|

市场调查报告书

商品编码

1851151

商业印刷:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Commercial Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

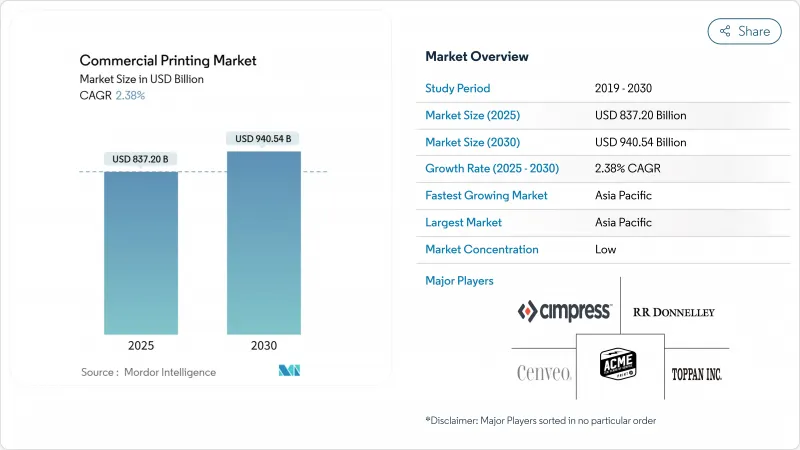

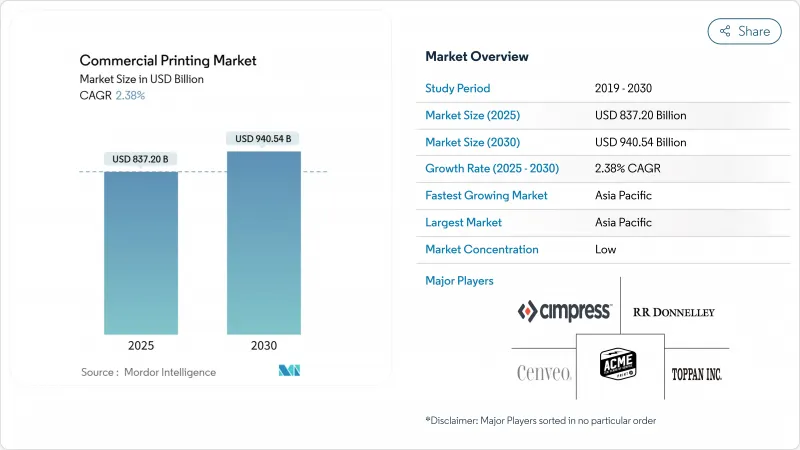

商业印刷市场预计到 2025 年将达到 8,372 亿美元,到 2030 年将达到 9,405.4 亿美元,年复合成长率为 2.38%。

这项业绩表明,商业印刷市场正在适应数位化变革,同时充分利用包装、可变资讯服务和永续基材的成长。电子商务对印刷包装的持续需求、向植物油墨的稳步转型以及按需数位工作流程的广泛应用,正在缓解传统出版业务仍然面临的收入压力。对用于印刷工作流程自动化的人工智慧投资以及在消费者附近部署微型工厂的倡议,预计将提高商业印刷市场众多参与企业的产量和盈利。同时,大型企业正与软体供应商合作,整合即时数据分析,而本地专业公司则在桌面促销应用领域开闢利基市场。

全球商业印刷市场趋势与洞察

按需包装印刷业务爆炸性成长

为了支持快速的产品上市和区域促销活动,电商企业越来越倾向于采用更短、更频繁的包装。这一趋势在亚太地区发展最为迅速,因为当地的履约中心需要更靠近消费者印刷包装,从而降低库存成本并减少产品过时。

可变数据印刷在个人化行销的应用日益广泛

北美和欧洲的广告商要求提供基于第一方资料的个人化邮件和包裹。大日本印刷株式会社于2025年推出了「Persona Insights」人工智慧工具,将政府人口统计与印刷工作流程相结合,可在一次生产过程中产生独特的设计变体。将数据分析与数位印刷相结合的印刷公司正在赢得优质、服务丰富的合同,并弥补传统商业印刷作业週转时间长的不足。

广告支出持续向数位媒体管道转移

品牌所有者正将预算分配给线上影片和社交媒体,这限制了杂誌和报纸印刷订单的成长。印刷商则透过专注于包装和直邮形式来弥补这一下滑,这些包装和直邮形式整合了QR码,以实现线上线下无缝衔接。

细分市场分析

2024年,柔印平台维持了41.07%的收入份额,这主要得益于长幅面软质包装印刷的良好经济效益。随着品牌对快速修改设计稿和个人化宣传活动的需求不断增长,预计到2030年,数位喷墨解决方案的商业印刷市场规模将以3.45%的复合年增长率成长。区域印刷商正越来越多地采用混合生产线,将柔印白层与可变喷墨颜色结合,以减少设定时间和浪费。预计到2028年,数位印刷在中幅幅面印刷方面的成本将与传统印刷持平,这将削弱柔印在饮料标籤等高SKU细分市场的优势。

人工智慧引导的套准和自动作业切换技术的进步正在减少人工投入并最大限度地提高运作。例如,Multi-Label Tech-Print 公司的 Domino N610i 等设备展示了中型印刷商如何利用六色、600 dpi 的引擎,一次性完成金属色和高密度白的印刷。水性喷墨墨水比溶剂型柔印墨水产生的 VOC排放更低,使印刷商能够满足日益严格的空气品质法规要求。

到2024年,包装将占商业印刷市场份额的44.08%,年复合成长率达3.07%,这主要得益于电子商务小包裹量的成长和品牌优质化趋势。折迭式纸盒和软包装袋广泛应用于依赖清晰货架展示的行业,例如化妆品、营养补充剂和已调理食品。报纸、杂誌和平装书等出版品的销售量持续下滑,尤其是在北美和西欧。然而,采用再生纸印刷的漫画和小批量文学作品在具有环保意识的消费者群体中呈现出成长动能。

商业印刷供应商正透过提供包含瓦楞纸箱、商店展示架和个人化插页卡的「宣传活动套件」来实现业务多元化。嵌入包装的印刷电子元件能够实现温度监控和防伪功能,深受亚太地区製药公司和奢侈品牌的青睐。包装的韧性抵消了其他行业广告支出週期性波动的影响,为印刷商提供了稳定的收入来源。

商业印刷市场报告按印刷类型(平张胶印喷墨、柔版印刷、网版印刷等)、应用(包装、广告、出版等)、印刷基材(纸张和纸板、织物和纺织品等)、幅面(大尺寸印刷等)和地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。

区域分析

预计到2024年,亚太地区将占全球印刷收入的45.64%,并在2030年之前以3.28%的复合年增长率成长。消费品包装生产、国内电子商务交易量以及政府对基础设施计划的奖励策略推动了印刷需求的成长。仅中国每年就新增数百条瓦楞纸板加工生产线,而印度的标籤行业将受益于商品及服务税(GST)的推行,该税种强制要求在物流渠道中使用标准化的条码进行识别。区域品牌正积极采用带有QR码的智慧包装,以提高行动优先消费者的忠诚度。

北美在全球印刷业中仍占据重要份额,儘管成长速度有所放缓。随着需求转向数据主导的直邮、药品说明书和高端包装,美国商业印刷市场规模趋于稳定。受教育出版业优先采用国内印刷内容的政策推动,加拿大印刷商正专注于小批量图书生产。

在欧洲,一般商业印刷量保持平稳,但C2C可回收基材和植物油墨的投资正在加速成长。德国正在试行纸质咖啡杯的押金返还制度,加工商也积极测试经认证可堆肥的阻隔涂布纸板。欧盟关于一次性塑胶包装形式的法规可能会在中期内推动纤维板的销售成长。

拉丁美洲和中东及非洲地区在商业印刷市场中所占份额虽小,但成长潜力巨大。巴西的PET回收率将在2025年达到56.4%,这将使食品品牌能够转向使用PCR含量较高的标籤和软包装袋,从而提升印刷量。波湾合作理事会成员国正在建造新的工业园区,其中的包装厂服务于乳製品、饮料和个人护理丛集,这将支撑近期对胶印机和凹版印刷机的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 按需包装印刷业务爆炸性成长

- 可变数据印刷在个人化行销的应用日益广泛

- 零售和消费品品牌对促销印刷品的需求持续成长

- 转向环保基材和植物油墨

- 将印刷电子技术(RFID、NFC)整合到包装和标籤中

- 靠近客户的微型工厂「列印即服务」中心的出现

- 市场限制

- 广告支出正在向数位媒体管道转移

- 纸张、油墨和能源投入价格的波动;

- 对传统油墨的VOC和化学品使用量有严格的限制

- 新型数位印刷机所需的半导体元件短缺

- 供应链分析

- 监管环境

- 技术展望

- 投资分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按列印类型

- 平张胶印

- 数位喷墨

- 柔版印刷

- 萤幕

- 凹版印刷

- 其他列印类型

- 透过使用

- 包裹

- 广告

- 发布

- 图书

- 杂誌

- 报纸

- 其他出版品

- 企业及贸易印刷

- 其他应用

- 透过印刷材料

- 纸张和纸板

- 塑胶和合成基材

- 织物和纺织品

- 金属和箔材

- 其他材料

- 按格式

- 大尺寸列印

- 小幅面印刷

- 直接物件印刷

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Toppan Inc.

- Dai Nippon Printing Co., Ltd.

- RR Donnelley & Sons Company

- Quad/Graphics Inc.

- Transcontinental Inc.

- Cenveo Worldwide Limited

- Cimpress plc

- Deluxe Corporation

- Shutterfly LLC

- LSC Communications LLC

- Mondi Group

- Printpack Inc.

- Multi-Color Corporation

- ACME Printing

- O'Neil Printing

- Xerox Corporation(Print Services)

- Smurfit Westrock(Print and Packaging)

- Berry Global Group(Graphics Services)

- Seiko Epson Corporation(Commercial Inkjet Systems)

- HP Inc.(PageWide Industrial)

第七章 市场机会与未来展望

The commercial printing market size is valued at USD 837.20 billion in 2025 and is forecast to reach USD 940.54 billion by 2030, advancing at a 2.38% CAGR.

This performance indicates that the commercial printing market is adapting to digital disruption while capitalizing on growth in packaging, variable-data services, and sustainable substrates. Ongoing demand for printed packaging in e-commerce, a steady shift toward vegetable-based inks, and wider use of on-demand digital workflows are cushioning revenue pressures that still affect traditional publishing work. Investments in artificial intelligence for print workflow automation, together with micro-factory concepts located near consumer hubs, are expected to raise throughput and improve profitability for many participants in the commercial printing market. At the same time, larger firms are pursuing alliances with software vendors to integrate real-time data analytics, while regional specialists are carving out niche positions in direct-to-object and short-run promotional applications.

Global Commercial Printing Market Trends and Insights

Explosive Growth in On-Demand Packaging Print Runs

E-commerce brands increasingly favor shorter, more frequent packaging runs to support fast product launches and regional promotions. A 2024 installation of a Domino N610i digital label press by Multi-Label Tech-Print in Ahmedabad underscores the migration toward high-throughput digital lines able to process hundreds of SKUs with minimal changeover time.The trend is advancing most rapidly in Asia-Pacific, where localized fulfillment centers require packaging that is printed close to consumers, limiting inventory costs and reducing obsolescence.

Rising Adoption of Variable-Data Printing for Personalized Marketing

Advertisers in North America and Europe are demanding individualized mailers and packaging tied to first-party data. Dai Nippon Printing introduced its "Persona Insight" AI tool in 2025, combining government demographic statistics with print workflows that generate unique design variants in one production pass. Printers that integrate data analytics and digital presses are securing premium, service-rich contracts that offset slower run lengths in traditional commercial jobs.

Ongoing Shift of Advertising Spend to Digital Media Channels

Brand owners allocate budget toward online video and social media, curbing growth in magazine and newspaper print orders. Printers offset the decline by emphasizing packaging and direct mail formats that integrate QR codes for seamless offline-to-online engagement.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Demand for Promotional Print from Retail and CPG Brands

- Transition Toward Eco-Friendly Substrates and Vegetable-Based Inks

- Volatile Prices of Paper, Ink and Energy Inputs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexographic platforms retained 41.07% revenue in 2024, underpinned by favorable economics for long runs on flexible packaging. The commercial printing market size for digital inkjet solutions is projected to widen by 3.45% CAGR to 2030 as brands demand quicker artwork changes and individualized campaigns. Regional converters increasingly deploy hybrid lines, marrying flexo white layers with variable inkjet color to cut setup times and waste. Digital cost parity at mid-length runs is expected before 2028, eroding flexo's historical edge in SKU-rich sectors such as beverage labels.

Advances in AI-guided registration and automated job changeovers are shrinking labor input and maximizing uptime. Investments like Multi-Label Tech-Print's Domino N610i show how medium-sized converters leverage six-color, 600 dpi engines to print metallics and high-opacity whites in one pass. Environmental compliance is another driver: water-borne inkjet fluids emit lower VOCs than solvent-based flexo blends, helping printers satisfy tightening air-quality rules.

Packaging held 44.08% of commercial printing market share in 2024 and will rise at a 3.07% CAGR on the back of e-commerce parcel volumes and brand premiumization. Folding cartons and flexible pouches serve cosmetics, nutraceuticals, and ready-to-eat meals, sectors that rely on vivid shelf appeal. Publishing work-newspapers, magazines, softcover books-experiences ongoing volume erosion, especially in North America and Western Europe. Yet manga and small-batch literary titles printed on recycled paper are registering niche growth among environmentally conscious consumers.

Commercial printing industry vendors diversify by offering "campaign kits" that bundle corrugated shipper boxes, point-of-sale displays, and personalized insert cards. Printed electronics embedded in packages enable temperature monitoring and anti-counterfeiting, features valued by pharmaceutical and luxury brands in Asia-Pacific. Packaging's resilience gives printers an anchor revenue stream, offsetting cyclical ad-spend patterns in other segments.

The Commercial Printing Market Report is Segmented by Printing Type (Offset Lithography, Digital Inkjet, Flexographic, Screen, and More), Application (Packaging, Advertising, Publishing, and More), Print Material (Paper and Cardboard, Fabric and Textiles, and More), Format (Large-Format Printing, and More) and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific dominated revenue with 45.64% in 2024 and is projected to post a 3.28% CAGR through 2030 as consumer packaged goods output, domestic e-commerce volumes, and government stimulus for infrastructure projects expand print demand. China alone adds hundreds of corrugated converting lines annually, while India's label sector benefits from GST roll-out mandating standardized barcode identification across logistics channels. Regional brands actively specify QR-code smart packaging to build loyalty among mobile-first consumers.

North America maintains a sizeable slice of global output, although growth is modest. The commercial printing market size in the United States is steady as demand migrates toward data-driven direct mail, pharmaceutical inserts, and luxury packaging. Canada's printers focus on short-run book production fueled by educational publishing mandates favoring domestically printed content.

Europe shows flat volume in general commercial work but accelerating investment in C2C recyclable substrates and vegetable-oil inks. Germany is piloting deposit-return systems for paper-based coffee cups, spurring converters to test barrier-coated boards certified for compostability. EU regulations on single-use plastic pack formats will likely channel incremental volume to fiberboard over the medium term.

Latin America and the Middle East & Africa together account for a smaller proportion of the commercial printing market but represent meaningful upside. Brazil's PET recycling rate reached 56.4% in 2025, allowing food brands to switch to PCR-rich labels and flexible pouches, which in turn creates print volume. Gulf Cooperation Council states are building new industrial zones that house packaging plants serving dairy, beverage, and personal-care clusters, underpinning near-term demand for offset and gravure equipment.

- Toppan Inc.

- Dai Nippon Printing Co., Ltd.

- R.R. Donnelley & Sons Company

- Quad/Graphics Inc.

- Transcontinental Inc.

- Cenveo Worldwide Limited

- Cimpress plc

- Deluxe Corporation

- Shutterfly LLC

- LSC Communications LLC

- Mondi Group

- Printpack Inc.

- Multi-Color Corporation

- ACME Printing

- O'Neil Printing

- Xerox Corporation (Print Services)

- Smurfit Westrock (Print and Packaging)

- Berry Global Group (Graphics Services)

- Seiko Epson Corporation (Commercial Inkjet Systems)

- HP Inc. (PageWide Industrial)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth in on-demand packaging print runs

- 4.2.2 Rising adoption of variable-data printing for personalized marketing

- 4.2.3 Sustained demand for promotional print from retail and CPG brands

- 4.2.4 Transition toward eco-friendly substrates and vegetable-based inks

- 4.2.5 Integration of printed electronics (RFID, NFC) into packaging and labels

- 4.2.6 Emergence of micro-factory "print-as-a-service" hubs close to customers

- 4.3 Market Restraints

- 4.3.1 Ongoing shift of advertising spend to digital media channels

- 4.3.2 Volatile prices of paper, ink and energy inputs

- 4.3.3 Stringent VOC and chemical-use regulations on conventional inks

- 4.3.4 Shortage of semiconductor components for new digital presses

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Type

- 5.1.1 Offset Lithography

- 5.1.2 Digital Inkjet

- 5.1.3 Flexographic

- 5.1.4 Screen

- 5.1.5 Gravure

- 5.1.6 Other Printing Types

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Advertising

- 5.2.3 Publishing

- 5.2.3.1 Books

- 5.2.3.2 Magazines

- 5.2.3.3 Newspapers

- 5.2.3.4 Other Publishing

- 5.2.4 Corporate and Transactional Printing

- 5.2.5 Other Application

- 5.3 By Print Material

- 5.3.1 Paper and Cardboard

- 5.3.2 Plastic and Synthetic Substrates

- 5.3.3 Fabric and Textiles

- 5.3.4 Metal and Foils

- 5.3.5 Other Materials

- 5.4 By Format

- 5.4.1 Large-Format Printing

- 5.4.2 Small-Format Printing

- 5.4.3 Direct-to-Object Printing

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Kenya

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Toppan Inc.

- 6.4.2 Dai Nippon Printing Co., Ltd.

- 6.4.3 R.R. Donnelley & Sons Company

- 6.4.4 Quad/Graphics Inc.

- 6.4.5 Transcontinental Inc.

- 6.4.6 Cenveo Worldwide Limited

- 6.4.7 Cimpress plc

- 6.4.8 Deluxe Corporation

- 6.4.9 Shutterfly LLC

- 6.4.10 LSC Communications LLC

- 6.4.11 Mondi Group

- 6.4.12 Printpack Inc.

- 6.4.13 Multi-Color Corporation

- 6.4.14 ACME Printing

- 6.4.15 O'Neil Printing

- 6.4.16 Xerox Corporation (Print Services)

- 6.4.17 Smurfit Westrock (Print and Packaging)

- 6.4.18 Berry Global Group (Graphics Services)

- 6.4.19 Seiko Epson Corporation (Commercial Inkjet Systems)

- 6.4.20 HP Inc. (PageWide Industrial)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment