|

市场调查报告书

商品编码

1687956

亚太地区自助仓储:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia-Pacific Self Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

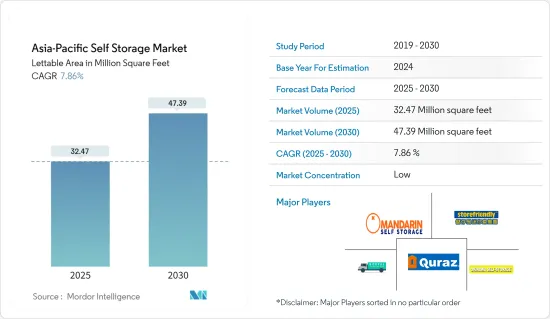

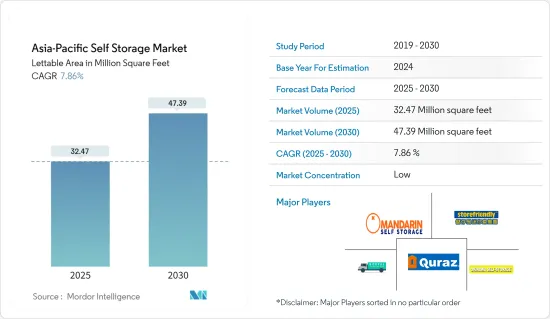

亚太地区自助仓储市场的可出租面积预计将从 2025 年的 3,247 万平方英尺扩大到 2030 年的 4,739 万平方英尺,预测期内(2025-2030 年)的复合年增长率为 7.86%。

由于各国的业务成长率不同,市场正在发生巨大的变化。这是基于所有权/财产类型、土地价值、投资模式等参数。

主要亮点

- 如图所示,亚太地区人口不断增长、都市化、社会意识增强以及小型企业扩张(尤其是香港、台湾和马来西亚等国家),预计将推动该地区对自助仓储设施的需求。

- 推动自助仓储设施需求的其他因素包括电子商务的扩张、远端办公和灵活办公空间的增加、向都市区的迁移以及租户的快速发展。

- 该地区生活空间成本的增加对市场成长率的贡献巨大。例如香港的人均居住空间比美国等新兴经济体小得多。进一步来看,根据香港政府统计处的数据显示,2021 年,香港公共租户的人均居住住宅为 13.5平方公尺,而 2017 年至 2021 年期间,这一数字一直在 13 至 13.5平方公尺之间。

- 可都市化/可开发土地昂贵且稀缺。建筑法规和规划条例是地方政府管理和控制发展的方式。在许多城市,开发控制法规都是多年前製定的,并且一直被随意修改,并且没有足够的经验证据证明其有效性。

- COVID-19 已经影响了多个经济体和行业,但一些行业仍在继续成功扩张。自助仓储产业并未受到疫情的严重影响,并随着消费者的仓储需求而逐渐成长。过去两年的疫情导致大量人员迁移,办公空间减少。由于这种情况,自助仓储的需求正在以前所未有的速度成长。

亚太地区自助仓储市场趋势

消费者意识的提高与人口密度推动市场成长

- 儘管许多企业在当前艰难的经济状况下举步维艰,但该地区的自助仓储设施仍在稳步扩张。由于消费文化、电子商务的兴起、居住空间的缩小以及人口的增长,自助仓储的需求正在激增,这推动了个人和家庭对安全、高效的个人物品储存设施的需求。

- 都市化的加速是推动市场成长的关键因素之一。随着城市人口的增长,越来越多的租户频繁搬家,导致都市区的居住空间变得更小、更昂贵。自助仓储业务已经在亚洲人口稠密、富裕的区域城市扎根。在较富裕的地区,居民更有可能购买占用家中更多空间的奢侈品。人们对专门的储存选择的需求日益增加,例如气候控制储存容器,用于保存葡萄酒、古董家具和电器产品等贵重物品。

- 新加坡、香港和东京是该地区平均住宅面积最小的。新加坡人口稠密,平均住房面积为730平方英尺,是亚洲最小的。超过75%的住宅没有收纳空间。根据市区重建局(URA)的讯息,新加坡的住宅在过去五年里一直在上涨。此外,中国和印度等国家的人口密度不断上升也推动了预测期内的市场成长率。自助仓储公司正在亚洲各地扩张,重建老化的设施并为新建设施做准备。此外,为了满足不断变化的市场需求,长期储存用户的需求预计将增加,从而导致该地区的大幅扩张。

日本拥有亚太地区最大的可出租面积

- 在日本,自助仓储市场逐渐被消费者认可,并成为一种新的房地产投资产品,带动了近年来市场的扩张。人们将家中的家具和贵重物品分散存放,并储存用于紧急情况和地震等自然灾害的救生食品,人们对自助仓储行业的兴趣也日益浓厚。

- 日本的自助仓储业务分为三类:仓储单位、租赁仓储空间和租赁货柜。首先,依据仓储业法经营的所谓「储藏室」。这些企业必须向客户偿还其存放物品的费用。下一种类型称为“租赁储存空间”,您可以租用位于建筑物或专用设施内的房间。最后还有租赁货柜,主要安装在室外。

- 此外,先前仅专注于B to B业务模式的仓储业,正向针对一般消费者的新业务模式-储藏室业务经营范围。此外,自助仓储设施正受到国内领先市场供应商提供创新解决方案的广泛关注。在日本,自助仓储设施被称为「储藏室」。

- 例如,根据Quraz于2021年11月进行的「年度供应调查」的最新估计,自助仓储市场(包括室内和室外)已大幅扩大至670亿日元,在过去10年中增长了一倍。调查还发现,由于远程办公和线上学习的快速普及以及在家办公生活方式的建立等生活环境的变化,新的储存需求正在出现。

亚太地区自助仓储产业概况

亚太地区的自助仓储市场高度分散,日本、新加坡和马来西亚等国家都有许多供应商。印度等新兴国家占据利基市场,并且正在迎来新进者。各参与者继续透过新设施扩大在新地区的影响力。

- 2022 年 5 月 - StorHub 营运的第四家自助仓储设施在香港开业。该仓储设施位于长沙湾长裕街18号柏裕工业中心,为该地区居民提供可靠、安全的仓储选择。

- 2022 年 3 月 - Quraz 有限公司宣布将在所有门市推出一项名为「Quraz 送货上门支援」的新服务,让消费者可以使用智慧型手机舒适地在家中接收和递送包裹。 「Quraz宅配支援」是一项新服务,可满足众多客户的需求并增加自助仓储设施的便利性。透过使用此服务,您无需离开家就可以从储存单元中取出诸如纸板箱、高尔夫球袋和手提箱等大件物品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 提高消费者意识和人口密度

- 市场限制

- 缺乏建造设施的可用空间

第六章 市场细分

- 按最终用户

- 个人

- 商业

- 按国家

- 日本

- 中国

- 香港

- 台湾

- 新加坡

- 马来西亚

第七章 竞争格局

- 公司简介

- Mandarin Self-storage Pte Ltd

- Store Friendly Self-storage Group Ltd(GSC)

- Boxful Limited

- Quraz Ltd

- Okinawa Self-storage

- StorHub Self-storage

- UD Self-storage

- Extra Space Asia

- Far East Organization(Store Y Self Storage)

- Storage King Group

第八章投资分析

第九章:市场的未来

The Asia-Pacific Self Storage Market size in terms of lettable area is expected to grow from 32.47 million square feet in 2025 to 47.39 million square feet by 2030, at a CAGR of 7.86% during the forecast period (2025-2030).

The market is transitioning considerably since the business grows at different rates in different countries. This is based on parameters such as ownership/property type, land rate, and investment models.

Key Highlights

- The growing population in Asia-Pacific, as indicated in the graph alongside the urbanization, public awareness, and the expansion of small enterprises, especially in countries like Hong Kong, Taiwan, Malaysia, and so on, are analyzed to boost the demand for self-storage facilities in the region.

- Additional factors driving the demand for self-storage facilities include e-commerce expansion, increased remote working and flexible office space, ongoing migration into cities, and the rapid development of renters.

- The growing living space costs in the region significantly contribute to the market growth rate. For instance, the living space per person in Hong Kong is much less compared to developed economies like the United States. To provide more context, according to the Census and Statistics Department of Hong Kong, in 2021, the average living space of public rental housing tenants in Hong Kong was 13.5 sq. m per person, and it has historically remained between 13 to 13.5 sq. m from 2017 to 2021.

- Urbanizable/developable land is both expensive and scarce. Building bye-laws and planning regulations are two ways that local governments control and manage development. Many cities have development control laws created years ago and have been modified haphazardly without enough empirical proof of their effects.

- COVID-19 has impacted several economies and industries; however, some industries continue to expand steadily. The self-storage industry has not been severely affected by the pandemic and has grown gradually with the consumer demand for storage. The past two years of the pandemic have seen enormous individual relocations and office space reductions. Due to this circumstance, the demand for self-storage has increased at an unprecedented rate.

APAC Self Storage Market Trends

Rising Consumerism and Population Density is Driving the Market Growth

- Self-storage facilities are expanding steadily in the region, despite many businesses struggling during difficult economic times. Demand for self-storage is surging as a culture of consumerism, the expansion of e-commerce, the constricting availability of living space, and the growing population drive demand from individuals and families for safe and efficient facilities for storing personal items.

- Growing urbanization is one of the significant factors positively driving market growth. Growing urban populations result in more tenants who move around frequently and smaller, more expensive living areas in cities. Self-storage businesses have established themselves in Asia's more populous and affluent regional cities. Affluent neighborhoods tend to have a greater propensity for inhabitants to buy luxuries that take up more room in their homes. There is an increasing demand for specialized storage options, such as climate-controlled storage containers, to preserve expensive goods such as wine, antique furniture, or electronics.

- In the region, the smallest average dwelling sizes are found in Singapore, Hong Kong, and Tokyo. Singapore has a dense population and the smallest dwelling sizes in Asia, with an average of 730 square feet. More than 75% of residential units lack a storage area. According to information from the Urban Redevelopment Authority (URA), housing prices have increased in Singapore over the last five years. Furthermore, the growing population density in countries such as China and India contributes to the market growth rate during the forecast period. Self-storage companies have expanded all over Asia, remodeling aging facilities and preparing brand-new construction. Additionally, to meet the market's shifting demands, the nation is expected to experience an increase in demand for long-term storage users, resulting in notable expansions in the region.

Japan to have the Largest Lettable Area in the Asia Pacific Region

- In Japan, the self-storage market has gradually gained recognition among consumers and as a new real estate investment product, leading to market expansion in the past few years. Decentralizing the housing of furniture and valuables, stockpiling survival food for emergency and natural disasters such as earthquakes, and attention to the industry have intensified with self-storage.

- There are three self-storage business classifications in Japan: trunk room, rental-storage space, and rental container. First is the so-called "trunk room" managed under the Warehousing Business Act. These operators must repay customers for the stored property. Next, is a class called a "rental-storage space" that uses rooms set up in a building or specialized facility for leasing. The last class is called a "rental container," mainly set up outdoors for rental.

- Furthermore, the warehousing industry, which focused only on a business-to-business format, has expanded its business to the trunk-room business to target the general consumer as a new business type. Additionally, trunk room self-storage facilities are gaining significant traction, with the leading market vendors in the country offering innovative solutions. Self-storage facilities are called "trunk rooms" in Japan.

- For instance, according to the latest estimates based on the Annual Supply Survey conducted in November 2021 by Quraz, the storage room market (including indoor and outdoor) has expanded significantly to JPY 67 billion, doubling over the past ten years. Furthermore, according to the survey, new storage needs have arisen due to changes in the living environment, such as the rapid penetration of telework and online learning and the ongoing stay-at-home lifestyle.

APAC Self Storage Industry Overview

The Asian-Pacific self-storage market is highly fragmented due to the presence of many vendors in countries such as Japan, Singapore, Singapore, and Malaysia. Emerging countries like India account for a niche market, witnessing new entrants. Different players continue to expand their presence in new regions through new facilities.

- May 2022 - In Hong Kong, the fourth self-storage facility operated by StorHub began its operations. The storage facility could offer trustworthy and safe storage options to locals living in the area at Precious Industrial Centre, No. 18 Cheung Yu Street, in Cheung Sha Wan.

- March 2022 - QurazCo. Ltd announced a new service, "QurazHome Delivery Support," at all stores that could allow consumers to put in and take out luggage with their smartphone while staying home. "QurazHome Delivery Support" is a new service that responds to many customers' requests and enhances trunk rooms' convenience. With this service, it could be possible to take large items such as cardboard boxes, golf bags, and suitcases from the trunk room that consumers use while at home.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Consumerism and Population Density

- 5.2 Market Restraints

- 5.2.1 Lack of Available Space to Build the Facilities

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Country

- 6.2.1 Japan

- 6.2.2 China

- 6.2.3 Hong Kong

- 6.2.4 Taiwan

- 6.2.5 Singapore

- 6.2.6 Malaysia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mandarin Self-storage Pte Ltd

- 7.1.2 Store Friendly Self-storage Group Ltd (GSC)

- 7.1.3 Boxful Limited

- 7.1.4 Quraz Ltd

- 7.1.5 Okinawa Self-storage

- 7.1.6 StorHub Self-storage

- 7.1.7 UD Self-storage

- 7.1.8 Extra Space Asia

- 7.1.9 Far East Organization (Store Y Self Storage)

- 7.1.10 Storage King Group