|

市场调查报告书

商品编码

1687968

美国自助仓储:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)United States Self-Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

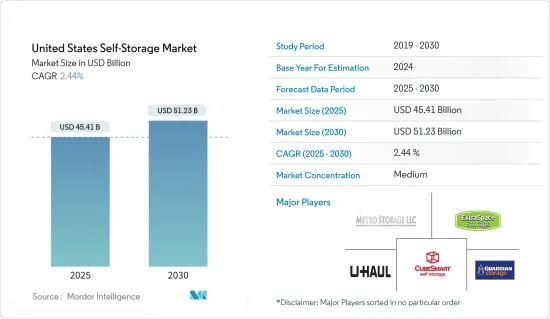

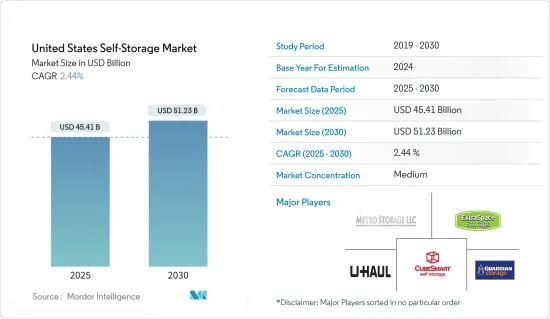

美国自助仓储市场规模预计在 2025 年为 454.1 亿美元,预计到 2030 年将达到 512.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.44%。

美国市场提供的自助仓储容器采用内建锁定机制、单独锁或两者兼有,有多种标准尺寸,并具有气候控制和数位监控覆盖设施,适合用户拥有经济、安全的外部储存空间,支援未来几年的市场成长。

主要亮点

- 为了寻求就业和更好的生活条件,人们从农村迁移到都市区,以及经济机会向大城市集中,这一趋势日益增长,支撑了美国城市人口的增长。

- 此外,自助仓储设施的所有者报告称,他们很难获得计划中的设施的自助仓储仓储分区核准,因为美国分区法将自助自助仓储归类为有条件使用。

- 自助仓储领域的市场参与者正在透过各种措施优先考虑客户的便利性。这包括远端存取和监控保险库以及开发用户友好的线上平台等趋势。这些技术创新简化了自助仓储预订和管理,推动了市场成长。

- 在美国,联邦和州立法挑战正在重塑自助仓储市场格局。美国各地的自助仓储业者要遵守一系列法规,涵盖留置权、销售税、分区法、滞纳金、租户资料保护、单位规模、安全、责任和车辆救援车等领域。虽然每个州都有自己独特的细微差别,但大多数州在基本要求上都有通用。

- 新冠疫情导致该国包括中小企业在内的企业纷纷转向远距工作文化和暂时停工,这导致用于存放行李的外部储存空间的需求增加,以避免支付商业建筑租金,导緻美国新冠疫情期间市场需求激增。

美国自助仓储市场的趋势

都市化加速和居住空间缩小正在推动市场

- 都市化加快是推动美国自助仓储市场成长的主要因素之一。美国持续的都市化正在减少居住空间并增加对额外储存的需求。此外,大都会地区的人口成长也鼓励供应商建立新的自助仓储设施。

- 根据美国人口普查局的资料,到 2023 年,加州、德州、佛罗里达德克萨斯、纽约州和宾州将成为美国人口最多的五个州。在繁华的大都会圈,工作和居住空间通常都很紧张,过去几年对额外储存解决方案的需求显着增长。加州、德克萨斯州、纽约州和宾夕法尼亚州等州是这一趋势的象征,自助仓储设施越来越受欢迎,可以满足企业和居民的多样化需求。

- 此外,美国各州人口密度的增加也推动了对自助仓储设施的需求,以服务人口较多地区的居民和企业。例如,根据美国人口普查局的资料,2023年哥伦比亚特区将成为美国人口最稠密的州,每平方英里有11,107.7人,其次是新泽西州,每平方英里有1,263.2人,罗德岛州,每平方英里有1,060.0人。

- 此外,随着美国都市区的成长,消费者在商品和服务上的支出推动了自助仓储空间的需求。世界银行的资料也印证了这一点,预测2050年美国都市化将达到89.16%。

- 市场上的供应商正在利用这一趋势,开设新的自助仓储设施,以提供一种经济高效且方便的方式来释放空间并安全地存放物品。例如,SecureSpace Self Storage 宣布将于 2024 年 1 月在宾州费城开设一个新的自助仓储设施 SecureSpace Philadelphia Grays Ferry。

- 因此有分析认为,随着美国城市的扩大和发展,自助仓储商店将成为城市基础设施不可或缺的组成部分。此外,美国许多州的城市人口持续增长和人口趋势上升将扩大对自助仓储单元的需求,以满足过剩储存的需求。预计这些因素将在预测期内对市场成长产生正面影响。

个人用户占大部分市场占有率

- 美国都市区租金上涨和人口密度上升支撑了住宅市场的发展。这刺激了国内住宅房地产市场向小型住宅和较少储藏室设施的转变,满足了美国对经济高效、安全的外部自助仓储空间的需求。

- 例如,2023年7月,公寓搜寻引擎和线上市场Rent.com报告称,全国建筑租金价格较2021年上涨了15%以上,美国租户的每月租金帐单增加了275多美元。这表明个人需要异地储存设施来降低租赁成本,这可能会在预测期内推动国内市场的成长。

- 此外,2023 年 11 月,专注于外交事务、国际和平与安全以及国际学生交流与推广的国际教育协会宣布,加州、纽约州和德克萨斯州是国际学生入学人数的最大贡献者。这可以推动美国境内移民人口增加的需求以及美国这些城市的人口密度增加,从而支持预测期内对外部储存空间的需求。

- 美国住宅人数激增,刺激了自助仓储设施的需求。根据美国人口普查资料,租屋住宅数量将从 2022 年的 4,310 万户增加到 2023 年的 4,380 万户。同时,房屋自有率呈下降趋势,预计 2023 年房屋自有率将为 66%,低于 2004 年的 69%。这种向出租住宅的转变使得租户难以将其物品运送到出租房屋,从而导致人们对自助仓储设施的偏好日益增加。这些设施提供了一种方便的解决方案,使租户可以存放他们的物品而不会弄乱他们的居住空间。

- 美国个人自助仓储需求的快速增长反映了不断变化的生活方式、都市化、生活转变以及对灵活储存选择的需求。随着个人在管理财产时越来越重视便利性、安全性和可访问性,自助仓储产业将继续成为更广泛的储存和搬运服务产业的重要组成部分。

美国自助仓储产业概况

美国自助仓储市场半固体,主要参与者包括 Metro Storage LLC、Guardian Storage Solutions、CubeSmart LP 和 U-Haul International Inc. 这些参与者正在采用联盟、创新、合併和收购等各种策略来增强其产品供应并获得永续的竞争优势。

- 截至 2023 年 12 月,CubeSmart LP 正在新泽西州和纽约州建造四个合资开发物业,预计将于 2025 年第三季完工。截至 2023 年 12 月 31 日,该公司已投资与这四个计划相关的 9,420 万美元中的 5,120 万美元。

- 2023 年 9 月,U-Haul 收购了位于 889 号州际公路 76 号的前布兰森山储存设施,以更好地满足布兰森居民的搬家和自助仓储需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

- 美国自助仓储设施的关键资料

- 储存设施数量

- 总可出租面积

- 运转率

- 每平方英尺平均租金

第五章 市场动态

- 市场驱动因素

- 都市化进程加快,居住空间缩小

- 经济前景改善与创新趋势

- 市场限制

- 政府法规

第六章 市场细分

- 依使用者类型

- 个人

- 商业

第七章 竞争格局

- 公司简介

- Metro Storage LLC

- Guardian Storage Solutions

- CubeSmart LP

- U-Haul International Inc.(U-Haul Holding company)

- Extraspace Storage Inc.

- Public Storage

- National Storage Affiliates Trust

- StorageMart

- Simply Self Storage Management LLC

- Ko Self Storage

- Global Self Storage Inc.

第八章投资分析

第九章:市场的未来

The United States Self-Storage Market size is estimated at USD 45.41 billion in 2025, and is expected to reach USD 51.23 billion by 2030, at a CAGR of 2.44% during the forecast period (2025-2030).

Self-storage containers offered in the US market are secured by a built-in locking mechanism, a separate lock, or both and come in one of many standardized sizes with climate control and digital surveillance coverage facilities, which makes it suitable for users to have an economical and secure external storage space, supporting its market growth in the future.

Key Highlights

- The increasing trend of migrant population from rural areas to urban areas for employment, better living conditions, and the concentration of economic opportunities in metropolitan cities support the growth of the Urban population in the United States, which has been estimated to grow significantly by the United Nations Department of Economic and Social Affairs.

- Additionally, self-storage facility owners have reported that the US zoning laws make it challenging to get self-storage zoning approval for their planned facilities because the country's cities have categorized self-storage under conditional use, making the facilities subject to government or municipal interference, restricting the independence of business operations of the self-storage facilities in the country and can restrict the market growth in the United States during the forecast period.

- Market players in the self-storage sector are prioritizing customer convenience through various initiatives. These include trends like remote access and monitoring of storage units, as well as the development of user-friendly online platforms. These innovations are streamlining the booking and management of self-storage units, fostering market growth.

- Challenges from federal and state laws are reshaping the landscape of the self-storage market in the United States. Self-storage vendors in the country navigate a web of regulations covering areas like Lien Rights, Sales Tax, Zoning Laws, late fees, tenant data protection, unit sizes, security, liability, and Vehicle Towing. While each state has its unique nuances, most states have commonalities in the basic requirements.

- The COVID-19 pandemic has resulted in the trend of remote working culture and temporary shutting down of businesses, including the SMBs in the country, which has raised the demand for external storage spaces during the pandemic to store their belongings to avoid the rent payment of commercial buildings, which has surged the demand for the market in the United States during the COVID-19 pandemic.

United States Self-Storage Market Trends

Increased Urbanization and Smaller Living Spaces to Drive the Market

- Increasing urbanization is one of the major factors driving the United States self-storage market growth. The continuous growth in urbanization across the United States has resulted in smaller living spaces, propelling the demand for extra storage. In addition, the rising population in metro areas further supports the growth in the construction and establishment of new self-storage facilities by market vendors.

- According to the United States Census Bureau data, California, Texas, Florida, New York, and Pennsylvania were the top five most populous states in the United States in 2023. In bustling metropolitan areas, where working and living spaces are often small, the demand for additional storage solutions has grown significantly in the past few years. States like California, Texas, New York, and Pennsylvania exemplify this trend, where self-storage facilities have become more popular, catering to the diverse needs of businesses and residents.

- Further, increasing population density in various federal states of the United States propels the demand for self-storage facilities to support residents and businesses in highly populated areas. For instance, according to the data from the US Census Bureau, in 2023, the District of Colombia had the highest population density in the United States, with 11,107.7 people per square mile, followed by New Jersey and Rhode Island, with 1,263.2 people per square mile and 1,060.0 people per square mile, respectively.

- Moreover, due to the rising urban population in the United States, consumer spending on goods and services is facilitating the need for self-storage spaces. This is evident from the World Bank data, the degree of urbanization in the United States is expected to reach 89.16% by 2050.

- Market vendors are capitalizing on the trend and opening new self-storage facilities to offer a cost-effective and convenient way to free up space and securely store belongings. For instance, in January 2024, SecureSpace Self Storage announced the opening of a new self-storage facility, SecureSpace Philadelphia Grays Ferry, in Philadelphia, Pennsylvania.

- Hence, as cities expand and evolve in the United States, self-storage stores are analyzed to become an integral component of the urban infrastructure. In addition, continuous growth in urban population and rising population trends in many States across the United States amplify the demand for self-storage units to meet the demand for extra storage. These factors are expected to positively influence the market growth over the forecast period.

Personal Users to Hold Major Market Share

- The Personal segment is supported by the increasing rent prices in the urban cities of the country and the population densities, which are fueling the adoption of small houses with fewer storage room facilities in the residential real-estates in the country, supporting the need for a cost-effective and secured external self-storage space in the United States.

- For instance, in July 2023, Rent.com, an apartment search engine and online marketplace, reported that the rent prices in the country's buildings have risen by over 15% nationally from 2021, adding over USD 275 to monthly rent bills to the tenants in the United States, showing the need for external storage facilities for the personal segment to reduce their renting expenses, which would fuel the market growth in the country during the forecast period.

- Additionally, in November 2023, the Institute of International Education, which focuses on foreign affairs, international peace and security, and international student exchange and aid, stated that California, New York, and Texas have contributed the highest enrollment of international students, which would fuel the demand for migrant population growth in the country and can increase of population densities in these cities of the United States, supporting the demand for external storage spaces during the forecast period.

- The United States has witnessed a surge in the number of renters, fueling the demand for self-storage facilities. Data from the US Census reveals that in 2023, the count of households in rented homes reached 43.8 million, up from 43.1 million in 2022. Concurrently, the rate of homeownership has been on a decline, with 66% of households owning homes in 2023, down from 69% in 2004. This shift toward renting has made it challenging for tenants to transport their belongings to their rental properties, leading to a rising preference for self-storage facilities. These facilities offer a convenient solution, allowing renters to store their items without cluttering their living spaces.

- The surging demand for personal self-storage in the United States is a reflection of evolving lifestyles, urbanization, life transitions, and the need for flexible storage options. As individuals increasingly prioritize convenience, security, and accessibility in managing their possessions, the personal self-storage sector is poised to remain a pivotal segment within the broader storage and moving services industry.

United States Self-Storage Industry Overview

The United States self-storage market is semi-consolidated, with the presence of several major players, such as Metro Storage LLC, Guardian Storage Solutions, CubeSmart LP, U-Haul International Inc. (U-Haul Holding company), and Extraspace Storage Inc. These players are adopting various strategies such as partnerships, innovations, mergers, and acquisitions in order to enhance their product offerings and gain a sustainable competitive advantage.

- In December 2023, CubeSmart LP had four joint venture development properties under construction located in New Jersey and New York, which are expected to be completed by the third quarter of 2025. As of December 31, 2023, the company had invested USD 51.2 million of an expected USD 94.2 million related to these four projects.

- In September 2023, U-Haul acquired the former Mt. Branson Storage facility at 889 State Hwy. 76 to better meet the moving and self-storage demands of Branson residents.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Key Statistics of Self-storage Facilities in United States

- 4.4.1 Number of Storage Facilities

- 4.4.2 Total Lettable Area

- 4.4.3 Occupancy Rate (%)

- 4.4.4 Average Rent Per Square Foot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Urbanization and Smaller Living Spaces

- 5.1.2 Improved Economic Outlook and Innovative Trends

- 5.2 Market Restraints

- 5.2.1 Government Regulations

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Personal

- 6.1.2 Business

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Metro Storage LLC

- 7.1.2 Guardian Storage Solutions

- 7.1.3 CubeSmart LP

- 7.1.4 U-Haul International Inc. (U-Haul Holding company)

- 7.1.5 Extraspace Storage Inc.

- 7.1.6 Public Storage

- 7.1.7 National Storage Affiliates Trust

- 7.1.8 StorageMart

- 7.1.9 Simply Self Storage Management LLC

- 7.1.10 Ko Self Storage

- 7.1.11 Global Self Storage Inc.