|

市场调查报告书

商品编码

1851306

物联网 (IoT):市场占有率分析、产业趋势、统计数据和成长预测 (2025-2030)Internet Of Things (IoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

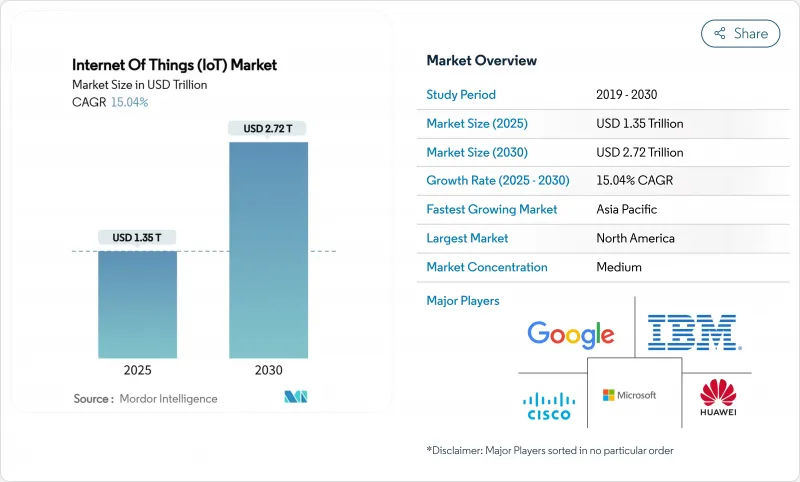

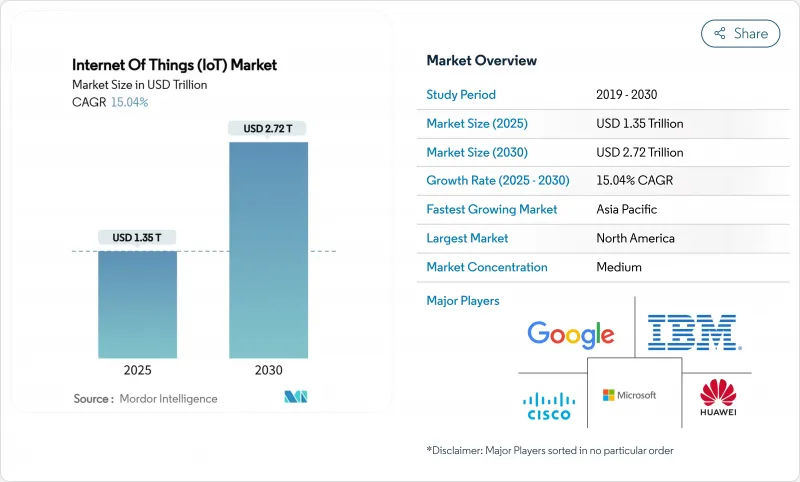

预计到 2025 年,物联网 (IoT) 市场规模将达到 1.35 兆美元,到 2030 年将达到 2.72 兆美元,年复合成长率为 15.04%。

对即时分析、预测性维护和自主决策系统的强劲需求正在加速其在工厂、农场和物流中心的部署。 5G的快速普及、低功率广域网路的成长以及感测器成本的下降,正在扩大互联资产的覆盖范围。企业也越来越重视边缘人工智慧,它既能保护资料主权,也能确保毫秒的反应速度。因此,各主要产业的投资正不断从先导计画转向全面生产。物联网市场在坚实的技术奖励上持续成长,这得益于稳健的资本投资以及旨在提高效率和永续性的监管激励措施。

全球物联网 (IoT) 市场趋势与洞察

互联设备的激增和感测器成本的下降

基础环境感测器的单位成本已从 20 美元降至 5 美元以下,使得在工厂和农场进行高密度测量在经济上可行。用于预测性维护的工业振动感测器现在的售价为 50 至 100 美元,而五年前的价格为 200 至 500 美元。硬体门槛的降低正在吸引新的软体整合商,并扩大物联网市场的人才库。 BMW的专用 5G 生产网路已将数千个感测器连接到边缘控制器,从而即时优化吞吐量。半导体暂时短缺造成了成本压力,但减少元件数量的设计创新将维持价格下降的势头。随着企业连结越来越小的资产,数据量将爆炸性成长,使分析服务成为成长最快的收入来源。

5G 和 LPWAN 的部署扩大了覆盖范围

目前,私有5G网路已成为超低延迟工业控制的基础,约翰迪尔位于滑铁卢的工厂就充分证明了这一点,该工厂的弹性生产线依赖无线重配置。 LoRaWAN和NB-IoT网路与5G网路相辅相成,连接了蜂窝网路经济性仍落后的偏远地区、矿场和管线。 Kineis和其他微型卫星营运商透过实现对牲畜群和海上资产的持续可视性,填补了剩余的通讯空白。电讯营运商正在调整其频谱和回程传输投资,以使设备密度与可实现的回报相匹配。这种接入方式的整合将使物联网市场能够全面覆盖人口密集的城市园区和人口稀少的偏远地区。

日益严重的网路安全和隐私侵犯事件

互联资产扩大了攻击面,勒索软体已导致工厂生产线停工,并暴露出其独特的攻击手段。欧盟网路安全法规强制规定了最低加密和修补程式要求,迫使供应商承担更高的合规成本。工业买家对安全启动晶片组和零信任架构的需求日益增长,提高了低成本供应商的进入门槛。虽然资料外洩事件可能会暂时减缓物联网技术的普及,但在物联网市场,长期安全投入通常会转化为更高的合约价值。

细分市场分析

到2024年,服务收入将占总收入的34%,这凸显了将设备和数据转化为可衡量成果的复杂性。咨询团队负责绘製工作流程图、建立安全架构并优化仪錶板,从而将感测器资料流转化为营运价值。儘管硬体价格持续下降,但整合需求推高了专业人员的人事费用,巩固了服务在物联网市场中占据最大份额的地位。边缘平台结合了容器编配和OTA修补功能,其复合年增长率将达到17.51%,因为买家坚持将延迟和资料管治保留在本地。连接模组能够吸收成本通货紧缩,并提高解决方案组装商的利润率,这些组装商可以将容量转售到数千个终端。

对灵活基础设施的需求推动了混合拓扑结构的出现,其中网关代理决定哪些资料保留在本地,哪些资料迁移到云端。这种编配促使人们对超大规模云端和工厂车间控制器之间的 API 协调性提出更高要求。软体供应商正在整合自动化机器学习引擎,以持续微调模型,并强化订阅模式,将客户锁定在其生态系统中。同时,卫星通讯业者正与地面通讯业者合作,捆绑备用连接,扩大物联网市场的地理覆盖范围。那些将硬体、整合和生命週期管理打包到基于结果的合约中的供应商,正在从以组件为中心的竞争对手手中夺取市场份额。

预计到2024年,製造业支出将占总支出的29.5%,因为工厂依靠预测性维护、机器人协同和供应链透明度来确保运作。西门子报告称,与改造棕地工厂以连接传统机器相关的数位维修产业订单创下历史新高。随着监管机构加强排放审核,环境、健康和安全仪錶板将受到更多关注。因此,儘管面临宏观经济逆风,工业工厂的物联网市场规模预计仍将强劲成长。

相较之下,农业将以19.2%的复合年增长率实现最快成长。土壤探测器、无人机影像和卫星链路使农民能够近乎即时地调整施肥和灌溉,从而降低每公顷的投入成本。新兴企业正在将感测器、分析和信贷服务打包成订阅模式,使中型农户也能负担得起。畜牧养殖户正在为牲畜佩戴项圈,以监测体温、反刍率和位置,从而减少疾病爆发和被捕食造成的损失。随着公共机构大力推动粮食安全,津贴正在加速互联农场的普及,并将物联网产业的基本客群。

区域分析

2024年,北美将占全球收入的32.3%,这得益于成熟的5G部署、广泛的专用蜂窝网络牌照发放以及强大的数位原民劳动力。从汽车到食品加工等各行各业的工业设施都在定期试点频谱共用网络,将高保真数据传输到边缘AI控制器。因此,儘管宏观环境波动,物联网市场仍保持稳定的资本配置。

预计到2030年,亚太地区将以15.1%的复合年增长率成长,主要得益于各国政府将物联网纳入製造业补贴和智慧城市规划。到2030年,印度、中国和东南亚的授权行动电话连接数将达到2.7亿。中国将加快对国内晶片代工厂的投资,以降低出口管制的不确定性;印度将利用与生产挂钩的奖励来吸引感测器组装厂。越南和印尼的新兴企业将整合低功耗广域网路(LPWAN)网关和云端平台,以低成本帮助中型工厂上线。总而言之,这些趋势将共同扩大物联网在全部区域的市场规模。

在欧洲,环境合规是重中之重,基于感测器的排放追踪已成为企业报告的必要组成部分。隐私法规鼓励现场处理,从而推动了边缘运算的普及。公私合作联盟正在资助智慧港口物流和跨境货物透明系统。中东和非洲仍处于应用初期,但有望在基于卫星的牲畜监测和太阳能水资源管理方面取得突破。国际发展机构正在资助能够快速见效的先导计画,以培养本地专业技术并扩大物联网市场基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 连网型设备的激增和感测器成本的下降

- 透过部署 5G 和 LPWAN 扩大覆盖范围。

- 边缘人工智慧分析提供即时价值

- 低地球轨道卫星物联网释放远端监控潜力

- 与环境、社会及治理 (ESG) 相关的供应链报告义务

- 基于物联网远端检测的使用量为基础的保险

- 市场限制

- 日益严重的网路安全和隐私侵犯事件

- 通讯协定碎片化和低互通性

- 出口限制对晶片/模组供应带来压力

- 边缘人工智慧的功耗会对设备电池带来压力。

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 主要用例和案例研究

- 宏观经济与疫情影响分析

第五章 市场规模与成长预测

- 按组件

- 硬体(感测器、处理器、连接模组、网关)

- 软体/平台(设备管理、资料管理、分析、安全)

- 连线类型(蜂窝网路(2G-5G)、LPWAN(NB-IoT、LoRaWAN、Sigfox)、卫星、近距离通讯(Wi-Fi、BLE、Zigbee))

- 服务(专业服务、託管服务、整合服务)

- 按最终用户行业划分

- 製造业和工业

- 运输与物流

- 医疗保健和生命科学

- 零售与电子商务

- 能源与公共产业

- 住宅和智慧建筑

- 农业

- 政府与智慧城市

- 透过使用

- 资产追踪和车队管理

- 预测性维护

- 智慧电錶

- 远端患者监护

- 智慧家庭和家电

- 联网汽车和V2X

- 环境与气候监测

- 按部署模式

- 云

- 本地部署

- 边缘/混合

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 非洲

- 南非

- 奈及利亚

- 埃及

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议和伙伴关係

- 市占率分析

- 公司简介

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- Cisco Systems

- Huawei Technologies

- Siemens AG

- IBM Corporation

- PTC Inc.

- Robert Bosch GmbH

- Honeywell International

- Oracle Corporation

- SAP SE

- AT&T

- Aeris Communications

- Fujitsu

- Wipro

- Intel Corporation

- Ericsson

- Qualcomm

- Advantech

- Sierra Wireless(Semtech)

- Quectel Wireless

- Telit Cinterion

- u-blox

第七章 市场机会与未来展望

The internet of things market stands at USD 1,350 billion in 2025 and is forecast to reach USD 2,720 billion by 2030, advancing at a 15.04% CAGR.

Strong demand for real-time analytics, predictive maintenance, and autonomous decision systems is accelerating deployments across factories, farms, and logistics hubs. Rapid 5G roll-outs, growth of low-power wide-area networks, and falling sensor costs expand the addressable base of connected assets. Enterprises also value edge AI because it protects data sovereignty while guaranteeing millisecond response times. As a result, investment continues to shift from pilot projects to full-scale production across every major vertical. The Internet of Things market, therefore, continues to compound on a solid technology foundation supported by resilient capital spending and regulatory incentives aimed at efficiency and sustainability.

Global Internet Of Things (IoT) Market Trends and Insights

Connected-device proliferation and falling sensor costs

Unit prices for basic environmental sensors have declined from USD 20 to below USD 5, making dense instrumentation economically viable across factories and farms. Industrial-grade vibration sensors used in predictive maintenance now retail for USD 50-100 compared with USD 200-500 only five years ago. Lower hardware barriers attract new software integrators, broadening the Internet of Things market talent pool. BMW's private 5G production network already links thousands of sensors to edge controllers that optimize throughput in real time. Temporary semiconductor shortages create cost pressure, yet design innovations that reduce component counts preserve downward price momentum. As firms connect ever-smaller assets, data volumes rise sharply, cementing analytics services as the fastest-growing revenue pool.

5G and LPWAN roll-outs widen coverage

Private 5G now underpins ultra-low-latency industrial control, demonstrated by John Deere's Waterloo Works where flexible manufacturing lines rely on wire-free reconfiguration. LoRaWAN and NB-IoT networks complement 5G by linking remote fields, mines, and pipelines where cellular economics still lag. Kineis and other nanosatellite operators bridge remaining gaps, enabling continuous visibility of livestock herds and maritime assets. Telecom operators coordinate spectrum and backhaul investments to match device density with viable returns. These converging access options keep the internet of things market on an inclusive path that spans both dense urban campuses and sparsely populated frontiers.

Escalating cybersecurity and privacy breaches

Connected assets expand the attack surface, with ransomware already halting factory lines and exposing proprietary recipes. The EU Cyber Resilience Act sets minimum encryption and patching obligations, forcing vendors to absorb higher compliance costs. Industrial buyers increasingly request secure-boot chipsets and zero-trust architectures, raising barriers for low-cost suppliers. Breach headlines could momentarily slow adoption, yet long-term security spending often translates into higher total contract values within the internet of things market.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI analytics enable real-time value

- LEO-satellite IoT unlocks remote monitoring

- Protocol fragmentation and poor interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services contributed 34% of 2024 revenue, underscoring the complexity of turning devices and data into measurable outcomes. Consulting teams map workflows, build secure architectures, and optimize dashboards that convert sensor streams into operational value. Hardware prices keep falling, yet integration demands elevate specialist labor rates, cementing services as the largest slice of the internet of things market. Edge platforms that blend container orchestration with OTA patching expand at 17.51% CAGR as buyers insist latency and data governance stay onsite. Connectivity modules absorb cost deflation, widening profit margins for solution assemblers who resell capacity across thousands of endpoints.

The push toward flexible infrastructure drives hybrid topologies where gateway agents decide what stays local and what travels to the cloud. Such orchestration intensifies demand for API harmonization between hyperscale clouds and factory floor controllers. Software vendors embed auto-ML engines that fine-tune models continuously, reinforcing subscriptions that lock customers into ecosystems. Meanwhile, satellite operators partner with terrestrial carriers to bundle fallback connectivity, broadening geographic applicability of the internet of things market. Vendors that package hardware, integration, and lifecycle management under outcome-based contracts are capturing share from component-centric rivals.

Manufacturing held 29.5% of 2024 spending as factories rely on predictive maintenance, robot coordination, and supply-chain transparency to safeguard uptime. Siemens reports record digital industries orders tied to brown-field retrofits that network legacy machines.Automotive plants deploy thousands of torque and vibration sensors, feeding edge AI that quarantines anomalies before they trigger costly downtime. Environmental, health, and safety dashboards gain prominence as regulators tighten emission audits. Consequently, the Internet of Things market size for industrial plants is expected to expand steadily despite macro headwinds.

Agriculture, by contrast, grows fastest at a 19.2% CAGR. Soil probes, drone imagery, and satellite links allow farmers to adjust fertilizer and irrigation in near real time, lowering input costs per hectare. Start-ups bundle sensors, analytics, and credit services into subscription models affordable to mid-sized holdings. Livestock ranchers fit collars that monitor temperature, rumination, and location, trimming disease outbreaks and predation losses. As public agencies push food security, grant funding accelerates connected-farm adoption, broadening the Internet of Things industry customer base beyond early adopters.

The IoT Market Report is Segmented by Component (Hardware, Software, Services, and More), End-User Industry (Agriculture, Retail and E-Commerce, Energy and Utilities, and More), Application (Asset Tracking and Fleet Management, Predictive Maintenance, Smart Metering, and More), Deployment Model (Cloud, On-Premises, and More), and Geography

Geography Analysis

North America owned 32.3% of 2024 revenue, anchored by mature 5G roll-outs, wide adoption of private cellular licenses, and a robust digital-native workforce. Industrial facilities from automotive to food processing routinely pilot spectrum-sharing networks that stream high-fidelity data to edge AI controllers.Policy frameworks prioritize innovation yet codify minimum security standards, promoting trust without stifling experimentation. Consequently, the Internet of Things market continues to see steady capital allocations even when macro conditions fluctuate.

Asia-Pacific is projected to grow at 15.1% CAGR through 2030 as governments embed IoT into manufacturing subsidies and smart-city blueprints. Licensed cellular connections are set to reach 270 million by 2030 across India, China, and Southeast Asia. China accelerates domestic chip foundry investments to buffer export control uncertainties, while India leverages production-linked incentives to attract sensor assembly plants. Start-ups in Vietnam and Indonesia integrate LPWAN gateways with cloud dashboards, bringing mid-tier factories online at low cost. Together, these trends expand the Internet of Things market size across a demographically diverse region.

Europe emphasizes environmental compliance, making sensor-driven emissions tracking integral to corporate reporting. Edge deployments rise because privacy regulations encourage onsite processing. Public-private consortia finance smart port logistics and cross-border freight transparency systems. Middle East and Africa remain earlier in the adoption curve but leapfrog with satellite-enabled livestock monitoring and solar-powered water management. International development agencies fund pilot projects that demonstrate quick payback, nurturing localized expertise and widening the internet of things market footprint.

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- Cisco Systems

- Huawei Technologies

- Siemens AG

- IBM Corporation

- PTC Inc.

- Robert Bosch GmbH

- Honeywell International

- Oracle Corporation

- SAP SE

- AT&T

- Aeris Communications

- Fujitsu

- Wipro

- Intel Corporation

- Ericsson

- Qualcomm

- Advantech

- Sierra Wireless (Semtech)

- Quectel Wireless

- Telit Cinterion

- u-blox

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Connected-device proliferation and falling sensor costs

- 4.2.2 5G and LPWAN roll-outs widen coverage

- 4.2.3 Edge-AI analytics enable real-time value

- 4.2.4 LEO-satellite IoT unlocks remote monitoring

- 4.2.5 ESG-linked supply-chain reporting mandates

- 4.2.6 Usage-based insurance powered by IoT telemetry

- 4.3 Market Restraints

- 4.3.1 Escalating cybersecurity and privacy breaches

- 4.3.2 Protocol fragmentation and poor interoperability

- 4.3.3 Export controls squeezing chip/module supply

- 4.3.4 Edge-AI power draw strains device batteries

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Key Use-Cases and Case Studies

- 4.10 Macroeconomic and Pandemic Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware (Sensors, Processors, Connectivity Modules, Gateways)

- 5.1.2 Software / Platforms (Device Management, Data Management, Analytics, Security)

- 5.1.3 Connectivity Type (Cellular (2G-5G), LPWAN (NB-IoT, LoRaWAN, Sigfox), Satellite, Short-Range (Wi-Fi, BLE, Zigbee))

- 5.1.4 Services (Professional, Managed, Integration)

- 5.2 By End-user Industry

- 5.2.1 Manufacturing and Industrial

- 5.2.2 Transportation and Logistics

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Retail and E-commerce

- 5.2.5 Energy and Utilities

- 5.2.6 Residential and Smart Buildings

- 5.2.7 Agriculture

- 5.2.8 Government and Smart Cities

- 5.3 By Application

- 5.3.1 Asset Tracking and Fleet Management

- 5.3.2 Predictive Maintenance

- 5.3.3 Smart Metering

- 5.3.4 Remote Patient Monitoring

- 5.3.5 Smart Home and Appliances

- 5.3.6 Connected Vehicles and V2X

- 5.3.7 Environmental and Climate Monitoring

- 5.4 By Deployment Model

- 5.4.1 Cloud

- 5.4.2 On-premises

- 5.4.3 Edge / Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 Cisco Systems

- 6.4.5 Huawei Technologies

- 6.4.6 Siemens AG

- 6.4.7 IBM Corporation

- 6.4.8 PTC Inc.

- 6.4.9 Robert Bosch GmbH

- 6.4.10 Honeywell International

- 6.4.11 Oracle Corporation

- 6.4.12 SAP SE

- 6.4.13 AT&T

- 6.4.14 Aeris Communications

- 6.4.15 Fujitsu

- 6.4.16 Wipro

- 6.4.17 Intel Corporation

- 6.4.18 Ericsson

- 6.4.19 Qualcomm

- 6.4.20 Advantech

- 6.4.21 Sierra Wireless (Semtech)

- 6.4.22 Quectel Wireless

- 6.4.23 Telit Cinterion

- 6.4.24 u-blox

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment