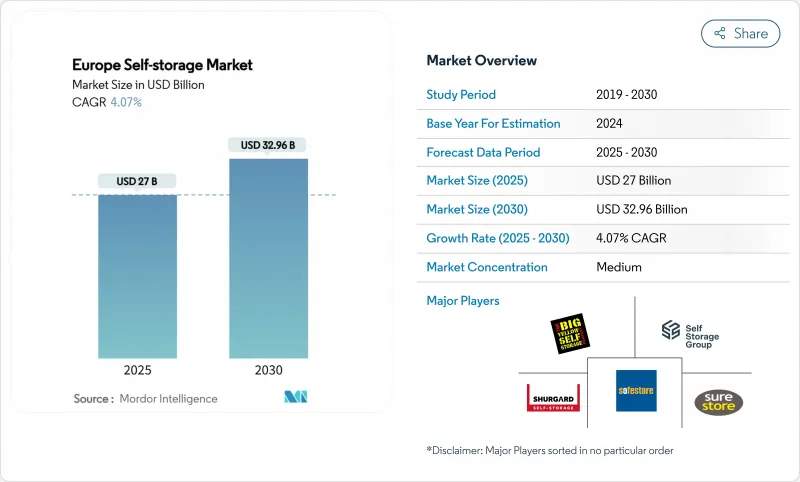

欧洲自助仓储市场预计到 2025 年将达到 270 亿美元,到 2030 年将达到 329.6 亿美元,复合年增长率为 4.07%。

推动这项扩张的因素包括城市人口的持续成长、居民流动性的增强,以及将自助仓储资产视为基础设施而非边缘房地产的机构投资者的涌入。在伦敦、巴黎、柏林以及其他类似的一线城市,城市收缩加上人口老化,使得自助仓储的入住率和租金水准在经济週期中保持稳定。中小电商企业越来越多地采用微型仓储策略,而学生和外籍人士的流动也带来了可预测的季节性需求。气候政策驱动的维修虽然成本高昂,但可以提高能源效率,并创造一个高端市场,从而提高改造后设施的效益。

欧洲自助仓储市场趋势与洞察

城市压缩与微型生活

不断上涨的地价正在缩小都市区的平均居住空间,迫使居住者将本地储物设施视为一个室外「房间」。过去三年,英国新增了100多个此类储物中心,每年为营运商带来10亿英镑的收入,租户可将家具和换季物品存放于此。混合租赁模式和全天候数位化服务进一步巩固了这项服务在城市日常生活中的地位。

由于社会老化,大规模住房计画正在缩减规模。

在德国、义大利和英国,老年房主纷纷搬入面积较小的房屋,这催生了对传家宝和笨重家具的临时储存需求。经合组织预测,到2050年,65岁以上人口将占七国集团居住者的25%,以巩固一个以需求为导向的长期基本客群。

严格的消防安全标准

北欧法规要求采用先进的灭火系统和检验的风险评估,这将使改造预算增加高达 25%,并推迟市场准入。

细分市场分析

到2024年,个人用户将占欧洲自助仓储市场收入的70%。家庭搬迁、微型居住和退休缩减居住空间等需求促使个人用户签订长期合同,即使在宏观经济衝击下也能保持入住率稳定。企业用户群虽然规模较小,但正以每年7.5%的速度成长,因为中小企业也开始采用计量型的仓储空间模式。营运商目前正在製定双品牌策略,以有效地实现两方面的盈利:一方面面向个人用户讯息,另一方面为企业用户提供承包物流物流。

预计到2030年,欧洲私人租赁自助仓储市场的规模将保持其主导地位,这主要得益于简化短期预订流程的数位化预订平台。同时,随着週边城市电子商务渗透率的不断提高,宅配取件、货架租赁和保险等交叉销售服务将提升企业客户的平均收入。

到 2024 年,非恆温仓储单元将占欧洲自助仓储市场份额的 60%。然而,恆温仓储库存以 9% 的复合年增长率增长,由于感测器、暖通空调和更严格的存取控制,其价格比标准房间高出 25-40%,这将支撑净利率的扩张。

已达到E级标准的设施正透过更高的租金和更低的解约率收回维修成本。到2030年,欧洲恆温自助仓储存仓储市场规模预计将超过100亿美元,这将为电子产品、艺术品和檔案文件等贵重物品的专项保险提供支撑。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲一线城市的城市紧密化与微型生活趋势

- 德国、义大利和英国的人口老化正在推动人们从大房子转向小房子。

- 电子商务小型企业的蓬勃发展推动了对灵活微型仓库的需求。

- 申根区内学生和外籍人士流动迅速增加

- 混合办公模式的兴起导致家庭办公室杂乱无章。

- 机构投资人对另类房地产收益的需求

- 市场限制

- 斯堪的纳维亚严格的消防安全标准限制了设施改造。

- 历史城区中心地带适当的重新规划工业用地稀缺

- 法国和西班牙的通膨挂钩租金指数上限

- 由于能源效率要求日益严格,维修成本增加

- 消费者分析

- 监理展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 依使用者类型

- 个人

- 商业

- 依储存类型

- 气候控制

- 非恆温控制

- 按空间大小

- 面积达 90 平方英尺

- 91至150平方英尺

- 151至300平方英尺

- 超过300平方英尺

- 透过使用

- 家居用品

- 电子商务微型仓配

- 文件和檔案存储

- 车辆存放

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Big Yellow Group PLC

- Self Storage Group ASA

- Lok'nStore Group PLC

- SureStore Ltd

- Access Self Storage Ltd

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage AB

- Casaforte(SMC Self-Storage Management)

- W Wiedmer AG

- MyPlace SelfStorage GmbH

- BlueSpace Self-Storage SL

- Space Station Ltd

第七章 市场机会与未来展望

The Europe self-storage market stands at USD 27 billion in 2025 and is forecast to reach USD 32.96 billion by 2030 at a 4.07% CAGR.

Expansion rests on steady urban population growth, rising residential mobility, and institutional capital inflows that treat storage assets as infrastructure rather than peripheral real-estate plays. Urban compression in London, Paris, Berlin, and similar Tier-1 cities, coupled with ageing populations downsizing, keeps occupancy and rental levels resilient across economic cycles. Small and medium e-commerce businesses increasingly adopt micro-warehousing strategies, while student and expatriate mobility supplies predictable seasonal demand. Climate-policy-driven retrofits, although costly, improve energy efficiency and create a premium segment that lifts yields for compliant facilities

Europe Self-storage Market Trends and Insights

Urban compression and micro-living

Intensifying land prices have shrunk average city dwellings, prompting residents to treat local storage facilities as an external "room." Over 100 new complexes opened in the UK in three years, earning operators GBP 1 billion annually as renters off-load furniture and seasonal goods. Hybrid leases and 24/7 digital access further embed the service into day-to-day urban living.

Ageing population downsizing from larger homes

Older homeowners in Germany, Italy, and the UK are shifting to smaller dwellings, creating interim storage demand for heirlooms and bulky furniture. OECD projections show the 65+ cohort reaching 25% of G7 city dwellers by 2050, locking in a durable, needs-based customer base

Stringent fire-safety codes

Nordic rules require advanced suppression systems and verified risk assessments, adding up to 25% to conversion budgets and delaying market entry

Other drivers and restraints analyzed in the detailed report include:

- E-commerce SMB boom driving flexible micro-warehousing

- Student & expat mobility

- Heightened energy-efficiency mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal users accounted for 70% of Europe self-storage market revenue in 2024. Household moves, micro-living, and retirement downsizing secure long-tenure contracts that stabilise occupancy during macro shocks. The business cohort, while smaller, is expanding at 7.5% annually as SMEs embrace pay-as-you-go inventory space. Operators now tailor dual-branding strategies-lifestyle messaging for individuals and turnkey logistics features for corporations-to monetise both streams effectively.

The Europe self-storage market size attached to personal tenancy is forecast to maintain a dominant share through 2030, helped by digital reservation platforms that simplify short-cycle booking. Meanwhile, cross-selling services such as courier pick-up, racking, and insurance lift average revenue per business customer as e-commerce penetration deepens in peripheral cities.

Non-climate units delivered 60% of Europe self-storage market share in 2024 thanks to lower fit-out costs. Yet climate-controlled stock, growing at 9% CAGR, underpins margin expansion because sensors, HVAC, and stricter access controls command fees 25-40% above standard rooms.

Regulatory upgrades accelerate the pivot: facilities that already meet class E standards recoup retrofit spending via higher rents and lower churn. The Europe self-storage market size for climate-controlled units is on track to surpass USD 10 billion by 2030, supporting specialised insurance offerings for electronics, art, and archival documents.

Europe Self Storage Market Report is Segmented by User Type (Personal and Business), Storage Type (Climate-Controlled, Non-Climate-Controlled), Space Size (Up To 90 Sq Ft, 91-150 Sq Ft, and More), Application (Household Goods, E-Commerce Micro-Fulfilment, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Big Yellow Group PLC

- Self Storage Group ASA

- Lok'nStore Group PLC

- SureStore Ltd

- Access Self Storage Ltd

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage AB

- Casaforte (SMC Self-Storage Management)

- W Wiedmer AG

- MyPlace SelfStorage GmbH

- BlueSpace Self-Storage S.L.

- Space Station Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Compression and Micro-Living Trends in Tier-1 European Cities

- 4.2.2 Aging Population Downsizing from Larger Homes in Germany, Italy and UK'

- 4.2.3 E-commerce SMB Boom Driving Need for Flexible Micro-Warehousing

- 4.2.4 Surging Student & Expat Mobility Within the Schengen Region

- 4.2.5 Rise of Hybrid Work Creating Home Office Clutter

- 4.2.6 Institutional Investor Appetite for Alternative Real-Estate Yields

- 4.3 Market Restraints

- 4.3.1 Stringent Fire-Safety Codes Limiting Facility Conversions in Nordics

- 4.3.2 Scarcity of Suitable Zoned Industrial Stock in Historic City Centres

- 4.3.3 Inflation-Linked Rental Index Caps in France and Spain

- 4.3.4 Heightened Energy-Efficiency Mandates Increasing Retrofit Costs

- 4.4 Consumer Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Storage Type

- 5.2.1 Climate-Controlled

- 5.2.2 Non-Climate-Controlled

- 5.3 By Space Size

- 5.3.1 Up to 90 sq ft

- 5.3.2 91-150 sq ft

- 5.3.3 151-300 sq ft

- 5.3.4 Above 300 sq ft

- 5.4 By Application

- 5.4.1 Household Goods

- 5.4.2 E-commerce Micro-Fulfilment

- 5.4.3 Document & Archive Storage

- 5.4.4 Vehicle Storage

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shurgard Self Storage SA

- 6.4.2 Safestore Holdings PLC

- 6.4.3 Big Yellow Group PLC

- 6.4.4 Self Storage Group ASA

- 6.4.5 Lok'nStore Group PLC

- 6.4.6 SureStore Ltd

- 6.4.7 Access Self Storage Ltd

- 6.4.8 Lagerboks

- 6.4.9 Nettolager

- 6.4.10 Pelican Self Storage

- 6.4.11 24Storage AB

- 6.4.12 Casaforte (SMC Self-Storage Management)

- 6.4.13 W Wiedmer AG

- 6.4.14 MyPlace SelfStorage GmbH

- 6.4.15 BlueSpace Self-Storage S.L.

- 6.4.16 Space Station Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment