|

市场调查报告书

商品编码

1645143

新加坡自助仓储:市场占有率分析、产业趋势和成长预测(2025-2030 年)Singapore Self-Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

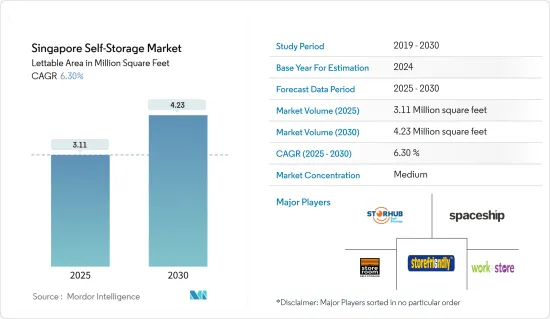

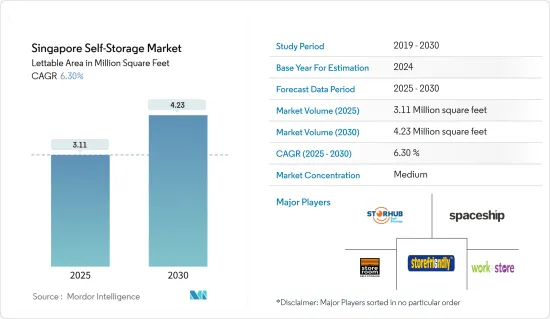

新加坡自助仓储市场规模(基于可出租面积)预计将从 2025 年的 311 万平方英尺扩大到 2030 年的 423 万平方英尺,预测期内(2025-2030 年)的复合年增长率为 6.30%。

新加坡自助仓储市场的需求不断增长,是由于都市化进程加快,需要自助仓储的居住空间缩小。此外,商业部门不断增长的需求也在推动市场的发展。

关键亮点

- 新加坡对自助仓储的需求正在稳步增长。土地变得越来越有限,更高密度、更小的住宅正在成为常态。因此,许多消费者选择自助仓储作为解决空间问题的可行解决方案。由于过去几年住宅、零售和工业房地产成本的上升,自助仓储用地已逐渐成为一种商品。这个市场为满足人们日益增长的对于家庭和办公室以外工作空间的需求提供了一个合理的替代方案。

- 此外,随着消费者生活方式的改变,如搬家、家庭扩张和退休,他们对更多空间的渴望也随之增加。随着都市化进程的推进,新加坡主要城市的公寓面积越来越小,价格也越来越贵。为了满足这种日益增长的客户需求,自助仓储的想法应运而生,而且随着单位数量的稳定增加,它对市场从业者也越来越有吸引力。

- 根据新加坡统计局的数据,2021 年新加坡的人口密度为每平方公里 7,485 人。新加坡人口逐年成长,空间却极为有限,导致住宅短缺、土地稀缺等问题。这种情况进一步增加了该国对自助仓储设施的需求。

- 人口结构的变化也导致了这种激增。许多人正在搬迁到远离大城市的地区。区域零售店的运转率上升(这些地区的租金历来较低)也促进了需求的增加。因此,农村商店的成长速度比大都会圈的商店更快。这些因素进一步推动了国内自助仓储市场的发展。

- 新冠疫情推动了自助仓储的需求,一些公司在新加坡开设了商店。这些空间可供个人和企业租用来储存财产和货物,咨询和回收的数量增加。许多人发现他们需要在家中拥有更多的空间来用于远距工作或培养新的嗜好。企业也向高端市场迈进,重新评估其办公空间需求,并囤积货物以应对供应链中断。

新加坡自助仓储市场趋势

预计都市化进程加速和居住空间缩小将推动新加坡自助仓储需求

- 新加坡是商务和旅游等各领域的中心。由于都市区众多,空间变得相当困难。该国的大多数住宅面积较小,大多数公寓都只有很少的宽敞房间。此外,市场的都市化趋势以及 GDP 的成长预计将促进市场成长。

- 全国城市人口的不断增长正快速推动对自助仓储设施的需求。例如,根据联合国亚太经社会的资料,新加坡城市人口成长迅速,从2014年的5,525,600人增加到今年的5,943,500人。

- 居住在新加坡的城市人口通常会投资租赁自助仓储单位。事实证明,对于新加坡那些物品较大、难以运输的人来说,租用自助仓储单位是一种便利的方式。对于拥有不常用物品的新加坡居住者,这也是一个有吸引力的选择。这些因素正在推动新加坡自助仓储市场的成长。

- 此外,Store-Y Self-Storage 等自助仓储公司正在都市区社区附近开设一些自助仓储地点,以更贴近客户。该公司在北部地区的Woodlands社区经营自助仓储 The Woodlands,并赢得了高度讚誉。

- 过去几年,新加坡经济持续成长,居住者的生活水准和消费信心不断增强。因此,居住在都市区的人们更有可能收藏物品,尤其是电器产品、酒和装饰品。

商业自助仓储类型市场预计将大幅成长

- 预计预测期内新加坡自助仓储市场的业务部分将显着成长。这是因为富裕的中阶不断壮大以及网路零售的兴起正在推动企业转向自助仓储来满足其需求。此外,全国各地的企业主都选择自助仓储,因为它比租用店面或仓库更便宜。

- 房地产管理公司 JLL 表示,新加坡近一半使用自助仓储设施的人是企业。这些用户对储存空间的使用比个人用户更稳定,这表明随着公司的发展,需求可能会增加。随着新加坡Start-Ups企业的成长,越来越多的在家经营企业的人选择外包他们的储存需求。这意味着您需要更多的储存空间来满足不断增长的业务需求。

- 该国的Start-Ups企业数量也在增加,灵活的自助仓储选择也迎合了Start-Ups的需求,电子商务行业也在不断增长,而精通技术的人口也越来越多。新兴企业希望节省资金并在经营业务时拥有更大的灵活性。

- 预计未来几年各行业新兴企业的崛起将进一步推动对商业自助仓储设施的需求。例如,根据东协资料,2021年,新加坡拥有20家Start-Ups独角兽企业,其中6家从事科技和通讯行业,5家从事电子商务行业。预计该国新兴企业的崛起将进一步推动该国自助仓储市场的需求。

新加坡自助仓储产业概况

新加坡的自助仓储市场竞争适中,由许多全球性和地区性公司组成。这些参与企业已经占领了相当大的市场占有率,并致力于在全球扩大基本客群。为了在预测期内保持竞争力,这些公司将投资于研发、策略联盟以及其他有机和无机成长策略。

2022年5月,美国位于美国的房地产投资信託基金(REIT)宣布在新加坡交易所进行首次公开发行(IPO),该公司的业务涉及自助仓储和以杂货店为核心的零售店。该公司的投资组合包括 22 处房产,总合317 万平方英尺。该基金由新加坡资产管理公司大华银行全球资本有限责任公司和美国房地产投资公司美国 Cos. LLC 赞助。此外,该公司还经营四个自助仓储地点和 15 多个购物中心。

2022 年 3 月,StorHub Self Storage 宣布将在裕廊酵母和实龙岗开设另外两个自助仓储设施。这些新开放的设施的加入使得自助仓储可以扩展到新的领域并为当地社区做出贡献。这家自助仓储公司目前总合13 个 StorHub 储存设施,可供新加坡各地居民轻鬆使用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对新加坡自助仓储产业的影响

第五章 市场动态

- 市场驱动因素

- 有利的市场条件,如高密度、人均收入和富裕人口

- 新加坡都市化进程加快,居住空间缩小,自助仓储需求上升

- 自助仓储产业经营模式不断发展,包括更重视附加价值服务和邻近市场的进入者

- 市场问题

- 租金相对较高,可出租面积减少

第六章 市场细分

- 自助仓储类型

- 个人

- 商业

- 依所有权类型

- 自有

- 已全部出租

- 混合型(部分出租)

第七章 竞争格局

- 公司简介

- Store Friendly Management Pte Ltd

- Spaceship Singapore(Astore Pte. Ltd.)

- StorHub Self Storage

- Store Room Pte Limited

- Work+Store(Work Plus Store Pte Ltd)

- D Storage Pte Limited

- Lock+Store(General Storage Company Pte Ltd)

- Beam Storage Pte Ltd.

- Far East Organization(Store-Y Self-Storage)

- Mandarin Self Storage

- Urban Space Self Storage

- U-Store@SG(Singapore G Pte Ltd)

第八章投资分析

第九章:市场的未来

The Singapore Self-Storage Market size in terms of lettable area is expected to grow from 3.11 Million square feet in 2025 to 4.23 Million square feet by 2030, at a CAGR of 6.30% during the forecast period (2025-2030).

The rise in demand for Singapore's self-storage market is due to increased urbanization and smaller living spaces, which demand self-storage. In addition, the increasing needs of the business segment are also driving the market.

Key Highlights

- Singapore has seen a steady increase in the demand for self-storage. The land is becoming increasingly limited, with denser and smaller houses becoming common. As a result, many consumers are looking to self-storage as an accessible answer to their space problems. Land for self-storage has gradually become a commodity due to the rising costs of residential, retail, and industrial real estate over the past few years. The market provides a reasonable option for the public's expanding desire for workspace outside homes and offices.

- Moreover, the requirement for more space for belongings depends on several changes in a consumer's lifestyle, such as moving home, family expansion, and retirement. With rising urbanization and apartments in major Singapore cities gradually getting smaller and more expensive, a significant portion of the country's population is finding they need more room. Self-storage ideas have come up to meet this growing customer need, and as the number of units steadily grows, it's appealing to the people who work in the market.

- According to the Singapore Department of Statistics, in 2021, the population density of Singapore was 7,485 people per square kilometer. The population of Singapore has been increasing over the years within a minimal space, posing challenges such as housing shortages and land scarcity. Such instances further drive the demand for self-storage facilities in the country.

- Demographic change is one factor driving this spike. Many people have been seen relocating from big cities to farther-flung areas. Increases have been made possible by improved occupancy at local stores, which have historically had low rental rates. As a result, rural stores have had a faster growth rate than major metropolitan locations. Such factors are further driving the self-storage market in the country.

- The COVID-19 pandemic drove up demand for self-storage, and some companies started expanding in Singapore. The number of inquiries and takers for these spaces, which individuals and companies hired to store possessions or goods, had increased. More people became aware of the need for more space in their homes for remote work and new interests. Businesses that were reconsidering their office space requirements or stockpiling goods in anticipation of supply chain disruptions were also moving upmarket.

Singapore Self Storage Market Trends

Increased Urbanization, Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Singapore

- Singapore is a hub for everything, from business to travel. Due to the enormous urban population in the country, space can be significantly harder to come by in urban places. Most homes in the country are on the small side, and most apartments have fewer spacious rooms. Also, with an increasing GDP value, the market urbanization trend is expected to cater to market growth.

- The growth in urban populations across the country is rapidly driving the demand for self-storage facilities. For instance, according to the UNESCAP data, the urban population in Singapore has rapidly increased from 5,525.6 thousand in 2014 to 5,943.5 thousand this year.

- The urban population living in Singapore usually invests in the rental of self-storage units. Self-storage unit rental has proved to be handy for people in Singapore who have possessions that are big and, therefore, difficult to keep around. It is also an attractive choice for Singapore residents with belongings they don't use that often. Such factors are fueling the growth of the self-storage market in Singapore.

- Moreover, self-storage companies like Store-Y Self-Storage have opened several self-storage stores near urban communities to lower customer proximity. The company has "Self Storage Woodlands," an acclaimed center in the Woodlands Community in the North Region.

- The continual growth of Singapore's economy in the last couple of years has given rise to greater resident affluence and consumerism. Because of this, people who live in cities are much more likely to collect things, especially collectibles like electronics, wines, and decorations.

Business Self-storage Type Segment is Expected to Witness a Significant Growth

- The business segment of the Singapore self-storage facility market is expected to witness significant growth over the forecast period, owing to the growing affluent middle class and the popularity of online retailing, which are leading businesses to turn to self-storage to fulfill their needs. Also, business owners in the country choose self-storage space because it is less expensive than renting shops or warehouses.

- JLL, a company that manages properties, says that almost half of the people who use self-storage facilities in Singapore are businesses. These users use storage space more steadily than individual users, suggesting that demand may rise as enterprises grow. As Singapore's startup scene grows, more people who run businesses from home are choosing to outsource their storage needs. This means that more storage space is needed to meet the needs of growing businesses.

- Also, the number of startups in the country is growing, and the flexible self-storage options meet the needs of startups in an e-commerce sector that is growing and a tech-savvy population that is growing. Startups want to save money and have more operational flexibility when running their businesses.

- The increasing number of startups in various industries will further boost the demand for self-storage facilities for business use in the coming years. For instance, according to the data from ASEAN, in 2021, Singapore had 20 startup unicorns; six were active in the technology and communication industry, while five were in the e-commerce industry. The increasing number of startups in the country will further drive the demand for the self-storage market in the country.

Singapore Self Storage Industry Overview

Singapore's self-storage market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their client base globally. To remain competitive during the forecast period, these companies will invest in R&D, strategic alliances, and other organic and inorganic growth strategies.

In May 2022, US REIT, a US-based REIT interested in self-storage and grocery-anchored retail locations, announced an IPO on the Singapore stock exchange. The company's portfolio of 22 properties totals 3.17 million square feet. It is sponsored by UOB Global Capital LLC, a Singapore-based asset management firm, and Hampshire Cos. LLC, a US real estate investment corporation. Additionally, it has four self-storage operating offices and more than 15 shopping centers.

In March 2022, StorHub Self Storage announced the opening of two additional self-storage facilities in Jurong East and Serangoon. The inclusion of these newly opened facilities brings self-storage to new neighborhoods to serve the community. The self-storage company now has a total of 13 StorHub storage facilities that are easily accessible to residents all around Singapore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Self-Storage Industry in Singapore

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Market Conditions Such as High Density, Per-Capita Income and Presence of Affluent Population

- 5.1.2 Increased Urbanization, Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Singapore

- 5.1.3 Evolving Business Models Within the Self-Storage Industry Such as Increased Focus on Value-Added Services and Entry From Adjacent Markets

- 5.2 Market Challenges

- 5.2.1 Relatively High Rental Rates and Shrinking Lettable Space

6 MARKET SEGMENTATION

- 6.1 By Self-storage Type

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Ownership Type

- 6.2.1 Self-owned

- 6.2.2 Fully-leased

- 6.2.3 Hybrid (Partly-leased)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Store Friendly Management Pte Ltd

- 7.1.2 Spaceship Singapore (Astore Pte. Ltd.)

- 7.1.3 StorHub Self Storage

- 7.1.4 Store Room Pte Limited

- 7.1.5 Work+Store (Work Plus Store Pte Ltd)

- 7.1.6 D Storage Pte Limited

- 7.1.7 Lock+Store (General Storage Company Pte Ltd)

- 7.1.8 Beam Storage Pte Ltd.

- 7.1.9 Far East Organization (Store-Y Self-Storage)

- 7.1.10 Mandarin Self Storage

- 7.1.11 Urban Space Self Storage

- 7.1.12 U-Store@SG (Singapore G Pte Ltd)