|

市场调查报告书

商品编码

1851282

分散式发电:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Distributed Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

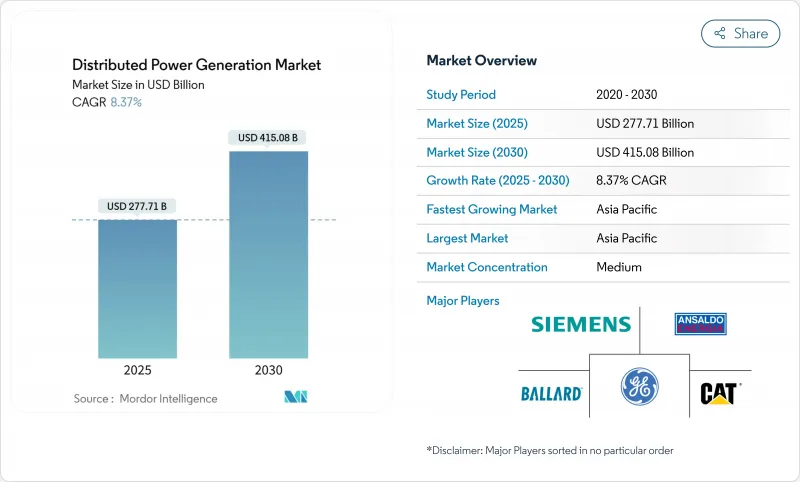

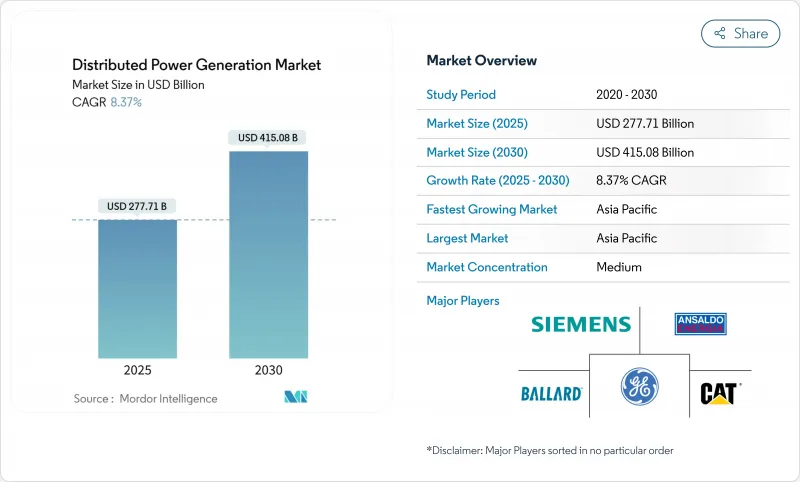

预计到 2025 年,分散式发电市场规模将达到 2,777.1 亿美元,到 2030 年将达到 4,150.8 亿美元,预测期(2025-2030 年)复合年增长率为 8.37%。

此次扩张反映了能源供应结构从集中式向本地化资产的转变,后者融合了太阳能、燃料灵活型引擎和数位化控制系统。资本成本下降、可再生能源发展的法规以及日益增长的电网韧性需求是关键驱动因素。亚太地区将支撑能源供应量和发展势头,北美将利用丰富的天然气资源,而欧洲将优先考虑能源安全。技术竞赛将围绕氢燃料电池和整合微电网展开,这些微电网将与储能、软体和服务结合。同时,互联瓶颈、储能资本需求以及日益严格的排放法规也增加了投资风险。

全球分散式发电市场趋势与洞察

小型太阳能光电发电的平准化电成本(LCOE)正在快速下降。

到2024年,中国拓普康(TOPCon)组件的价格将降至每瓦0.16美元,这将拉低全部区域的平准化电费,并重塑分散式经济格局。标准化的安装规范、低成本的逆变器以及财政激励措施将产生越来越大的影响,使亚太地区成为全球小型太阳能发电的标竿。各国政府正在简化授权和电网规范,进一步缩短计划週期。价格压力迫使其他地区的供应商透过提高效率和针对特定应用的设计来脱颖而出。

商业和工业用錶后安装蓬勃发展

欧洲企业正加速推动自发电,以对冲批发价格波动风险并履行企业脱碳承诺。在欧盟新规的推动下,德国屋顶光电装置创下历史新高。欧盟新规要求自2026年起新建商业建筑必须安装太阳能光电系统,并于2028年将此要求扩展至现有建筑维修。储能係统与太阳能光电系统结合,能够实现负载转移和辅助设备服务收入,使分散式资产成为兼具经济效益和环保效益的工具。在联邦税收优惠和各州清洁能源政策的推动下,北美企业也正在效仿这一模式。

新兴国家电网互联的障碍

全球可再生能源併网申请已超过3000吉瓦,其中80%的申请因成本上升和审批流程冗长而被撤回。由于新兴市场电网缺乏现代化标准和劳动力,小型计划面临的延误尤其严重。儘管「先到先得」的改革正在进行中,但已开发市场以外的进展仍然缓慢,限制了近期再生能源併网的普及。

细分市场分析

到2024年,太阳能产业将占总收入的35%,这主要得益于住宅和轻型商业屋顶采用的简化安装系统和逆变器套件。预计到2024年,太阳能发电将占分散式电力市场889亿美元的份额。燃料电池虽然目前规模较小,但其复合年增长率将达到11.8%,成为成长最快的领域,这主要得益于资料中心园区计划对无柴油执行时间的需求。卡特彼勒公司在怀俄明州的一个超大规模资料中心检验了一套1.5兆瓦的氢燃料电池备用系统,该系统实现了99.999%的服务水准目标。风力微型涡轮机和往復式燃气引擎则主要面向那些优先考虑土地利用效率和热电联产能力的特定设施。目前的竞争重点在于储能和电力电子设备的集成,而非独立的发电系统。

2024年,0-100kW的住宅和小型企业系统将占市场需求的47%,这反映了套件设备采购和承包安装模式的普及。以销量计算,该细分市场占据最大的市场份额。同时,到2030年,1000kW以上的解决方案将以10.2%的复合年增长率成长,因为工业园区为了避免电网限製而选择自发电。供应商将透过数位孪生和维运分析来优化调度,以适应公用事业公司的收费标准,从而实现差异化竞争。 101至1000kW的中阶机组主要安装在医院和大学校园内,兼具标准化撬装设备和有限的客製化工程功能。

分散式发电市场报告按技术(太阳能、风力发电机、燃气涡轮机、柴油发电机、燃料电池、其他)、额定功率(0-100千瓦、101-1000千瓦、其他)、燃料类型(可再生、不可可再生)、连接方式(併网、离网)、最终用户(住宅、通讯类型(可再生能源、非再生能源)、连接方式(併网、离网)、最终用户(住宅、电信类型(可再生能源、非再生能源)、连接方式(併网、离地)、最终

区域分析

到2024年,亚太地区将占据分散式发电市场44%的收入份额,并将在2030年之前继续维持11.1%的年复合成长率,成为全球成长最快的地区。该地区的领先地位得益于大规模生产的光伏组件、广泛的政策奖励以及不断增长的电力需求。光是中国的屋顶光电专案到2024年就将新增超过50吉瓦的装置容量,而印度的配电公司正在将屋顶光电装置整合为虚拟电厂。东南亚一些国家的政府已经正式推行净额收费制度,开放了用户侧光电投资。

北美地区天然气储量绝对值排名第二,这得益于其丰富的天然气资源和优惠的税额扣抵。美国市政电力公司在密西根州推出的20兆瓦电錶后端项目,正是市政公用事业公司如何利用本地抑低尖峰负载的典范。 30个州级可再生能源组合标准鼓励在学校和市政设施中采用太阳能+储能係统。维吉尼亚、德克萨斯州和亚伯达的数据中心丛集正在推动双燃料和氢燃料引擎的早期应用,进一步提升了该地区的能源需求。

在天然气供应因地缘政治因素而中断之后,欧洲分散式能源战略与能源安全的迫切需求相契合。欧盟太阳能标准要求新商业建筑自2026年起必须配备太阳能发电设施,促使开发商采用分散式布局。法国正在加速商业不动产的维修,要求面积超过1500平方公尺的停车场必须使用50%的太阳能,违者将被处以最高4万欧元的罚款。德国简化了功率不超过800瓦的「阳台发电装置」的註册流程,扩大了家庭用户的参与范围。历史城区的发展受到遗产位置限制和冗长的市级授权。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲小型太阳能光电发电的平准化度电成本快速下降

- 欧洲商业和工业(C&I)电錶后端安装蓬勃发展

- 在非洲和岛屿的通讯塔上部署微电网

- 天然气价格波动导致北美沼气发电机需求改变

- 美国市政公共产业强制性可再生能源组合标准(RPS)

- 中东资料中心氢燃料电池试点项目

- 市场限制

- 新兴经济体电力网互联的障碍

- 针对间歇性分散式发电的资本密集型储能组合方案

- 欧盟都市区严格的氮氧化物/粒状物排放法规抑制了柴油发电机的销售

- 历史城区屋顶太阳能发电的审核制度十分复杂

- 供应链分析

- 监理展望

- 技术展望

- 波特的五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 太阳能发电(最高 5 兆瓦,屋顶和地面安装)

- 风力发电机(最高 5 兆瓦)

- 微型涡轮机

- 燃气涡轮机(最高 50 兆瓦)

- 燃料电池(PEMFC、SOFC 等)

- 柴油发电机

- 天然气发电机

- 水力发电和小型水力(10兆瓦以下)

- 其他(生物质热电联产、史特灵引擎)

- 额定功率

- 0~100 kW

- 101~1,000 kW

- 1000千瓦或以上

- 按燃料类型

- 可再生

- 不可可再生

- 连结性别

- 併网

- 离网及偏远地区

- 最终用户

- 住房

- 商业设施

- 工业和製造业

- 公用事业和独立发电商峰值/储备

- 电信资料中心

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- Caterpillar Inc.

- Cummins Inc.

- Siemens AG

- General Electric Co.

- Schneider Electric SE

- Ansaldo Energia SpA

- Ballard Power Systems Inc.

- Bloom Energy Corp.

- Capstone Turbine Corp.

- FuelCell Energy Inc.

- Rolls-Royce plc(mtu Onsite Energy)

- Aggreko Ltd.

- Yanmar Holdings Co., Ltd.

- Wartsila Corp.

- Kohler Co.

- Canadian Solar Inc.

- Sunverge Energy Inc.

- MTU Aero Engines AG Microgrid Solutions

- Generac Power Systems Inc.

- Plug Power Inc.

第七章 市场机会与未来展望

The Distributed Power Generation Market size is estimated at USD 277.71 billion in 2025, and is expected to reach USD 415.08 billion by 2030, at a CAGR of 8.37% during the forecast period (2025-2030).

The expansion reflects a structural move from centralized supply toward local assets that combine solar, fuel-flexible engines, and digital controls. Widespread equipment cost reductions, pro-renewable regulations, and rising grid-resilience needs are the main accelerants. Asia-Pacific anchors volume and momentum, while North America leverages abundant gas, and Europe focuses on energy security. Technology competition revolves around hydrogen-ready fuel cells and integrated microgrid offerings that bundle storage, software, and services. At the same time, interconnection bottlenecks, energy-storage capital needs, and tightening emission caps shape investment risk.

Global Distributed Power Generation Market Trends and Insights

Rapid Decline in Small-Scale Solar-PV LCOE

Chinese TOPCon module prices fell to USD 0.16 per watt in 2024, driving a region-wide drop in levelized electricity costs and reshaping distributed economics. Installation labor standardization, low-cost inverters, and concessional finance amplify the effect, positioning Asia-Pacific as the global benchmark for small-scale PV. Governments streamline permitting and grid-code rules, further shortening project cycles. The price pressure forces suppliers elsewhere to differentiate on efficiency and application-specific design.

Booming Commercial & Industrial Behind-the-Meter Installations

European firms accelerate on-site generation to hedge volatile wholesale prices and meet corporate decarbonization pledges. Record rooftop additions in Germany follow EU rules that require solar on new commercial buildings from 2026, broadening to retrofits by 2028. Battery systems paired with PV allow load shifting and ancillary service income, making distributed assets a financial and environmental tool. North American businesses replicate the model, spurred by federal tax incentives and state clean-energy mandates.

Distribution-Network Interconnection Barriers in Emerging Economies

Renewables waiting in global interconnection queues exceed 3,000 GW, and 80% of applications are withdrawn due to escalating costs or long studies. Emerging grids lack modern standards and workforce capacity, so small projects face disproportionate delays. Although a "first-ready, first-served" reform is underway, progress outside advanced markets remains slow, restraining near-term deployment.

Other drivers and restraints analyzed in the detailed report include:

- Microgrid Adoption for Telecom Towers across Africa & Islands

- Natural-Gas Price Volatility Shifting Demand toward Biogas Gensets

- Capital-Intensive Energy-Storage Pairing for Intermittent DG

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The solar segment commanded 35% of 2024 revenues, anchored by residential and light-commercial rooftops that capitalize on simplified mounting and inverter kits. Solar's share of the distributed power generation market size for 2024 stood at USD 88.9 billion. Though smaller today, fuel cells deliver the highest 11.8% CAGR, led by projects at data-center campuses where operators seek diesel-free uptime. Caterpillar validated a 1.5 MW hydrogen fuel-cell backup system that met a 99.999% service-level target for a hyperscale facility in Wyoming. Wind micro-turbines and reciprocating gas engines round out the mix, serving niche sites that value either land-use efficiency or combined heat-and-power capability. Competitive dynamics now center on integrating storage and power electronics rather than standalone generation hardware.

Household and small-business systems in the 0-100 kW bracket captured 47% of 2024 demand, reflecting kit-based procurement and turnkey installation models. The segment accounted for the largest distributed power generation market share in unit terms. At the other extreme, Above 1,000 kW solutions will record a 10.2% CAGR through 2030 as industrial campuses opt for on-site generation to bypass grid constraints. Vendors differentiate through digital twins and O&M analytics that fine-tune dispatch against utility tariffs. Mid-range 101-1,000 kW packages serve hospitals and university estates, balancing standardized skids with limited custom engineering.

The Distributed Power Generation Market Report is Segmented by Technology (Solar, Wind Turbines, Gas Turbines, Diesel Gensets, Fuel Cells, and More), by Rating (0 To 100 KW, 101 To 1, 000 KW, and More), Fuel Type (Renewable and Non-Renewable), Connectivity (On-Grid and Off-Grid), End-User (Residential, Telecom and Data Centers, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the distributed power generation market with a 44% revenue share in 2024 and continues to post the fastest 11.1% CAGR to 2030. Regional leadership rests on mass-manufactured PV modules, extensive policy incentives, and surging electricity demand. China's rooftop program alone realized more than 50 GW of new capacity in 2024, while India's distribution utilities aggregate rooftop installations into virtual power plants. Several Southeast Asian governments are formalizing net-billing regimes, unlocking behind-the-meter investment.

North America ranks second in absolute value and combines an abundant natural gas supply with favorable tax credits. American Municipal Power's 20 MW behind-the-meter program in Michigan typifies how municipal utilities leverage local generation for peak shaving. Thirty state-level renewable portfolio standards catalyze solar-plus-storage at schools and municipal facilities. Data-center clusters in Virginia, Texas, and Alberta drive early adoption of dual-fuel or hydrogen-ready engines, further lifting the region's demand profile.

Europe's distributed strategy aligns with energy-security imperatives following geopolitical gas disruptions. The EU Solar Standard obliges new commercial buildings to integrate PV from 2026, pushing developers toward distributed layouts. France mandates 50% solar coverage on parking lots over 1 500 m2, with fines up to EUR 40 000 for non-compliance, accelerating commercial-real-estate retrofits. Germany simplified the registration of "balcony power plants" up to 800 W, broadening household participation. Heritage-site constraints and lengthy city-level permitting temper growth in historic urban cores.

- Caterpillar Inc.

- Cummins Inc.

- Siemens AG

- General Electric Co.

- Schneider Electric SE

- Ansaldo Energia SpA

- Ballard Power Systems Inc.

- Bloom Energy Corp.

- Capstone Turbine Corp.

- FuelCell Energy Inc.

- Rolls-Royce plc (mtu Onsite Energy)

- Aggreko Ltd.

- Yanmar Holdings Co., Ltd.

- Wartsila Corp.

- Kohler Co.

- Canadian Solar Inc.

- Sunverge Energy Inc.

- MTU Aero Engines AG Microgrid Solutions

- Generac Power Systems Inc.

- Plug Power Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Decline in Small-Scale Solar-PV LCOE in Asia

- 4.2.2 Booming Commercial & Industrial (C&I) Behind-the-Meter Installations in Europe

- 4.2.3 Microgrid Adoption for Telecom Towers across Africa & Islands

- 4.2.4 Natural-Gas Price Volatility Shifting Demand toward Biogas Gensets in North America

- 4.2.5 Mandated Renewable Portfolio Standards (RPS) in U.S. Municipal Utilities

- 4.2.6 Hydrogen-Ready Fuel-Cell Pilots in Middle-East Data Centers

- 4.3 Market Restraints

- 4.3.1 Distribution-Network Interconnection Barriers in Emerging Economies

- 4.3.2 Capital-Intensive Energy-Storage Pairing for Intermittent DG

- 4.3.3 Stringent NOx/PM Limits Curtailing Diesel Genset Sales in EU Urban Areas

- 4.3.4 Complex Permitting for Rooftop PV in Historic City Centers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (Rooftop & Ground-Mounted <=5 MW)

- 5.1.2 Wind Turbines (<=5 MW)

- 5.1.3 Microturbines

- 5.1.4 Gas Turbines (<=50 MW)

- 5.1.5 Fuel Cells (PEMFC, SOFC, Others)

- 5.1.6 Diesel Gensets

- 5.1.7 Natural-Gas Gensets

- 5.1.8 Hydrokinetic and Small Hydro (<=10 MW)

- 5.1.9 Others (Biomass CHP, Stirling Engines)

- 5.2 By Power Rating

- 5.2.1 0 to 100 kW

- 5.2.2 101 to 1,000 kW

- 5.2.3 Above 1,000 kW

- 5.3 By Fuel Type

- 5.3.1 Renewable

- 5.3.2 Non-Renewable

- 5.4 By Connectivity

- 5.4.1 On-Grid

- 5.4.2 Off-Grid and Remote

- 5.5 By End-user

- 5.5.1 Residential

- 5.5.2 Commercial and Institutional

- 5.5.3 Industrial and Manufacturing

- 5.5.4 Utility and IPP Peaking/Reserve

- 5.5.5 Telecom and Data Centers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Cummins Inc.

- 6.4.3 Siemens AG

- 6.4.4 General Electric Co.

- 6.4.5 Schneider Electric SE

- 6.4.6 Ansaldo Energia SpA

- 6.4.7 Ballard Power Systems Inc.

- 6.4.8 Bloom Energy Corp.

- 6.4.9 Capstone Turbine Corp.

- 6.4.10 FuelCell Energy Inc.

- 6.4.11 Rolls-Royce plc (mtu Onsite Energy)

- 6.4.12 Aggreko Ltd.

- 6.4.13 Yanmar Holdings Co., Ltd.

- 6.4.14 Wartsila Corp.

- 6.4.15 Kohler Co.

- 6.4.16 Canadian Solar Inc.

- 6.4.17 Sunverge Energy Inc.

- 6.4.18 MTU Aero Engines AG Microgrid Solutions

- 6.4.19 Generac Power Systems Inc.

- 6.4.20 Plug Power Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment