|

市场调查报告书

商品编码

1851299

卵磷脂:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Lecithin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

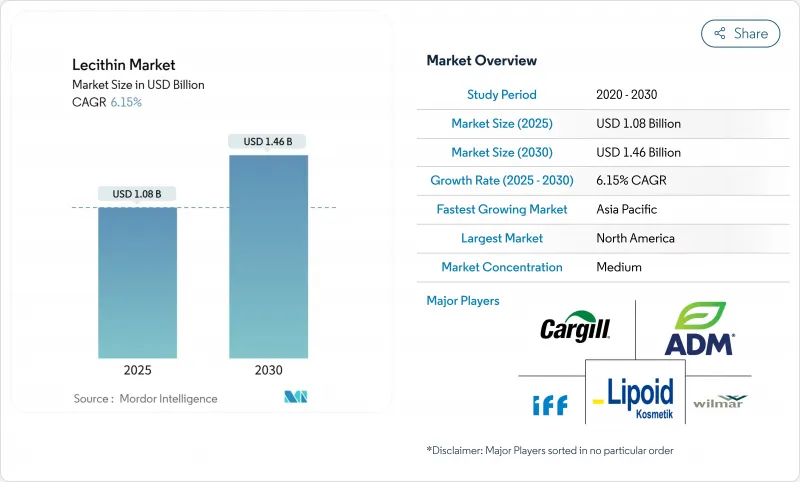

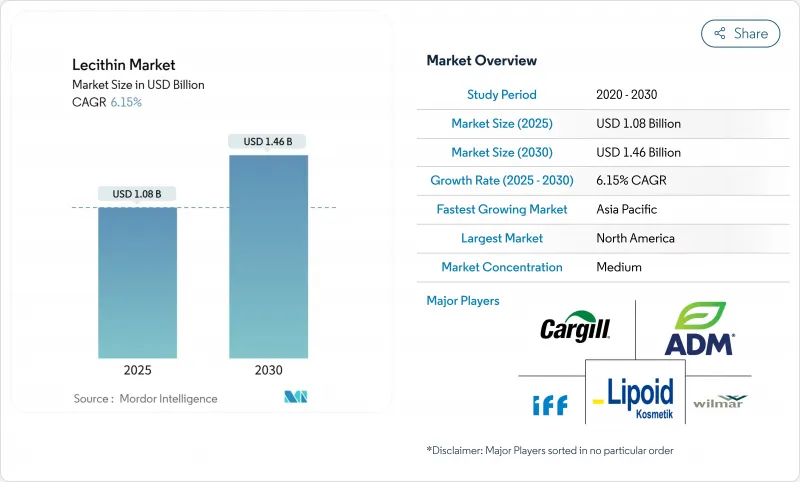

预计到 2025 年卵磷脂市场规模将达到 10.8 亿美元,到 2030 年将达到 14.6 亿美元,2025 年至 2030 年的复合年增长率为 6.15%。

由于加工食品中天然乳化剂的使用日益增多、严格的洁净标示法规以及药用级磷脂的普及,市场需求持续稳定成长。同时,製药公司正将卵磷脂应用于药物传递和认知健康产品领域,推高了高纯度卵磷脂的平均售价。向日葵卵磷脂因其非基因改造特性和在洁净标示配方中不含致敏物质的特性而经历了显着增长。由于消费者对基因改造成分的担忧日益加剧,北美和欧洲的食品饮料生产商正从大豆卵磷脂转向向日葵卵磷脂。向日葵卵磷脂风味中性且磷脂含量高,非常适合用于植物来源乳製品、烘焙产品和糖果甜点。製药业也在增加向日葵卵磷脂在脂质体药物递送系统的应用,而对高纯度和可追溯性的需求正在推动高纯度卵磷脂市场的成长。

全球卵磷脂市场趋势与洞察

加工食品对乳化剂和稳定剂的需求日益增长

加工食品产业正转向使用天然乳化剂,卵磷脂成为维持产品稳定性并满足洁净标示要求的关键成分。消费者对便利、保质期长、即食食品的偏好日益增长,推动了对能够维持产品一致性、改善质地并延长保质期的乳化剂和稳定剂的需求。卵磷脂提取自大豆、葵花籽和鸡蛋等天然来源,具有乳化剂、分散剂和保湿剂等多种功能,为生产商提供了多功能性和成本效益。洁净标示运动鼓励食品生产商选择卵磷脂等天然添加剂而非合成添加剂,从而提升了市场需求。消费者在加工包装食品上的支出依然强劲,美国劳工统计局预测,2023年美国家庭在烘焙产品上的平均支出将达到574美元。

在动物饲料应用中采用率不断提高

动物营养应用是卵磷脂需求的重要成长领域,这主要得益于监管部门的核准及其在提高牲畜生产力方面的有效性。食品药物管理局(FDA) 的《联邦法规》第 21 篇第 573 部分确认了卵磷脂作为动物饲料的安全性,为饲料生产商提供了清晰的法规结构,并确保了整个行业的统一实施。卵磷脂中的磷脂质能够改善单胃动物的脂肪消化,进而提高牲畜的生长速度和饲料转换率。水产养殖业是卵磷脂等功能性饲料成分需求的主要驱动力。根据联合国粮食及农业组织 (FAO) 的数据,2022/23 年度全球水产养殖产量将达到 1.309 亿吨,使水产养殖总产量达到 2.232 亿吨,比 2020 年增加 4%。这种成长推动了对永续植物性饲料的需求,以取代水产养殖和牲畜饲料产业中的传统饲料成分。

原物料价格波动

卵磷脂市场面临原物料价格波动带来的重大限制,尤其是大豆、葵花籽和鸡蛋的价格波动。这些主要原料来源易受多种因素影响,包括天气、地缘政治议题、贸易政策和供应链中断。例如,美国、巴西和乌克兰等主要产区的极端天气和干旱会降低作物产量,并影响生产所需原料的供应和成本。此外,由于卵磷脂来自油籽加工,食用油市场的波动也会影响卵磷脂的价格。大豆油和葵花籽油需求的变化,以及消费模式的转变和生质燃料法规的调整,都会影响卵磷脂的供应和价格。这种波动性为生产者维持稳定的成本结构和利润率带来了挑战。製造成本的增加也会影响卵磷脂相对于合成乳化剂的竞争力,尤其是在价格敏感型市场。

细分市场分析

到2024年,大豆卵磷脂将占据65.49%的市场份额,这主要得益于其成本效益,而这又得益于成熟的供应链和全球大豆加工基础设施。向日葵卵磷脂是成长最快的来源,预计从2025年到2030年将以7.89%的复合年增长率增长,因为其非基因改造特性和不含致敏物的特性符合消费者对健康的偏好和不断增长的市场需求。鸡蛋卵磷脂预计将在需要卓越功能性的特殊应用领域中保持其地位,尤其是在製药和高端食品领域,同时在高价值领域也展现出良好的业绩记录。

在供应链中断影响传统原料来源的情况下,菜籽卵磷脂已成为可行的替代方案,为製造商提供了更大的采购弹性。包括油菜籽卵磷脂在内的替代成分,正透过监管部门的核准扩大市场份额,例如嘉吉公司获得了美国食品药物管理局(FDA) 的「公认安全」(GRAS) 认定,使其能够更广泛地应用于有机和非基因改造配方中。

到2024年,食品级卵磷脂将占据57.15%的市场份额,主要服务于加工食品行业,用作烘焙、糖果甜点和乳製品中的乳化剂。该成分在食品加工过程中具有极高的通用性。受其在药物递送系统和营养保健品配方中日益广泛的应用推动,预计2025年至2030年间,药用级卵磷脂的复合年增长率将达到9.37%。由于卵磷脂具有良好的安全性,并已获得美国食品药物管理局(FDA)核准用于多种用途,其在製药领域的应用将持续成长。监管部门的核准将进一步增强整个製药製剂市场的成长潜力。

其他等级的卵磷脂,包括用于化妆品和工业用途的卵磷脂,随着製造商将卵磷脂应用于非传统领域,也蕴藏成长机会。像美国卵磷脂公司这样的企业,正透过开发大豆和向日葵卵磷脂的专用丝胺酸(包括磷脂酰丝氨酸),推动医药级卵磷脂市场的发展。这些配方符合严格的药品品质标准和规范。高价值的衍生物使供应商能够在医药应用领域获得更高的溢价和利润率。

区域分析

2024年,北美将占据卵磷脂市场的主导地位,份额达35.69%,这主要得益于美国食品药物管理局(FDA)严格的法规,该法规鼓励使用天然乳化剂。由于对大豆和菜籽压榨设施的大量投资以及植物来源食品的日益普及,该地区保持着均衡的产能。消费者在膳食补充剂上的高支出推动了优质磷脂在脑健康产品中的应用。亚太地区预计在2025年至2030年间达到最高的复合年增长率(CAGR),达到8.72%。中国膳食补充剂产业的扩张以及印度烘焙连锁店的发展将推动对标准卵磷脂和优质卵磷脂产品的需求。

亚太地区是成长最快的地区,预计2025年至2030年复合年增长率将达到8.72%。该地区营养保健品市场不断扩张,消费者可支配收入的增加推动了高端原料的普及。中国营养保健品市场,尤其是卵磷脂在认知健康和心血管保健产品的应用,是该地区需求成长的主要驱动力。亚太地区庞大的加工食品製造业对高性价比的乳化解决方案有着巨大的需求,同时,消费者对卵磷脂健康益处的认知不断提高,也促进了高端卵磷脂在各种应用中的使用。

欧洲在销售和价值两方面保持平衡。欧洲食品安全局 (EFSA) 的法规以及对基因改造作物的担忧正在推动对向日葵和油菜籽卵磷脂的需求。在地理政治问题解决之前,东欧生产商受益于其与向日葵产区的地理优势。南美洲是重要的供应基地,巴西拥有庞大的大豆产量。中东和非洲由于食品加工业的扩张以及消费者对功能性成分意识的提高,蕴藏着巨大的成长潜力。然而,与成熟市场相比,基础设施的限制和法律规范的不完全仍然限制着这些市场的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加工食品对乳化剂和稳定剂的需求日益增长

- 在动物饲料应用中采用率不断提高

- 在製药和营养保健品产业中不断拓展的应用

- 来自植物性和纯素食品产业的需求不断增长

- 消费者对洁净标示天然食品原料的需求不断增长

- 天然化妆品配方中应用日益广泛

- 市场限制

- 原物料价格波动

- 消费者对基因改造食品的负面看法

- 替代乳化剂与界面活性剂之间的竞争

- 液态卵磷脂产品的保存期限有限

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按来源

- 大豆

- 向日葵

- 蛋

- 油菜籽

- 其他资讯来源

- 按年级

- 食品级

- 医药级

- 其他的

- 按形式

- 液体

- 粉末

- 其他的

- 自然

- 有机的

- 传统的

- 透过使用

- 饮食

- 麵包糖果甜点

- 乳製品

- 饮料

- 其他食品和饮料

- 餵食

- 营养补充品

- 製药

- 化妆品和个人护理

- 其他应用

- 饮食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 荷兰

- 义大利

- 瑞典

- 波兰

- 比利时

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 泰国

- 新加坡

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 秘鲁

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 沙乌地阿拉伯

- 埃及

- 摩洛哥

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International

- Lipoid GmbH

- Sternchemie GmbH and Co KG

- VAV Life Sciences Pvt Ltd

- American Lecithin Company

- The Scoular Company

- Ciranda Inc.

- Sonic Biochem

- Lecico GmbH

- Clarkson Specialty Lecithins

- Fishmer Lecithin

- AAK

- GIIAVA Industrial Biotech

- SternWywiol Gruppe

- Emerson Resources

- Austrade Ingredients

第七章 市场机会与未来展望

The lecithin market size is valued at USD 1.08 billion in 2025 and is forecast to reach USD 1.46 billion by 2030, advancing at a 6.15% CAGR during 2025-2030.

Rising uptake of natural emulsifiers in processed foods, stringent clean-label regulations, and deepening penetration of pharmaceutical-grade phospholipids keep demand on a solid upward path. In parallel, pharmaceutical companies extend lecithin's reach into drug-delivery and cognitive-health products, lifting average selling prices in the high-purity segment. Sunflower lecithin is experiencing significant growth due to its non-GMO status and allergen-free properties in clean-label formulations. Food and beverage manufacturers in North America and Europe are transitioning from soy-based to sunflower-derived lecithin as consumers become more concerned about genetically modified ingredients. The neutral flavor profile and high phospholipid content of sunflower lecithin make it suitable for plant-based dairy, bakery, and confectionery products. The pharmaceutical industry is also increasing its use of sunflower lecithin in liposomal drug delivery systems, where high purity and traceability requirements drive growth in the high-purity lecithin segment.

Global Lecithin Market Trends and Insights

Rising Need for Emulsifiers and Stabilizers in Processed Foods

The processed food industry is shifting toward natural emulsifiers, making lecithin an essential ingredient for maintaining product stability while meeting clean-label requirements. The increasing consumer preference for convenient, shelf-stable, and ready-to-eat food products has created a higher demand for emulsifying and stabilizing agents that maintain consistency, improve texture, and extend shelf life. Lecithin, extracted from natural sources such as soybeans, sunflower seeds, and eggs, serves multiple functions as an emulsifier, dispersing agent, and wetting agent, providing manufacturers with versatility and cost efficiency. The clean-label movement has encouraged food producers to choose natural additives like lecithin over synthetic alternatives, increasing its market demand. Consumer spending on processed and packaged foods remains strong, as evidenced by U.S. households spending an average of USD 574 on bakery products in 2023, according to the Bureau of Labor Statistics .

Increased Adoption in Animal Feed Applications

Animal nutrition applications represent a significant growth area for lecithin demand, supported by regulatory approvals and demonstrated benefits in livestock productivity. The Food and Drug Administration (FDA)'s 21 CFR Part 573 regulations confirm lecithin's safety for animal feed applications, providing a clear regulatory framework for feed manufacturers and ensuring consistent implementation across the industry . The phospholipid content in lecithin improves fat digestion in monogastric animals, resulting in better growth rates and feed efficiency in livestock operations. The aquaculture industry has become a major driver of demand for functional feed ingredients like lecithin. The Food and Agriculture Organization of the United Nations (FAO) reports that global aquaculture production reached 130.9 million tons in 2022/23, contributing to a total fisheries and aquaculture output of 223.2 million tons, representing a 4% increase from 2020 . This growth has increased pressure on aquafeed and animal feed industries to incorporate sustainable, plant-based alternatives to conventional feed ingredients.

Fluctuating Raw Material Prices

The lecithin market faces significant constraints due to fluctuating raw material prices, particularly soybeans, sunflower seeds, and eggs. These primary sources are vulnerable to various factors, including weather conditions, geopolitical issues, trade policies, and supply chain disruptions. For instance, extreme weather events or droughts in major producing regions such as the United States, Brazil, or Ukraine can reduce crop yields, affecting the availability and cost of lecithin production materials. The volatility in the broader edible oil market also influences lecithin prices, as lecithin is derived from oilseed processing. Changes in soybean or sunflower oil demand, whether from shifting consumption patterns or biofuel regulations, affect lecithin supply and pricing. This instability creates challenges for manufacturers in maintaining stable cost structures and profit margins. The increased production costs also affect lecithin's competitiveness against synthetic emulsifiers, particularly in price-sensitive markets.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Applications in Pharmaceutical and Nutraceutical Industries

- Growing Demand from Plant-Based and Vegan Food Sectors

- Negative Consumer Perception of GMO Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soy lecithin holds a dominant 65.49% market share in 2024, supported by established supply chains and cost benefits from the global soybean processing infrastructure. Sunflower lecithin represents the fastest-growing source segment with a projected 7.89% CAGR during 2025-2030, driven by its non-GMO status and allergen-free characteristics that align with consumer health preferences and increasing market demands. Egg lecithin maintains its position in specialized applications requiring superior functionality, particularly in pharmaceutical and premium food products, while demonstrating consistent performance in high-value segments.

Rapeseed lecithin has emerged as a viable alternative during supply chain disruptions affecting conventional sources, offering manufacturers additional sourcing flexibility. Alternative sources, including canola lecithin, have expanded their market presence through regulatory approvals, such as Cargill's Food and Drug Administration (FDA) Generally Recognised as Safe (GRAS) determination, enabling broader use in organic and non-GMO formulations.

Food grade lecithin holds 57.15% market share in 2024, primarily serving the processed food industry with emulsification solutions across bakery, confectionery, and dairy applications. The ingredient demonstrates significant versatility in food processing operations. Pharmaceutical grade lecithin projects a 9.37% CAGR during 2025-2030, driven by its increasing use in drug delivery systems and nutraceutical formulations. The pharmaceutical segment expands through lecithin's proven safety profile and Food and Drug Administration (FDA) approval for various applications. The regulatory acceptance strengthens market growth potential across pharmaceutical formulations.

Additional grades, including cosmetic and industrial applications, present growth opportunities as manufacturers implement lecithin in non-traditional uses. Companies such as American Lecithin Company advance the pharmaceutical-grade segment by developing specialized derivatives, including phosphatidylserine from soy and sunflower lecithins. These formulations comply with stringent pharmaceutical quality standards and specifications. The high-value derivatives enable suppliers to benefit from premium pricing and enhanced profit margins in pharmaceutical applications.

The Lecithin Market is Segmented by Source (Soy, Sunflower, and More), by Grade (Food Grade, Pharmaceutical Grade, and Others), by Form (Liquid, Powder, and Others), by Nature (Organic, and Conventional), by Application (Food and Beverage, Animal Feed, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 35.69% share of the lecithin market in 2024, supported by strict Food and Drug Administration (FDA) regulations favoring natural emulsifiers. The region maintains balanced capacity through significant investments in soybean and canola crushing facilities and increased plant-based food product launches. High consumer spending on supplements drives the adoption of premium phospholipids in brain-health products. Asia-Pacific demonstrates the highest growth rate with an 8.72% CAGR during 2025-2030. The expansion of China's supplement industry and India's bakery chains drives demand for both standard and premium lecithin products.

Asia-Pacific emerges as the fastest-growing region with a CAGR of 8.72% during 2025-2030, driven by expanding nutraceutical markets and rising disposable incomes that enable premium ingredient adoption. China's dietary supplement market, particularly for lecithin applications in cognitive health and cardiovascular wellness products, contributes significantly to regional demand expansion. The region's processed food manufacturing base generates substantial demand for cost-effective emulsification solutions, while increasing consumer awareness of health benefits supports premium lecithin usage in various applications.

Europe maintains a balanced approach between volume and value segments. European Food Safety Authority (EFSA) regulations and GMO concerns drive demand toward sunflower and rapeseed lecithin. Eastern European producers benefit from proximity to sunflower production regions, pending resolution of geopolitical issues. South America serves as a key supply center, leveraging Brazil's substantial soybean production. The Middle East and Africa present growth potential due to the expansion of food processing industries and rising consumer awareness of functional ingredients. However, infrastructure constraints and underdeveloped regulatory frameworks continue to limit market growth compared to mature markets.

- Archer Daniels Midland Company

- Cargill Inc.

- Bunge Limited

- International Flavors & Fragrances, Inc.

- Wilmar International

- Lipoid GmbH

- Sternchemie GmbH and Co KG

- VAV Life Sciences Pvt Ltd

- American Lecithin Company

- The Scoular Company

- Ciranda Inc.

- Sonic Biochem

- Lecico GmbH

- Clarkson Specialty Lecithins

- Fishmer Lecithin

- AAK

- GIIAVA Industrial Biotech

- SternWywiol Gruppe

- Emerson Resources

- Austrade Ingredients

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising need for emulsifiers and stabilizers in processed foods

- 4.2.2 Increased adoption in animal feed applications

- 4.2.3 Expanding applications in pharmaceutical and nutraceutical industries

- 4.2.4 Growing demand from plant-based and vegan food sectors

- 4.2.5 Consumer demand for clean-label and natural food ingredients

- 4.2.6 Increased adoption in natural cosmetics formulations

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices

- 4.3.2 Negative consumer perception of GMO ingredients

- 4.3.3 Competition from alternative emulsifiers and surfactants

- 4.3.4 Limited shelf life of liquid lecithin products

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Soy

- 5.1.2 Sunflower

- 5.1.3 Egg

- 5.1.4 Rapeseed

- 5.1.5 Other Sources

- 5.2 By Grade

- 5.2.1 Food Grade

- 5.2.2 Pharmaceutical Grade

- 5.2.3 Others

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Powder

- 5.3.3 Others

- 5.4 By Nature

- 5.4.1 Organic

- 5.4.2 Conventional

- 5.5 By Application

- 5.5.1 Food and Beverage

- 5.5.1.1 Bakery and Confectionery

- 5.5.1.2 Dairy Products

- 5.5.1.3 Beverages

- 5.5.1.4 Other Food and Beverages

- 5.5.2 Animal Feed

- 5.5.3 Dietary Supplements

- 5.5.4 Pharmaceuticals

- 5.5.5 Cosmetics and Personal Care

- 5.5.6 Other Application

- 5.5.1 Food and Beverage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Spain

- 5.6.2.5 Netherlands

- 5.6.2.6 Italy

- 5.6.2.7 Sweden

- 5.6.2.8 Poland

- 5.6.2.9 Belgium

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Colombia

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Nigeria

- 5.6.5.4 Saudi Arabia

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill Inc.

- 6.4.3 Bunge Limited

- 6.4.4 International Flavors & Fragrances, Inc.

- 6.4.5 Wilmar International

- 6.4.6 Lipoid GmbH

- 6.4.7 Sternchemie GmbH and Co KG

- 6.4.8 VAV Life Sciences Pvt Ltd

- 6.4.9 American Lecithin Company

- 6.4.10 The Scoular Company

- 6.4.11 Ciranda Inc.

- 6.4.12 Sonic Biochem

- 6.4.13 Lecico GmbH

- 6.4.14 Clarkson Specialty Lecithins

- 6.4.15 Fishmer Lecithin

- 6.4.16 AAK

- 6.4.17 GIIAVA Industrial Biotech

- 6.4.18 SternWywiol Gruppe

- 6.4.19 Emerson Resources

- 6.4.20 Austrade Ingredients