|

市场调查报告书

商品编码

1851352

光伏发电(PV):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Solar Photovoltaic (PV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

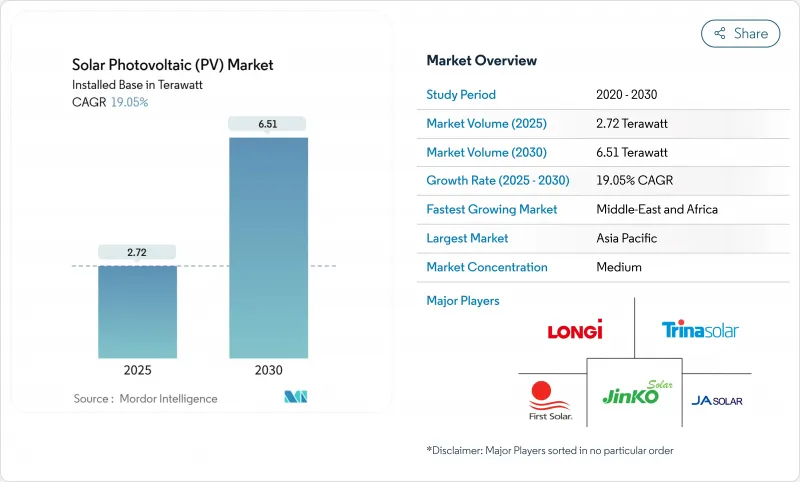

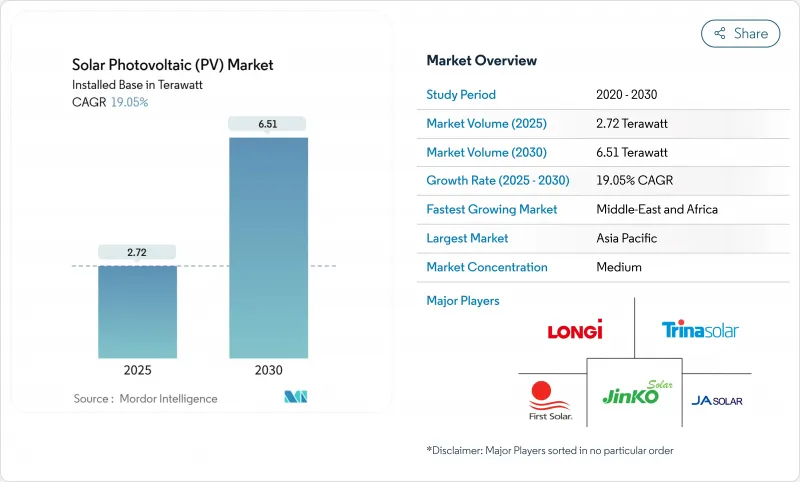

预计太阳能发电市场的装置容量将从 2025 年的 2.72兆瓦成长到 2030 年的 6.51兆瓦,在预测期(2025-2030 年)内复合年增长率为 19.05%。

组件成本下降、电池效率创历史新高以及相关政策的支持,正推动太阳能技术在多个地区超越传统发电方式。产能已提升至1.8太瓦,在需求加速成长的情况下,确保了稳定的供应。儘管迭层和钙钛矿技术的创新可能颠覆现状,但单晶硅电池仍然是产业标竿。受美国《通膨控制法案》、欧盟《净零排放产业法案》及类似措施的推动,策略性供应链资源配置将降低对单一地区生产的依赖,同时引入新的区域成长点。儘管电网整合障碍、多晶硅价格波动和贸易体制的变化构成短期风险,但企业全天候清洁能源合约的增加以及对绿色氢能的需求将支撑长期需求。虽然公用事业规模的太阳能发电目前占据市场主导地位,但随着土地资源日益紧张和能源独立需求的加剧,住宅和浮体式係统的市场份额正在不断增长。

全球光电市场趋势与洞察

模组平均售价下降扩大市电平价区

2024年,组件价格年减51.8%,导致多家中国製造商跌破损益平衡点,并促使供应商削减供应,稳定了价格进一步下跌的趋势。目前,全球70%的电力市场已市电平价,使得先前被认为不具备经济效益的地区也能渗透太阳能市场。沙乌地阿拉伯的平准化电力成本为10.4美元/兆瓦时,在高太阳辐射条件下展现出成本领先优势。随着成本降低与微电网需求成长的共同作用,撒哈拉以南非洲地区预计将获得显着收益。儘管贸易措施和区域性含量法规可能会造成区域价格差异,但到2026年,全球平均价格可能会随着能源效率的提高而下降。

IRA主导的美国光伏製造回流

目前已宣布超过1000亿美元的投资承诺,将使美国电池和组件产量翻两番,并重塑全球供应链。韩华Qcells正在建造一座从硅锭到组件的一体化生产基地,而First Solar正在阿拉巴马州建设一条新的薄膜生产线,这将使美国国内产能提升至11吉瓦。国内产能补贴将使计划成本降低10%至20%,进而抵销亚洲历来在成本上的优势。这项倡议可以降低地缘政治风险,但前提是政策能够持续稳定,并且需要逐步扩大规模,主导一个学习曲线。

高渗透率区域的电网拥塞和抑制

加州2024年输电中断量将达到340万兆瓦时,较上年同期成长29%,凸显了发电成长与输电扩建之间的不匹配。在德克萨斯州,如果不进行大规模电网升级,到2035年太阳能弃电率可能上升至19%。到2040年,欧洲的电力调度量可能会成长六倍,这将为电力公司和消费者都带来成本。诸如西部能源不平衡市场(WEIM)之类的区域协调机制为减少弃电提供了可能,但新建输电线路的典型前置作业时间为七到十年,这是投资者必须考虑的限制因素。

细分市场分析

2024年,单晶硅组件将贡献87%的发电容量,并透过系统级学习曲线的进步巩固其成本领先地位。这项技术是太阳能光电市场规模的核心,预计到2030年,该技术领域的复合年增长率将达到19.05%。由于TOPCon太阳能电池能够在无需大量资本投入的情况下提高效率,因此占了新生产线的70%。 CdTe和CIGS等薄膜解决方案在空间受限和高温应用领域保持其独特的优势。串联和钙钛矿结构正吸引创业投资资金,以加速中试生产线的建设并突破理论产量的上限,其中隆基的实验室规模效率达到了30.1%,Qcells的组件效率达到了28.6%。异质结电池具有较高的开路电压,但面临金属化成本的挑战,而背接触电池则着眼于建筑一体化太阳能发电的美观性。因此,技术竞赛围绕着提高效率、材料可用性和生产扩充性展开,这些因素正在推动整个太阳能光电市场的采购决策。

持续的研发将确保效能提升转化为更低的系统成本,从而暂时巩固单晶硅的优势。然而,效率每提高1%,有效面积就会减少约2%,这在都市区和农业太阳能环境中可节省大量成本。对迭层太阳能电池的投资动能显示其具有颠覆性潜力,预计首批商业产品将于2027年前交付。最终的普及速度将取决于其耐久性和资本投入强度。在此之前,诸如高银含量金属化浆料和增强型双面电池等渐进式升级将使现有产品保持竞争力。

光伏(PV)市场报告按技术(单晶硅、多晶、薄膜、串联/钙钛矿)、最终用户(住宅、商业/工业、公用事业规模的独立发电厂)、部署类型(地面安装、屋顶/建筑集成、浮体式光伏)和地区(北美、亚太、欧洲、南美、中东/非洲)进行细分。

区域分析

到2024年,亚太地区将占全球光伏装机量的64%,这主要得益于中国一体化的供应链和持续的政策支持。中国国内产能的扩张,加上东南亚组装中心的出口,确保了全球光伏组件供应充足。印度的生产连结奖励计画计画正在吸引吉瓦级晶圆厂,以规避美国和欧盟的贸易壁垒。日本正在试验在灌溉池塘上安装浮体式光电阵列,而澳洲则致力于屋顶光电部署并增加分散式发电容量。这些发展凸显了亚太地区作为全球太阳能市场核心的历史地位和持续影响力。

在「2030愿景」框架和绿氢能策略的推动下,中东和非洲地区到2030年将以22%的复合年增长率成长。沙乌地阿拉伯的58吉瓦目标、阿联酋的14吉瓦雄心以及阿曼的绿色氨计划,都体现了从试点项目向吉瓦级建设的过渡。非洲在2023年累积装置容量超过16吉瓦。至2030年,投资项目规模将超过100吉瓦,并可获得优惠融资。在地化的组件组装线以及与矿业公司签订的双边购电协议,有助于降低外汇风险敞口,并增强融资可行性。

北美正利用IRA奖励恢復国内生产并吸引下游投资。超大规模资料中心的成长正在推动对基本负载可再生能源的需求。在欧洲,日益重视能源安全和减少对中国的依赖,正透过协调竞标加速屋顶电站和光伏储能混合电站的部署。在智利阿塔卡马沙漠,容量係数超过30%,实现了创纪录的低评级。在各个地区,政策制定、资源供应和资金筹措生态系统正在塑造太阳能市场的发展轨迹。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 模组平均售价下降扩大市电平价区

- 美国光伏製造正在向国内转移。

- 人工智慧驱动的太阳能发电预测可降低平衡成本

- 来自绿色氢电解槽计划的需求

- 企业全天候清洁能源购电协议承诺

- 农光互补技术释放土地双重用途的效益

- 市场限制

- 高渗透率地区电网拥塞和限电风险

- 多晶硅价格的快速波动正在挤压生产商的利润空间。

- 反倾销贸易措施扰乱供应链

- 日益严格的屋顶消防安全法规推高了系统平衡(BOS)成本。

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 装置容量和出货趋势

- 价格和LCOE趋势

- 重大计划储备

第五章 市场规模与成长预测

- 透过技术

- 单晶硅

- 多晶

- 薄膜(CdTe、CIGS、a-Si)

- 串联/钙钛矿

- 最终用户

- 住宅

- 商业和工业

- 公用事业规模的独立发电厂

- 依部署类型

- 地面安装

- 屋顶/建筑一体化光伏(BIPV)

- 浮体式式光电

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- LONGi Green Energy Technology Co. Ltd.

- Trina Solar Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Technology Co. Ltd.

- First Solar Inc.

- Canadian Solar Inc.

- Hanwha Q Cells Co. Ltd.

- SunPower Corporation

- Risen Energy Co. Ltd.

- Sharp Corporation

- Suntech Power Co. Ltd.

- REC Solar Holdings AS

- GCL System Integration Technology

- Maxeon Solar Technologies

- Yingli Solar

- Adani Solar

- Axitec Energy GmbH

- FuturaSun Srl

- Waaree Energies Ltd.

- Meyer Burger Technology AG

第七章 市场机会与未来展望

The Solar Photovoltaic Market size in terms of installed base is expected to grow from 2.72 Terawatt in 2025 to 6.51 Terawatt by 2030, at a CAGR of 19.05% during the forecast period (2025-2030).

Module cost declines, record-high cell efficiencies, and supportive policies have enabled the technology to undercut conventional generation across diverse geographies. Manufacturing capacity has climbed to 1.8 TW, underpinning robust supply even as demand accelerates. Monocrystalline cells remain the benchmark, though tandem and perovskite innovations are poised to disrupt the status quo. Strategic supply-chain reshoring-driven by the US Inflation Reduction Act, the EU Net-Zero Industry Act, and similar initiatives-introduces new regional growth vectors while tempering dependence on single-region production. Grid-integration hurdles, price volatility in polysilicon, and shifting trade regimes pose near-term risks, yet rising corporate 24/7 clean-power contracts and green-hydrogen ambitions anchor long-term demand. Across segments, utility-scale assets dominate today's solar photovoltaic market, but residential and floating systems capture an expanding share as land constraints and energy-autonomy preferences intensify.

Global Solar Photovoltaic (PV) Market Trends and Insights

Falling Module ASPs Widen Grid-Parity Zones

Module prices fell 51.8% year-over-year in 2024, pushing several Chinese producers below break-even and prompting supply reductions that stabilize the trajectory of further declines. Grid parity is now achieved in 70% of global electricity markets, unlocking solar photovoltaic market penetration in regions once considered uneconomic. Saudi Arabia recorded a levelized cost of electricity of USD 10.4/MWh, illustrating cost leadership under strong irradiance. Sub-Saharan Africa stands to gain as cost reductions converge with rising mini-grid demand. Trade actions and localized content rules may introduce regional price spreads, yet global median prices trend lower through 2026 as efficiencies climb.

IRA-Driven On-Shoring of PV Manufacturing in the US

Announced commitments exceeding USD 100 billion will quadruple US cell and module output and realign global supply networks. Hanwha Qcells is building an integrated ingot-to-module complex, and First Solar's new thin-film line in Alabama boosts domestic capacity to 11 GW. Domestic content bonuses shave 10-20% from project costs, neutralizing historic Asian cost advantages. The initiative mitigates geopolitical risk but hinges on sustained policy continuity and incremental scale-driven learning curves.

Grid Congestion and Curtailment in High-Penetration Regions

California curtailed 3.4 million MWh in 2024, a 29% jump that spotlights the mismatch between generation growth and transmission expansion. Texas could see solar curtailment rates rise to 19% by 2035 without major grid upgrades. Europe's redispatch volumes may increase sixfold by 2040, costing operators and consumers alike. Regional coordination frameworks-such as the Western Energy Imbalance Market-demonstrate curtailment-reduction potential, yet typical lead times of seven to ten years for new lines keep the constraint front-of-mind for investors.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Solar Forecasting Cuts Balancing Costs

- Demand from Green-Hydrogen Electrolyzer Projects

- Rapid Polysilicon Price Swings Squeeze Producer Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monocrystalline-Si modules supplied 87% of 2024 capacity and delivered system-level learning-curve gains that reinforce their cost leadership. This technology sits at the heart of the solar photovoltaic market size for the technology segment, which is projected to grow at a 19.05% CAGR to 2030. TOPCon cells captured 70% of new production lines because they raise efficiency without large capital retooling. Thin-film solutions like CdTe and CIGS retain niches in space-constrained or high-temperature applications. Tandem and perovskite architectures, with LONGi's 30.1% lab-scale efficiency and Qcells' 28.6% module milestone, attract venture funding that accelerates pilot lines and pushes theoretical yield ceilings higher. Heterojunction offers high open-circuit voltages but encounters metallization cost hurdles, while back-contact cells target aesthetics for building-integrated photovoltaics. Technology competition thus pivots on efficiency advancements, material availability, and production scalability-factors that collectively steer procurement decisions across the solar photovoltaic market.

Continued R&D ensures performance gains translate to lower balance-of-system costs, reinforcing monocrystalline leadership in the near term. Yet every 1 percentage-point efficiency jump trims active area by roughly 2%, a saving critical in urban or agrivoltaic settings. Investment momentum behind tandem cells indicates disruption potential, and first commercial shipments are plausible before 2027. The eventual diffusion pace will hinge on durability proofs and capex intensity. Until then, incremental upgrades-such as metallization pastes with higher silver fraction efficiency or bifacial enhancements-keep current lines competitive.

The Solar Photovoltaic (PV) Market Report is Segmented by Technology (Monocrystalline-Si, Multicrystalline-Si, Thin-Film, and Tandem/Perovskite), End-User (Residential, Commercial and Industrial, and Utility-Scale IPPs), Deployment Type (Ground-Mounted, Rooftop/Building-Integrated, and Floating PV), and Geography (North America, Asia-Pacific, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific contributed 64% of global installations in 2024, driven by China's integrated supply chain and sustained policy support. Domestic Chinese additions, plus exports into Southeast Asian assembly hubs, kept the global module supply abundant. India's production-linked incentive program draws gigawatt-scale fabs as firms hedge against US and EU trade barriers. Japan pilots floating PV arrays atop irrigation ponds, while Australia intensifies rooftop adoption, boosting distributed capacity. These developments anchor Asia-Pacific's role as the historical and ongoing nucleus of the solar photovoltaic market.

The Middle East and Africa region is growing at a 22% CAGR through 2030, propelled by Vision 2030 frameworks and green-hydrogen strategies. Saudi Arabia's 58 GW target, the UAE's 14 GW ambition, and Omani green-ammonia projects illustrate the shift from pilot programs to gigawatt build-outs. Africa exceeded 16 GW cumulative capacity in 2023; investment pipelines exceed 100 GW for 2030, contingent on concessional finance. Local module-assembly lines and bilateral power-purchase contracts with mining firms mitigate currency-risk exposure and strengthen bankability.

North America leverages IRA incentives to restore domestic production and attract downstream investment. Corporate procurement remains the region's prime demand driver, with hyperscaler data-center growth elevating baseload renewable requirements. Europe intensifies focus on energy security and de-risking Chinese dependency; coordinated tenders accelerate rooftop adoption and hybrid plants that blend storage with PV. South America capitalizes on stellar irradiation; Chile's Atacama Desert records capacity factors above 30%, enabling record-low tariffs. Across regions, policymaking, resource endowments, and financing ecosystems collectively sculpt uptake trajectories in the solar photovoltaic market.

- LONGi Green Energy Technology Co. Ltd.

- Trina Solar Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Technology Co. Ltd.

- First Solar Inc.

- Canadian Solar Inc.

- Hanwha Q Cells Co. Ltd.

- SunPower Corporation

- Risen Energy Co. Ltd.

- Sharp Corporation

- Suntech Power Co. Ltd.

- REC Solar Holdings AS

- GCL System Integration Technology

- Maxeon Solar Technologies

- Yingli Solar

- Adani Solar

- Axitec Energy GmbH

- FuturaSun Srl

- Waaree Energies Ltd.

- Meyer Burger Technology AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Falling module ASPs widen grid-parity zones

- 4.2.2 IRA-driven on-shoring of PV manufacturing in the U.S.

- 4.2.3 AI-enabled solar forecasting cuts balancing costs

- 4.2.4 Demand from green-hydrogen electrolyzer projects

- 4.2.5 Corporate 24/7 clean-power PPA commitments

- 4.2.6 Agrivoltaics unlocks dual-land use revenues

- 4.3 Market Restraints

- 4.3.1 Grid-congestion & curtailment risks in high-penetration regions

- 4.3.2 Rapid polysilicon price swings squeeze producer margins

- 4.3.3 Anti-dumping trade actions fragment supply chains

- 4.3.4 Rising rooftop-fire regulations add balance-of-system (BOS) cost

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Installed-Capacity and Shipment Trends

- 4.9 Pricing and LCOE Trends

- 4.10 Key Projects Pipeline

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Monocrystalline-Si

- 5.1.2 Multicrystalline-Si

- 5.1.3 Thin-film (CdTe, CIGS, a-Si)

- 5.1.4 Tandem/Perovskite

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale IPPs

- 5.3 By Deployment Type

- 5.3.1 Ground-mounted

- 5.3.2 Rooftop/Building-Integrated (BIPV)

- 5.3.3 Floating PV

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacifc

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Australia

- 5.4.3.7 Rest of Asia-Pacifc

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 LONGi Green Energy Technology Co. Ltd.

- 6.4.2 Trina Solar Co. Ltd.

- 6.4.3 JinkoSolar Holding Co. Ltd.

- 6.4.4 JA Solar Technology Co. Ltd.

- 6.4.5 First Solar Inc.

- 6.4.6 Canadian Solar Inc.

- 6.4.7 Hanwha Q Cells Co. Ltd.

- 6.4.8 SunPower Corporation

- 6.4.9 Risen Energy Co. Ltd.

- 6.4.10 Sharp Corporation

- 6.4.11 Suntech Power Co. Ltd.

- 6.4.12 REC Solar Holdings AS

- 6.4.13 GCL System Integration Technology

- 6.4.14 Maxeon Solar Technologies

- 6.4.15 Yingli Solar

- 6.4.16 Adani Solar

- 6.4.17 Axitec Energy GmbH

- 6.4.18 FuturaSun Srl

- 6.4.19 Waaree Energies Ltd.

- 6.4.20 Meyer Burger Technology AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment